$2,167,659!

$2,167,659!

That is up $15,088 on our paired portfolios since our last review and, I am very happy to say, $1,878,544 (86.6%) of it is now CASH!!! We cut about half of our Long-Term Portfolio (LTP) positions but then we added 5 more in past month and we are very well-hedged in the Short-Term Portfolio (STP), with roughly $500,000 worth of downside protection against a 20% drop in the S&P 500 so, at the moment, we probably make more money on a drop than we would on a pop.

The S&P 500 is hovering right about where it was on August 17th, when I wrote: "Top of the Market Tuesday – Cashing Out While We Can" so I'm not going to rehash our reasons. In fact, the Friday before that (13th), the S&P had finished the week at 4,450 and this morning we're at 4,466 and we'll see how that holds up into Quad Witching tomorrw.

As I noted in yesterday morning's report, the S&P 500 has been week this month and 4,480 is the Strong Bounce line, according to our 5% Rule™, so we'll see how that goes into the weekend. It doesn't affect our well-balanced portfolios and we have no intention of getting too bullish again ahead of earnings next month but we are finding bargains and some of the biggest bargains are sitting right in our portfolios!

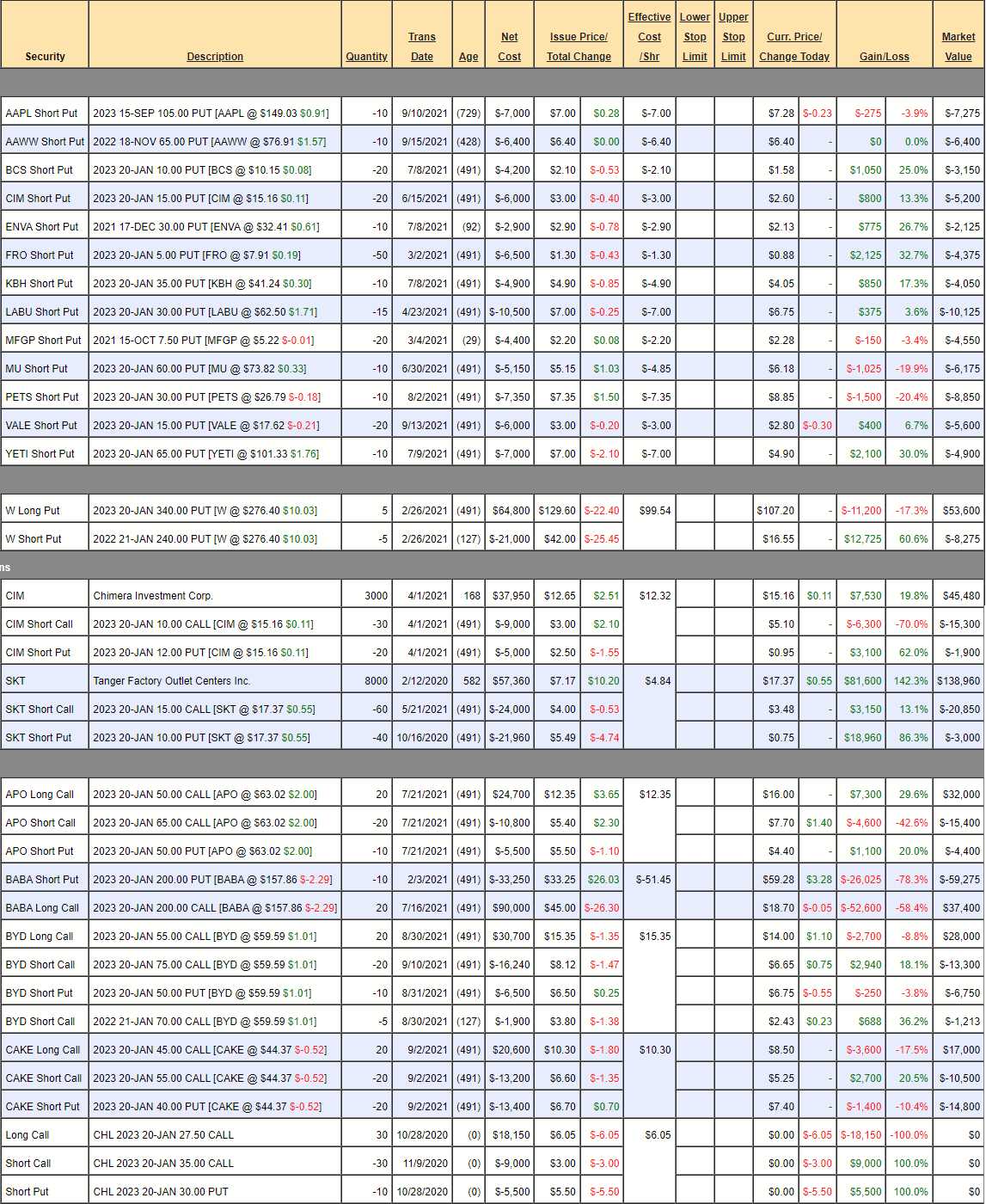

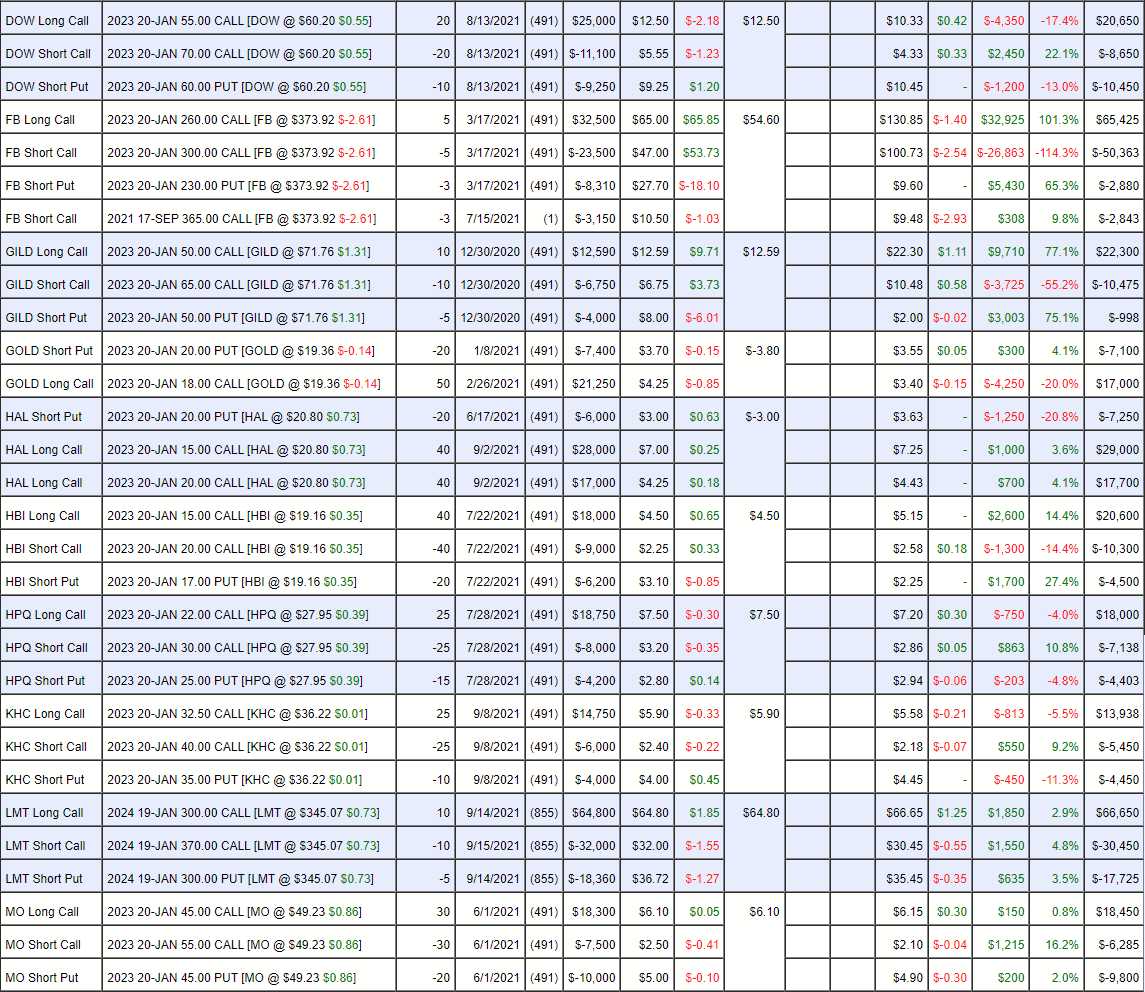

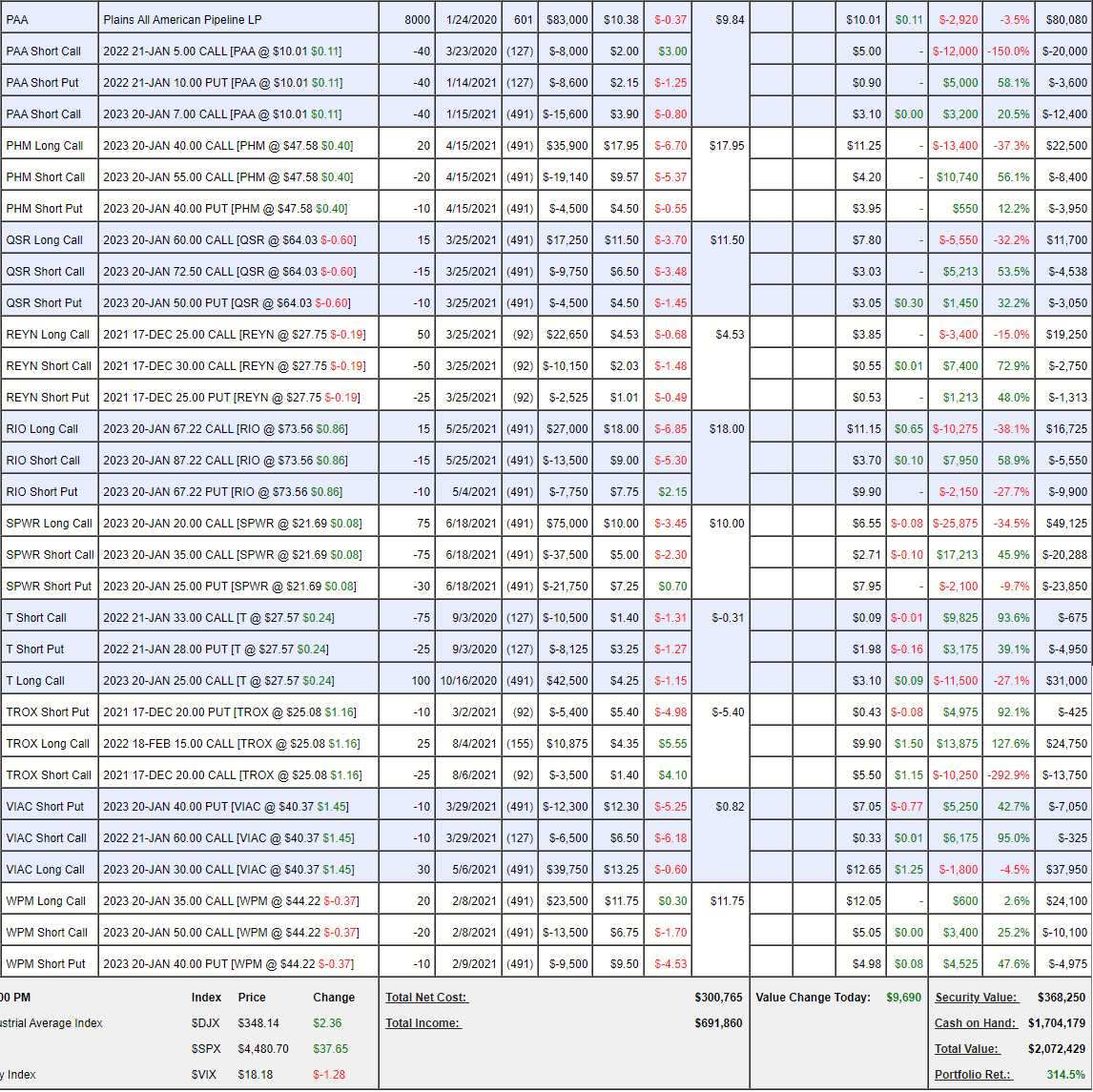

These are the positions that have survived the gauntlet of several purges and we have 40 positions that are using $368,250 in cash and $555,000 in margin that can easily make another $500,000 (54%) over the next 12 months. At this point in the cycle (toppy and looking to correct), we shouldn't have any position that we wouldn't be THRILLED to double down on if it drops 40% – meaning we would ride out a 20% correction and see what happens.

Long-Term Portfolio Review (LTP):

- Short Puts – These are all stocks we REALLY would like to own at the net price. We just sold 10 AAPL Sept 2023 $105 puts for $7 and that puts us in 1,000 shares at net $98 – yes PLEASE!!! If that doesn't happen, we get to keep the $7,000 for promising to buy AAPL at a 34% discount to the current price. This is free money, folks, why would you not take it? Our 13 short puts have paid us $78,300 and now the 2024s are out so we'll be selling at least a couple a month until we get to 30 open positions (about $200,000), at which point we'll begin cutting back again.

