Down we go again.

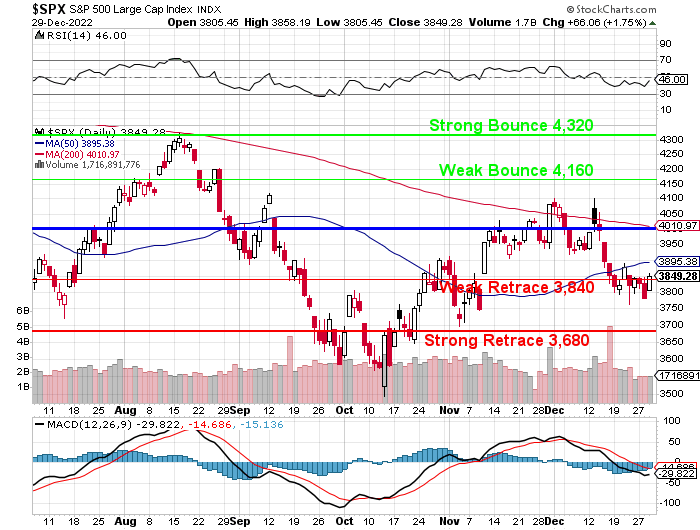

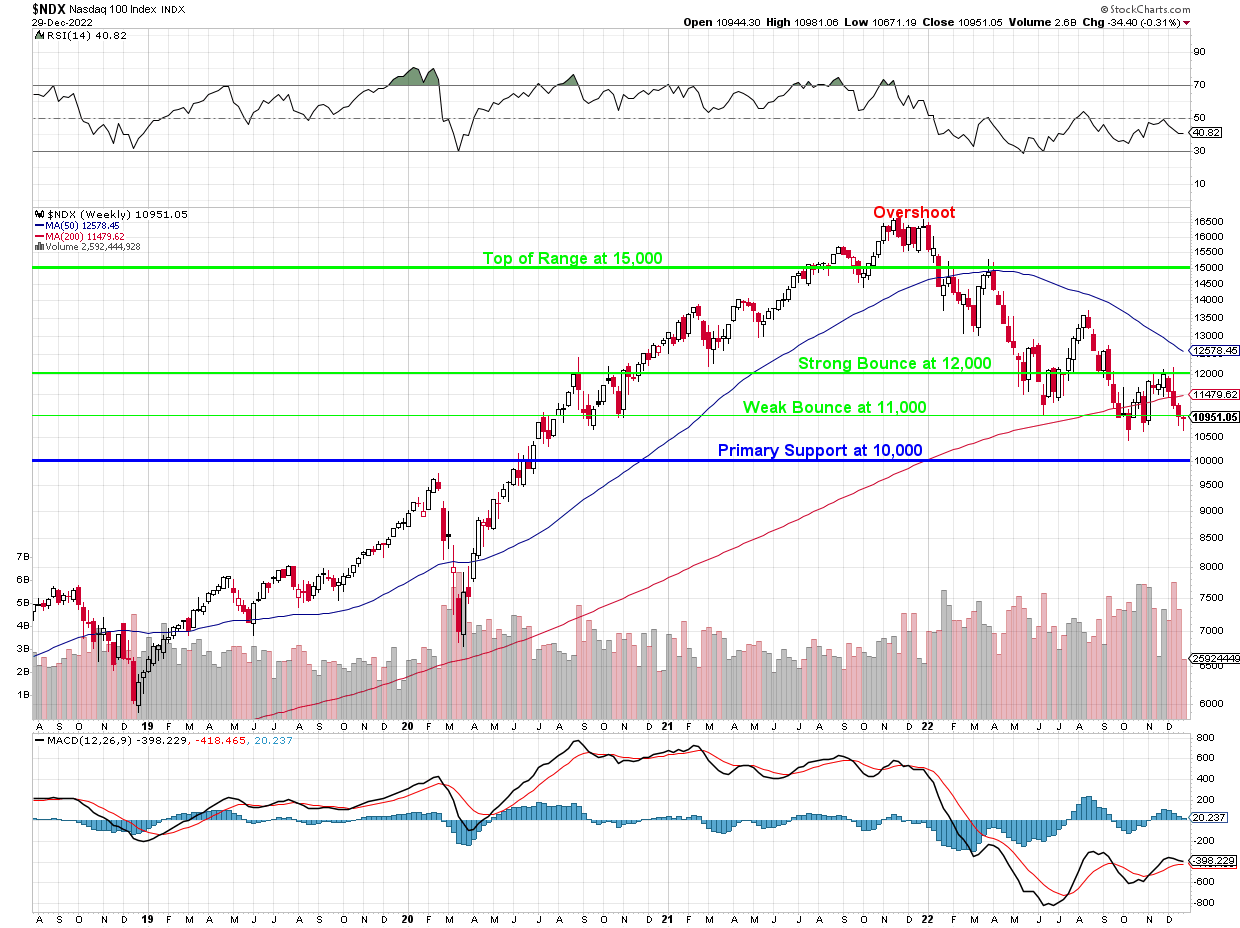

As I have said to our Members, these low-volume holiday moves are meaningless but what is meainingFUL is the 20% drop for the year on the S&P 500 and the even more pathetic 33% drop for the year on the Nasdaq 100. Yet a lot of you out there like to pretend things are OK and, JUST BECAUSE WE’RE TURNING A PAGE ON A CALENDAR, things will magically improve starting Tuesday. This is the very definition of wishful thinking…

As you can see on the Nasdaq chart above, we never thought the index should have been at 16,500 in the first place and that’s why we gave the Nasdaq such a harsh range for 2022. We discussed in yesterday’s Report how I felt the valuations were insane last year and we were shorting the market into 2022 based on those valuations plus I was the only person still worried about Covid at the time.

