This is not a good trend:

The S&P 500 is now down 5% from 4,550 at 4,322.50, on the way to a 15% correction at 3,750 so we're 1/3 of the way to our predicted correction and, so far, our Member Portfolios are holding up very well with our Long-Term Portfolio now at $2,030,974 (down from $2,072,429 in our Sept 16 review) and the Short-Term Portfolio now at $132,669 (up from $94,705 in Sept 16th) for a total of $2,163,643 vs $2,167,659 3 weeks ago. NOW THAT's WELL-BALANCED!

The S&P 500 is now down 5% from 4,550 at 4,322.50, on the way to a 15% correction at 3,750 so we're 1/3 of the way to our predicted correction and, so far, our Member Portfolios are holding up very well with our Long-Term Portfolio now at $2,030,974 (down from $2,072,429 in our Sept 16 review) and the Short-Term Portfolio now at $132,669 (up from $94,705 in Sept 16th) for a total of $2,163,643 vs $2,167,659 3 weeks ago. NOW THAT's WELL-BALANCED!

We're actually quite bearish – our hedges don't really start kicking in until there's a 10% correction but losing just $4,000 on a 5% market pullback is wonderful so we're very pleased with where we stand at the moment – especially heading into the Q3 earnings reports. We just had the final read on Thursday of our Q3 GDP and that came in strong at 6.7% so it's not the earnings we'll be watching, but the Q4 guidance.

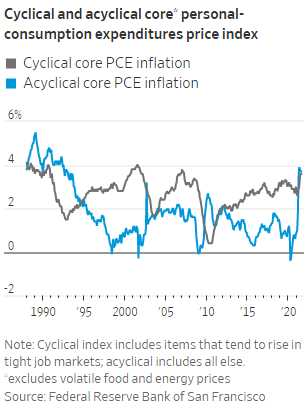

Things are really heating up on the inflation front and that's good for some companies but, for others, it can be a nightmare to manage. The chart on the left shows the rapid rise of Acyclical Inflation – the kind that doesn't just go away – and we're up at levels we haven't seen since the late 80s. This is the Fed's own chart yet, in speeches, they are still in denial and calling this inflation "transitory". After a full year of "transitory" 10% inflation – we'll see what our Corporations have to say when they give guidance this month and next (not that you can believe their BS either).

Things are really heating up on the inflation front and that's good for some companies but, for others, it can be a nightmare to manage. The chart on the left shows the rapid rise of Acyclical Inflation – the kind that doesn't just go away – and we're up at levels we haven't seen since the late 80s. This is the Fed's own chart yet, in speeches, they are still in denial and calling this inflation "transitory". After a full year of "transitory" 10% inflation – we'll see what our Corporations have to say when they give guidance this month and next (not that you can believe their BS either).

Currently, 80% of the Items in the Consumer Price Index are rising. In the 70s and 80s, it was 100% but part of that is due to changes in measurments since that time as now, if you paid $1,200 for an IPhone with 256G of memory and now you pay $1,400 for an IPhone with 521G of memory, the Fed considers that to be a CHEAPER phone, since you got twice the memory for your money.(and processing power, etc) – so no inflation there – DEflation, in fact!

There's also a substitution model in the CPI so, if you uese to eat Filet Minon at $13.20 a point and that went up 10% to $14.50 but then people switched to Hanger Steaks, which went from $11 to $12.20 – then your cost of steak went down $1, didn't it? Yes, these are real tricks the Government uses to mask inflation in the CPI (so they have to pay less Veteran's Benefits, less Social Security, less Unemployment and, of course, LESS Ineterest on the Debt.

Then there is the whole voodoo BS of Owner's Equivalent Rent, which measures amount of rent that would have to be paid in order to substitute a currently owned house as a rental property. In other words, OER figures the amount of monthly rent that would be equivalent to the monthly expenses of owning a property (e.g. mortgage, taxes, etc.). When rents are rising (like they are now) the OER seems low (since you can rent your house for more and the mortgae hasn't increased) and it makes the entire CPI seem much lower than it is (as this doesn't help new home-buyers at all.

