$2,234,532!

$2,234,532!

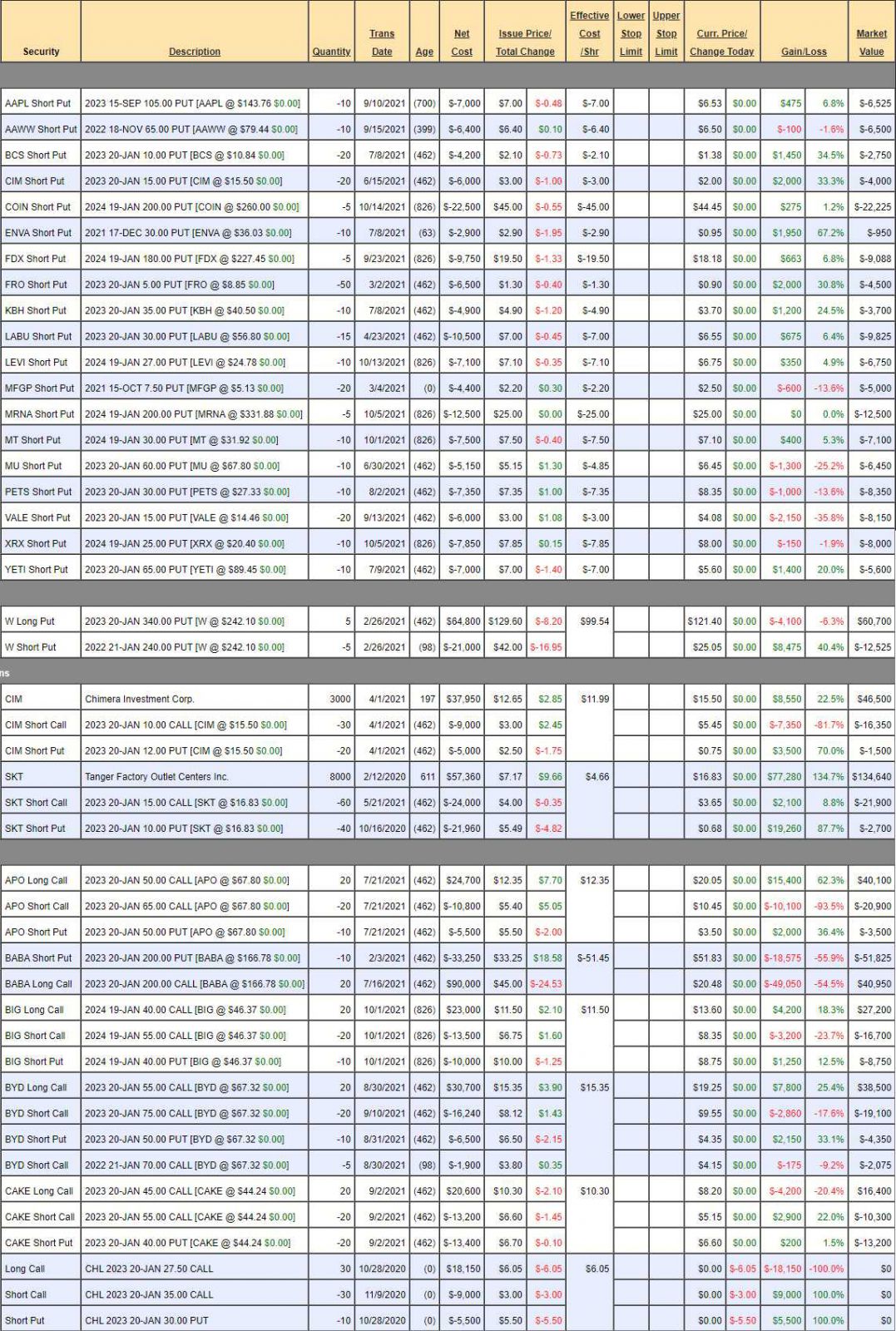

That is up a whopping $66,833 in our paired portfolios, thanks to yesterday's market surge and that's even including this week's STP losses, since we did that review on Tuesday, and have dropped about $25,000 since. That means the gains in the LTP were stunning – and we only made 2 adjustments last month! Best of all, we are swimming in CASH!!! We have $1,778,583 (83.5%) of it – up thanks to a lot of new puts that were sold in the past month, while the market was lower.

And that's our cycle – we buy low and then we sell high and we sold back in August – cutting about half of our positions and leaving us with cash to go shopping with and, what is the first thing we do when we add new positions? We sell puts. That puts even more cash into our portfolio and THEN, if we like the test drive, we establish an initial position by scaling in with a long spread (hedged, of course).

I know it seems like a slow, tedious process but it protects our positions so we can ride out the dips and you can see the results as we started with a combined $600,000 in the LTP/STP back on October 1st of 2019 (arguably a bad time to start – just ahead of an epic crash) and now we're up $1,634,532 (272%).

