I love it when a plan comes together!

Last week, I felt like I was going to have to call Animal Control to help me fight off the bears. As I mentioned in last week's Wrap-Up, all 14 misses (out of 55 trade ideas for the week) we had were bullish plays that we were grabbing on the way down. On Friday we went bullish on USO, SSO, DIA, TBT (well, we're always bullish on TBT), AET, ABX, Copper Futures and even poor BP. Those followed up on bullish plays we had taken on Thursday on TSRA, USO, MEE, FCX, EEM, ERX and XOM. We went into the weekend still bearish but we were excited about flipping back to bullish. My closing comment in the Wrap-Up was: " I’m hoping for a blow-off spike down on Monday with heavy volume, hopefully followed by a recovery over the next few days" and, gosh darn it, wouldn't you know that's EXACTLY what we got.

I don't MAKE the markets do these things, I simply tell you what is going to happen and how you can make money on it… Needless to say, we had a LOT of fun this week at PSW! Last weekend, however, was such a bearish frenzy in the MSM that it was making our Members nervous and THAT I do not tolerate so I wrote : "The Worst-Case Scenario: Getting Real With Global GDP!" to illustrate why I felt our bottoms would hold and I began a Top 20 Buy List on Sunday and boy did we get some fabulous entries this week!

Monday Market Movement – Will We Survive?

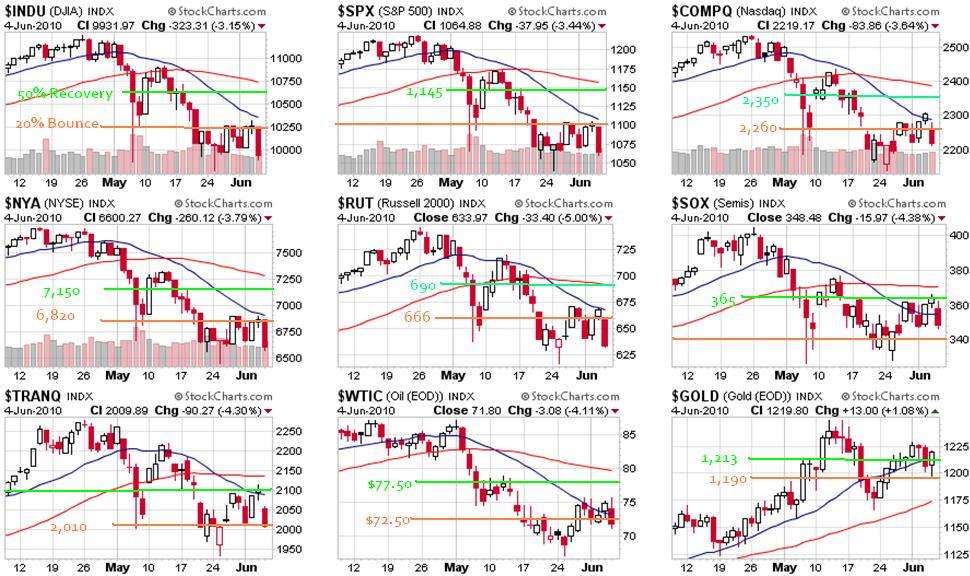

As I said on Monday Morning: "I already stuck my neck out calling a bottom so now we're just waiting patiently." We were disappointed to have not gotten a stronger statement from the G20 over the weekend but it was just the Finance Ministers, so we weren't expecting too much until the big boys meet at the end of the month. While we were in a buying mood, I cautioned against getting too bullish until we took back our anticipated "weak bounce" levels, which were the orange lines on Monday's Multi-Chart:

I pointed out (on another Multi-Chart) that Europe was already gathering strength so we were pretty confident things would go our way but, as I said in the 9:50 Alert to Members, SOX 340 and TRANQ 2,000 had be taken back before we could feel confident. My outlook for the day was: "On the whole, I think this is a flush ahead of the real buying. The futures were doing well and now they are trying to shake out the retailers before hitting the buy button. At least I hope so." Here's how the week ended up on the same Multi-Chart:

Notice how the 20 and 50 dma lines are converging on our trend lines. That's not a good thing at all if we can't take those weak bounce levels, not just next week but – EARLY next week. Right now, those 50 dmas (red) can still be turned up by a strong move (over our greens) by the end of the week but if we don't break on through to the other side then we may end up consolidating at the bottom of our range for quite a while, perhaps all month…