- W – This spread is $32,000 in the money and showing net $45,325 out of a potential $50,000 – so we're done with it. Kill it.

- CIM – Way over target and paid us a lovely $990 dividend on June 29th.

- SKT – Over our target and just paid us $1,424 on July 29th.

Just two dividend stocks like those pay $9,656 per year in dividends. That's another 2% per year added to our original $500,000 portfolio and, the two positions are only net $143,390 so $9,656 is 6.7% of that while we wait to get called away at $210,000 for another $66,610 (46%) in profit. They seem boring but this is more than a 50% return in 16 months!

- APO – Fairly new and on track.

- BABA – We were recovering but took another downturn.

- BYD – New trade, still good for a new one.

- CAKE – Also great for a new trade as it's cheaper than our entry. This is a net $8,300 credit on the $20,000 spread so there's $28,300 of upside potential at $55.

- CHL – Dead money at the moment.

- DOW – Another new one that's cheaper than our entry but we're already $10,000 in the money on the net $1,550 entry on the $20,000 spread so there's $18,450 (1,190%) upside potential here.

- FB – Miles in the money. We have to roll the 3 short Sept $365 calls at $9.48 ($2,844) to 3 short Jan $400 calls at $13.50 ($4,050).

- GILD – Well in the money.

- GOLD – We are aggressively long on this one.

- HAL – Brand new. $20,000 spread at net $4,050 has $15,950 (393%) upside potential if HAL simply holds $20. Aren't options fantastic?

- HBI – On track

- HPQ – On track but also good for a new trade as they only need to get to $30 and it's a $17,500 spread at net $6,459 so it's $11,041 (170%) of upside potential from here.

- KHC – Brand new trade. $18,750 potential at $40 and we're $9,300 in the money already yet you can still buy this spread for net $4,038 so there's $14,712 (364%) of upside potential. Arent' optons fun?

- LMT – Brand new.

- MO – $30,000 spread that's $15,000 in the money at net $2,365 – FUN!

- PAA – Just paid us a $1,440 dividend on July 29th. We'll get half called away and maybe we'll buy more again, but that's a January decision.

- PHM – On track.

- QSR – I'm a little worried about the sector with the Delta virus but, long-term, they are a bargain.

- REYN – The price of aluminum is skyrocketing and putting pressure on margin but i't a great long-term play. We are waiting for longer-term options to come out so we can roll the longs.

- RIO – This one is $9,000 in the moeny but you can buy it for net $1,275 on the $30,000 spread!

- SPWR – We're down about $10,000 but I love this one.

- T – Disappointing but making money. Eventually, we'll roll to the 2024 $20 calls for hopefully $3.50 or less.

- TROX – New trade and blew past our target already. We should roll our 25 Feb $15 calls at $9.90 ($24,750) to 50 of the 2024 $20 calls at $5.75 ($28,750) and then we can roll the short calls along over time.

- VIAC – Could be our Stock of the Year for 2022 if we're still at $40 come Thanksgiving. We're just waiting for the short calls to expire and then we'll sell some more on a pop.

- WPM – On track.

Very few changes to make as we're very happy with our LTP positions.