Since mid August, we added short puts on AAPL, AAWW, COIN, FDX, LEVI, MRNA, MT, VALE and XRX, putting an additional $86,600 into the portfolio in exchange for simply promising to buy those value stocks if they get significantly cheaper (net $98 for AAPL, net $175 for MRNA) – those would become our base entry if we do get an entry and THEN we lower the basis further by selling more puts and calls (assuming we still like the stock).

This is a simple strategy to follow but it requires PATIENCE for the long-term investor as it takes several quarters just to establish a position – BUT IT'S WORTH IT!!!

- Short Puts – As noted above, we get paid to make a watch list of stocks we want to buy if they get cheaper. Makes you feel kind of silly for having an unpaid watch list, doesn't it? VALE took a hit but you have to keep things in proportion as we REALLY would like to buy them for net $12 and the stock is now $14.46 so the "loss" that is shown in the puts is not relevant – as long as we still like the stock and want to own it for the net price.

- W – This is the only short in the LTP and we're already at goal but it's a $50,000 spread with a year of additional put selling to go. It's interesting to note the short Jan $240 puts are not even in the money but showing still $25 per contract. That's $12,525 we will pick up if W can hold $240 for 98 days.

- CIM – Pays a nice dividend and well above our target.

- SKT – They are back to paying dividends so a great bonus for this successful spread.

- APO – Over goail already.

- BABA – We're agressively long on these and I think we're safely bottoming so let's roll the 20 2023 $200 calls at $20.50 ($41,000) to 40 2024 $180 ($39)/230 ($23.50) bull call spreads at net $15.50 ($62,000) and that puts us in a fairly conservative $200,000 spread for an additional $21,000.

- BIG – One of our new ones. Still great for a new trade as it's a $30,000 spread that's over $10,000 in the money yet the net is still just $1,750. Aren't options fun?

- BYD – Another recent addition, already doing well.

- CAKE – I just ate there, it was pretty crowded. We're at the money and the spread is cheaper than we started with a net $7,100 credit if you are brave enough to take this net $20,000 spread for a $27,100 profit potential at $55. The risk is owning 1,000 shares of CAKE for ($40,000 – $7,100 =) $32,900 or $32.90/share. That's the worst case…

- CHL – Still in limbo due to restrictions with Chinese stocks.

