Berkshire Hathaway (BRK-A) lost $48Bn in Q2.

Softbank (SFTBY) lost $23Bn in Q2. Blackrock (BLK), however, with $8.5 TRILLION under management, managed to make $1.7Bn (0.02%) but, with that kind of money, you can play all sorts of accounting tricks not to show a loss. As I have said, it’s very much a stock-pickers market and those guys didn’t JUST pick their stocks – they were already in the portfolio and some companies are simply handling inflation better than others.

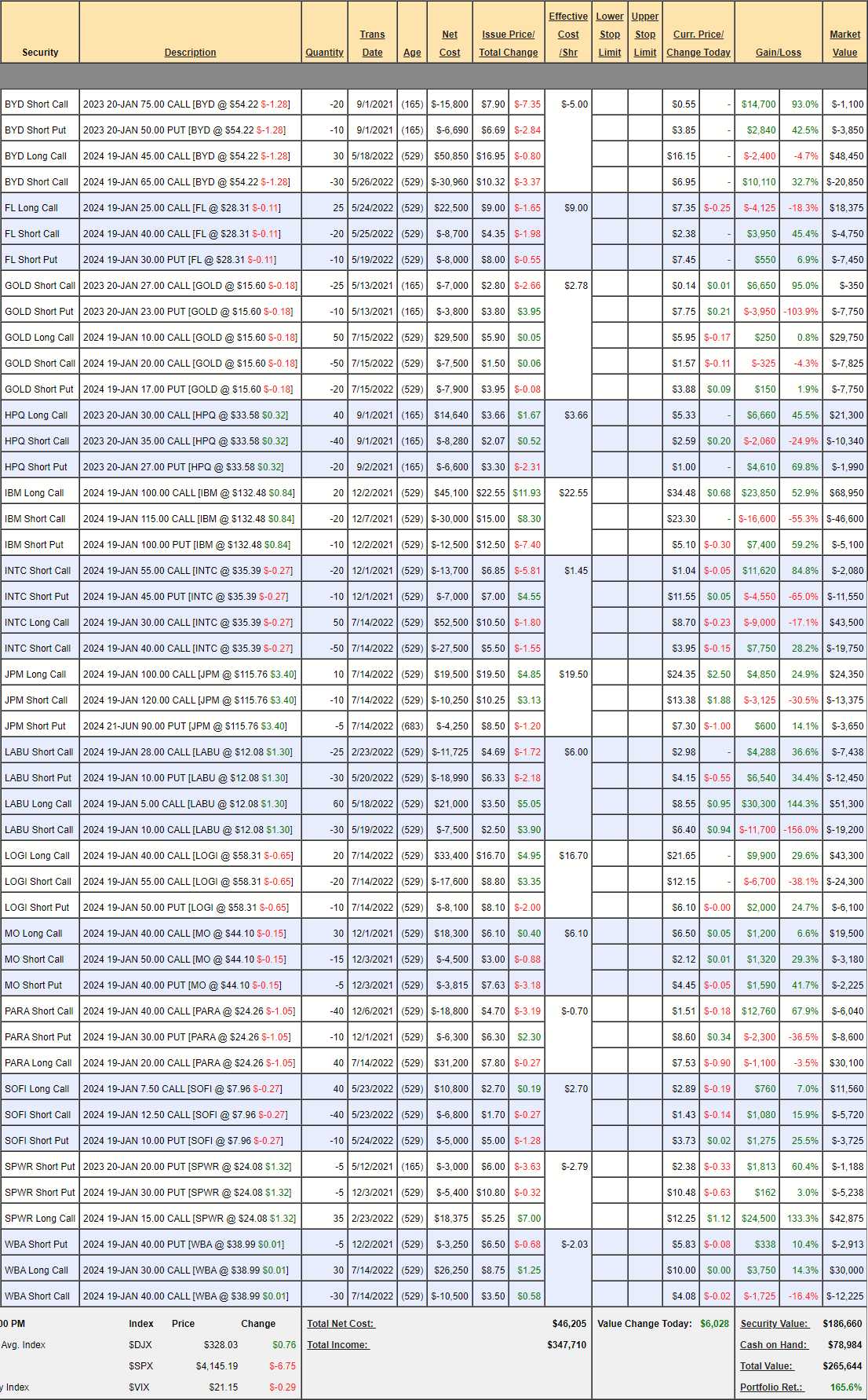

We didn’t just pick our stocks either but we did pick them expecting these conditions. As I noted last week, our Money Talk Portfolio, which is traded live on Bloomberg TV only once each quarter, went from $194,331 on July 13th to $237,659 last Wednesday and now, those same untouched positions (we only trade on the show) have jumped to $265,644 – up another $27,985 (10.5%) for the week.

