Congrats to all who played along!

Congrats to all who played along!

On December 29th, we sent out a Top Trade Alert to our Members and you can read the whole thing but the gist of it was that this was the first time we went long on TSLA (it had been our favorite short) since it was $50 many years ago. The Trade Idea we had on the stock was a spread that was a bit more aggressive than the 150% Trade Idea we had discussed that Tuesday:

“Speaking of bullish plays: On Tuesday we discussed TSLA but we didn’t make it official. So, for the LTP, let’s:

-

- Sell 10 2025 $85 puts for $20 ($20,000)

- Buy 30 2025 $100 calls for $57 ($171,000)

- Sell 30 2025 $125 calls for $46.50 ($139,500).

That’s net $11,500 on the $75,000 spread with $63,500 (552%) upside potential at $125. It’s a lot more aggressive than Tuesday’s trade, which paid 150% at $80 but we can always roll down to something like that if things don’t turn around for TSLA.”

We hit the dead bottom on that trade (getting the best prices) and already, not even 30 days later, TSLA is back over $160 after earnings that crushed expectations (not ours) and both trades are on-track to making their full 150% and 552% returns, respectively. In fact, the more aggressive Top Trade is already up $20,000, which is a gain of 172% on our $11,500 outlay in less than a month!

The Tuesday trade was much more conservative and in that trade we committed to buying 1,000 shares of TSLA at $50 ($50,000), rather than $85,000 in the trade above. In this case, we put up more money ($24,000) and took less risk of assignment but the trade-off was less leverage on our cash:

“Let’s say we sold 10 short TSLA 2025 $50 puts (obligating us to own 1,000 shares at $50) for $10,000 and bought 20 of the 2025 $50 ($80)/80 ($63) bull call spreads for net $17 ($34,000). That would be net $24,000 on the $60,000 spread that is 150% in the money to start. If TSLA stays over $80, you make $36,000 (150%). “

Already those short $50 puts are just $3.60 ($3,600) and the $50/80 spread is now $118.50/96.50 (net $22 = $44,000) for net $40,400 on the spread, which is already up $16,400 (68.3%) in exactly one month.

You don’t have to take big risks to make big money with options. Today that trade seems ridiculously conservative (which it was meant to be) but look at the chart – that was UGLY at the time. Of course, as we discussed earlier in the week, we don’t give a damn what the chart looks like – we are Fundamental Investors and we buy a stock when the VALUE is compelling – not the picture.

TSLA is, in fact, the most-traded option in the market, with 3M contracts traded on the average day. That’s more than QQQ! That makes it fun for all sorts of things we like to do, so we’ll be playing with TSLA a lot more in 2023.

Earnings continue to disappoint, on the whole, with 5 beats and 4 misses so far this morning but the misses include CVX, CHTR and AXP and the beats include ALV and CL so – context. I was ranting about CVX yesterday in our Live Member Chat Room, so no need to rehash it here.

