Yikes, this is disappointing:

At least it looks like we’re going to hold 4,000 but consider that ALL of the gains for the market came on Feb 1st and 2nd (Fed meeting) and then it was all downhill from there. I thought people were nuts, especially after we got Friday’s jobs number, when I said:

“8:30 Update: 517,000 new jobs?!? WTF?!? There’s no way this doesn’t turn us lower as it’s the exact opposite of what the Fed wants. How could they not have had an idea of this on Wednesday before they only raised rates 0.25%? That’s an out of control number and unemployment is, of course, going the wrong way – now 3.4%”

On Friday I laid out our plan for improving our hedges in the Short-Term Portfolio (STP) and on Tuesday we took advantage of that 2nd spike up and executed the trades. That raised our bearish potential from $4M to $6M so we would actually, at the moment, make a lot more money if the market goes down 20% than if it goes up 20%. Still, the added hedges allowed us to do some shopping, notably with yesterday’s Natural Gas Sector Trade Ideas.

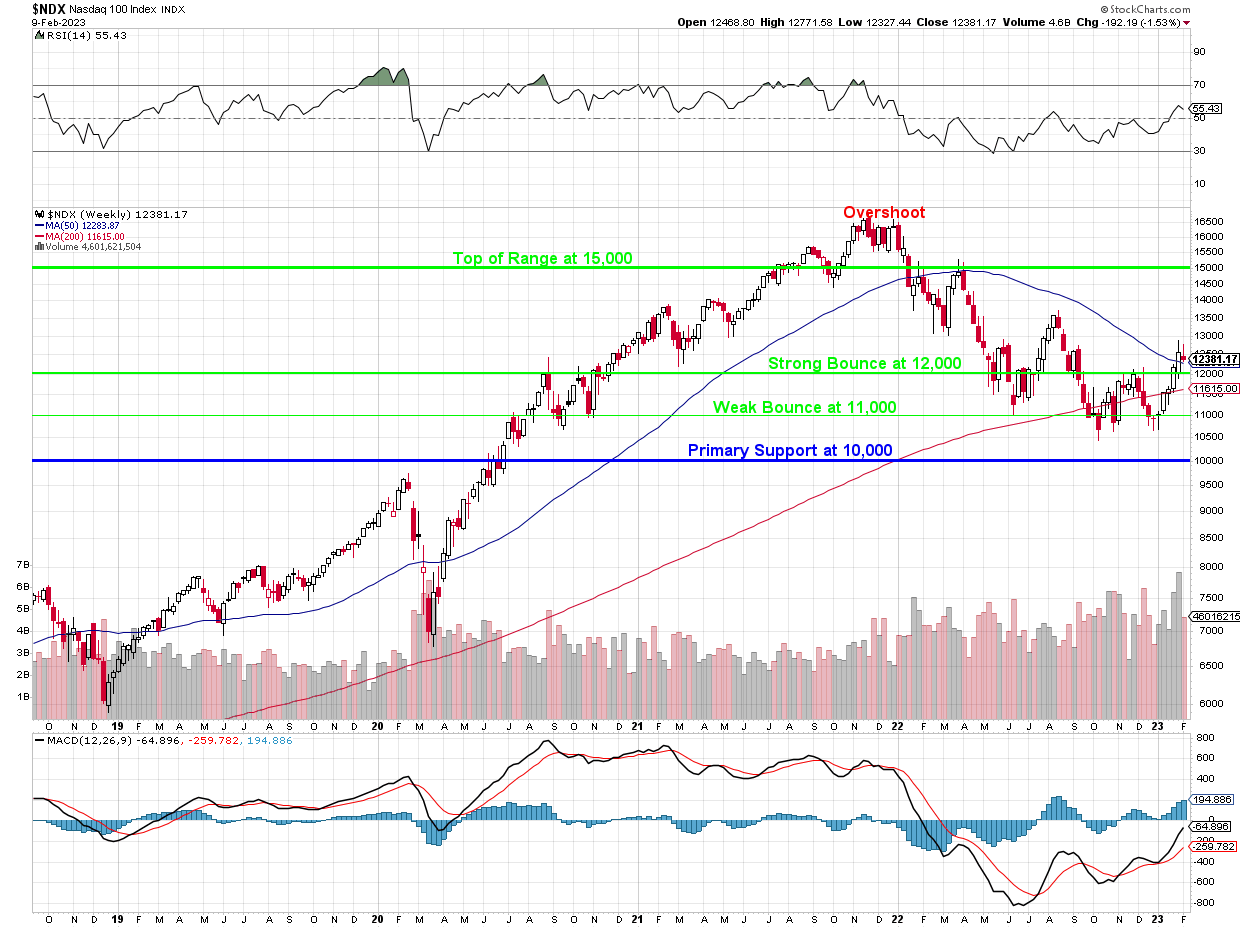

At the moment, we SHOULD get some support off the 50-week (200-day) moving average on the Nasdaq, which sits at 12,283 at the moment. We just popped over it last week so it’s being tested for the first time. We fell from 12,800 and let’s call it 12,300 so we want to see at least a Weak Bounce to 12,400 with the Strong at 12,500 and, of course, failing 12,300 means we’re really going to need those hedges!

