Up and down we go!

Up and down we go!

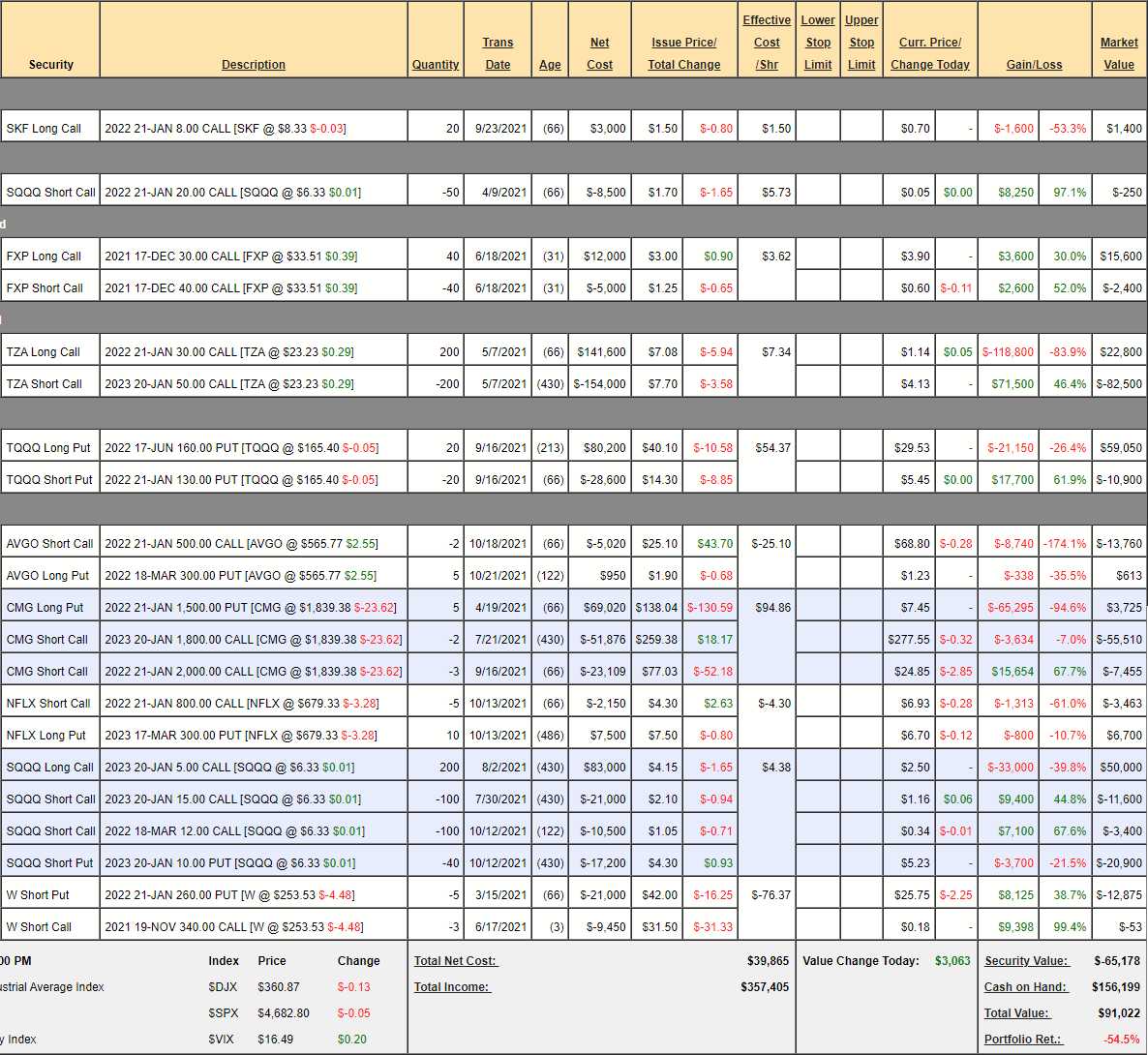

In our September Portfolio Review (16th), we were down about 50% in the STP at $94,705 but our October Review (12th) caught the dip and the STP blasted back to $128,727 but now the S&P is back at record highs and the STP is back to $91,022 and that's down 54.5% but we still have $156,199 in cash so there's no need to add money yet – but it is a good time to improve our hedges.

The STP's primary function is to act as a hedge for our bullish positions in the Long-Term Portfolio, which we'll review at the end of the week. The LTP is at $2,210,453 at the moment, up 342% overall, up $79,858 ($2,130,595) since our October 15th review. So up $79,858 in the LTP and down $37,705 in the STP is up net $42,153 and that's the number we care about. Sure we could have made more money if we had less hedges but we went back to mainly CASH!!! in August and we've been cautious into the end of the year and will remain so until Q1 earnings are over.

