Two weeks to go.

Two weeks to go.

Two weeks ago the S&P was down at 3,350, down about 4% from where we are now so don't get complacent – especially into the elections and ESPECIALLY when Global Covid Cases topped 40M this weekend with 8.15M in the US and growing at 0.05M per day along with 220,000 deaths.

You KNOW Trump is lying about the virus, you KNOW Trump has been lying about it since day one. You KNOW Trump is essentially doing nothing to stop it and I REALLY hate to be that guy every week but how can you let yourself be deluded by all this other nonsense when we are STILL right in the middle of a Global Crisis?

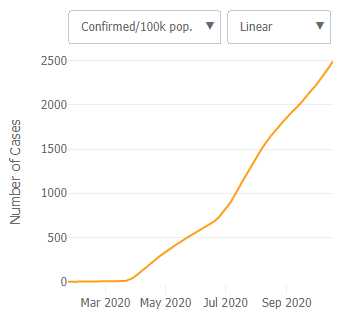

Come on people, let's not rely on the lie to make us feel good. This is the chart of how many people per 100,000 in the US are infected by the Corona Virus. In May, I said I was very concerned because passing 1/250 (400 per 100,000) means that any time I went outside and walked down the street and walked into a store – I probably either passed an infected person or touched something they had touched and we now know the virus lasts a lot longer than we thought on surfaces.

Come on people, let's not rely on the lie to make us feel good. This is the chart of how many people per 100,000 in the US are infected by the Corona Virus. In May, I said I was very concerned because passing 1/250 (400 per 100,000) means that any time I went outside and walked down the street and walked into a store – I probably either passed an infected person or touched something they had touched and we now know the virus lasts a lot longer than we thought on surfaces.

That was back in May. Now it's October and 1/2,500 people were infected as we brilliantly ended our lockdown on Memorial Day Weekend to "save" Trump's economy and now 1/40 people are infected. That means, if you go to a restaurant – even one that's 1/2 empty – you are likely there with an infected person and your children are in class with infected people and now you can't walk down the block without coming in contact with infected people and Trump is doing what to control it before it gets to 1/4 people? What? Name SOMETHING???

Our lives are at stake people – our actual lives! 220,000 Americans are dead an "only" 8M out of 330M have contracted the virus so far. That means 40x more to go and 40x 2,200 is 8,800,000 dead – that's the entire population of New York City DEAD! That's Los Angeles, Houston and Chicago COMBINED – DEAD! That's Phoenix, Philadelphia, San Antonio, San Diego, Dallas and San Jose COMBINED – DEAD!

What is Trump doing about it? What????

We are still in the early stage of this disease and, like Global Warming, the earlier you act the easier it is to fix but a failure to act can have catastrophic consequences (like viruses spreading out of control in a changing environment). Globally, one in 200 people are affected, we may be able to stop the global spread of the virus by, as Trump says, containing it in America where it's growing competely out of control. Like the wildfires Trump doesn't help to contain either – we simply have to let the virus burn out in America to keep the rest of the World safe at this point.

We are still in the early stage of this disease and, like Global Warming, the earlier you act the easier it is to fix but a failure to act can have catastrophic consequences (like viruses spreading out of control in a changing environment). Globally, one in 200 people are affected, we may be able to stop the global spread of the virus by, as Trump says, containing it in America where it's growing competely out of control. Like the wildfires Trump doesn't help to contain either – we simply have to let the virus burn out in America to keep the rest of the World safe at this point.

Voters in the US will effectively decide the fate of the World in 15 days and, sadly, we've seen this movie play out several times before and people don't want to hear that there's a dangerous virus out there or that the Climate is on the verge of collapsing – because it's DEPRESSING but do you know what's even more depressing – A DEPRESSION – especially on where your money got wiped out in the market crash you didn't want to see coming.

So it's my job to warn you – over and over again – to remind you to pay attention to the things you may be ignoring and to get you to avoid the biggest danger of them all – COMPLACENCY. Please make sure you have a good amount of CASH!!! in your portfolio and please make sure that, if you have long positions, that you also have hedges to insure them. The upcoming election is a wildcard but so is Black Friday (Nov 27th) – especially one with no shoppers at the stores.

So it's my job to warn you – over and over again – to remind you to pay attention to the things you may be ignoring and to get you to avoid the biggest danger of them all – COMPLACENCY. Please make sure you have a good amount of CASH!!! in your portfolio and please make sure that, if you have long positions, that you also have hedges to insure them. The upcoming election is a wildcard but so is Black Friday (Nov 27th) – especially one with no shoppers at the stores.

Black Friday is so-called as it's the first day of the year the ledgers of retailers go from red (the cost of being open all year) to proiftable (black) but how is that going to happen when there are no crowds of shoppers? And what about all the holiday jobs that aren't going to exist? Where's all this holiday money going to come from when bonuses and raises are cut? Why can't this market look even 5 weeks ahead?

Take a look at Macy's (M), for example, 75% of their profits are made in the 4th Quarter:

That's typical for a retailer – it's all about Christmas and Christmas may be cancelled this year but that's 2 months away and we have an election in two weeks and black Friday 3 weeks after that so first things first.

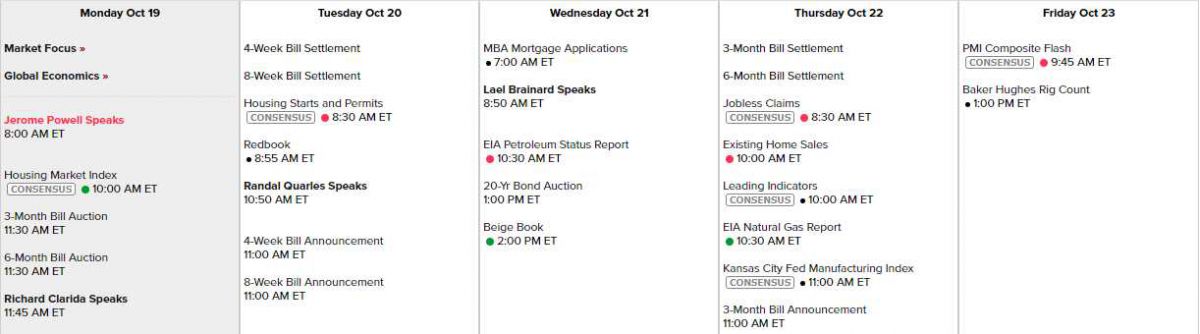

Powell spoke first thing this morning but it was about digital currencies, which Central Banks are just starting to pay attention to. Only 3 more Fed speakers this week and very little data so it's all going to be about earnings and there we get some biggies with IBM tonigh, PG, PM, TRV, NFLX, TXN on Tuesday, VZ,TSLA, WHR, CMG and CSX Wednesday, KO, T, LUV, PHM, FCX, INTC, COF, and MAT on Thursday (speaking of Christmas) and CLF, AXP, and ABB Friday makes for a busy week indeed.

Be careful out there!