I do have hope as even old pokey, the NYSE, has made a nice move over the 20 dma and is ready to rumble over our 6,820 target with just the smallest of pushes on Monday. The Dow is squished right between the 20 dma and our line of resistance, which makes perfect sense and, as I pointed out in yesterday's post, is EXACTLY what we expected to happen based on our observation of of Friday, February 13th. Monday was a watch and wait day but we did do a little more fishing:

- USO June $31/34 bull call spread at $1.80, now $2.48, up 37%

- USO $31 puts sold for $1.20, now .50 – up 58% (pair trade)

- Oil futures at $70, finished the week at $74.20 (many entries were made) – up $10 per penny per contract!

- Copper futures at $2.775, finished the week at $2.9265 (only entry for week) – up $12.50 per 0.0005 per contract!

- DIA $103 calls at .53, out at .80 – up 51%

What's cool about the above set is – THAT WAS ALL IN MY FIRST ALERT OF THE WEEK! I do so love it when a plan comes together! As I said last week – whatever you do, DON'T refer your friends to our Newsletter, where we tell you what's going to happen in the markets every day, it's better for us if you wait until fall when prices are up 100% and this is most likely the last time you'll get this warning before the "I told you so's" begin! Anyway, as I said, that was only the first Member Alert of the week:

- BRK.B 2012 buy/write at $48.45/59.23 – on target

- HMY 2012 complex spread – on target

- VLO July $17 puts sold for .97, now .82 – up 15%

- VLO 2012 buy/write at $9.96/13.73 – on target

- GLL July $39 calls at $2.20, out at $2.40 – up 9%

- TBT June $39 calls sold for .90, out at .60 – up 33% (cover to our longs)

- QQQQ $45 calls at .75, out at .90 – up 20%

Just as important as my ideas on what to buy are my ideas on what not to buy. At 10:09 I told Cwan I did not like a new SDS entry, saying: "No, I don’t like any short-term hedges right now. I said to cash out Friday as we should be at bottom here and, if not, THEN we can reposition but VIX is "only" 35 right now, which means we’ll still get good entries if we fail last week’s lows." At 10:50, Sean asked about a cash position and I said: "If you have too much cash (+75%), then BUYBUYBUY. THIS IS WHERE WE THINK THE BOTTOM IS!!! We may go lower or this may be the last time you get these entries – EVER."

Just as important as my ideas on what to buy are my ideas on what not to buy. At 10:09 I told Cwan I did not like a new SDS entry, saying: "No, I don’t like any short-term hedges right now. I said to cash out Friday as we should be at bottom here and, if not, THEN we can reposition but VIX is "only" 35 right now, which means we’ll still get good entries if we fail last week’s lows." At 10:50, Sean asked about a cash position and I said: "If you have too much cash (+75%), then BUYBUYBUY. THIS IS WHERE WE THINK THE BOTTOM IS!!! We may go lower or this may be the last time you get these entries – EVER."

I cannot emphasize this concept enough. Berkshire, for example, was at $70.45 when we bought it and we hedged it with the sale of the 2012 $70 puts and calls for $22 which dropped our net entry to $48.45 with a $21.55 profit if called away at $70 (up 44%) and an obligation to buy another round of Berkshire at $70 should they fall below that line at Jan 2012 expiration for an average entry of $59.23. That's STILL 16% below the current price on a stock that tracks the S&P VERY WELL. Sacrifice just $1.50 of that upside on a 500% S&P hedge and we're covered for another $7.50 drop, all the way to $51.73. If you don't WANT to own 200 shares of BRK.B for $51.73 a share then DON'T buy ANY now for $70.45 but we are making long-term plans here and we are accumulating our first round of stocks at a possible bottom. This is not complicated folks…

Hayek vs. Keynes – An Economic Smackdown (Redux)

The Keynesians were on the run and the belts were being tightened in Europe and the market was freaking out – although it was freaking out about stuff we have been talking about for months! This is the problem with being fundamentalists – sometimes we are so far ahead of the market that we can't believe the reaction we see when things that are old news to us finally get the attention of the MSM but I have greatly improved my market timing this year by assuming that the average investor is a Cramer follower (something I previously refused to believe) and that the average fund manager is no smarter than Cramer himself. Yes, I know that makes you wonder how they can possibly walk AND chew gum at the same time but, sadly, this seems to be the case as there is no "smart money" on Wall Street anymore.