Now that valuations are a bit more realistic, we have a Watch List (see Wednesday’s Report) with over 100 stocks we think will hold up in 2023 and 2024 DESPITE the potential Recession and continuing Covid. Oh and DESPITE the Higher Interest Rates, Global Debt, Inflation, the War, Europe’s Energy Crisis (caused by the War), continuing Supply Chain Issues, Faltering Democracies, Global Warming, Commercial and Residential Real Estate Collapses and the Mass Extinction Event we’re only at the beginning of.

Needless to say, we’re not exactly in a hurry to buy stocks – even the ones on our watch list. Still, there is a point, even if the World is ending, that we do find certain stocks attractive. For example, if Covid mutates and kills 90% of the people on the planet that would solve the climate problem and, assuming you are a survivor – you are going to wake up in the morning hungry and you’ll want to work out some kind of system with your remaining neighbors by which some of them produce food while others make clothes and others figure out how to get IPhones working again, etc.

Needless to say, we’re not exactly in a hurry to buy stocks – even the ones on our watch list. Still, there is a point, even if the World is ending, that we do find certain stocks attractive. For example, if Covid mutates and kills 90% of the people on the planet that would solve the climate problem and, assuming you are a survivor – you are going to wake up in the morning hungry and you’ll want to work out some kind of system with your remaining neighbors by which some of them produce food while others make clothes and others figure out how to get IPhones working again, etc.

So, even in a worst-case scenario, we like AAPL, we like T, we like LEVI, we like MCD – what are the things people are going to prioritize – even if things do fall apart? Those are the great stocks to buy when they are on sale – as they do just fine in a good economy as well.

![calving and hobbes lemonade stand comic american economy subsidized Subsidies [Comic Strip]](http://twistedsifter.com/wp-content/uploads/2011/04/calving-and-hobbes-lemonade-stand-comic-american-economy-subsidized.jpg)

That’s why we’re long on Natural Gas (/NG) again at $4.50 – we think people like to be warm and the Groundhog did not call for an early spring yet (but next week will be extra warm in the US, so we have to be patient).

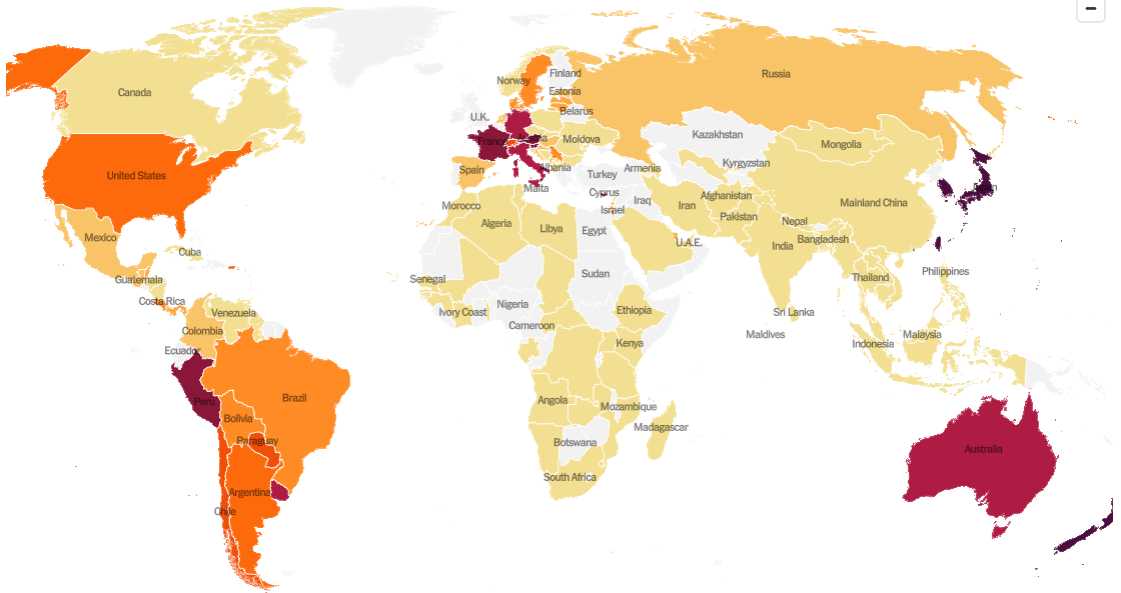

One year ago today, we had 301,472 new Covid cases and 1,207 people died of Covid on Dec 29th. Yesterday the US reported 58,354 new cases and 355 deaths – so we’re MUCH better off than we were last year and my main concern is China and, hopefully, we’ve built up enough herd immunity that it won’t spread back to us – hopefully.

Still, we can’t put our heads in the sand. Japan is having 170,000 new cases per day, 66,000 in South Korea, 27,000 in France, 30,000 in Germany, 20,000 in Italy, 30,000 in Brazil and China isn’t even reporting their cases and don’t get all holier than though with China as you KNOW most US cases are no longer reported either.

Still, we can’t put our heads in the sand. Japan is having 170,000 new cases per day, 66,000 in South Korea, 27,000 in France, 30,000 in Germany, 20,000 in Italy, 30,000 in Brazil and China isn’t even reporting their cases and don’t get all holier than though with China as you KNOW most US cases are no longer reported either.

With all these cross-currents, we’re mostly waiting to hear what companies have to say in their Jan/Feb earnings reports and THEN we’ll see who’s standing up best in the current economy. Don’t forget the US Government still might shut down – that’s a nasty wild-card as well.

Whatever does happen in 2023, we’ll make our adjustments and weather the storm – just like we always do.

HERE’S WISHING YOU AND YOUR FAMILY A HAPPY, HEALTHY AND PROSPEROOUS 2023,

– PHIL

My resolution is to see Randy live next year: