695,000.

695,000.

That was the most people ever laid off in a single week in the US, way back in 1982. In March, layoffs peaked out at 6.9M in a single week and, for the month of July, they've been around 1.3M – each week – double our worst week in history 4 weeks in a row. And this is what President Trump calls a recovery?

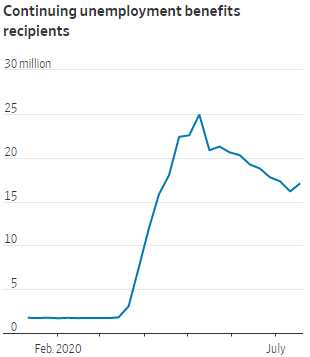

As you can see from the Unemployment Chart, we still have about 17M jobless Americans (officially) and it's getting worse again. Temporarilly laid off workers went back to work but the jobs thate are being lost now are the permanent kind, due to store closing, restaurant closings, etc. – jobs that aren't going to bounce back quickly and can't be "fixed" with a small stimulus loan.

And, don't forget, the Government supplemented businesses NOT to lay off workers through July but now that those supplements have run out, a lot of companies have to make hard choices to either pay the rent or pay the workers and many are just giving up and doing neither and, when the landlords can't pay the bank – that's when the Fed leaps into action! A good example of reality from the Wall Street Journal this morning:

Shana O’Mara has been receiving unemployment benefits since early July, after the expiration of a government loan that was sustaining her Tempe, Ariz., travel agency. She stopped drawing a salary from her business to keep it alive, but has continued to work without pay helping customers rebook and cancel trips.

She said her most recent weekly unemployment benefit payment fell to $214 after taxes, from $748 the preceding week, reflecting the July 31 expiration of an additional $600 in pretax federal benefits. “I don’t think anyone can live on $800 a month,” she said. Her family has stopped ordering takeout, and she called her auto lender and credit-card issuers asking for deferrals. She said the enhanced benefits allowed her to keep serving her clients, rather than seek out a job.

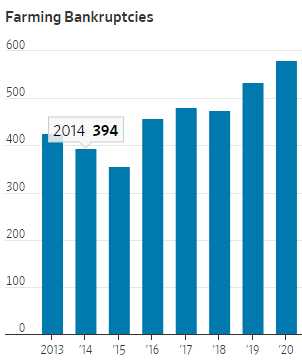

That's happening to 30M people this week – how is that going to be good for the economy? Despite the record levels of Federal Aid ($33Bn so far this year), 4 farmers a day are going bankrupt this year as the virus affects their workers along with Trump's idiot tariffs and the virus is also hitting food prices as restaurants are mostly closed and consumer spending is way down.

That's happening to 30M people this week – how is that going to be good for the economy? Despite the record levels of Federal Aid ($33Bn so far this year), 4 farmers a day are going bankrupt this year as the virus affects their workers along with Trump's idiot tariffs and the virus is also hitting food prices as restaurants are mostly closed and consumer spending is way down.

Before the pandemic, a global grain glut and foreign competition had pushed down agricultural prices. Trade disputes deepened the pain, drawing retaliatory tariffs from top buyers of U.S. farm commodities, such as China and Mexico. Then the coronavirus hit, upending the U.S. food-supply chain. As restaurants closed, farmers plowed under thousands of acres of vegetables and dumped milk into manure lagoons. Corn prices plummeted as Americans stopped driving, cutting demand for ethanol, a corn-based biofuel blended into gasoline. Prices for slaughter-ready cattle and hogs dropped as meatpacking plants that became virus hot spots slowed or halted production.

Hog farmers have lost nearly $5 billion in actual and potential profits for 2020, according to the National Pork Producers Council, a trade group. In California alone, agricultural businesses stand to lose as much as $8.6 billion, according to a study commissioned by the California Farm Bureau Federation. U.S. farm debt has grown steadily since then to more than $425 billion this year, the U.S. Department of Agriculture estimates. That is the largest sum since a farm crisis in the 1980s that pushed many farmers and lenders out of business.

If more aid isn’t extended, farm income is expected to fall 12% to $79.4 billion in 2021, according to the Food and Agricultural Policy Research Institute. Government payments would drop by half to less than $17 billion. “It’s hard to pinpoint the damage when you’re in the middle of the hurricane,” said John Newton, chief economist at the American Farm Bureau Federation. “Sure, half the house is still standing, but this thing is not past us yet.”

Is this our past or our Future? Sadly, it's hard to tell at the moment…

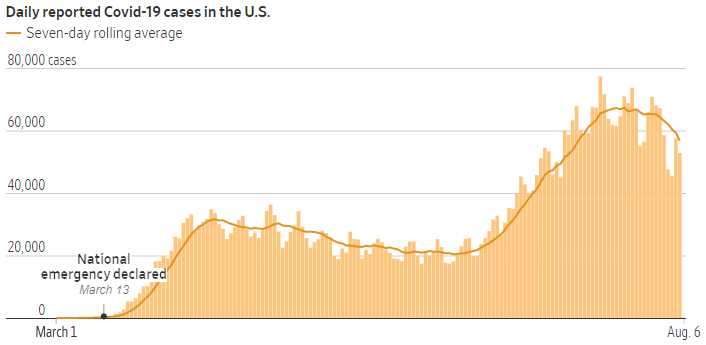

What happens in the next few months will be critical to America's Future History but, unfortunately, we will have the same "leaders" for another 5 months and I'm not sure we have that long before Depression becomes inevitable. As you can see from the chart below, our re-opening around Memorial Day led to a 250% increase in virus cases, from 20,000 a day to 70,0000 a day and now our base is 50,000 a day and we're about to send our children back to school, where they will mix with all the other kids and then come back home to you and you can then mix with your co-workers and so on and so on and so on – good luck to us all!

If the school opening goes as badly as the Memorial Day opening, we're looking at 175,000 new cases per day and that will be game over for the economy. Even a massive, total shutdown with China-like precautions would take 3-6 months to become effective and our health care system will be quickly overwhelmed. Even worse, we won't know it for at least a month, that's how long after Memorial Day we began to spike higher – as these infections are very stealthy, which is why they spread so easily.

Be careful out there.