Wall Street has become such a blatantly rigged casino that all that is left under the tent are "rubes" (and there's one born every minute) that are pulled in by the carnival barkers like Cramer and his ship of fools at CNBC and, even worse, the "professional" gamblers (fund managers) who think they have a system which, like all systems, works until it doesn't. Look, even SELMA Hayek laughs at all the suckers. She knows that the game is rigged as well as the fact that you can't spend your way out of debt – it's asinine!

Wall Street has become such a blatantly rigged casino that all that is left under the tent are "rubes" (and there's one born every minute) that are pulled in by the carnival barkers like Cramer and his ship of fools at CNBC and, even worse, the "professional" gamblers (fund managers) who think they have a system which, like all systems, works until it doesn't. Look, even SELMA Hayek laughs at all the suckers. She knows that the game is rigged as well as the fact that you can't spend your way out of debt – it's asinine!

You can spend your way out of a recession IF YOU HAVE BEEN SAVING but, if your recession is caused by excessive debt – then you are simply in denial. Imagine if the bible story had Joseph interpreting the Pharaoh's dream and telling him – "What you need to to is party for seven years like there's no tomorrow and then, when the drought comes – we'll all be so fat that we can sell it as a diet program." That's right, even thousands of years ago they had economic cycles and Joseph did not get famous for his tax cutting programs – Joseph advised Pharaoh to SAVE during the good years – to put the surplus in a "lock box," so to speak, so that it would be available in the event of a real emergency.

Testy Tuesday – Gentle Ben vs. Reality

Nothing sums up the US Economic policy better than this picture of Ben praying.

Even in his upbeat speech on Tuesday, Bernanke said he is "hopeful" the economy will gain traction. Hey Ben – "hopeful" is how the people are supposed to feel – you are in charge of MAKING IT HAPPEN! We are the friggin' United States of America for goodness sakes – why can't we remember how to act like it? "My best guess is we will have a continued recovery, but it won’t feel terrific," Bernanke said.

Whuck??? Surely this man can be fired and replaced with someone who has a spine… I don't know if many people realize this but we are currently following the VERY DANGEROUS economic path that Bernanke laid out in this thesis paper (Philosophy, not Economics) at MIT in 1979.

Chapter 1 analyzes "the problem of making irreversible investment decision when there is uncertainty about the true parameters of the stochastic economy." Chapter 2 claims that: "Dynamic considerations can make periods of unemployment and excess capacity part of an efficient growth path" (whuck again!) and Chapter 3 drives it home by claiming that labor contracts can be broken during long-term periods of "apparent labor market disequilibrium." On page 107 of his dissertation, Bernanke says (and I kid you NOT):

Because of the prohibitions against slavery or indenture, and because of difficulties in setting a legal standard of worker compliance, labor contracts are not fully enforeceable on workers. This incompleteness causes observed contracts to differ from the IDEALIZED model in several ways. Contracts must be structured to make voluntary compliance attractive. This may involve staggering benefits towards the end of the working life (through seniority rules, for example) setting up artificial barriers to mobility or giving workers firm-specific training which is not easily used elsewhere.

In other words, Dr. Bernanke is a doctor of totally screwing over workers – the perfect man to head the Fed, an organization that was designed from the outset to hand control of our nation's wealth to the bankers – who have been sucking it dry ever since. I won't get into it here but either read or watch "The Creature from Jekyll Island." Pat Buchanan says:

Once you do, you will fully understand what is really going on with the banking bailouts and our current economy. Bottom line? Everything you hear on TV or read in the press regarding the bailouts and banking system is a lie. This video is possibly the most important you will ever watch – so much so that you may want to view it several times. As more Americans finally figure out what is really going on I expect to see some aggressive action against the Federal Reserve and their cheerleaders in Washington.

