Wheeee!

Wheeee!

That was fun yesterday, where, in the Morning Report, I said:

“Russian Crude currently trades at $50 and Putin has threatened to unilaterally cut production if the caps are enforced but first Brent Crude, now $87.50, would have to be back over $100 and that’s not very likely so it’s all a lot of hot air and is no reason for WTIC (/CL) to be at $82.50 this morning. Still, it’s a dangerous short (last week was obvious) and I’d be very careful playing it – with very tight stops above $82.50.”

As you can see, that worked out very well, paying $5,500 at yesterday’s close and another $1,000 this morning as oil prices collapsed under the weight of their own BS. We are officially done with the shorts now – as that was a huge drop and we are not greedy (You’re welcome!).

Futures are nothing to be feared and they make a great tool in our investing toolbelt – IF we know how to use them properly – and that is: Only once in a while and with great care – like a chainsaw…

We wait, PATIENTLY, for opportunities when there is significant resistance AND clear Fundamental evidence showing us a reversal is in order – like Natural Gas this morning, which is too low under $5.50 – so /NG is a good long the way /CL was a good short yesterday.

We wait, PATIENTLY, for opportunities when there is significant resistance AND clear Fundamental evidence showing us a reversal is in order – like Natural Gas this morning, which is too low under $5.50 – so /NG is a good long the way /CL was a good short yesterday.

Oil (/CL) is probably oversold too and can be played for a bounce but the issue there is I wouldn’t have conviction playing oil long and I’d be very quick to stop out if it fails $76 again but /NG I believe is way underpriced at $5.50 for the long haul. In fact, if you want to play it with options instead of stocks, our UNG play in the Short-Term Portfolio is back to where it started at net $2 for the Jan $15/20 bull call spread. If all goes well and /NG is back over $7 in January, the spread will return $5 for a 150% gain in a month.

We’re seeing stock plays too but we’re generally being cautious into the Holidays. Yesterday, in our Live Member Chat Room, we found a Top Trade-worthy play for META but we just did a Top Trade Alert on them on October 27th – so no need to be redundant but still a good trade idea, nonetheless.

We also reviewed our hedges yesterday as I’m not seeing a lot of data to convince me that we’re not heading into a Global Recession next year. As I said on Bloomberg last week, I think it will be mild for the US and Canada but we’re Global Citizens too and we’re not going to get through this unscathed – hence our heavy CASH!!! positions and abundance of hedging.

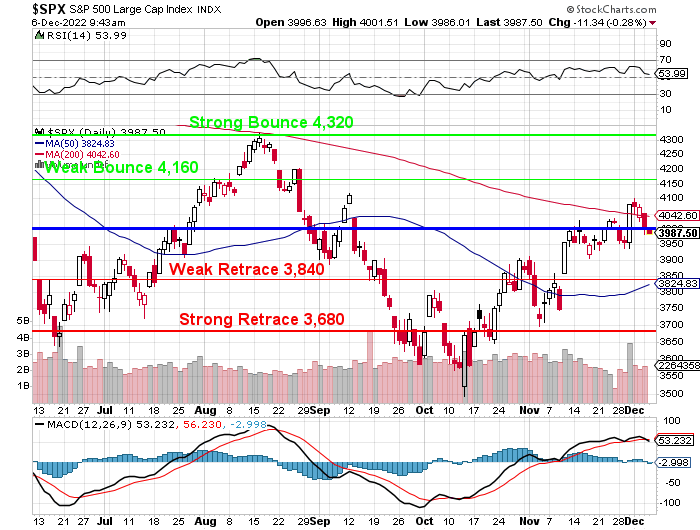

The S&P did pretty much what we expected – testing and failing the 200-day moving average and it’s a big concern how easily we fell back below 4,000 – even with the much-weaker Dollar (now 105). The Dollar was at 107.50 into Thanksgiving so we have a 2.3% currency advantage now and we still can’t close the deal – that’s bad!