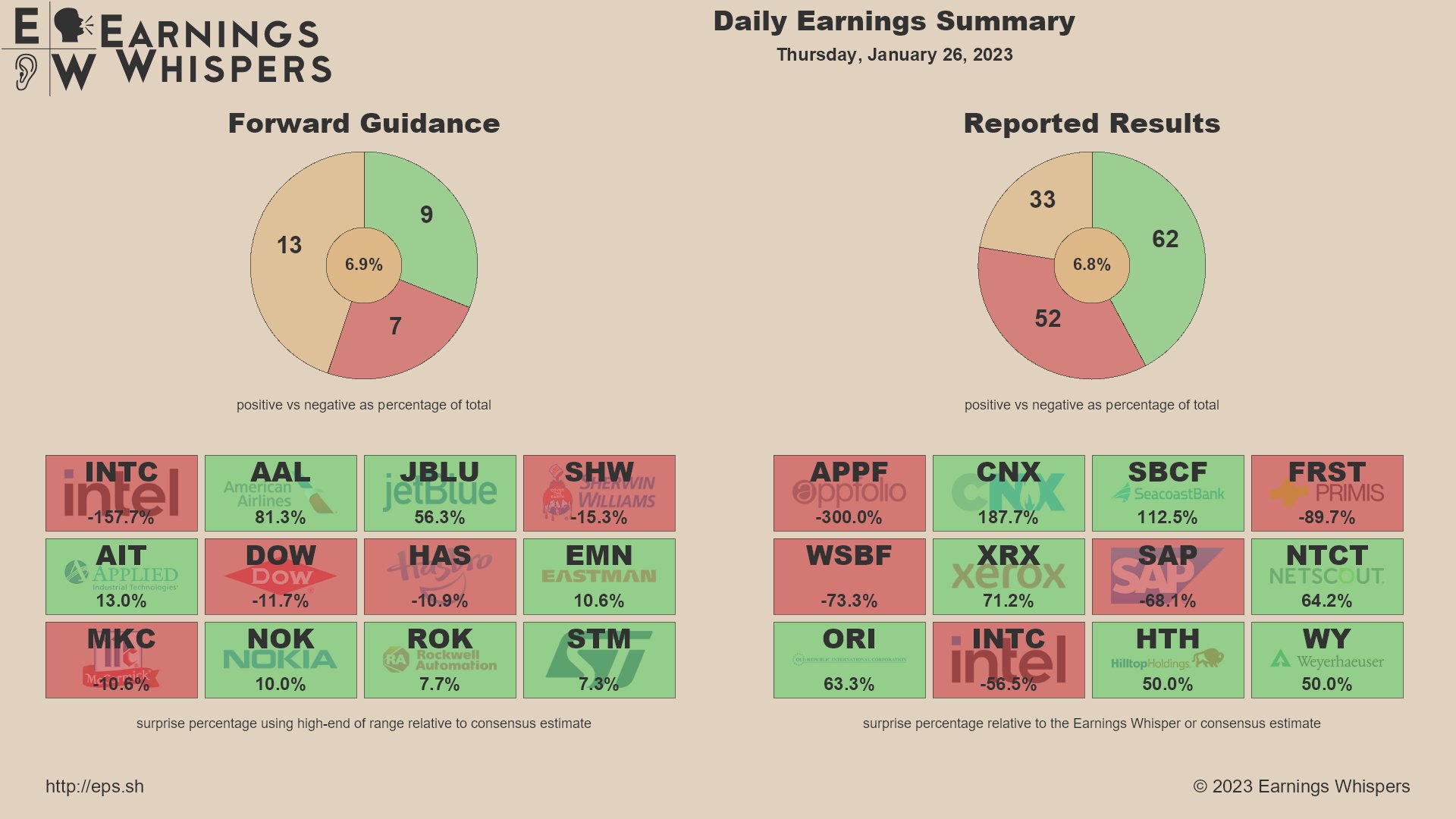

Last night was not so terrible, with only 10 (40%) of of 25 of the reporting companies missing but that included Intel (INTC), who are dragging the Nasdaq a bit this morning (see my comments to our Members last night). PACW was also a disaster and earnings, on the whole, have been mostly terrible so far.

Those are the S&P results so far and keep in mind that many in-line reports are the result of financial engineering to hit the number, not so much a sign of a healthy company. Healthy earnings seasons are above 70/30, NOT 62/52!

Also of note, on Monday that chart was 32/23 with 12 in-line – so we’re losing ground as well…

On the whole, we’re having a good earnings season so far as our Long-Term Portfolio (LTP) has greatly improved (up $250,000 since our 1/17 review) and our Short-Term Portfolio is up $100,000 thanks to the declining VIX (we sell a lot of premium). The S&P is up about 150 points (3.8%) since expiration week and the funny thing is – we would have made a lot more money if the market had dropped but it’s not too bad for being wrong (so far) – that’s the power of hedging your portfolio!