How many people in Congress do you think even bothered to read Bernanke's thesis before approving him? Did Obama? Let me in there to ask some friggin' questions – I'll make Ron Paul look like he's been serving Ben tea! To some extent, I often wonder if this whole thing – this economic collapse of ours – is nothing more than a grand experiment to Bernanke to see if he can bring about a repeat of the Great Depression that he loves so much to study. Remember, Ben doesn't have to be involved in a conspiracy to debase our currency and drive down labor costs so the top 1% can transfer wealth up the ladder – he only has to be the right tool for "THEM" to get the job done. Anyone who actually reads what Bernanke spent his college years writing can see is is the perfect man for that kind of hack job!

How many people in Congress do you think even bothered to read Bernanke's thesis before approving him? Did Obama? Let me in there to ask some friggin' questions – I'll make Ron Paul look like he's been serving Ben tea! To some extent, I often wonder if this whole thing – this economic collapse of ours – is nothing more than a grand experiment to Bernanke to see if he can bring about a repeat of the Great Depression that he loves so much to study. Remember, Ben doesn't have to be involved in a conspiracy to debase our currency and drive down labor costs so the top 1% can transfer wealth up the ladder – he only has to be the right tool for "THEM" to get the job done. Anyone who actually reads what Bernanke spent his college years writing can see is is the perfect man for that kind of hack job!

Ben did use the term codependency to describe our relationship with other countries. While the good doctor seemed to intend it to be "the good kind" of codependent – I thought the bad kind was a very good description of the current global crisis. Still, Bernanke's statement was SO panic-inducing and the news was SO negative that I put our a hyena alert that morning as I warned:

At this point, this is nothing more than what we call hyena attacks, which happen when the bearish investors send their media hounds out to attack any weak prey in an attempt to foment a very profitable panic in a stock or a currency and you will often see them at key turning points, as it’s often the bears who are panicking as they reach the bottom and they are desperate to get out of their short positions before the situation turns around. This does NOT mean that we go cotnrarian to the Hyenas, though – we learned in 2008 just how effective these attacks can be but they are a good sign that a stock or, in this case – a country, is under attack.

Despite all the gloom and doom in the MSM, we continue to steer more bullish at PSW. We have been dipping our toes in the water and bargain-hunting blue-chips and even this morning I posted a long on both oil and Dow futures, which are both up nicely at 9:15. We got a nice penny spike on copper futures yesterday (and that’s plenty for copper!) and we added longs (well-hedged still) on BRKB, HMY, VLO and TBT and, after hours, I laid out a nice SSO (ultra-long S&P) option spread that has 700% upside if the S&P can hold 1,050 through January.

That SSO spread had been discussed in Monday evening's Member Chat and we had VERY easy entries thanks to Tuesday morning's panic drop. It was a Jan SSO complex spread at net .50 that makes a 700% profit for our Members if SSO is over $33 (now $36.32) at Jan expirations but, due to this week's quick little bounce, the spread is already at $1.40 and up 180% in the first week – not too shabby! Always keep in mind that that's the kind of insurance we like to have IN CASE we are too early with our bullish bets. Fortunately, it turns out we seem to have timed them just right this week:

- SSO Jan complex spread – on target

- UNG 2012 buy/write – on target

- UNG Oct complex spread – on target

- OIH July $89.10 puts sold for $5.70, now $2.30 – up 59%

- RIG 2012 $35 puts sold for $9.20, now $9.10 – up 1%

- GLL July $39 calls at $1.65, out at $2.40 – up 31%

- FAS Jan $10/20 bull call spread at $3, now $6.30 – up 110%

- FAZ Jan $23/32 bull call spread at $1, now .90 – down 10% (brilliant pair trade!)

- C 2012 complex spread – on target

- SDS Sept $38/42 bull call spread at $1.05, now .82 – down 22% (still good insurance!)

- SSO Jan complex spread – on target

- MTN stock at $38.50, now $39.09 – up 1.5% (Oxen idea)

All those trade ideas came by 1pm. The rest of the day we watched the action. At 2:17, with all of our bets bullish and the Dow barely holding the 9,800 line, I said to Members: "We are right on track to hit 10,000 tomorrow by the way… We’ll need good consumer confidence numbers at 5pm but then we have wholesale inventories and the Beige Book at 2pm that Bernanke thinks looks pretty good. Friday is May retail sales and expectation have now crashed for those (0.2%) but gas sales will drag them down. To me, it looks like a major seller, not major selling and when this guy is done, we can move up pretty quick." Here's the chart of the future I predicted:

We didn't make any momentum bets into the close as I'm never THAT confident and we already had so many bullish positions it was silly to add overnight risk to our list of crimes if the whole thing hit the fan but, then we got (at 8:59 pm) a very odd, very wrong looking push lower in the futures that I decided was Japan reacting to what was now day-old news (Fitch downgrade) that we had already shaken off in US trading so we went long on Russell futures at 612. Those are now trading at 644 but, of course, we took that money and RAN! We also added the PGH trade but I'll put that under Wednesday's list…

Which Way Wednesday – Beige Book Edition

Which Way Wednesday – Beige Book Edition

We love our Beige Book days – they are always good for wild rides. Wednesday was the beginning of our pattern recognition days, where I pointed out that the reason we had flipped bearish in late April was simply that we had gone over the top of our predicted trading range and the reason we flipped bullish this week was because we were below the bottom of our trading range. Unlike TA people – we don't just keep extrapolating every trend to continue forever… As fundamental investors we believe there is an actual value to the stocks we are trading and sometimes they are priced to high (and we sell) and sometimes they are priced too low (and we buy).

I laid out my rangeish (not bullish) premise in Wednesday's post so I won't rehash it here. The very interesting thing about Wednesday was that I LIKED the Beige Book report but we sold off so I had to go against my original plan and stay bullish into the apparent rejection. That was hard but it paid off nicely the next day. We didn't know that in the morning but my closing statement to the morning post was great advice:

We’re very bullish here UNLESS we fail to retake our weak bounce levels – then we’ll be getting the hell out of our short-term bullish positions and thinking long and hard about the next move. Copper zoomed up to $2.87 and oil is up to $74 pre-market so congrats to all who played there but – DON’T BE GREEDY!!! Use stops and remember that cash is still king – we are finding great opportunities every single day in this crazy market so why lock into one-way bets until things settle down?

I amended the statement in my 9:51 Alert to Members, where I added: "If we are going up, the market will probably buck like a bronco because they don’t want to give the retail longs and easy ride so be very careful out there!" As you can see from the week's chart above, the movement of the day certainly bore me out.

- PGH Jan buy/write – on target

- USO June $35 puts (rolled) at $1.10 avg., out at $1.40 – up 21%

- ATPG 2012 buy/write – on target

- BTU 2012 buy/write – on target

- QQQQ July $45 calls at $1.08, now $1.65, up 52%

Since we had run up so much into the book, I had warned members at 12:22 to cover our long DIA positions and at 1:51, just ahead of the book I said: "Well I flipped bearish on those DIAs and then went to go eat something so I’m guarding against a sell-off and I’ll eat the delta difference to the upside until I lighten up on the callers so I’m kind of ready for anything. This BBook covers mainly May, when we know consumer spending slowed down but oil prices really plunged and that should have perked up outlook for a lot of people. If we got a nice pullback ahead of the book, I’d risk long but we’re at the top of a 2.5% run here so I’d rather guard against a pullback and be pleasantly surprised if we break higher." Again – I can only tell you what is going to happen – what you do with that information is up to you!

At 2:04, I got a quick glance at the headlines and warned Members: "BBook is here! Nothing too exciting at a glance but markets will do what they plan to do anyway. If we don’t pop new highs soon, most likely we sell off." That was followed with my full review for Members at 2:30, where I decided it was bullish enough to fight the tide of selling but not bullish enough to support oil at $75. By the last 15 minutes the selling had just gotten silly so we got bullish on our DIA hedges and added the above QQQQ play into the close.

Thrusting Thursday – Where's Our Rocket Fuel?

Thrusting Thursday – Where's Our Rocket Fuel?

I was a little worried early in the morning as we weren't getting the big bounce I'd hoped for in the futures so I sent out an early, 8:01 Alert to Members where I said: "Futures are up but weakening as Euro is still testing that $1.20 line. Copper is $2.85 and over that line is good and oil is still high at $74.76 but too dangerous to short futures. We are in the same position as yesterday and needing to do the same thing as yesterday so those are the morning levels, pretty much we need a 2% move up and, if we don’t get it today, I’m going to get a bit nervous into the weekend." You can tell from the post's title (published at 8:29) that we still weren't getting much action just one hour from the open.

