We are halfway through our first year!

We are halfway through our first year!

Months 1, 2, 3, 4 and 5 are available for review. This is an opportunity to learn our portfolio-building strategies step by step that, hopefully anyone will be able to follow. Our goal in this portfolio is to show our Members how to use slow, steady, simple options strategies to amass over $1M over 30 years by investing just $700/month ($252,000). If you can apply this discipline in your early working years – your retirement will be a breeze.

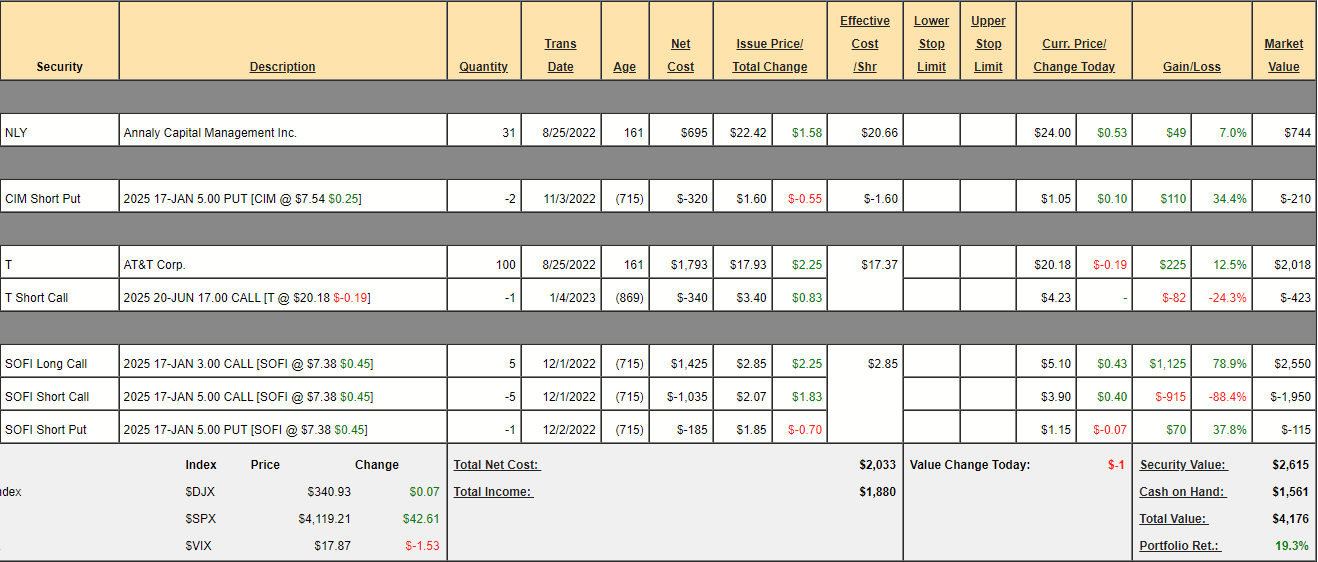

Our goal is to make 10% a year on our investments and, though it has only been 5 months – the portfolio is already up 19.3%. That’s a pace of 40% per year and, if we did that for 30 years, we’d have $728,433,713.90. No, I’m not kidding, you can do the math right here! Don’t expect to keep up that pace – we’ll have ups and downs along the way and this portfolio doesn’t attempt to time the market – it’s just off to a good start.

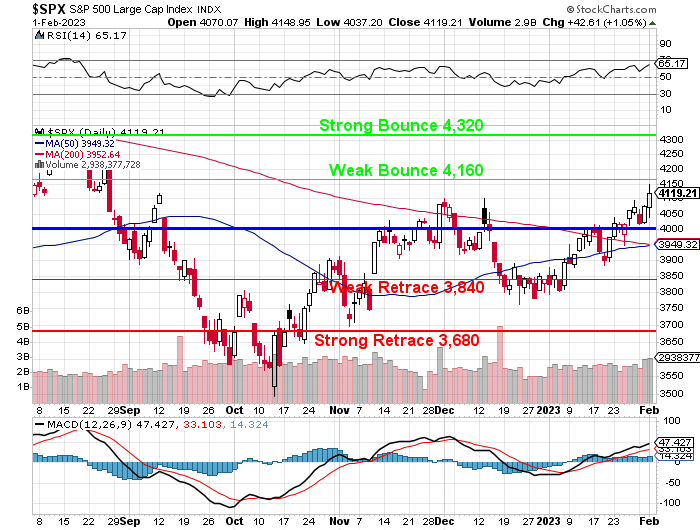

When we started the portfolio (Aug 25th), the S&P 500 was at 4,000 and now we’re at 4,155, which is only up 3.88%. That’s the magic of using options – even when you play them very conservatively.