The trick is to play the RIGHT longs, not just foolishly follow indexes or ETFs. We pick stocks with good Fundamentals (like TSLA) and then leverage their upside with options so that, if the market does go up and we’re not wrong about our Fundamentals, we get outsized returns, even in small market moves up (like 3.8%).

- Tuesday’s Top Trade Alert was for Banco Argentina (BBAR) and that is only up 5% since our selection, so still playable.

- On December 6th, we chose Signet Jewelers (SIG) with a net $3,000 outlay on a $40,000 options spread that is already net $5,500, so up $2,500 (83%) so far but still another $34,500 (627%) of upside potential at $80 in 2025 – that doesn’t suck.

- On November 3rd, our Top Trade Alert was for Barrick Gold (GOLD) when they were down at $13.23 and I called the Analysts who had downgraded them “idiots”. That trade idea was net $1,100 on a $14,000 spread and we’re already at net $8,700 so up $7,600 (690%) with another $5,300 (69%) to go. This is the kind of trade we may pull the plug on, as we have better things to do with $7,600 than make 69% over two more years.

How do we call these exact bottoms on stocks? FUNDAMENTALS! Traders don’t like Fundamentals because it’s a lot of work and there’s no pictures to tell you what to do but, unlike TA, Fundamentals are real!

According to Gladwell, it takes 10,000 hours to master a skill. That’s 40 hours a week for 250 weeks (5 years). Trading is a skill and, if you treat it like one – you will be able to master it. A lot of people join our site looking for the “Indicator” or the “Rule” that tells them what to do but it’s just as ridiculous to believe in those things as it would be for a Doctor or Lawyer to ask the same thing so they can skip all that practice and get to work.

It simply doesn’t work that way but, like other professions, trading can be very rewarding if you take the time to learn how to do it correctly.

- On October 27th, our Top Trade Alert was for Facebook (META), who also had an ugly chart. That trade idea was for net $17,500 in cash on a $75,000 spread and, with META back at $147.50 already, the spread is at net $61,000 already (because we aggressively did not fully cover the longs) for a nice, quick $43,500 (248%) profit in 3 months.

- On October 6th, we liked Total Energy (TTE) at $50.63 and they have blasted up 33% to $64.50 already. That one was net $5,750 on a $37,500 spread and it’s already at $23,750, which is up $18,000 (313%) but $13,750 to go (57%) and it looks like a very safe way to make it but… yawn….

- Also on October 6th, we liked Weyerhaeuser (WY) at $29.27 and they are only up to $33.65 but, because we sell a lot of premium (Being the House – NOT the Gambler) and the VIX dropped considerably, we have still turned a net $3,500 investment on the $25,000 spread into net $10,975, which is up $7,475 (213%) so far with almost 150% more to go.

- That brings us back to the first (and final) Top Trade Alert for Q4, which was Tanger Factory Outlets (SKT) on October 4th, which was also looking awful at $14.02. They’ve had a very nice run back to $18.97 as of yesterday’s close and we had two trade ideas for them. One was a dividend play at net $15,040 that is now net $22,940 for a $7,900 profit plus $440 in dividends (10/28) so up $8,340 (55%) in 4 months is just fine for a conservative dividend play. The options trade was net $3,950 on a $21,000 spread and that’s already net $17,000, so we’re up $13,050 (330%) on that one so far.

That’s a net $120,465 gain on our last 3 months of Top Trade Alerts with NO misses! These were not pie-in-the-sky trades and they were no riskier than buying stocks. Although we gave ourselves 2 years to hit our goals on each one – the benefits of good timing gave us great short-term returns anyway.

I’ve put in my 10,000 hours (probably getting closer to 100,000 for me at this point). Stop trading like it’s a hobby and let me guide you through your own 10,000 hours of learning this profession – I promise it will be worth your while!

Have a great weekend,

-

- Phil