By the way, this is NOT a picture of David Ristau at his graduation party as many have suggested… 😎

We discussed how fear was driving the markets and how we had to stick with our plan (well-hedged, long-term entries on blue-chip stocks) and BE PATIENT. You know I'm serious about patience when I start quoting Mr. Miyagi and telling people to chill out and go watch "The Man Who Planted Trees" again. I would urge anyone who was impatient to read Thursday's post – especially now with the retrospect of what actually happened the next two days. As I said at the time:

There’s an old saying that goes: "Patience is waiting. Not passively waiting. That is laziness. But to keep going when the going is hard and slow – that is patience." Teaching options strategies is easy – teaching people how to patiently wait for the right opportunity to deploy them is the real challenge! We went to cash early (see yesterday’s post) at the top and had to wait for a clear signal to go short and now we are PATIENTLY waiting for a CLEAR signal to go long. Right now, the going is certainly hard and slow but this is the low-end consolidation that we didn’t have before the last rally and it’s just what we need in order to fuel up for a real move up to new highs once we see some real signs of a recovery.

- AAPL June $260 calls for $1.10, out at $1.50 – up 36%

- DIA July $105 calls at $1.10, now $1.30 – up 18%

- DIA June $104 calls sold at .43, still .43 – even (pair trade)

- QCOM Jan artificial buy/write – on target

- OIH July $89 puts solf for $3.25, now $2.30 – up 29%

- VLO Jan buy/write – on target

- ERF Jan buy/write – on target

- FDX 2012 buy/write – on target

- TNA stock at $40.70, out at $41.70 – 2.5%

- TNA June $38/41 bull call spread at $2.20, still $2.20

- TNA June $38 puts sold for $1.80, now .90 – up 50% (pair trade)

Turning $10,000 into $50,000 by January 21st!

Turning $10,000 into $50,000 by January 21st!

We were so pleased with the way the week was going and ready to add a new set of disaster hedges (to lock in our gains) at Dow 10,250/S&P 1,100 that I decided we needed some upside hedges as well. That led to another round of our upside hedges, plays that return 500-1,000% in a rising market in a relatively short time-frame. This is NOT about taking your only $10,000 and rolling the dice on making $50,000, this is about taking 10% (or less) of a $100K virtual portfolio and adding some risk, that we intend to hedge with a $1K, 5x downside play that should cover ALL of our losses with 50% stops.

The last time we did this was in February and, of course, all of them worked on that crazy run we had so this is more like a re-load of similar plays at a similar spot.

Flashback Friday – Pattern Recognition 101

This time we focused on the S&P chart and how similar the current pattern of trading is to the pattern we saw in that February sell-off. I posed the question: "Is it possible that when computers do almost all of the trading that the market begins to fall into highly repetitive patterns or is is just some huge coincidence?" I pointed out that the pattern of Friday, Feb 13th had a dip in the morning followed by a recovery to a flatline into the close and we almost repeated it exactly except for the late-day stick, that took us to 10,211 at the close. I'm not sure if that makes me happy or not – we'll see on Monday but we were already so loaded up with bullish plays that there was little for us to do on Friday but sit back and watch the fun – a very nice way to finish a successful week of trading!

We did, of course, stick to our guns and take advantage of the morning dip with the pickup of the July $105s and the sale of our USO puts, which we had picked up on Wednesday and rolled on Thursday – we love to take quick profits and run…

- DIA July $105s at $1, now $1.30 – up 30%

- XOM 2012 buy/write – on target

- XOM 2012 complex spread – on target

- FAS/XLF Jan complex spread – on target

So, all in all, an amazing week with just two misses, out of 44 trade ideas and both were hedges on Tuesdsay (FAZ and SDS)! We are too bullish but we closed all our June calls and it's not likely even a drop on Monday will force us out worse than even on our gains so we could afford to stay bullish into the weekend but I did not like the action into Friday's close which was, as I said, an unnecessary stick.

We did NOT hit our weak bounce targets and we are ready to slap out TZA and SDS disaster hedges down hard on Monday if we can't hold 10,000 on the Dow or 1,070 on the S&P and we'll find out tomorrow night if Europe survives the weekend so tune in for that news in Member Chat. So far (9pm Saturday), no one seems to have said anything particularly stupid (in the EU I mean – not on Fox) and that's encouraging at the moment but they're probably all watching the World Cup and staying out of trouble.