I’m not saying this to brag but to respond to all the people who are saying there is nothing good to trade. There’s tons of stuff to trade – it’s just that we’ve mostly put all the really good stuff in our portfolios already so all we need to do now is wait for them to mature – PATIENTLY!

Good trading is not about constantly trading but about picking good stocks that don’t need to be constantly traded – that is the entire premise of the Money Talk Portfolio, which we’ve been demonstrating on Bloomberg for many years (this is our 3rd portfolio, starting with a fresh $100,000 each time).

Not only did we fully review the Portfolio on the 13th, but we also listed the upside potential of each position and added two brand new positions (JPM and LOGI) which had another $36,375 of upside potential over 18 months but required just $13,625 using options. Overall, the upside potential of the portfolio on July 13th was $299,583 and, since then, we’ve realized $71,313 of it – miles ahead of our expected $16,643/month.

Things can be going TOO WELL and we can expect a reversion to the mean at some point. Even if all of our trades go perfectly, they can’t possibly pay 100% for 18 months (mostly) so there has to be a point of diminishing returns if we make 23.8% of our expected total returns in a single month (vs 5.5% expected monthly).

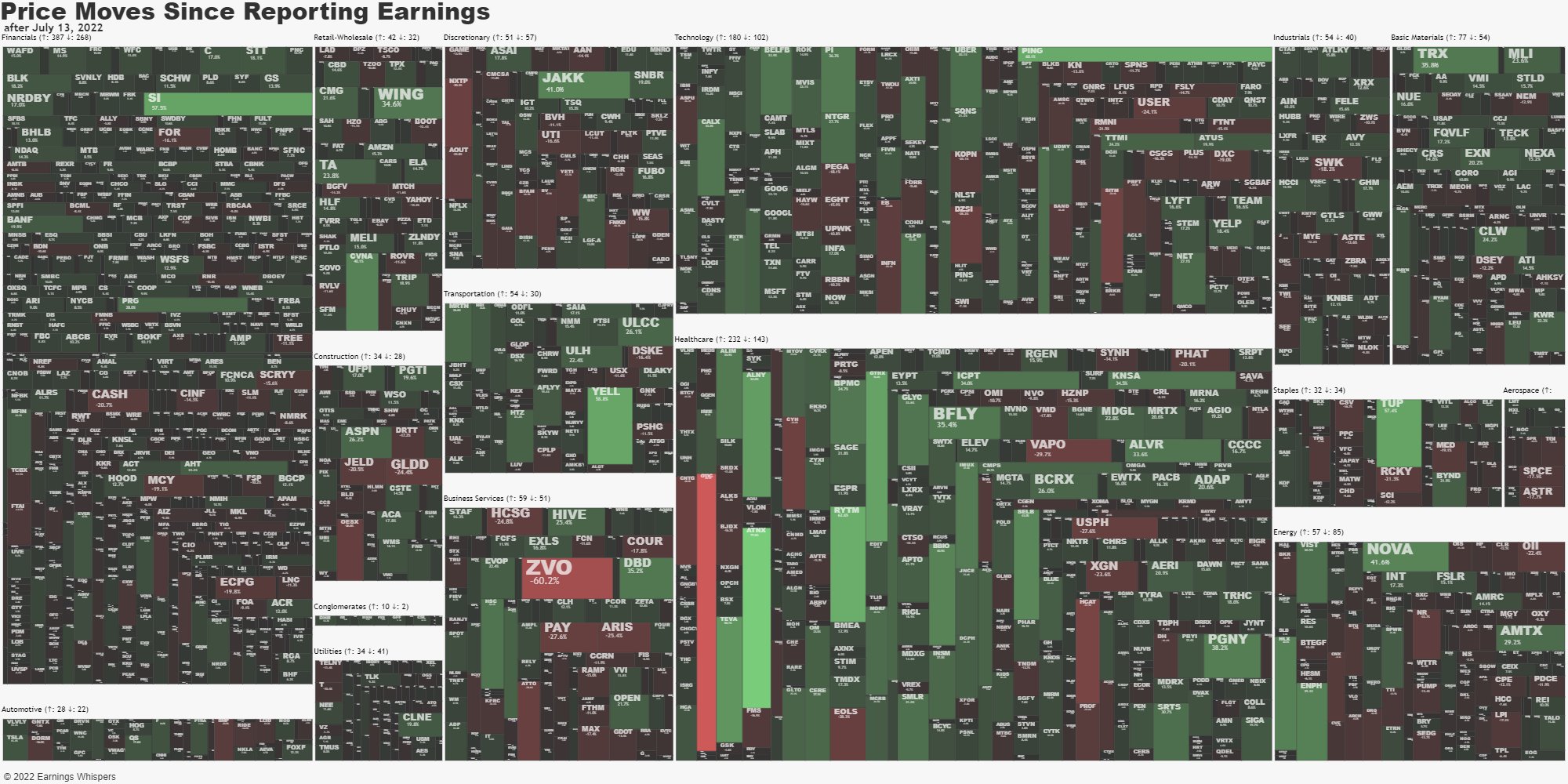

If you are good, Fundamental Investor, Earnings Season is your time to shine. We pick stocks that we feel are undervalued based on the Fundamentals and, when the reports come in, we get a good idea of whether or not our investing premises are holding up.

Sunpower (SPWR) is a good example of that and we got very aggressive with them recently, buying back the short calls to maximize our gains when they finally took off. Our premise was either we finally pass the stimulus bill for solar energy or the World was going to end – so there wasn’t much to lose betting on a solar company to eventually do well!

The bill is just passing now but they’ve already had a great couple of weeks and that position is now net $36,499, up from net $9,975 on the 13th, when I said:

“SPWR – Our Stock of the Decade has has a bad 2nd and 3rd year and we already got more aggressive on this spread by buying back the short calls so our net is now $9,975, which means we need to be over $18 to see a profit (we’ll roll the puts) but let’s say $25 is realistic and that would put us at $35,000 for a potential gain of $25,025 (250%). That last huge spike was Biden getting elected and expectations for massive solar funding. The huge dip since was the lack of that funding from Congress – but it will come eventually as solar is now economically viable without stimulus.”

So we’re already at goal, with the position up 250% in just three weeks. Now we have to decide if we want to take it off the table or cover it. Since it is our Stock of the Decade – we do expect to make a lot more than 250% so we’re going to stick with it. 2025s don’t come out until September.

The $15 calls are $12.25 and, if we sell the 2024 $35s for $4.65, we’re capping our gains at $11 more and tying up $7.60 for 18 months to make $11 (144%). On the other hand, we could cash our $42,875 in calls, leave the short puts and flip to a new play:

-

- Sell 5 SPWR 2024 $30 puts for $10.50 ($5,250)

- Buy 40 SPWR 2024 $25 calls for $7.40 ($29,600)

- Sell 40 SPWR 2024 $40 calls for $3.50 ($14,000)

In this case, we’d be taking net $32,525 off the table (not much less than closing the current spread with a huge profit) but we would still have this net $10,350 spread that has $60,000 additional Dollars of upside potential. So we will have drastically reduced our risk to the downside (other than the possible stock assignment from the short puts, which we don’t mind) while still giving ourselves all the upside we would have had up to $40.

We can’t officially do this trade in the Money Talk Portfolio as we won’t be on the show for another 2 months but our Stock of the Decade is in most of our Member Portfolios and we never let a good rally go to waste at PhilStockWorld – do we?

Trading should be fun and it is fun the way skiing is fun when you know what you are doing – not so much when you don’t. Much like a skier, even an expert trader knows there are some things he just shouldn’t do, right? We are not into high-risk trading – we are Fundamental Investors who use options both for hedging as leverage so, when we are right, we are VERY right and, when we are wrong – we have cushion to fall back on.

So check our our very detailed notes from the 13th on the Money Talk Portfolio (and there’s also a dozen other stock ideas for our Watch List) and now let’s see how that applies to our Future is Now Portfolio, whose performance in the past few weeks make the Money Talk Portfolio look like a failure:

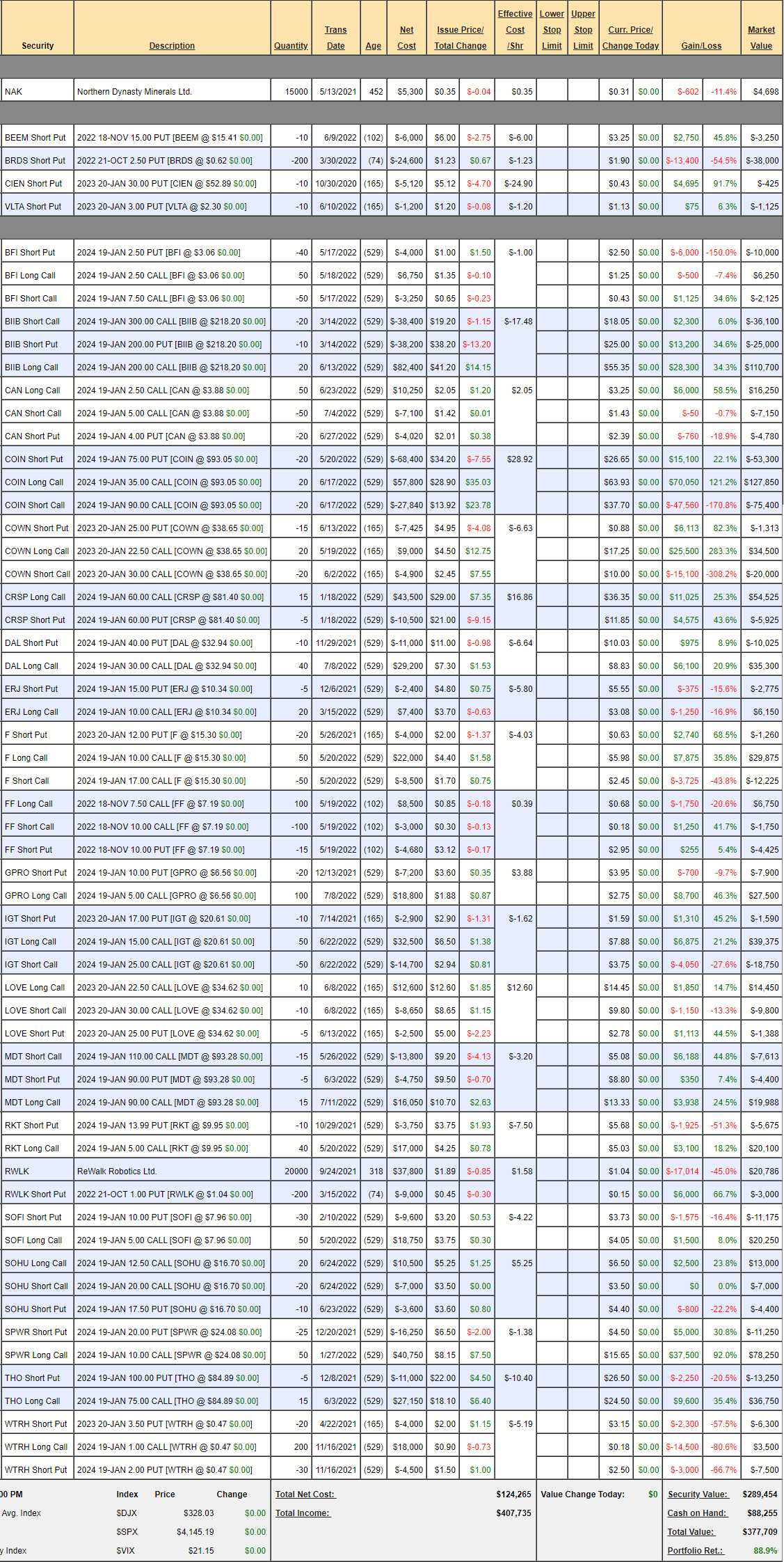

In the July 14th Review, we were DOWN 4.8% at $190,367 so $377,709 is just shy of a double – up $187,342 (98.4%) in three weeks – and we only made two small changes! This portfolio is all about potential.

One of the changes was tripling up on Northern Dynasty (NAK) – who are sitting on top of the World’s largest gold and copper mine – but the EPA won’t let them mine it because it might kill some salmon (well, most of them). Human history teaches us that, eventually, all gold gets mined so this is a patience play. If the Republicans win the next election – this will be our consolation prize… The Supreme court recently de-fanged the EPA so it remains to be seen if they can still hold NAK and their partners back. NAK JUST got $60M from an investor in exchange for royalties going forward – so someone believes in them. That gives them plenty of money to fight the EPA in court (and contribute to the GOP).

BEEM – Essentially a penny stock with a $155M valuation at $15.41 and earnings are on the 12th, they are in the EV Charging space. When we sell short puts – it’s generally to remind ourselves to keep an eye on them.

BRDS – Electric Scooters. The whole thing has fallen out of favor but I still think it’s got a great future. We collected $1.23 for the $2.50 shares so our net is $1.27 on 20,000 shares and we’ll roll them along to longer months when they open up.