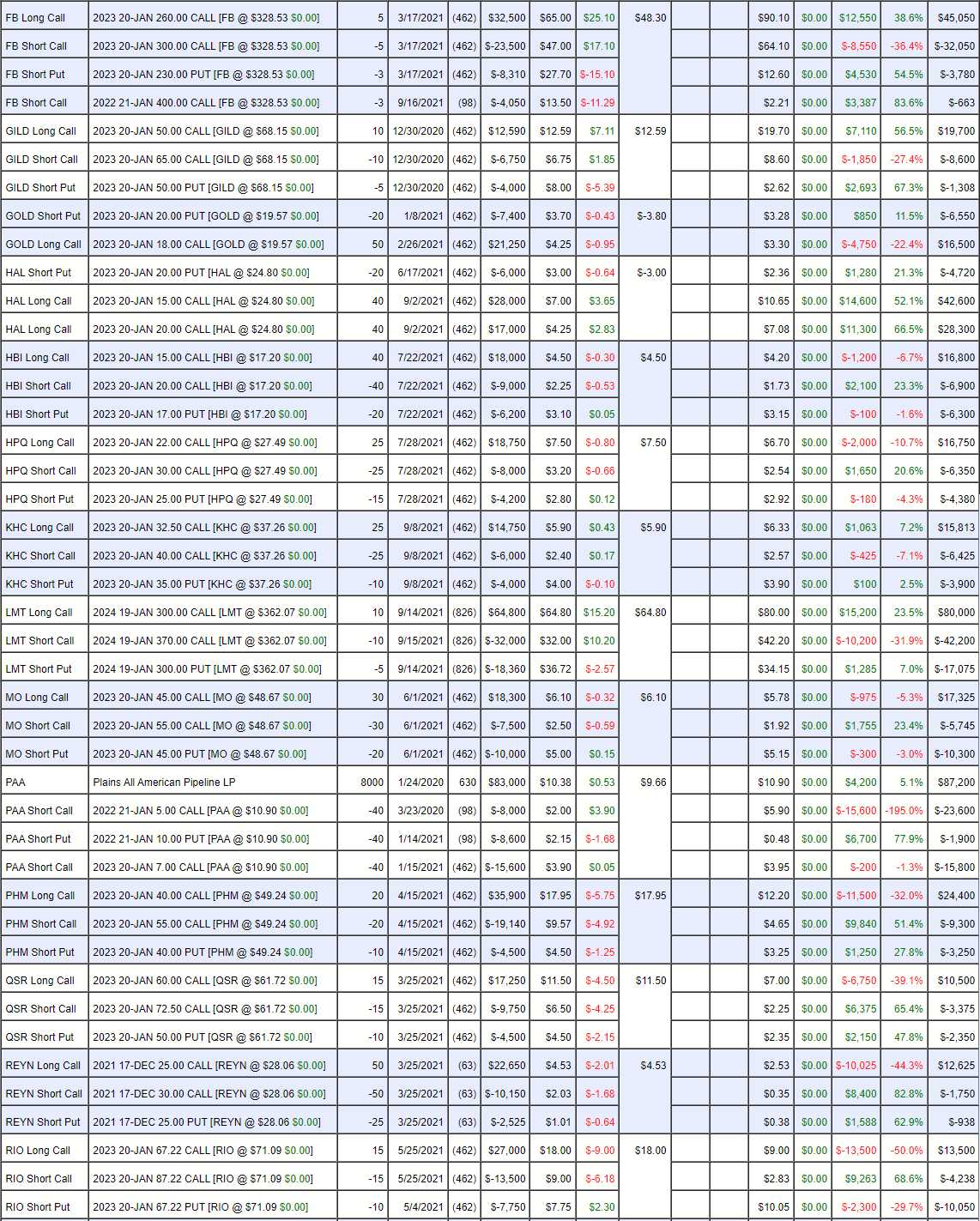

- DOW – Inflation is a problem for them but this is a great entry.

- FB – Right on target for our short puts and calls, getting paid on the long spread is just a bonus on this income-producting spread.

- GILD – In the money already.

- GOLD – Another aggressive long and, since 2024s are out, let's roll the 50 2023 $18 calls at $3.30 ($16,500) to 50 2024 $125 calls at $5.75 ($28,750) and we'll cover the extra $12,250 at some point but no hurry. Also, we can roll the 20 2023 $20 puts at $3.30 to 20 2024 $25 puts at $8.50 and put $10,000 in our pockets but it's the same net $16.50(ish) if assigned – so why not collect more money? Now we've spent just net $6,500 to improve our position by $15,000 and 12 more months to gain.

- HAL – Way over our target already.

- HBI – Still time to catch this one at net $3,600 on the $20,000 spread that's half in the money.

- HPQ – Still great for a new trade at net $6,020 on the $20,000 spread that's $12,500 in the money. They are just GIVING money away in this market!

- KHC – Also good for a new trade.

- LMT – Our Stock of the Century but it's still early. This is a $70,000 spread at net $20,725 despite being almost at goal already. Options be crazy!

- MO – Still good for a new trade.

- PAA – Another nice dividend. Over our targets so we'll get called away on half in Jan.

- PHM – 2/3 in the money but still only net $11,850 on the $30,000 spread.

- QSR – Still a nice net $4,775 entry on the $18,750 spread.

- REYN – Need this to get going as time it ticking. Earnings in early November and then we'll decide what to do.

- RIO – Moving with the commodity prices but I love it with a net $788 credit on the $30,000 spread that's $8,000 in the money. They are just trying to throw money at you – do you want it?

- SPWR – Nothing I like better than a big, fat position in SPWR!

- T – Up for the 3rd consecutive day?!? Amazing! Those short Jan calls will go worthless but we should invest in rolling the 100 2023 $25s at $2.40 ($24,000) to 200 of the 2024 $23 ($4.25)/30 ($1.35) bull call spreads at $2.90 ($58,000) and we can sell 40 2024 $25 puts for $4.30 ($17,200) as we certainly don't mind owning 4,000 shares of T at net $20.70, right? So for net $16,800 and our $20,000 loss (net $10,000 assuiming the short Jan calls go worthless) we have moved into a longer-term $140,000 spread that's currently $52,400 in the money. I can certainly live with that!

- TROX – Got bought before we could establish a bigger position. Too bad.

- VIAC – Another one of my favorites and we're aggressively long so all is well.

- WPM – Back on track after an ungly dip. The 2024 $40 ($8.75)/$47 ($6.50) bull call spread is just net $2.25 and that's too cheap not to buy 50 of for $11,250 but let's just call it a NEW play on WPM (so we'll have 2) and also sell 20 of the 2024 $35 puts for $5.50 ($11,000) so that net $250 for our new $35,000 spread. How can we not?

- X – Still good for a new trade at net $1,500 for the $36,000 spread that's $22,000 in the money to start. Options are fun! And they are giving this money away even though we all know Biden has 3 years left and wants LOTS of infrastructure to be built – so there's a massive catalyst.

You can see why this portfolio simply mints money – the leverage is incredible and, if you pick stocks that perform, the returns are simply amazing. Notice how we stick to mostly blue chip stocks with conservative targets – why swing for the fences when you can make so much money more cautiously?