What worries me for the rest of the month is we are now 60% into the S&P 500’s earnings so the focus now will turn to the Russell 2000 and the small caps, which includes a lot of smaller retailers who may not have had a very merry Christmas last quarter. Also, here’s a very alarming chart because the disappointing earnings we’ve had so far have put the Russell 1,000s Current Earnings Yield LOWER than the current Fed Fund Rate.

In simple terms, you are better off putting your money in the bank than giving it to these companies! Mid Caps don’t tend to do buybacks the way their S&P 500s do so they can’t cover up the fact that actual earnings (as in Dollars actually made by the company) have been in a fairly steady decline for a decade.

The Fed thinks the solution to this problem is to destroy the job market and lower wages but how about trying to increase the labor force (education, training, day care, public transportation) and BOOST the economy instead? Then companies would earn more money and can afford to pay their workers a living wage…

Meanwhile, the Republicans want to CUT $1Tn from the Budget. No one seems to have explained to them that our $25Tn GDP INCLUDES $1Tn in deficit spending and if they stop the deficit spending, they will DECREASE the GDP by 4% and plunge the country into a Recession/Depression.

Or maybe they understand that perfectly well, which is why they want to do it into the next election cycle? They certainly didn’t have an issue with Trump when he averaged $2Tn a year in deficit spending. Biden got it down to $1.4Tn already – even after he passed a $1.7Tn “Build Back Better” program.

Or maybe they understand that perfectly well, which is why they want to do it into the next election cycle? They certainly didn’t have an issue with Trump when he averaged $2Tn a year in deficit spending. Biden got it down to $1.4Tn already – even after he passed a $1.7Tn “Build Back Better” program.

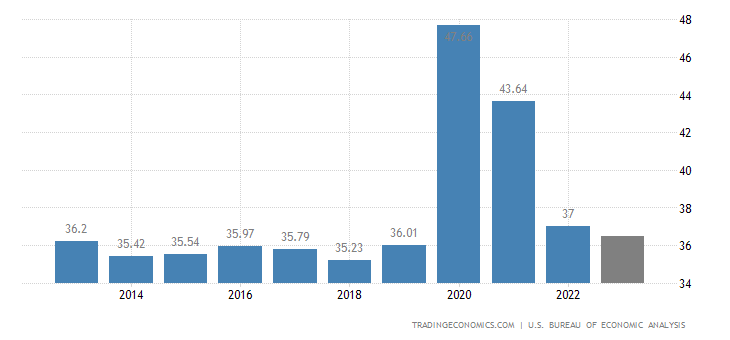

Government Spending is currently about 36% of our GDP ($6Tn). It was 47.5% in 2020. Cutting $1.4Tn from that is 25% of 36%, which is actually 8% of our GDP. Isn’t this a poorly thought out plan?

Perhaps the Government could focus on the real problem: Corporations, who made over $3.5Tn pre-tax (and post deductions, depreciation, etc.) last year, paid just $436Bn in taxes (12.4%), if they paid 35% like the rest of us, that would be $1.22Bn. In fact, our ENTIRE $32Tn deficit has been caused simply because CORPORATIONS ARE NOT TAXED ADEQUATELY.

Corporate taxes used to be 30% of the Government’s total collections, now they are just $436Bn out of $4.6Tn in tax Revenues. Underpaying like that for the past 40 years is ALL of the US deficit and really more since the debt’s from their non-payments accumulate and cause us to pay interest.

Corporate taxes used to be 30% of the Government’s total collections, now they are just $436Bn out of $4.6Tn in tax Revenues. Underpaying like that for the past 40 years is ALL of the US deficit and really more since the debt’s from their non-payments accumulate and cause us to pay interest.

Corporations are declaring record profits and the US is declaring record debts – those things are not disconnected yet it is pounded into our heads that taxing is bad – unless you are taxing the poor, which is what the 300% increase in Payroll Taxes does! Now the GOP wants to place a 30% sales tax on everything to balance the budget – rather than ask Corporations to pay their fair share – another terrible plan…

Have a great weekend,

-

- Phil