The LTP/STP paired portfolios are at a record-high $2,301,475 from a $600,000 start on 10/11/19, so we're up $1,701,475 (283%) on our 2nd anniversary – isn't that worth protecting? And it's the protection we have in the STP that allows us to be so aggressive when adding new longs to the LTP – which we did a lot of during the October dip (see our October Top Trade Alerts as examples).

Now it's time for Thanksgiving and we'll be picking our Trade of the Year in two weeks and that is the option trade I feel will most likely return 300% by the end of the following year. We've never been wrong about a Trade of the Year but we did miss our timing twice – fortunately we always give ourselves 2 years – just in case.

Since we're just about at what I think may be a pre-correction market top – we're going to get more aggressive with our hedges this morning:

- SKF – We thought the Financials might falter in an inflationary cycle and they did not so – Kill it!

- SQQQ – These are leftover short calls that will expire in January.

- FXP – We are very lucky to be profitable here – not worth further risk. Kill it!

- TZA – This is one of our major hedges. The short calls will expire worthless so we'll roll the 200 Jan $30 calls at $1.14 ($22,800) to 200 2023 $20 calls at $8 ($160,000) and we'll sell 200 2024 $40 calls for $7.50 ($150,000) for net $10,000. It's a little tricky as we're giving the short calls 12 extra months but they are all premium that will decay at $150,000/24 = $6,250/month while the 2023 $20s have $100,000 premium over 12 months so $8,333/montn so we're at a $2,000/month disadvantage we can make up by selling short calls or simply adjusting along the way but, for now, we pocket $12,800 and still have a $400,000 spread while we wait for the short Jan calls to expire.

- TQQQ – The short puts should expire worthless but we want to salvage the net $26 we spent on the spread and fortunately the Jan $160 puts are still $29.53 ($59,050) so we'll roll them along to 20 of the 2023 $200 ($66.50)/$150 ($37.50) bear put spreads at net $58,000 – so now we have a $100,000 spread that's $70,000 in the money. So we've widened the spread and improved the strike without taking any money out of our pocket and, when the short Jan puts expire – we'll sell more for income (something we've been doing all year).

- AVGO – This is the losing (so far) half of a trade with QCOM, which we just cashed out. Come January, we'll rollt the short calls to longer, higher strikes.

- CMG – This one makes our portfolio yo-yo. At the moment, we're down but no point in adjusting – we'll be very happy if the $63,000 worth of short calls go worthless and we may yet luck out on the short puts once that $1,800 line breaks.

- NFLX – I don't see how they'd hit $800 by January but let's kill the March puts while they are only down 10%. Don't forget what your premise was when you entered a trade – the puts were speculation on earnings that didn't work out – we chose March because they shouldn't take much damage if we were wrong and they didn't – trade over. The short calls, however, are a value play – NFLX still isn't worth $800 and we have conviction on that.

- SQQQ – Our other major hedge. The short March $12s and Jan $10s are likely to expire worthless for + $24,000 and then we'll sell another $30,000 worth of short calls and we will have already paid for all of our longs – that's a good hedge! Meanwhile, it's a $200,000 hedge at least (the short calls can be rolled along) but, realistically, it's a 3x ETF and if the Nasdaq drops 20%, SQQQ goes up 60% to $10 so really a $100,000 hedge is what we should count on.

- W – The short calls will expire worthless and we're right on target with the short puts and I can't believe how well they are holding their value (we want it to die) with just 66 days left to expiration but what can you do but learn to be patient? It does put us in the funny position of rooting for a stock we don't actually like but if they can get back over $250 – I will feel good about holding on.

So the real hedges are TZA, TQQQ and SQQQ and TZA can be $30 x 1.6 = $48 so $360,000 in protection there and $100,000 from TQQQ and $100,000 from SQQQQ is what we can count on and $500,000 of downside protection against a 20% drop in the indexes is fine for now.

We will look for some short-term plays to replenish some cash in the STP but, if that doesn't work – we'll have to take some of the LTP's profits and move them to the STP before we can get too aggressive buying more longs for 2022.

