Tl;dr: Rates unchanged (in target range of 5.25%-5.5%, a 22-year high) but hawkish-er than expected forecast for rates… but at the same time signaled a ‘soft landing’ with higher growth forecasts.

-

Dot plot’ of rate projections shows policymakers still foresee one more hike this year, but 2024 and 2025 rate projections each rose by a half-percentage point, a signal the Fed expects rates to stay higher for longer

-

Twelve of 19 policymakers on the FOMC expect one more rate hike this year to be appropriate; the remaining seven favor holding rates steady

-

Median projection for economic growth in 2023 jumps to 2.1% from 1% in June; officials significantly reduce unemployment forecasts and now expect jobless rate to peak at 4.1%, rather than 4.5%

-

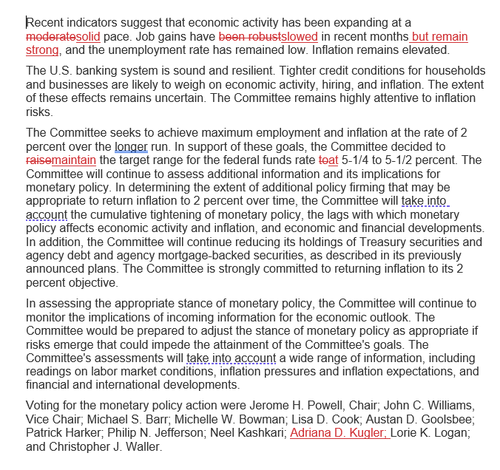

Statement repeats prior language saying officials are considering “the extent of additional policy firming that may be appropriate”; Fed acknowledges job gains have “slowed” but says they “remain strong”

Dots:

- 2023: 5.625% versus 5.625% previous and 5.625% expected

- 2024: 5.125% versus 4.625% previous and 4.875% expected

- 2025: 3.875% versus 3.375% previous and something like 3.875% expected

- 2026: 2.875%

- Long-run: 2.50% versus 2.50% previous and 2.625% expected

SEP forecasts: Growth forecasts were marked up quite substantially this year and next. Headline inflation was adjusted slightly higher in 2023 and 2025, with core marked lower this year but up a bit in 2025.

One thing that appears to be missing for their analysis…

Fed estimates that r* remains at 0.5%, and yet rates in 2026, when US debt may hit $50 trillion will be 3%.

This means that blended interest on US debt will be ~$2 trillion, double where it is now.

Game over

— zerohedge (@zerohedge) September 20, 2023

* * *

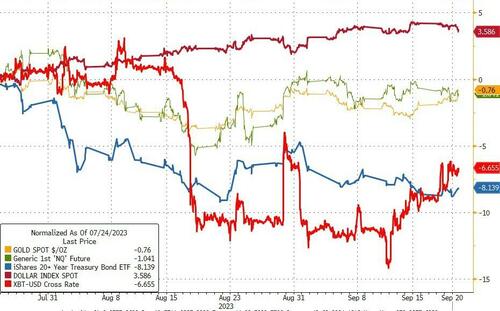

Since the last FOMC statement and press conference (on July 26th), the dollar has soared but bitcoin and bonds have been battered lower in price (with gold and stocks basically unch)…

Source: Bloomberg

Interestingly, spot gold is exactly back up to the spike-lows of the July FOMC day..

Source: Bloomberg

Additionally, The Fed’s jawboning of “higher for longer” is increasingly being accepted by the rates market as the SOFR spreads for Dec 2023-2024 and 2023-2025 have surged since the last FOMC…

Source: Bloomberg

In fact the real shift started in September (as 2023 rate-hike exp faded and 2024 rate-cut exp were reduced)…

Source: Bloomberg

Of some note, we have seen financial conditions tighten significantly since the last FOMC (while at the same time, macro surprise data has disappointed)…

Source: Bloomberg

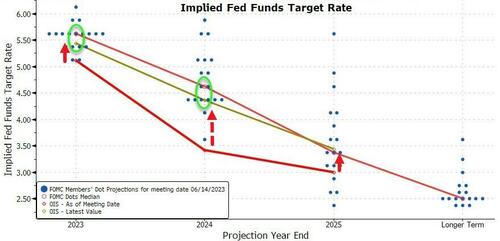

And so, while the world is sure that The Fed will remain on ‘pause’ today, all eyes are on the Dot-Plot for signals of just how ‘higher for longer’ they will be and for Powell’s tone during the presser with consensus expecting the FOMC will reiterate its ‘date-dependence’ but retaining a tightening bias while removing one rate-cut from 2024’s dots.

For context, since the last FOMC, the market has shifted hawkishly (red arrows) up towards The Fed’s prior Dot-Plot, but remains more dovish (green ovals) than The Fed…

Source: Bloomberg

And so, what did we get?

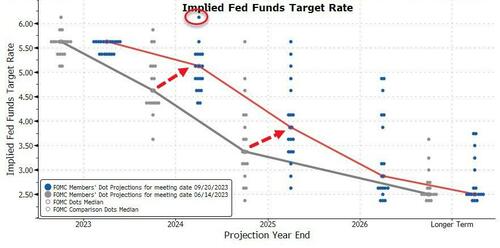

The fed left rates unchanged – as expected – but the dots were significantly more hawkish, slashing two cuts from 2024 dot-plot:

-

*FED: 12 OFFICIALS SEE ONE MORE HIKE THIS YEAR, 7 SEE ON HOLD

-

*FED ’23 MEDIAN RATE FORECAST STAYS AT 5.6%; ’24 RISES TO 5.1%

One Fed member is projecting a 6.125% End 2024 rate…

Dots:

-

2023: 5.625% versus 5.625% previous and 5.625% expected

-

2024: 5.125% versus 4.625% previous and 4.875% expected

-

2025: 3.875% versus 3.375% previous and something like 3.875% expected

-

2026: 2.875%

-

Long-run: 2.50% versus 2.50% previous and 2.625% expected

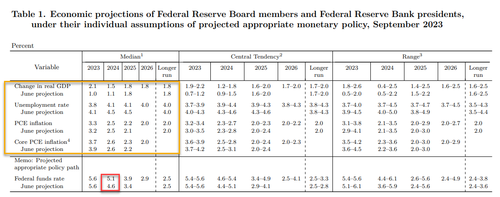

SEP forecasts:

The Fed upgraded its median projection for growth in 2023 to 2.1% from 1% in June. They also lowered their unemployment forecast.

That is large but it’s also playing catch-up and reflects how the economic outlook has changed since June, when recession calls were still live.

Headline inflation was adjusted slightly higher in 2023 and 2025, with core marked lower this year but up a bit in 2025.

There were virtually no changes to the statement:

Over to you Mr.Powell…