How high is too high?

How high is too high?

You pot smokers out there know what I mean! High can be fun, too high can be scary. On August 11th it was: "20 Million Tuesday, 28,000 Tuesday – Record Infections, Record Highs" and, speaking of infections, happy 6M America! We had 5M on August 10th… Anyway, August 3rd was "Monday Market Movement – Nasdaq 11,000 and Bust, Again?" and, 10% later, I was certainly wrong about that one.

AAPL was $425 on month ago, now it's split 4:1 and it's $129 so 4x that is $516, that's up 21.5% in 30 days for the World's biggest company so of course the AAPLDaq is up 10% but AAPL had help. GOOGL has gone from $1,450 to $1,650 (13.7%), AMZN from $3,100 to $3,450 (11.2%), FB from $250 to $295 (18%) and, of course, TSLA has gone from a split-adjusted $300 to $500 (66%) over the past 30 days.

This is NOT reality, this is a game. When you are playing a game and the rules are not clear and they keep changing – your chance of winning becomes random or, if someone else is making the rules, then your chance of winning is pretty much zero and you might want to play a board game under those conditions but should you really be playing with your retirement account?

Please just THINK about what you are doing. As I noted last week, there's very few stocks pulling up the whole market and, while some of these sky-high valuations may be justified, the weight of the thousands of others that are not begins to put a drag on the indexes at some point. Think of each index Dollar added to the underperforming stocks as a weight the high-flyers need to carry with them to get to the next level. At the rate the Government is spending and the Fed is printing – we do have a lot of lift – but it's not infinite and every day the markets move higher adds more weight that needs to be lifted to the next level.

Please just THINK about what you are doing. As I noted last week, there's very few stocks pulling up the whole market and, while some of these sky-high valuations may be justified, the weight of the thousands of others that are not begins to put a drag on the indexes at some point. Think of each index Dollar added to the underperforming stocks as a weight the high-flyers need to carry with them to get to the next level. At the rate the Government is spending and the Fed is printing – we do have a lot of lift – but it's not infinite and every day the markets move higher adds more weight that needs to be lifted to the next level.

Evenually, gravity will take its toll.

You don't have to take great risks to make good money in a bull market. Take our Income Fund, for example, which is up 12%, net of fees (free and clear returns) in just two months. We started the Income Fund on July 1st and the S&P was at 3,100 and now it's at 3,500 so it's up 12.9% – we're matching the S&Ps returns (exceeding them actually but there are management fees, of course) WITHOUT taking excessive risks (see Doug's notes). It's not just about MAKING 12% in a quarter, it's about KEEPING the money you've made if the market begins to go the other way. Hedge Funds don't outperform in a bull market because they are hedging the risk of a downturn.

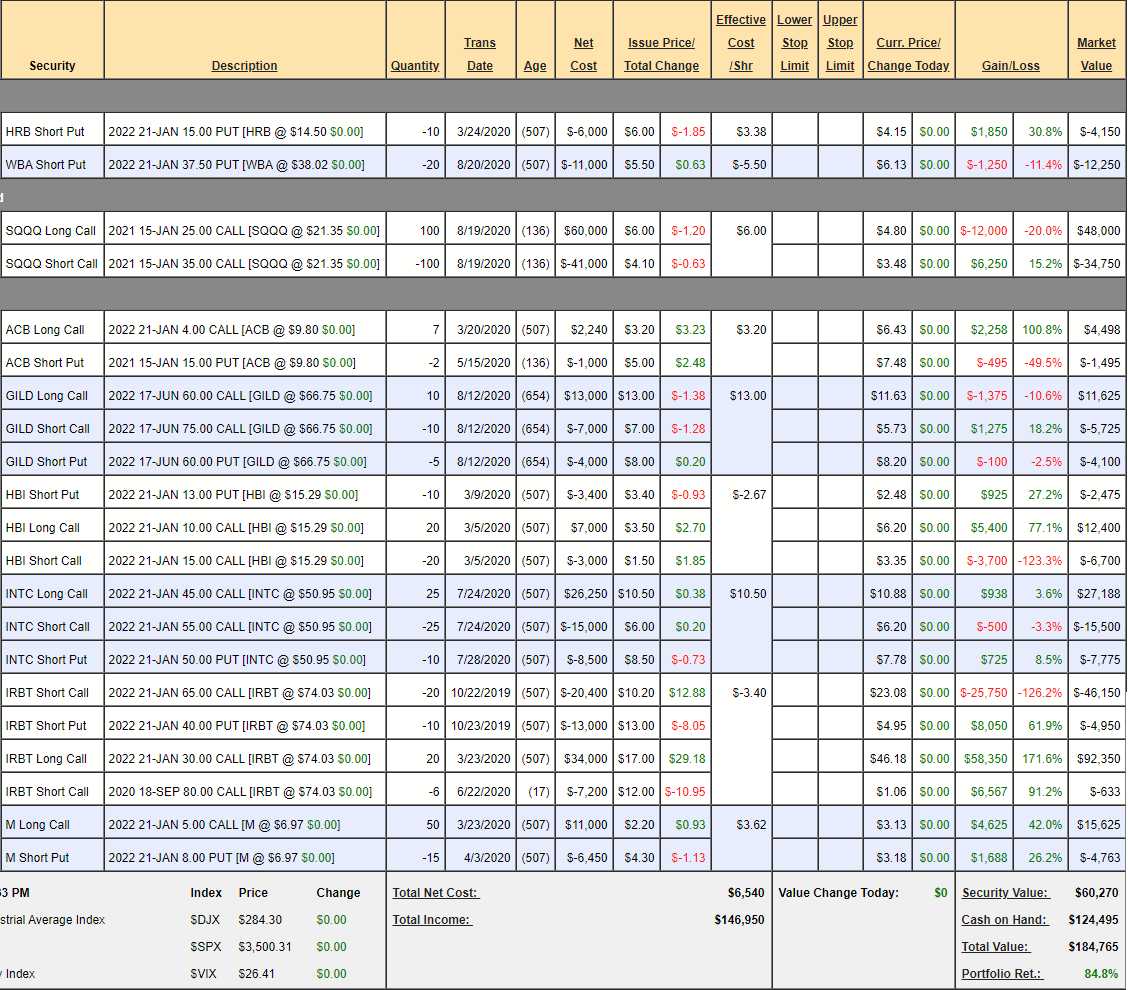

There are no crazy momentum stocks in our Earnings Portfolio but it's up 84.8% for the year with sensible stocks like HRB, ACB, GILD, WBA, HBI, INTC, IRBT and M – just a nice, diversified group of value stocks generally in well-hedged positions that simply do very well (along with everything else) in a bull market:

I'm not saying you should get out of everything – I'm just emphasizing that you can make very nice returns WITHOUT taking on a lot of risk. Look at GILD, which is at a loss in the portfolio. That's a $15,000 spread at $75 or above in June of 2022 and currently the spread is net $1,800 so it has a $13,200 (733%) upside potential and the worst case is owning 500 shares of GILD at $60 ($30,000) plus the $1,800 you may lose is net $63.60, which is still 5% below the current price. That's your worst case to own on of the World's top pharma companies – THAT is how we invest sensibly!

Yesterday our index shorting lines were:

- Dow 28,750

- S&P 3,500

- Nasdaq 12,000

- Russell 1,585

We made some quick money on the dip but now the Dow and the Nasdaq are over the lines so it's no play unless one of them crosses back under (and the others are below). One day this rally will break – not necessarily today though…

Be careful out there!