Technically, December has been a bust.

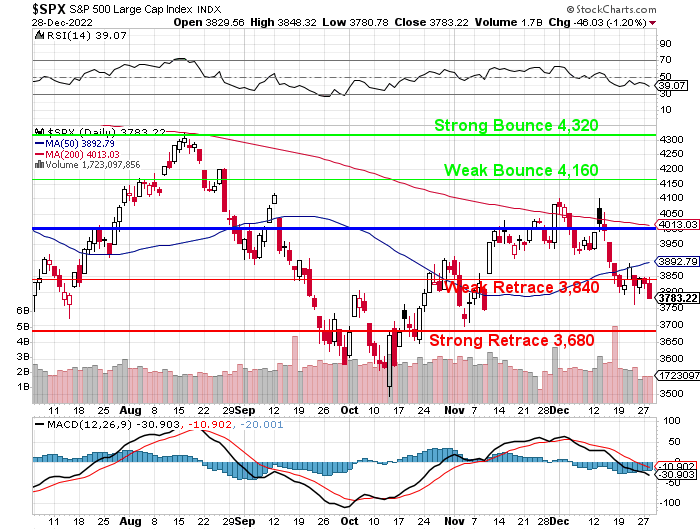

We started the month at 4,100 on the S&P 500 and, yesterday, we closed at 3,783 – down 317 points or 7.7%. Hopefully, we can claw our way back to 3,840 today and hold it into tomorrow or we’re going to have some very weak technicals to contend with as we begin 2023.

Regardless of whether we bounce into the end of the year, let’s keep in mind we began the year at 4,800 and 4,320 would be down 10% from there and we’re not even dreaming of that (the Strong Bounce Line) as we’re down at the Weak Retrace Line, which is exactly 20% down for the year on the S&P 500.

Here’s how we ended 2021 and began 2022 at PSW:

- Dec 22 – Will We Hold It Wednesday – Russell 2,200 Edition (again)

-

- “After shooting up to it last Winter on a stimulus-fueled 50% run, the Russell kind of lost interest in going anywhere this year and, once again, it’s looking to prove itself on one side or the other of the 2,200 line. Perhaps that’s because despite the Russell having a forward (dreamland) p/e ratio of 30 at 2,200 – it has a trailing (reality) p/e ratio of 642 times earnings.”

-

- Dec 23 – Thursday Failure – UK hits new Record Number of Covid Cases – US Right Behind

-

- “Keeping the malls open through Christmas is very likely to cost us Q1 (again) as we have to shut down eventually to get this thing under control. It is critical to have hedges in place and, now that we’re back to 4,700 on the S&P 500 – I’m tempted to take this opportunity to cash out our portfolios completely and not risk another market melt-down when traders are “surprised” that we are once again overwhelmed by Covid.”

-

- Dec 27 – Still-Merry Monday – Markets and Covid Cases Remain at All-Time Highs

-

- “Of course, those of us who are actually shopping know that the 8.5% increase is not because we’re buying more stuff but because the stuff we are buying is more expensive. There was a lot of sticker shop at those retail stores and a lot less sales than usual. People may be making a little more money in a tight labor market but it’s not making it to the bank with so many rising expenses along the way.”

-

- Dec 28 – Tree Topping Tuesday – S&P 500 Tests 4,800 Up 6.66% for the Month!

-

-

“THEY” have taken full advantage of the low-volume, holiday markets to bring the S&P up to new highs at just under 4,800 and we have Dow 36,272, Nasdaq 16,654 and only the Russell, at 2,264 is not at the all-time high – which was 2,460 back in November – so we’re 8% below that level still.

“Does that mean we should bet the Russell to catch up and make all-time highs? Not necessarily. There’s no way to know that these low-volume rallies can stick once the participants return and start selling so we’re just in a “watch and wait” sort of mode at the moment – we did all our bargain-hunting during the dip – now we are reaping the rewards on our bullish bets.”

-

-

- Dec 29 – Weakening Wednesday – 543,415 New Covid Cases Hard to Ignore

-

-

“I think I’m going to get a bit more hedged into the weekend, while the shorts are cheap. We just did our Short-Term Portfolio Review (STP) on Dec 14th and determined we had $580,000 worth of downside protection against a 20% drop but our Long-Term Portfolio has popped up to $2,197,044 – up over $100,000 in the past two weeks – so we should be taking about 1/3 of those ill-gotten gains to lock in the other 2/3 with some more hedges. When you are up $100,000 on paper – isn’t is smart to guarantee you’ll be able to pull out $66,000 when you need to? That’s what hedging is all about.