-

- CIEN – Network Sevices. Did so well that we’re just going to close them at 100%.

- VLTA – More EV Charging.

- BFI – Nice little hamburger chain off to a poor start. Long-term hold though. This is a $25,000 spread at a net $5,875 credit and it may look like a loss but the 2024 $2.50 puts are out of the money so it’s all premium and, as long as we REALLY want to own 4,000 shares at $2.50 ($10,000), that shouldn’t scare us at all. The upside potential at $7.50 is $30,875 (525%) in a very margin-efficient trade.

-

- BIIB – Nice Biotech Drug Maker with a huge, active pipeline. Already taking off for us but still just net $49,600 on the $200,000 spread so $150,400 (303%) upside potential if we get our $300 target right in 18 months.

-

-

- CAN – Circuits and they’ve been specializing in BitCoin equipment so they sold off but that was just because it’s popular – they can make chips for AI and all sots of other things but, as usual, traders don’t understand the underlying value of the things they invest in and they bail out as soon as a fad seems to be fading out. Even though we are already up $5,190 at net $4,320, it’s a $12,500 spread with $7,310 upside potential at $5.

-

-

-

- COIN – Boy have they had a rough ride but I think just surviving the shake-out is good for them down the road. We are back in the black with a net $850 credit on the $110,000 spread so our upside potential is $110,850 (13,041%) at $90 – which it’s over. How’s that for a new trade?

-

Notice with COIN we sold those $75 puts in May when I thought it had bottomed and then, a month later, we added the spread. That’s a typical sequence we go through.

-

-

- COWN – I couldn’t believe how cheap they were trading at. Just a little financial company, now being bought by TD Bank. It’s already net $13,187 out of a potential $15,000 but no reason not to sit tight and collect the last $1,813.

-

-

-

- CRSP – They got cheap enough that we bought back the short calls. People lost faith or patience but everything I read says gene editing is the future. Let’s say it get to $120 before we cover and that would be at least $90,000 on the calls and currently net $48,600 so good for another $41,400 (85%) if all goes well. Actually, we’ll be more clever than that but that’s our base case.

-

-

-

- DAL – Also was way too cheap. Still is at net $25,275. At $40 it will be a $40,000+ spread so, conservatively, we expect $15,000 out of it (59%) but we can do better.

-

-

-

- ERJ – Little competition for BA and Airbus but also does defense work and, best of all – Flying Cars! Seemed too cheap to me in March and a bit cheaper now at net $3,775 but it will be $10,000 at $15 for a $6,225 upside and we’re going to get more aggressive.

-

-

-

- F – Now who went and threw away a perfectly good car company? We jumped in a little early but we didn’t want to let it get away at that price. It’s a $70,000 spread and still only net $16,390 so there’s $53,610 (327%) upside potential at $17.

-

-

-

- FF – It drives me crazy that people don’t see how great they are. Biofuels and specialty chemicals is nice and boring and PROFITABLE! They made so much money last year they paid a $2.50 special dividend and the year before it was $3. Here we have a $25,000 spread at net $575 so there’s still $24,425 (4,247%) upside potential at $10 and we only sold 15 puts but we’ll have to buy some more time so I’m not going to count it as it will be, essentially, a new trade.

-

-

-

- GPRO – Another fine example of traders having no patience for a company executing a good plan. We got way more aggressive and it’s paying off. If they hit just $8 our $5 calls will be over $3 and that’s $30,000 and currently it’s net $19,600 so a conservative $10,400 (53%) to gain before we roll.

-

-

-

- IGT – Sports betting should boost them along with the comeback for casinos. On tradk for the full $50,000 at net $19,035 gives us $30,965 (162%) upside potential.

-

-

-

- LOVE – Modular furniture. I think they have a strong growth outlook. Already over our target at net $3,262 on the $7,500 spread we bought 2 months ago for $1,450. So we have $4,238 (130%)upside potential remaining and they are just GIVING AWAY money on this one. This is what I mean when I said it’s annoying when our initial entry goes well – we didn’t have a chance to make it a bigger spread…

-

-

-

- MDT – Who doesn’t love medical devices? It’s a $30,000 spread at net $7,975 despite us being up over $10,000 already (we started with a credit). $22,025 (276%) upside potential remains.

-

-

-

- RKT – Mortgages of the future. We got aggressive here but still only net $14,425 and the IPO was $20 but let’s say $15 would be $10+ on the $5s so $40,000 would be $25,575 (177%) upside potential from here.

