Well, we stopped going down.

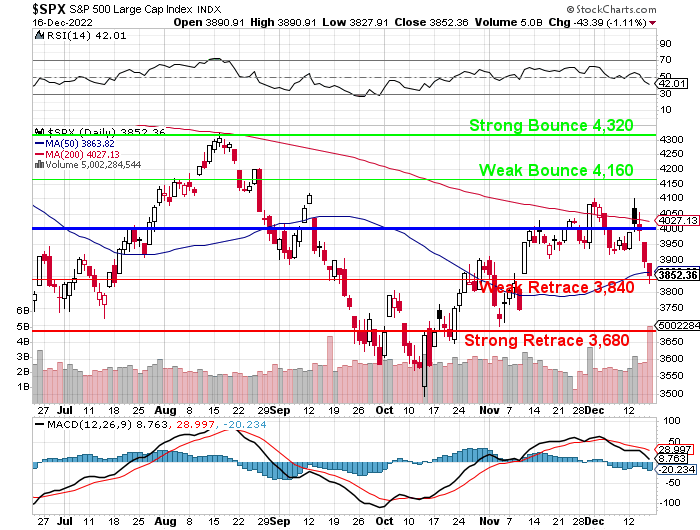

That’s a victory right there and we should be happy to accept it as the charts were getting a little ugly last week. The S&P is just over the 50-day moving average (3,863) at 3,883 this morning and holding that line is important as it’s a panic line for many TA traders. I know we have support at 3,840 but that’s 5% Rule™ support and we’re the only ones that have these lines – so they’re not going to be that effective if everyone else is panicking.

That’s a victory right there and we should be happy to accept it as the charts were getting a little ugly last week. The S&P is just over the 50-day moving average (3,863) at 3,883 this morning and holding that line is important as it’s a panic line for many TA traders. I know we have support at 3,840 but that’s 5% Rule™ support and we’re the only ones that have these lines – so they’re not going to be that effective if everyone else is panicking.

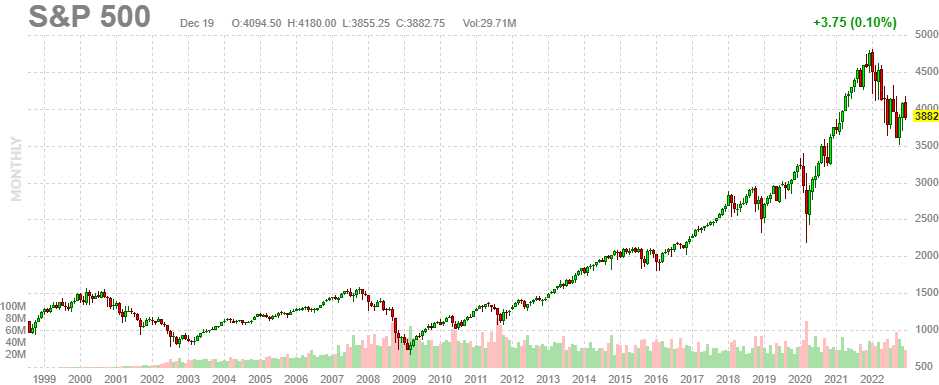

Let’s keep the BIG picture in mind and that’s that the S&P 500 was at 4,778 at the open on Jan 1st of this year so we’re down 895 points (18.7%) for the year going into the next year – that’s NOT a good trend at all – as you can see by the monthly chart:

As I noted last Jan 3rd in: “Still-Merry Monday Markets – 2022 Begins at the Top“:

“It’s happy 4,785 on the S&P 500 this morning, so I guess we didn’t need those hedges but forgive me if I don’t dump them just yet – as the year is young. The dangers are still out there. In fact, Evergrande is still a thing as trading had to be halted in Hong Kong this morning as the property developer was ordered to demolish 39 buildings in the next 10 days because the building permits were “illegally obtained.”

“With $197Bn worth of bonds coming due in January for the Property Industry, this is not a good time to shake investor confidence though it is possible the Government did Evergrande a “favor” by giving them an excuse to cancel a project they can no longer afford, building yet another speculative, empty city to rot on the Chinese landscape. “

At the time, China was our top concern for the year as I thought the property markets were primed for a collapse and, in fact, our first trade of the year was shorting by using the China Ultra-Short ETF (FXP). Covid was also a problem, as I noted in Dec 29th’s “Weakening Wednesday – 543,415 New Covid Cases Hard to Ignore“:

“For perspective, the entire World shut down in the Spring of 2020, when we peaked out at just over 30,000 cases per day in the US – that is 1/18th as many cases as we had on Monday alone. Does it make sense to you that the “messaging” you are getting from the Government and the Corporate Media is now to just grin and bear is as the virus spreads completely out of control. As we suspected would happen on Monday, already the Government is “solving” the problem by officially telling people they only need 5 days of isolation instead of 10 days – because they want everyone to get back to work.

“I think I’m going to get a bit more hedged into the weekend, while the shorts are cheap. We just did our Short-Term Portfolio Review (STP) on Dec 14th and determined we had $580,000 worth of downside protection against a 20% drop but our Long-Term Portfolio has popped up to $2,197,044 – up over $100,000 in the past two weeks – so we should be taking about 1/3 of those ill-gotten gains to lock in the other 2/3 with some more hedges. When you are up $100,000 on paper – isn’t is smart to guarantee you’ll be able to pull out $66,000 when you need to? That’s what hedging is all about.

- “One investment we can make is to buy 100 more SQQQ 2023 $5 calls for $2.11, as that’s $21,100 for calls that are $7,500 in the money and a 20% drop on the 3x ETF would send it up 60% to $9.20, and we’d be $4.20 in the money at $42,000, so we are buying $21,000 worth of protection and, eventually, we will sell covers to lower our cost but, for now, we’re going to buy back the 100 short March $12 calls for 0.18 ($1,800) as they’ve already lost 83% of their value – we will do better selling new short calls on the next bounce.“

SQQQ ended up reverse-splitting 1:5 on Jan 23rd so those were, essentially 20 2023 $25 calls but I’m happy to say those calls are now over $25 each, which is up $23 (1,009%) so it was a good hedge though SQQQ was as high as $70 twice this year so shame on you if you didn’t make a lot more than that!

This year is very different as we’ve moved to roughly 80% CASH!!! in our portfolios and we’re actually bearish into the new year – last year we were just cautious. Chinese Real Estate is still a problem, Covid is still a problem – especially in China and we have our war, which we didn’t have last year as well.

Oil started the year at $70 and now it’s $75.70 this morning – not terrible, though it was terrible ($120) in the first half of the year. Natural Gas (/NG) was $4 and now it’s $6, so that’s not good and EVERYTHING is about 10% more expensive than it was last year.

Still, I don’t think things are that dire many over valuations, which I loudly complained about on Dec 22nd in “Will We Hold It Wednesday – Russell 2,200 Edition (again)” where I said:

“That’s right, even after ingesting $3Tn (15% of our GDP) of stimulus in the past 12 months, even with ultra-low interest rates from the Fed and all those SBA loans and even with all that free money given to their customers – things are still not going so great for the small-caps. By comparison, the Nasdaq is trading at 35 times trailing earnings (still ridiculous) and the S&P is at 29 times trailing earnings with forward estimates at 30 and 22 respectively – though I can’t see the S&P possibly improving that much in 12 months.“

The good news is that the trailing p/e for the S&P 500 is now 19 and 23.5 on the Nasdaq, 23.42 on the Dow and 72.61 on the Russell – which is still high but it was (seriously) 642.17 last year – THAT was insane! The Russell is at 1,774 so down 426 (19.4%) points so it wasn’t so much the change in price as the actual earnings that improved as we’ve come past Covid though certainly we’re nowhere near “normal” at 72 times earnings, are we?

And the S&P doesn’t usually trade at 19x either (16x maybe) so why would we expect to go back to where we were with 0% interest rates and Trillions (10%+ of the GDP) in annual stimulus spending if that’s not the case going forward? We have to accept that conditions have changed and we have to accept that we’re not bouncing back – this (4,000 in the mid-range) is very likely to be our new reality going forward…

We may dip back to 3,680 – that’s the low end of our range and only 5% away from where we are now. We may see the markets panic lower if anything bad happens – including bad Q4 earnings or an uptick in inflation again. I don’t see a lot of happy things around the corner so we’ve gone “Cashy and Cautious” into the holidays and I know that’s a little boring but it’s a lot more exciting than losing money because we ignored the risks, right?

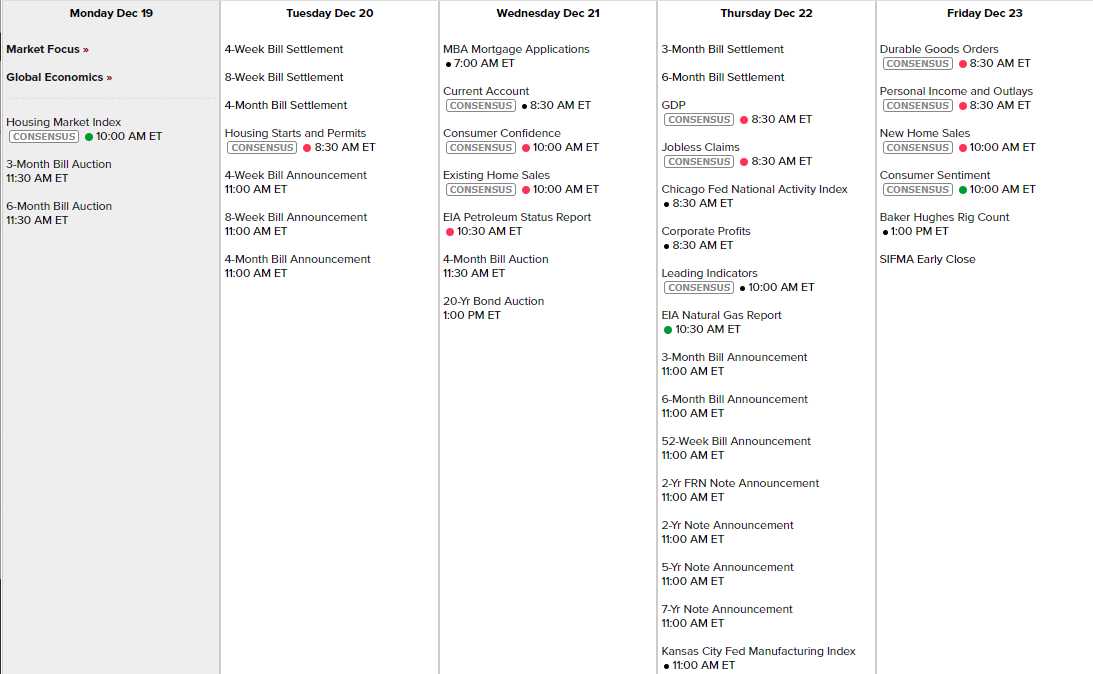

This week’s calendar is just as dull, with NOT Fed Speakers and not much excitement on the Data front either. The Housing Index will be predictably bad this morning, Housing Starts tomorrow also dull, Consumer Confidence will be uninspiring Wednesday but let’s watch that 20-Year Note Auction at 1pm. GDP Thursday is the 3rd revision (yawn) and the Chicago Fed can’t be worse than NY and Philly (can it?) and Leading Economic Indicators are likely to be sad as will be Durable Goods on Friday as I don’t believe they’ll include Boeing’s new orders. New Home Sales = Sad and Consumer Sentiment – well, you know…

There are still a surprising amount of earnings to check out:

FDX can be a big market-mover tomorrow night. GIS, NKE, CCL, RAD, MU, KMX… all interesting.

All in all, it’s a good week to get ready for the holidays…