“One investment we can make is to buy 100 more SQQQ 2023 $5 calls for $2.11, as that’s $21,100 for calls that are $7,500 in the money and a 20% drop on the 3x ETF would send it up 60% to $9.20, and we’d be $4.20 in the money at $42,000, so we are buying $21,000 worth of protection and, eventually, we will sell covers to lower our cost but, for now, we’re going to buy back the 100 short March $12 calls for 0.18 ($1,800) as they’ve already lost 83% of their value – we will do better selling new short calls on the next bounce. ”

-

-

- Dec 30 – Fabulous Thursday – Ending the Year on Top

-

-

“So far, so bad on our S&P 500 (/ES) Futures shorts.

“We’re down about $1,200 with only 3 of our 4 shorts filled (we never made 4,800 – our goal to fill the final short) but we were up about $1,400 during yesterday’s Live Trading Webinar (replay available here), so the potential is clearly there. This position is a hedge not a trade, so we didn’t take the money and run – as we would have on a trade.

“This isn’t a bet on where the S&P will be now, during a meaningless, low-volume rally – but where it will be once the traders come back from their holidays – as the virus numbers begin to skyrocket. Today we are averaging 301,472 cases per day (14-day average), the most since the start of Covid and that’s up from and average of 267,305 new cases per day, YESTERDAY. How does the 14-day average change so fast? Because we’re dropping off the oldest day, two weeks ago, when there were few cases and adding yesterday, which was another record. This trend is accelerating so far, not slowing down.”

-

-

- Dec 31 – Final Friday – 2021 Ends With Record High – Covid Cases

-

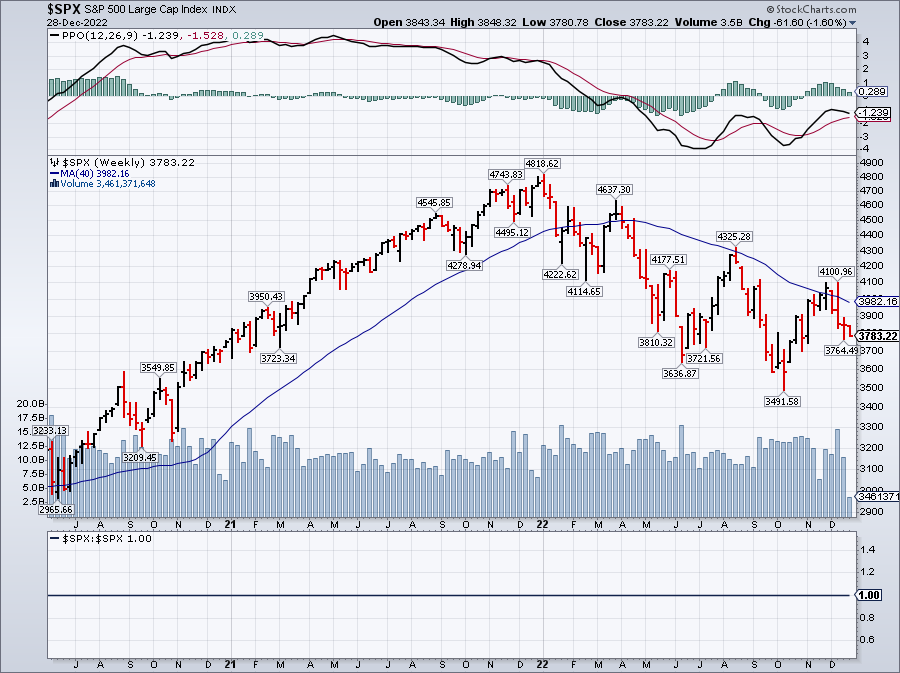

- “Most importantly, the S&P 500 is wrapping up a WINNING! year at 4,766 this morning after starting the year at 3,750 so 1,000 points is 26.666% – winning! 4,800 completes a 50% gain from 3,200 which is where we were in December of 2019 and we pulled back to 2,400 in March of 2020, which was a 50% retracement of the run from 1,600 that began in 2013. That means a weak retrace of the current run would be 320 points – back to 4,480 (which you can see has been tested twice in December), while a strong retrace of 640 points (which would be a weak retrace of the run from 1,600) will take us back to 4,160 – those are the lines we’ll be watching (out) for in Q1.”

-

- Jan 3 – Still-Merry Monday Markets – 2022 Begins at the Top

-

- “It’s happy 4,785 on the S&P 500 this morning, so I guess we didn’t need those hedges but forgive me if I don’t dump them just yet – as the year is young. The dangers are still out there. In fact, Evergrande is still a thing as trading had to be halted in Hong Kong this morning as the property developer was ordered to demolish 39 buildings in the next 10 days because the building permits were “illegally obtained.”