-

-

-

- RWLK – We chased, that was a mistake. Bad entry cost us a lot but they are buying back $8M of their own stock – about 15% of it – because they think $1 is way too cheap. The current valuation is $65M and they have $82M in the bank and no debt. Only $8M in sales so far but they expect double next year and they are “only” losing $12.5M this year so not a huge burn rate to cover. Mostly this is about getting their device approved as it’s about $70,000 vs a $3,500 wheel chair and, unfortunately, insurance companies don’t define your ability to walk as “necessary enough” to justify the extra expense. Germany has approved it and other countries will follow. If the US approves it under Medicare, this company will fly so we’re just holding the stock with our fingers crossed.

-

-

-

- SOFI – They got approved as a Bank! That means they can go to the Fed and their competitors can’t – huge advantage! It’s the same net $9,075 we bought it for but we do have a profit on the short calls we bought back. I feel strongly we get to $15, which would make our $5s $10+ for $50,000 so $40,925 (450%) upside potential here.

-

-

-

- SOHU – Chinese gaming content. It has been heavily restricted but approvals seem to be coming along. They could break much higher but we’ll be thrilled with $20 and that would be $15,000 and it’s currently net $1,600 so $13,400 (837%) upside potential from here if the stock rises less than 20%. Seems fair…

-

-

-

- SPWR – Our stock of the decade is picking up steam. We are already up a ton but I’d hate to cover it. At $30 the $20s would be $20+ so call it $100,000 and currently net $67,000 with $33,000 (49%) upside potential but we’ll do a lot better with adjustments.

-

-

-

- THO – Mobile homes are the future. You never know if the place you live will be inhabitable in 10 years – or have water – or be in a disease hot spot… So it’s smart to have wheels on your house, isn’t it? Wouldn’t the Grapes of Wrath have gone much better if the Joads’ had an RV? The company has been beset by supply chain issues but 80-90% completed trailers are filling up their lots and there’s a never-ending supply of orders for them. The supply chain issue will work out eventually – the housing crisis will not. We’re aggressively uncovered and, back at just $120, our $75 calls will be $45+ ($67,500) and currently we’re at net $23,500 so $44,000 (187%) upside potential is conservative.

-

-

-

- WTRH – These guys are trying REALLY hard to get things going. Hopefully 18 months is a enough time to give them but I’m not going to count on this money.

-

So our 4 short puts can make us $42,800 if they can go worthless but it’s all up to BRDS and that’s NOT going to happen by October unless they get bought (doubtful). I won’t count on those or NAK – just wildcards that would be fun if they come in as winners.

That leaves us with 21 spreads and those have $642,011 upside potential (not including the ones we don’t have a lot of faith in). That’s pretty good for a $377,709 portfolio over the next 18 months.

See? Fun!

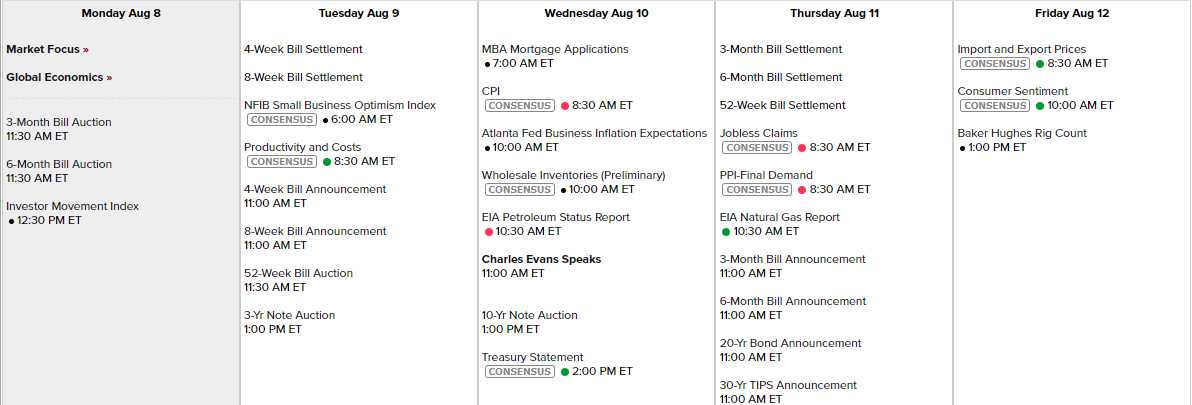

On the Calendar this week, we have Inflation Data, Consumer Sentiment and very little Fed Speak:

That will keep the attention focused on Earnings:

Which have overwhelmingly gotten good reactions so far: