We're back baby!

The Dow Jones Industrial Average topped out at 29,500 in February as we ignored the virus in China and then it plunged 11,000 (37%) points, to 18,500 in late March and now it's back up 9,500 (51%) since then and we're only 1,500 points (5%) from a full recovery. Recovery, of course, is a funny word when over 7M Americans now have a disease that has terrible, long-lasting effects on the body but who cares – it's rally time!

The revised Q2 GDP came in yesterday at -31.4%, which was better than the previous estimate of -31.7% but that's not why we rallied, we rallied because it was the last day of the quarter and the hedge funds all like to "dress the window" and make things look good in the brochures they use to lure in fresh month during the following quarter.

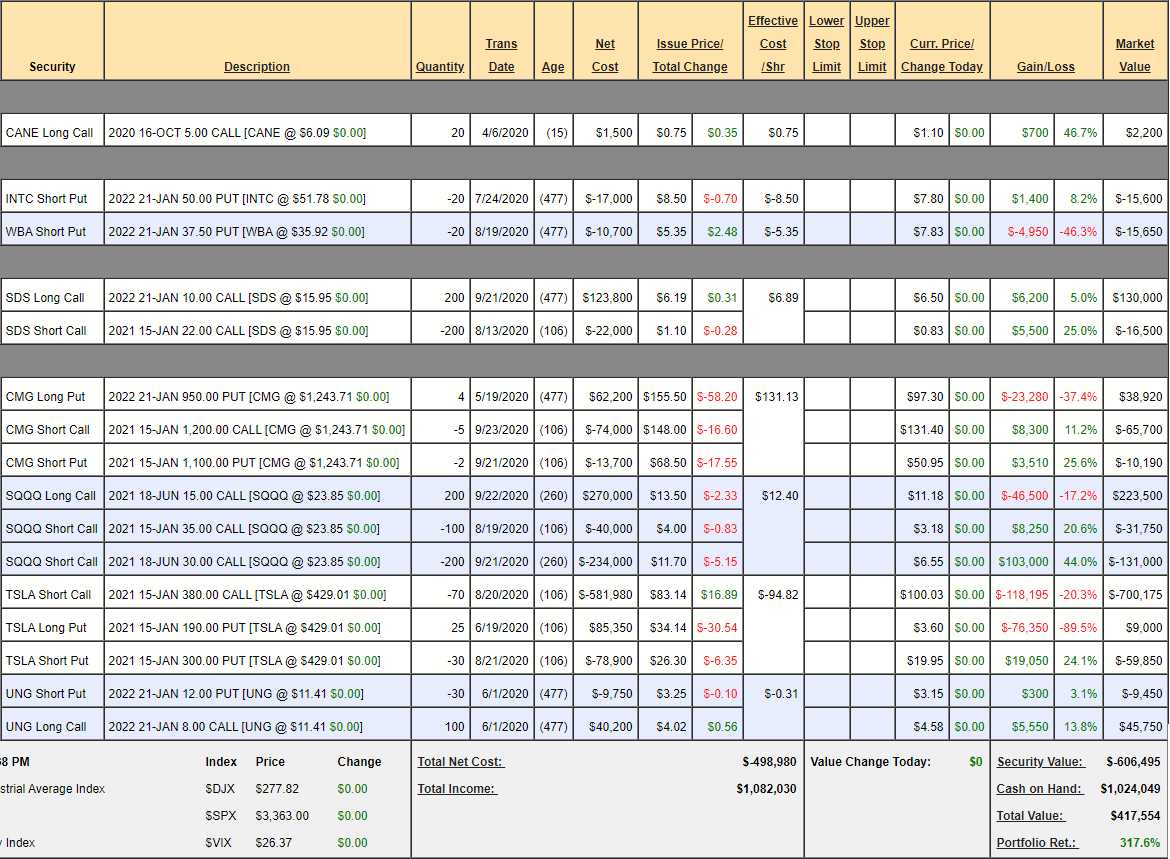

This will be a nice time to go over our hedges and make sure we're prepared – just in case the indexes are rejected at their all-time highs again – given the 200,000 dead and 7M infected and 31.4% decrease in economic activity and all. Oh, and the nation's slide into Fascism…. So, in our Short-Term Portfolio, which we reviewed back on Sept 18th, we've made no changes but we've made a lot of money as Tesla Calmoed down a little – though that may change at any moment again:

While the TSLA position has the potential to give us a huge pay-off, it's very volatile and we need to focus on our hedges, which we KNOW will pay us if the market falls for sure. At the moment, our primary hedges are SDS and SQQQ so let's make sure they are adequate to protect what is now a $1M Long-Term Portfolio (up 100% for the year).

- SDS – This is now a simple bull call spread and the spread is $12 wide with SDS at $16 so it needs to gain $6 to be 100% in the money for $240,000. $6 is 37.5% of $16 and SDS is a 2x Ultra-Short of the S&P so the S&P would have to fall a bit less than 20%, from 3,380 to 2,704 for us to collect the full $240,000 and we're currently net $120,000 in the money and the spread is net $113,500 so it's offering us $126,500 against a 20% drop in the S&P.

- SQQQ – This is a 3x ETF at just under $24 so it needs to get to $30 which is up 25% and that requires roughly an 8% drop in the Nasdaq 100 from 11,555 to 10,630 – it wasn't far off that last week! The $15/30 spread has a $300,000 potential and it's currently net $60,750 so it's much more efficient than the SDS spread with $239,250 upside potential from here. The downside is it's a June spread, so the Nasdaq would have to go down and stay down for us to colllect but that's fine because, if it doesn't stay down – it means our longs are recovering.

So we have about $350,000 of downside protection in the STP, which should get the LTP through a rough patch but I'd feel better if we had some good short-term protection and TQQQ has been fun to play so let's re-establish a short in what will be a calendar spread we can build up over time:

- Buy 40 TQQQ March $130 puts for $30 ($120,000)

- Sell 40 TQQQ November $100 puts for $7.50 ($30,000)

That's net $90,000 on the $120,000 potential spread, which doesn't sound exciting but our longs are 6 months out and our shorts are 2 months out so they can be rolled to a wider spread or, if that's not needed, we can re-sell 2 more times and knock our cost down to $30,000 on the $120,000 spread and that makes sense. We'll officially add that to the STP.

We should be able to roll the $100 puts to the Jan $80 puts (now $7.25) and that would widen the spread to $50 ($200,000) so we're techincally adding $110,000 worth of protection for $90,000 so we've punched up our protection by 33% and that makes me feel a little better heading into the weekend with all these longs still in play.