-

- Jan 4 – Troubling Tuesday – US Covid Cases Hit 1M New Cases in a Single Day

-

-

- Can the markets continue to “ignore and soar” while this is going on across the globe? There is a bright side to everyone catching the virus this winter – herd immunity. It is a real thing and a mild version of the virus may just get us to where we need to be a bit faster. But, that’s an experiment in progress and WISHING for a positive outcome does not make it so. Meanwhile, the damage we fact in getting to herd immunity in Q1 is going to be very real indeed.

-

We will see how the indexes hold up as the volume returns this week. It takes a while for traders to get out of vacation mode and now we’ll see how much reality they are willing to take as they come back to rising Covid cases and declining GDP estimates.

- Jan 5 – Will We Hold It Wednesday – S&P 4,800 Edition

-

- “We’re so close to 5,000, we might as well get there as, clearly, the numbers are meaningless. We’ve discussed how trading the S&P 500 at 40 x earnings is ridiculous but it’s still happening so get used to the “new normal“, I guess. Of course it all comes down to risk vs. reward and there’s just as much RISK in a 10-year bond that pays you 1.666% as there is in a stock that pays a 3% dividend so of course buy the stock.”

-

- Jan 6 – Fed Faltering Thursday – Markets “Surprised” by the Fed Minutes?

-

-

“The market dropped 2.5% after yesterday’s Fed Minutes were released and all they said was what they announced at the Dec 15th meeting, which is they are going to start tightening in 2022, probably with 3-4 0.25% hikes. You would think they announced the end of the World the way the market started selling off and the day’s volume only hit 104M on SPY – not even a major volume day.

“Still, as I had noted in our Live Trading Webinar BEFORE it happened, we simply don’t have enough buyers to support any kind of selling so, as soon as there’s any bad news and people try to sell – the bottom can fall out very quickly. Having a 2.5% drop means we look for a 0.5% (weak) or 1% (strong) bounce and, if we don’t get those – then it’s likely we’re in for another downturn.”

-

-

- Jan 7 – Friday Follies – Still 2,200 After All of a Year

“FOUR IN THE MORNING

CRAPPED OUT, YAWNING

LONGING MY LIFE AWAY

I’LL NEVER WORRY

WHY SHOULD I?

IT’S ALL GONNA FADE” – PAUL SIMON

“That pretty much sums up the market recently as we wrap up an entire year of the Russell 2000 running along the same 2,200 line for what is now the 12th month. There is a certain point at which you stop saying it’s consolidating for a move up and start saying we’re clearly over-valued at this level.”

The reason I like to use similar headlines is to remind our Members that there are many repetitive cycles in the market. This is like football – there are only so many plays: Wedge, Sweep, Reverse… maybe 20 major plays that get run, with variations but generally you’re going to see some running plays, passing plays and a few kicks.

That doesn’t make the game uninteresting and it’s actually kind of enjoyable when you can try to guess what the coach will do next (you can bet on that now!) and I find it very useful to go back and review what we said last year and how the predictions held up.

As it turns out, on Jan 7th, we added a lot more TZA and SQQQ hedges to our Short-Term Portfolio (STP) and that was very well-timed ahead of the 20% drop and our STP was, indeed, our best-performing portfolio of the year – as it contained most of our hedges.

We are, in fact, much more bearish now than we were last year – expecting a downturn in Q1 and, hopefully, we’re not using this comment next year as a review to show how we positioned for the great market melt-down of 2023!

Speaking of melt-downs: Exports from Hong Kong fell the most in 70 years in November – that is NOT GOOD! Overseas shipments plunged 24.1% last month from a year earlier, the Census and Statistics Department said Thursday. That was the worst decline since 1954, and far more severe than the median estimate of a 16.2% decline in a Bloomberg survey of Economorons. Exports had also fallen 10.4% in October.

Imports also declined 20.3% in November from a year earlier, the biggest drop since 2009 and worse than Economorons’ projection of a 13.8% decline. Exports to mainland China, the US and other economies including Japan, Taiwan and Vietnam all dropped by double-digit percentages. The decline in shipments to China was 29.7%, far worse than October’s drop of 12.9%. Exports to the US plunged 26.8%.

This is nasty stuff folks! Like last year, it’s the same playbook – let’s be very, very cautious until we see what happens when the volume comes back but this time we’re already a lot more hedged and a lot more Cashy – almost to the point where we’d love a nice sell-off…