When we started the portfolio (Aug 25th), the S&P 500 was at 4,000 and now we’re at 4,155, which is only up 3.88%. That’s the magic of using options – even when you play them very conservatively.

As with all our PSW portfolios, the returns tend to accelerate as our positions mature but this is WAY ahead of expectations and certainly we shouldn’t expect to keep up this pace in a no-margin portfolio (but it’s kind of normal for our Members’ margin portfolios in positive years).

Last month, we filled out our AT&T (T) position, using $771.92 (we had a little cash left over from prior trades and dividends) and that left us with $61 and T just paid out an 0.278 dividend on Jan 9th for another $27.80, giving us $88.80 (very lucky in China) and we’re adding another $700 ($4,200 invested in total), giving us $788.80 to spend this month.

And, by the way, I know this seems a bit dull to you higher net-worth investors but you can be doing the same thing for your children or your grandchildren with $7,000 a month of $70,000 a month – the principle is exactly the same! Meanwhile, the idea of this is to create a portfolio that can help as many people as possible get on the road to a comfortable retirement by setting extremely realistic goals.

Before we add new positions, we need to look over our current positions to see if they need adjusting and all of them are nicely on track but NLY, who paid us a lovely 0.88 last month, are not complete. That’s because we originally had a lot more NLY shares but they did a reverse split and the shares are now expensive (for this small portfolio).

Ideally, we wanted to get to 100 shares so we could start selling options but buying 69 more shares will cost us $1,656 and then we could sell the 2025 $22 calls for $3 ($300) so $1,356 means we can cover that position in two weeks.

Our anticipated return on NLY after having spent net $2,051 on 100 shares would be 8 0.88 dividends ($88 x 8) for $704 and called away at $22 ($2,200) for a $149 profit on the shares would be $853 or 41.6% over 2 years, which is just fine, but let’s see if anything is better first.

CIM, which we already sold 2 short puts for, is $7.54 and pays 0.23/qtr so, if we were to buy 100 shares for $754 and sell 1 2025 $7 call for $1.25 ($125), that would be just net $629 and we expect 8 0.23 dividends ($184) and a profit of $71 if called away at $7 (lower than the stock is now!) for $255/629 = 40.5% again – darn!

Even worse, NLY and CIM are the same management team, so there’s no real advantage to either REIT. So I guess, we may as well go with the most boring possible thing and just use our $788.80 to buy 32 more shares of NLY for $24 ($768) and that will leave us with $20.80 towards next month, when we should be able to get to 100 shares and cover.

-

- Buy 32 additional shares of NLY (63 total) for $24 ($768) ‘

The tie-breaker for me is adding another dividend stream and we already have 2 short CIM, which is our pledge to buy 200 shares at $5 ($1,000) in exchange for $320 we collected. Against the net $680 in buying power it cost us, those are a 47% return over 2 years.

Keep in mind that the outsized returns we are currently getting are from SOFI, which was not even $5 when we added it and now it’s $7.38 and our conservative goal was only $5. We spent net $205 on the $1,000 spread giving us $795 (387%) upside potential against our cash (the short puts required another $500 of our buying power). That spread is already net $485, representing 72% of the portfolio’s gains so far.

SOFI was a Trade of the Year Runner up and fit in this portfolio so we jumped on it on Dec 1st but we’re not ready to do too many options just yet. We will be after year two, when these original trades begin to cash out and we find ourselves with thousands to spend instead of hundreds.

Until then, we continue to grind our way to our first $Million$ – hopefully a lot sooner than 30 years!

Actually, at the pace we’re at now (40%), just over 10 years!