He KNOWS what he’s doing!

He KNOWS what he’s doing!

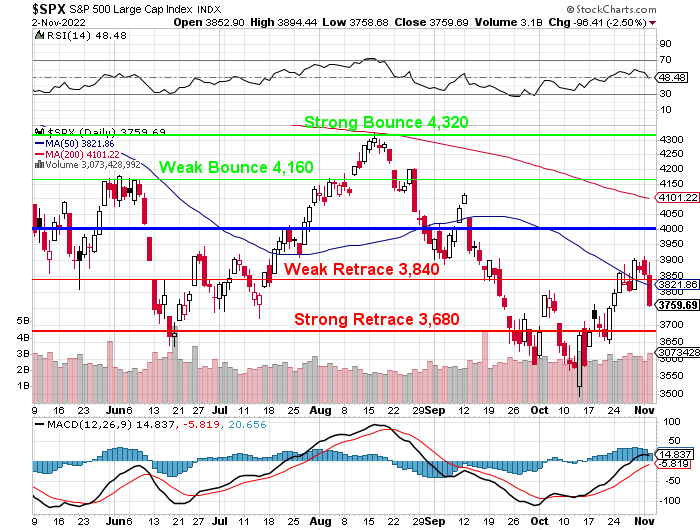

While the Fed Statement took on a more doveish tone and rallied the markets, Powell immediately put a stop to that as soon as he started speaking and, just like last time, on September 21st, Powell’s remarks killed the rally. The S&P 500 was at 3,925 that day but we finished the day at 3,806 and we were back to 3,600 on the 30th.

Yesterday we topped out at 3,907 and we closed at 3,768. As I noted back in September in “F’ing Fed Thursday – Powell Brings the PAIN!!!“:

“Well, he did promise us pain.

“Jay Powell held nothing back yesterday as the Fed popped rates the expected 0.75% to 3% but what spooked the markets is them saying definitively, that they were looking for 4.25-4.5% THIS YEAR! There’s only two meeting left this year so that’s at least another 0.75% hike November 2nd and then 0.5-0.75 on December 14th –Merry F’ing Christmas!

“Yes, we remember how badly the markets reacted to previous rate-hiking sessions but, in 2000 we had thousands of Dot Com Companies trading at 100, even 1,000x valuations and of course they were going to crash. In 2008, Energy companies were trading like oil would be $200 and Banks and Real Estate companies had very unreal earnings.

“This time is a little different as we’ve already had a nice pullback and, as I noted yesterday, 4% Fed Funds Rates are not what we’d call restrictive – the thing that was unreal was the 0.25% rates. Yes, you have to be very concerned that companies with high debt won’t be able to meet their obligation and the strong Dollar hurts some companies and helps others – we just have to differentiate.”

And differentiate we did as we set up a buy list and added 15 new trade ideas during the sell-off to our Long-Term Portfolio (LTP) – as well as our other Member Portfolios. Here we are, 6 weeks later, selling off again for the SAME REASON we sold off last time Powell spoke. He told us 4.25-4.5% by the end of the year – how else do they get there without more hikes?

What is new information for the markets (but not for our Members, as our target has been 6% in June 2023 since they started) is that 4.5% is not going to be enough to reign in inflation. Well DUH!!! Anyone who can read data could have guessed that 10.7M open jobs and 9.7% Inflation was not going to curl up and die just because the Fed put rates back to a NORMAL 4.5% – certainly that will not drive the CPI back down to the Fed’s now-delusional 2% target level.

Just yesterday morning (“Which Way Wednesday – Fed Edition“) I was saying that inflation is not going away until wages increase enough to catch up and we are MILES away from that happening with 20 states still at the 2009 Minimum Wage limit of $7.25/hr ($290/week). You can’t even EAT for that much money – let along afford a refrigerator to put the food in (or a kitchen to put the refrigerator in or pay for the electricity to run it)!

Just yesterday morning (“Which Way Wednesday – Fed Edition“) I was saying that inflation is not going away until wages increase enough to catch up and we are MILES away from that happening with 20 states still at the 2009 Minimum Wage limit of $7.25/hr ($290/week). You can’t even EAT for that much money – let along afford a refrigerator to put the food in (or a kitchen to put the refrigerator in or pay for the electricity to run it)!

It annoys the Wealthy when “Average Joes” move into their neighborhood and send their average kids to good colleges who rejected their wealthy, dopey children and it especially annoys them when other people have access to their doctors – so they make everything cost more and more money until the Average Joe can’t keep up anymore – essentially they get pushed out of the Middle Class and are no longer a threat to the embedded aristocracy.

That’s been the way the game has been played for thousands of years – why would you think this blip of Workers Rights in the US was ever going to last? The Supreme Court is now rapidly dismantling all the progress we made in the 20th Century. The Elitist President is glorified and the Working Class President is vilified by the Media – which is owned almost entirely by the richest people on Earth. Coincidence?

- Some Colleges Have More Students From the Top 1% Than the Bottom 60%.

-

Roughly one in four of the richest students attend an elite college – universities that typically cluster toward the top of annual rankings. In contrast, less than one-half of 1% of children from the bottom fifth of American families attend an elite college; less than half attend any college at all.”

-

It’s not the inflation that’s killing people – it’s the lack of wage increases to keep up with them. If I’m earning $290 a week and wages rise to $15/hr and I’m then making $600/week and wages are, let’s say, 1/3 of the cost of the average producer, then prices would have to go up 33% to compensate but that still means my 100% greater wages will be able to buy 50% more products than they used to (do the math!).

That’s not a problem – that’s a SOLUTION!!!