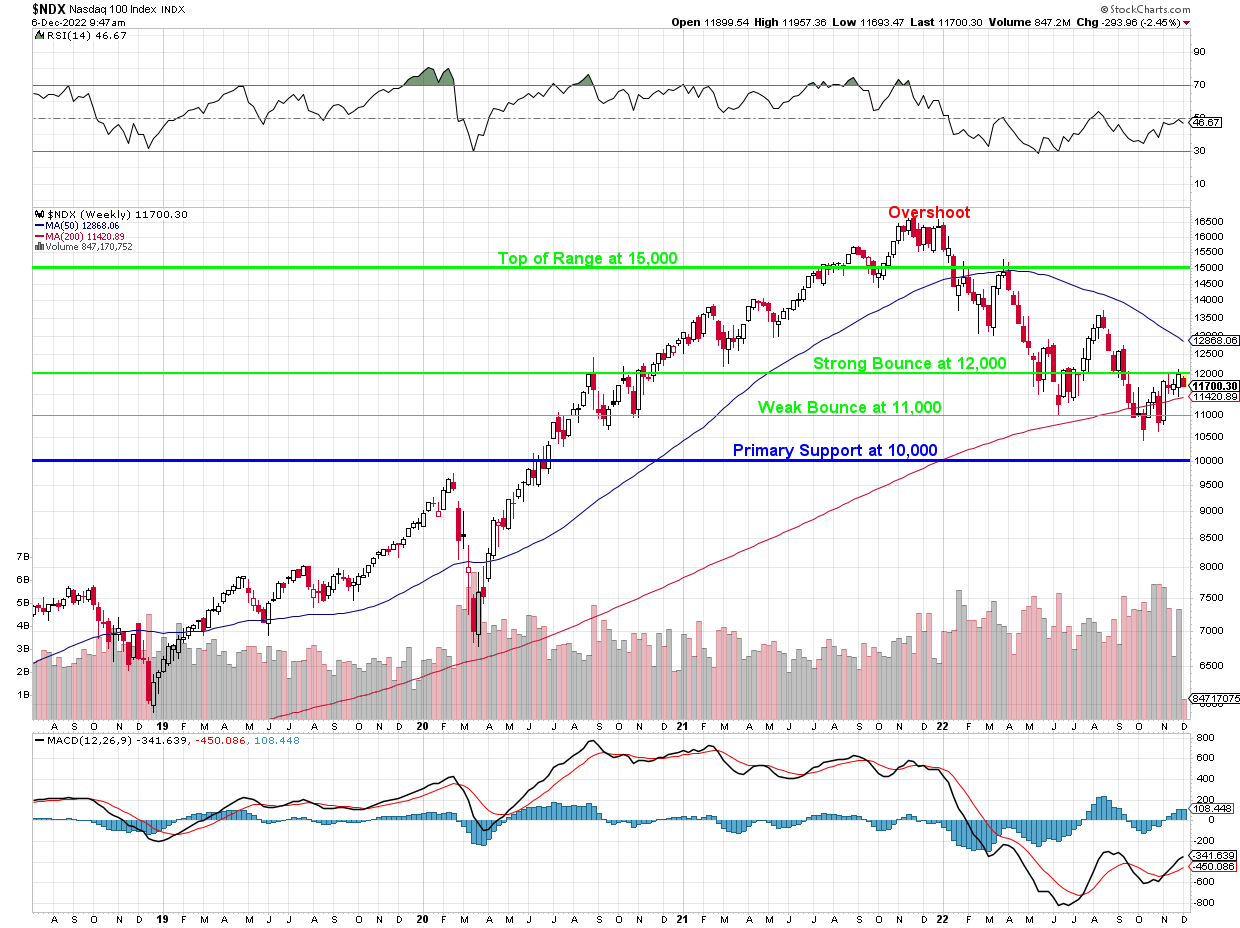

In our slower-moving Nasdaq weekly chart, we failed 12,000 exactly as expected and, sadly, that’s the 200 WEEK moving average that has to get over 12,000 and it’s taken over 3 months to get halfway from 11,000 – so it’s not going to save us now. The 50-week moving average, however, is 850 points away from failing 12,000 and that would be very bearish. We’re at 11,700 and it’s at 12,868 so 1,168 points and we have fallen that much since 13,000 in August (4 months) – so things are really going to be hitting the fan at the end of Q1!

Have I mentioned how much I’m loving our hedges lately?