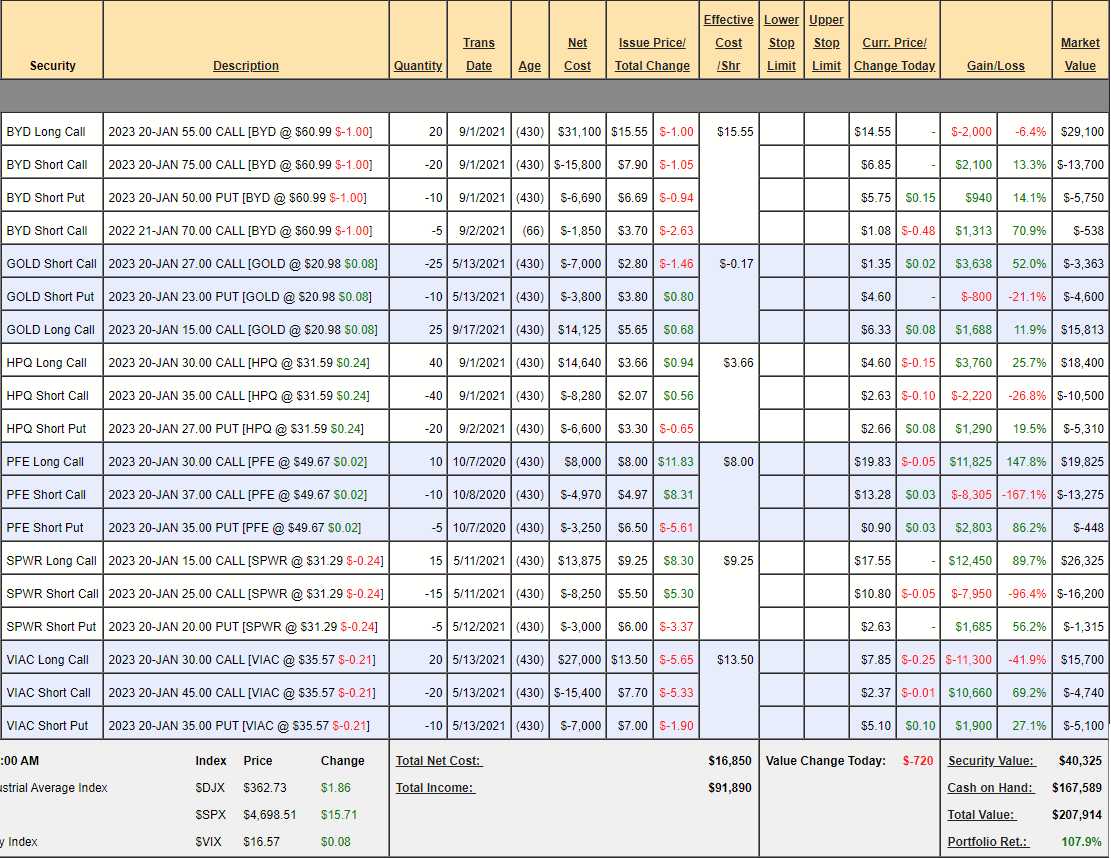

Money Talk Portfolio Review: This portfolio is easy to review as it doesn't change. We only make changes to the portfolio when I am going to be live on the show and the last time was back in September, when we added BYD and HPQ. So no changes this week but I'm back on the show December 1st to announce our Trade of the Year but PSW Members will be getting that on Thanksgiving (not that I know what it is yet).

Since we can only make adjustments on the show, I tend to pick "set and forget" kinds of conservative trades that I expect to be fairly bullet-proof from quarter to quarter. We started the MTP with $100,000 on 11/13/2019 and we're currently at $207,914 which is up 107.9% on our 2-year anniversary and up $7,423 from our last review – not bad for an untouched portfolio that's 80% in CASH!!!

- BYD – Not a lot of gains so far as we had a bit of a pullback so still good for a new entry.

- GOLD – In the running for our Stock of the Year at $20.90. It's a great inflation hedge and net $7,930 on this $30,000 spread means there's still $22,070 (278%) upside potential at $27 in Jan, 2023 but we can construct something even better for 2024 and I really don't believe inflation is going to be "transitory".

- HPQ – Still hass that new trade small but already took off. Still it's a $20,000 spread at net $2,590 so nothing wrong with it now as it's a stupidly-cheap stock.

- PFE – $7,000 spread at net $5,000. It almost should be closed but we don't need the money and we have no doubt it will make 40% by next January so we may as well let it ride. Making 40% in a year is considered a lot by most traders – we're just spoiled….

- SPWR – Our Stock of the Decade is possibly going to be our Stock of the Year. The question is whether we see an immediate catalyst. This $15,000 spread is 122% in the money at net $8,810 so $6,190 (70%) left to gain by next January and again – you guys are way too spoiled as that looks boring, doesn't it?

- VIAC – Yet another candidate for our 2022 Stock of the Year and, yet again, it comes down to who has the best catalyst as the VALUE is ABSOLUTE here. As this stands, we're $11,000 in the money on the $30,000 spread at net $5,860 so there's $24,140 (411%) left to gain if we make it to $45 but even holding $35 will give us almost a double. Based on how easy it is to make money – this should be our Trade of the Year!

What an amazing portfolio – every single position would be good for a new trade. A very solid way to deploy money in 2022!