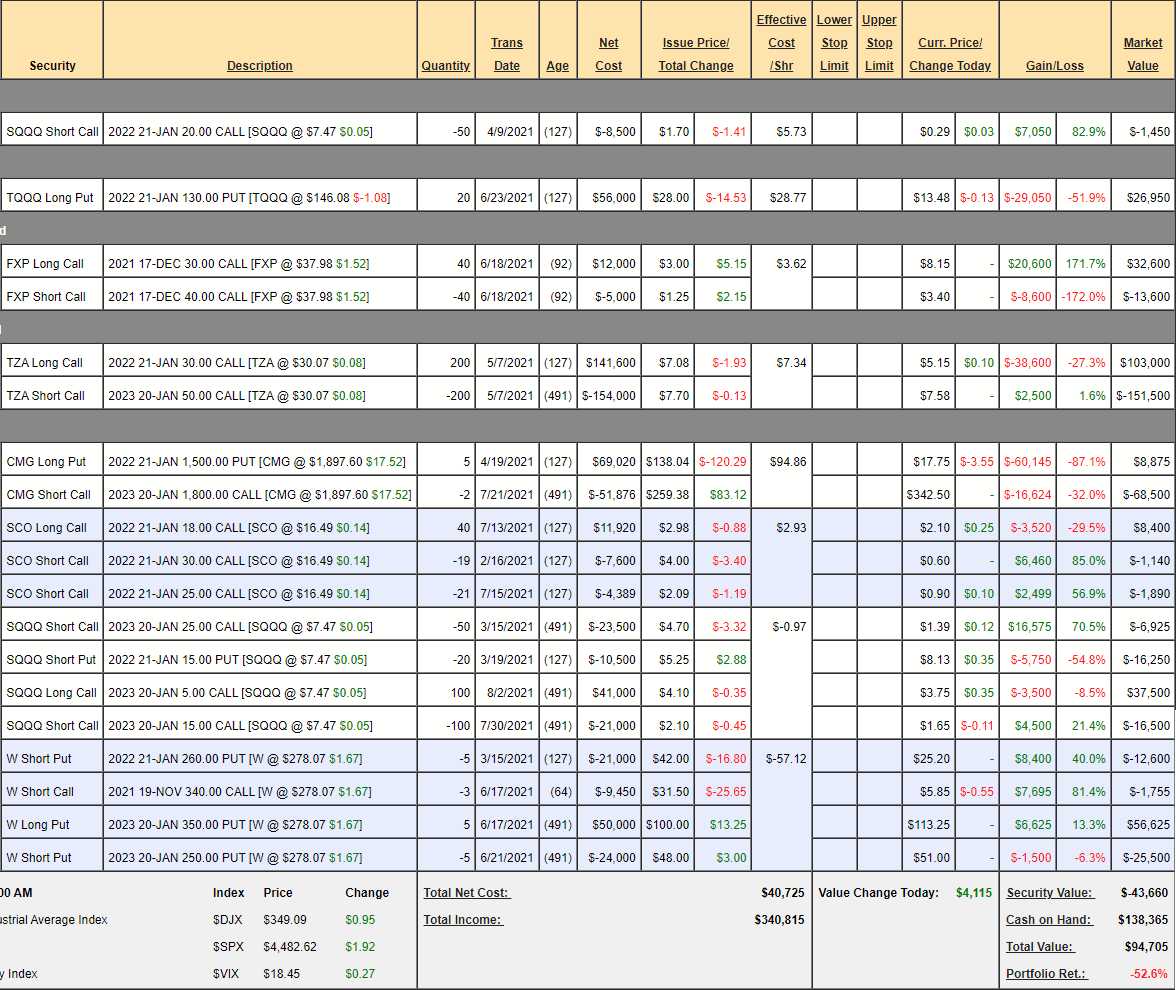

Short-Term Portfolio Review (STP): $94,705 is down $29,970 since our last review as CMG particularly killed us. We stopped out of the short calls with a $90,000 loss and we'll hopefully make that back SLOWLY by selling some more short calls. It's time to spend a little money to add more protection but not too much – just in case the market keeps rising. The STP is supposed to lose money in an up market – but it's still annoying.

- SQQQ – Thise will expire worthless in January.

- TQQQ – We're down 50% on our January shorts but here's a magic trick: We roll the 20 Jan $130 puts at $13.50 ($27,000) to 20 of the June $160 puts at $39.50 ($79,000) and we'll partially pay for that by selling 20 Jan $130 puts for $13.50 to another sucker ($27,000) so we're spending net $25,000 to roll our puts $32,000 in the money with 6 additional months of protection. If TQQQ does goe lower, we roll the puts to a lower strike in June (the $100 puts are now $13.50). If TQQQ is flat or higher in Jan – we sell another round of June puts anyway to finish paying for the roll.

- FXP – On track for the full $40,000 and only net $19,000 so far.

- TZA – 2023 $30s are $10.50 so $5.35 to roll them. We'll hope for a pop before doing that but we'll get there eventually. TZA is a 3x short so a 20% drop on the Russell will send the ETF up 60%, from $30 to $48 and that would put us $360,000 in the money. The current net of the spread is a $48,500 credit but we knew we'd have to spend that money to roll the longs eventually.

- CMG – As noted above, we lost $90,000 on the previous short calls amd we don't try to make it up in one shot. We can sell Jan $2,000 calls for $75 so let's sell 3 of those for $22,500 and hopefully we get the sell-off we're expecting by then.

- SCO – The short Jan calls will expire worthless unless oil completely collapses and we'll see how the next month goes before rolling the long calls.

- SQQQ – Let's buy back the short 2023 $25 calls at $1.40 ($7,000) and the rest of the spread is fine for now.

- W – Hit our goal but bouncing back a bit. Our put spread is $44,000 out of a potential $45,000 – so there's no point to that anymore – let's cash it out.

You always have to be on alert for the net price of your spread (or parts of your spread) vs what you hope to gain. Volatility can sometimes give you great exits – but only if you pay attention!

IN PROGRESS