Good Friday to all. Hope you had a fantastic week. Only big news for updating is that we got out of Reliance Steel & Aluminum (RS) yesterday morning for a solid gain. We had no new positions yesterday as I took the day off to recover some health. We got involved with RS for an Overnight Trade at 36.80, and we exited at 37.75, giving us a solid gain of 2.55%.

Good luck today!

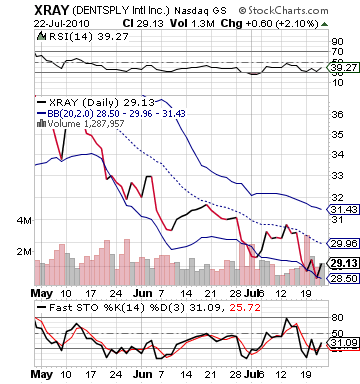

Buy Pick of the Day: DENTSPLY International Inc. (XRAY)

Analysis: DENTSLPY International (XRAY) is a dental products supply company. The company should be getting a very nice boost today to its share prices after similar company Align Technology (ALGN) reported some shattering earnings. ALGN reported a 41% increase in revenue and beat earnings by 50% with an EPS of 0.21 vs. the expected 0.14 and tripled EPS from one year ago. The company is seeing a renewed buying of their Invisalign braces and other dental  products that disappeared over the past two years.

products that disappeared over the past two years.

DENTSPLY is set to report earnings next week, but the ALGN earnings are definitely reason to believe that a buying of XRAY will occur today. ALGN is up over 15% in pre-market earnings, and a lot of those buyers are going to be looking to other dental product companies with similar structures as well. DENTSPLY is one of the other leading orthodonics suppliers, so the fit is there.

XRAY is also a great pick on a day that appears to be a bullish day because it is undervalued. Since May, the stock has lost over 25%, and it has not had too much to be excited about for buying. Yet, today, this news could really boost up the share prices. The stock is well below the 50 mark on RSI that shows fair valuation. The stock is heavily oversold on stochastics, and it close to its lower band. The stock has a beta of just 1, so it will be a slow mover.

We want to get involved this morning at the highest 29.50. It is not a stock that is open in pre-market, so I will take anything below that at the start. Otherwise, we may have to pass.

Entry: We are looking to enter at 29.30 – 29.50.

Exit: We are looking to exit for a 2-3% gain.

Stop Loss: 3% on bottom.

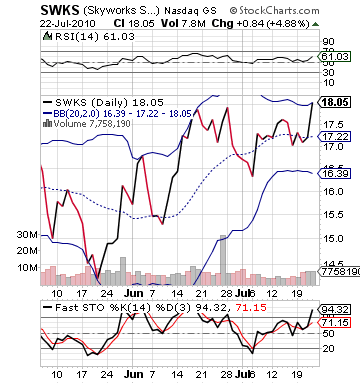

Short Sale of the Day: Skyworks Solutions Inc. (SWKS)

Analysis: Skyworks is a much different story from DENTSPLY. This company has been on fire as of late. Since May, this stock has gained over 20%. Skyworks is the Apple iPhone supplier of a number of parts, and it goes how Apple goes. SWKS just reported a very solid earnings last night, but I do not think it was nearly good enough. They only beat earnings estimates by 0.02, but investors were expecting more as they ran the stock up yesterday 6%. When a stock moves that high before earnings…it tends to disappoint.

goes. SWKS just reported a very solid earnings last night, but I do not think it was nearly good enough. They only beat earnings estimates by 0.02, but investors were expecting more as they ran the stock up yesterday 6%. When a stock moves that high before earnings…it tends to disappoint.

The stock is down in pre-market, and it is not being helped by the fact that the stock was downgraded this morning after earning by Charter Equity. With the high valuation the stock has, coupled with a downgrade and disappointing earnings, I would venture to guess that profit taking will occur. Even though there are solid earnings out there today, the market is not reacting quite as well, and we have seen future decline since around 8:30 AM.

If we can get into SWKS at a relatively decent price, then we will take it. I do not want to go much lower than 17.70, but watch for the Morning Levels Alert to see any changes.

Good luck!

Entry: We are looking to get involved at 17.85 – 17.70.

Exit: We are looking to cover for a 2-3% gain.

Stop Buy: 3% on top.

Good Investing,

David Ristau