4,480.

4,480.

That's the strong bounce line on the S&P 500 and we've been failing it all week and now we're failing it FOR the week and that's a big negative on the weekly charts. We predicted that we would fail the strong bounce line on Monday, when it was 4,490 (we made a lower low on Wednesday, which lowered the bar for a bounce) based on the Fundamental Outlook for the week and so far, so right, I suppose.

I'm feeling good about going to CASH!!! last month, September has not been kind and we've been finding some good bargains along the way to refresh our portfolios. Our slimmed-down LTP still made $44,533 for the month but those gains were largely offset by our too-bearish (for now) STP, which we adjusted yesterday. Of course, we didn't adjust it to be less bearish – a bit more so, if anything.

Our defense if the market goes higher will be to buy more longs. There are plenty of bargains out there as some stocks have come down quite a bit like Las Vegas Sands (LVS), which is back in the realm of reality now at $37.50, which is $28.66Bn in market cap and, before Covid, LVS was making $2.5Bn per year. I'm not suggesting we race right into this one (we just bought BYD) because China has changed the rules in Macau and, of course, Covid – but it's a good example of a stock we wouldn't have bought because it was way too high that has now become attractive again.

There are always bargains to be had – if you are patient!

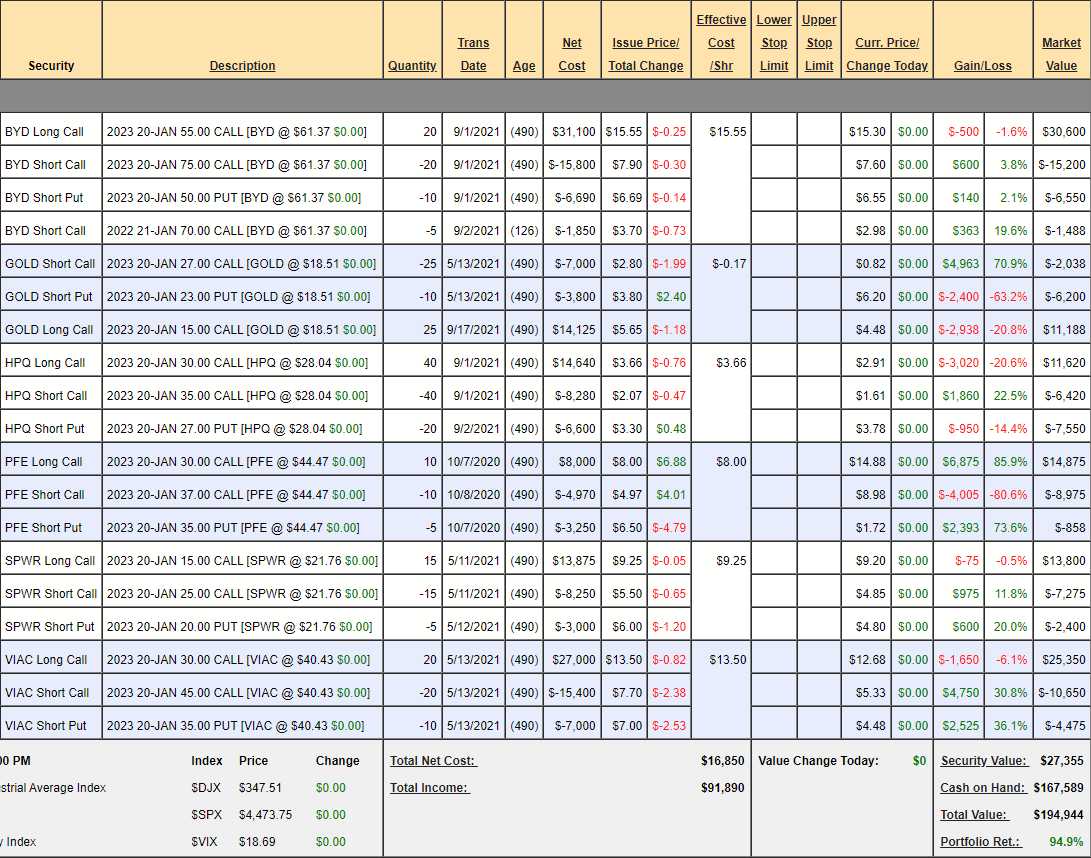

Money Talk Portfolio Review: Patience is what our Money Talk Portfo is all about, as we only trade it when we're on the show – roughly once per quarter. We can't touch it otherwise so the picks have to be ROCK SOLID and we made a few changes in our last cycl – when I was on the show on September 1st (it taped on Aug 31st). We cashed out our winning positions on IBM and SKT and we added HPQ and the afore-mentioned BYD. The portfolio is down $962 for the month at $194,944 but that's up a healthy 94.9% and, best of all, we have $167,589 of lovely, lovely CASH!!!

- BYD – Brand new trade from last time and no action so still a chance to grab this $40,000 spread for net $7,362.

- GOLD – We widened this spread by dropping the long calls and GOLD has taken a turn for the worst but it's a great inflation hedge and we're still $7,500 in the money on this net $2,950 spread that has the potential to pay $30,000 at $27, which would put Gold (the metal) a bit over $2,000.

- HPQ – Another newbie and I love the bargain. It's cheaper than we bought it for with a net $2,350 credit on the $20,000 spread so that's $22,350 upside potential at $35.

- PFE – Big pullback recently but we still love them, long-term. We got in early so not worried at all.

- SPWR – If they are this low at Thanksgiving, they will be my Stock of the Year for 2022 as this is a crazy-low price for an industry leader in the solar sector with every World Government looking to move to much more solar for the rest of this decade. It's a $15,000 spread, currently at net $4,125 – easy money!

- VIAC – Or maybe this should be my stock of the year… They have got to be joking with this price but someone has had a sell program running at this level since April. Will they ever run out of shares to dump? I think so and then we are left with VIAC at a $26Bn valuation – despite making $2.6Bn for the year. Even better – they made $2.4Bn last year – this stock is Covid-proof!

Why is there so much upside potential in these stocks? Why are they all good for a new trade? Becasue these are the ones we kept BECAUSE they have great upside potential and BECAUSE we would take them all as new trades. That's how a great portfolio should look – especially a passive on that you can't adjust often.

IN PROGRESS