According to Zillow, for example, housing prices went up 13.2% last year yet, according to the CPI, the cost of shelter only increased 1.8% – complete an utter BS on one of the most important components of the CPI and the CPI is the basis of many Government payouts and projection – like the Budget Plan and even your own COLA adjustments at work, etc. It affects everyone and it's based on massive manipulation of the data to pretend inflation doesn't exist.

In fact, as noted by Shadow Stats, if we measured inflation now the way it was measured before 1980 – it would be more than double what the Government claims it is today. That means the inflation we are experiencing now is actually WORSE than the inflation that was considered a national emergency back in the 70s and the Fed is well aware of this but, by simply pretending it doesn't exist – they get everyone to ignore it.

In fact, as noted by Shadow Stats, if we measured inflation now the way it was measured before 1980 – it would be more than double what the Government claims it is today. That means the inflation we are experiencing now is actually WORSE than the inflation that was considered a national emergency back in the 70s and the Fed is well aware of this but, by simply pretending it doesn't exist – they get everyone to ignore it.

Isn't it dangerous to drive economic policy bases on fantasy models? Probably – I guess we'll find out, right?

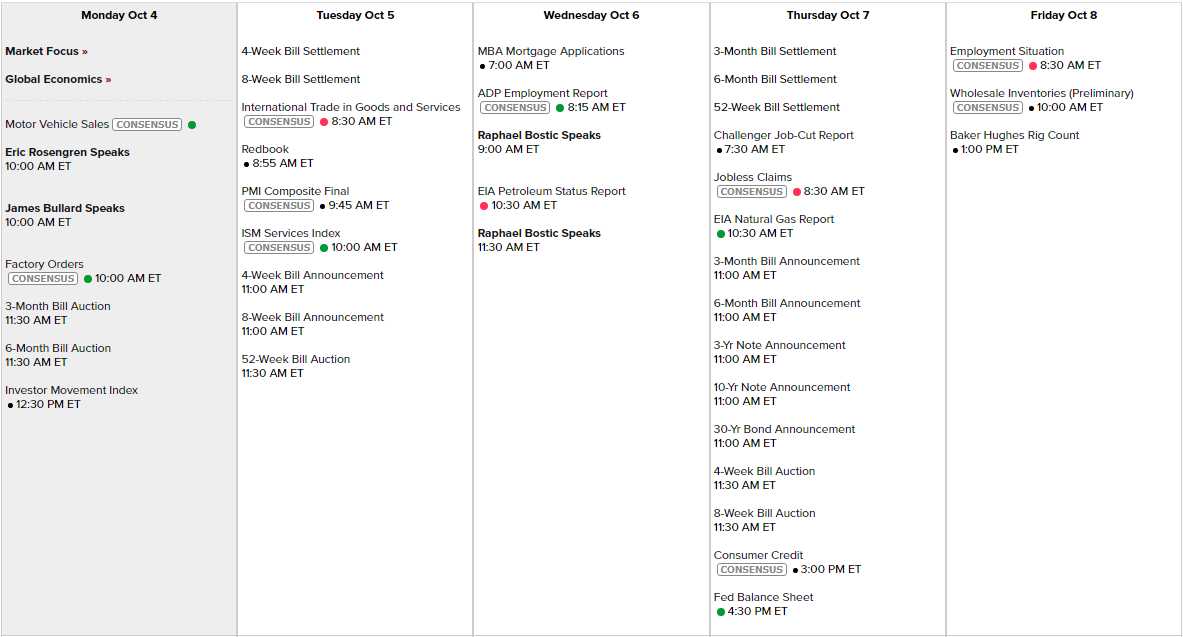

After 13 Fed Speeches last week, we're down to just 4 this week and we have Non-Farm Payrols on Friday and before that it's Motor Vehicle Monday along with Factory Orders, tomorrow we have PMI and ISM and not much Wednesday or Thursday so it's a pretty boring data week until the NFP report, overall:

We remain "Cashy and Cautious" into earnings and our portfolios are marvelously well-balanced but that doesn't prevent us from adding new longs and last week we put out Top Trade Alerts on 4 new positions for our Members, finding good value in X, MT, BIG and XRX.

Balanced doesn't have to mean boring.