The Effects of Quantitative Tightening: Less Liquidity, More Volatility

By Niccolo Conte, Visual Capitalist

This infographic is available as a poster.

This infographic is available as a poster.

Quantitative Tightening: Less Liquidity, More Volatility

How are interest rate hikes and quantitative tightening affecting markets?

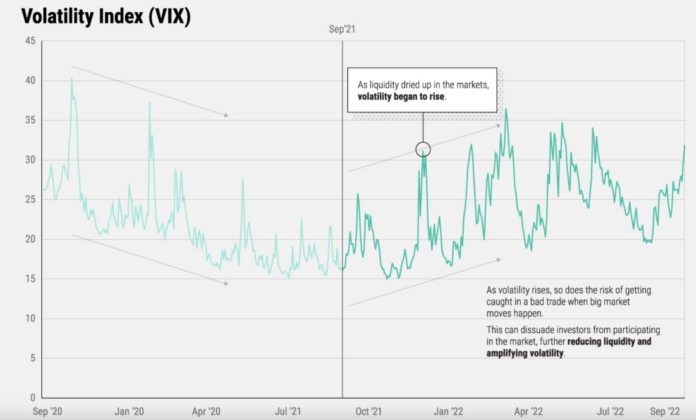

The Federal Reserve’s fast-paced rate hikes and initial reductions of its balance sheet have resulted in liquidity drying up across markets, amplifying volatility and uncertainty.

This Markets in a Minute from New York Life Investments explains how quantitative tightening affects markets, and charts the rise in volatility spurred by the severe decline in S&P 500 futures book depth.

What is Quantitative Tightening (QT)?

Quantitative tightening (QT) is the infamous twin to quantitative easing (QE). For context, quantitative easing is the injection of liquidity into bond markets by the Federal Reserve buying Treasuries and mortgage-backed securities which are added onto the Fed’s balance sheet.

As a result, during periods of quantitative easing, Treasuries and certain mortgage-backed securities have a large-scale buyer providing buy-side liquidity, reducing the impact of sellers in the market. This supports bond prices, and prevents bond yields from rising too quickly.

Quantitative tightening is a reduction of the assets on the Federal Reserve’s balance sheet. This means letting Treasuries mature and not rebuying them, or even selling them on the market. Opposite to quantitative easing, QT removes buy-side liquidity from the market and can result in bond prices falling and yields rising.

How Rate Hikes and Quantitative Tightening Affect Markets

Along with quantitative tightening’s reduction of liquidity from markets, interest rate hikes can also result in less market liquidity.

As interest rates rise, so do borrowing costs for capital. This results in less money being lent out and fewer deals being funded, higher mortgage and other loan rates, and tighter overall purse strings of market participants and everyday consumers. In this way, higher interest rates slow down market and economic activity.

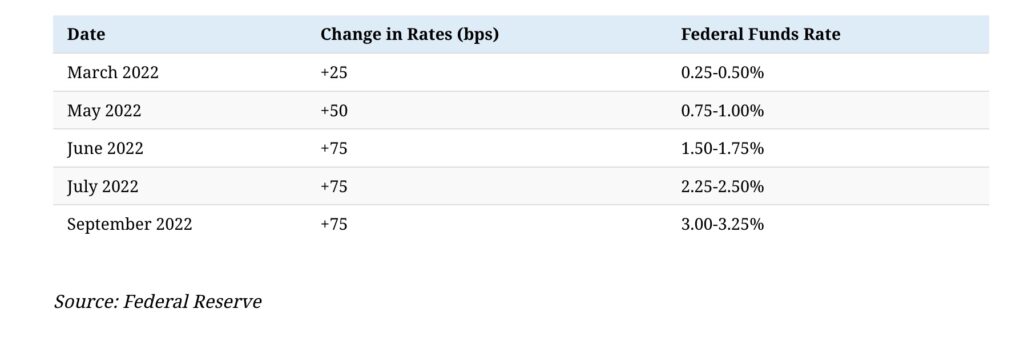

The Fed’s pace of rate hikes in 2022 has been one of the fastest in history, with the Federal Funds rate starting the year at 0.0-0.25% and projected to end the year somewhere between 4.0-4.5%.

As rates have continued to rise, the rate of quantitative tightening doubled in September to now let a maximum of $60 billion of Treasuries and $35 billion of mortgage-backed securities roll off its balance sheet without repurchase.

This acceleration in QT could see market liquidity dry up even more, further amplifying volatility.

How Low Liquidity and High Volatility Raise Risk

One of the clearest measures of liquidity is a market’s book depth. Book depth is the amount of available buy and sell orders in a market’s order book.

More orders stacked up on either side results in thicker book depth, or deeper liquidity for incoming buy and sell orders to tap into, while less orders on either side result in thinner book depth, especially at the top of the book.

The top of the book is where buy and sell orders are closest to the last traded price:

- $101 – Closest sell orders

- $100 – Current/last traded price

- $99 – Closest buy orders

In the example above, buy orders at $101 and sell orders at $99 are at the top of the order book since they are closest to the last traded price.

As liquidity tightens and book depth thins out, orders at the top of the book become smaller, meaning that prices can move around more easily as big trades come into the market to fill orders at the top of the book.

In this way, tighter liquidity and thinner book depth result in higher volatility, largely raising risk for market participants. This can turn into a self-reinforcing cycle, as investors sit out of the markets to avoid periods of high volatility, resulting in even less liquidity and higher volatility.

Looking Ahead

As book depth has thinned out significantly over the past year, volatility began to rise alongside the market’s uncertainty.

With more rate hikes incoming and the Fed’s QT operations continuing at a faster pace now, market participants may brace for even less liquidity in markets and the possibility for further volatility and heightened risk.