USO Oil Fund – All of the Drops, Only Some of the Gains

For the past two weeks we've been shorting USO on and off and it's been very entertaining.

We all know that most ETFs are a total scam as they use a system called "creation units" to deliver shares to market WITHOUT changing the net asset value of the underlying assets of the fund. Because the funds are front-loaded (or front-unloaded) with cash during the day, professional arbitrators have a field day buying or shorting the underlying stocks or commodities that the ETFs MUST buy to "square up" their positions at the end of a day. Effectively, ETFs allow professional investors to pool the money of small investors into one, easy-to-manipulate target that follows pre-defined rules they can trade against.

In the case of USO, which has always underperformed oil by a wide margin, the divergence is so bad and the flaws in the fund are so vulnerable to attack by the already manipulative NYMEX crowd, that oil expert Stephen Schork has labeled it a pyramid scheme:

So how is this like a pyramid scheme? A pyramid scheme is funded by a constant flow of dollars into the venture by new investors. The second investor knowingly and willingly pays the first investor on the assumption he will get paid by the third investor… and so on. It’s similar to a Ponzi/Madoff scheme, with the key difference, investors don’t know (or don’t want to know as long as those alleged returns keep rolling in) they are being scammed.

The USO is being funded by a proliferation of new retail investors looking to diversify into “alternative investments” (which as far as we have been able to ascertain, alternative investment is a euphemism for Las Vegas style bets on commodities by retail investors tired of watching their 401Ks drop). More importantly, these investors are obviously out of their league, i.e. taking buy-and-hold positions in a contango which raises their cost basis every month they roll into the higher priced deferred contract.

We assume they are buying the USO because they are bullish. But in a peculiar way, their actions could be helping to prevent the market from rallying. These new investors are not funding a pyramid per se, but they are helping to fund storage. That is to say, with global demand in the doldrums, the contango will persist. And, as long as it lasts, traders will continue to front-run the rolls, which in turn will exacerbate the contango, which will then incentivize storage builds further, which will then ultimately weigh on oil prices.

As Izabella Kaminska writes in the Financial Times: "The important thing to remember is that all of the above conditions create a very unfavourable investment climate for retail investors holding USO. Oil market participants win precisely because they can play the contango trade effectively and predictably. Retail investors just lose and will continue to do so until either the contango disappears or the oil price shoots up beyond the rate of their losses. Yet many analysts agree the oil price is unlikely to ascend much higher while the contango is in place, and as Schork highlights, the contango is unlikely to disappear while the market can continue to benefit from its structure."

In other words, although USO has over 100,000 NYMEX contracts, indicating an open interest for 100M barrels of oil – they have no intention (or physical capability) of ever taking delivery of the product. The 100M barrels worth of contracts they buy and sell every month have NO VALUE to them at all, other than as a trading vehicle to generate fees. As for the suckers retail investors that put money into the fund – they would be very shocked if a truck actually pulled up to the house and delivered 100 barrels of oil to their doorstep. In effect, they ENTIRE SCHEME is based on people buying something they don't want at all in the hopes of selling it to someone else who doesn't want it for a higher price – this is how the whole thing collapsed so quickly the minute demand didn't live up to expectations last fall.

The nature of this Ponzi scheme forces USO to "roll" their contracts always to the next month (to avoid delivery) and "contango" means that the front-month contracts are cheaper than the longer contracts (oil is readily available now but may not be in the future) and USO is obligated to sell their front-month barrels and exchange them for the next month, paying the spread every single month. Even in rare cases of "backwardation" (a crisis/shortage causes the front month to spike up ABOVE the longer months), USO only gets a very small advantage as they still roll just a month forward, maybe making one dollar on the way to losing the next $12.

As the next month contract BECOMES the front-month contract, the value drops again (the contango – and think if it as a CON dance and you've got the picture) so USO can effectively (in the above example) take your $50,000 and buy 1,000 barrels of March oil at $50, then roll them to 943 barrel of April oil at $53 (which drop to $50 again) and then roll them to 890 barrels of May oil at $53. You can run this math many different ways but there is no way you can win buying oil like this and that is how using an ETF like USO to trade will give you all of the drop of owning a commodity but only some of the gain!

With the current spread between the July contracts, which expire June 22nd, and the August contracts is currently $1. That means if you hold a USO contract for one year, each month they roll your barrels forward it costs you $1 – that's $12 a year or about 1/3 of the entire price of the ETF that you are spotting from day one. On the other side of the trade, NYMEX traders can sell July contracts short ahead of USO's rollover, which is currently 1/3 of all outstanding June contracts and they can buy the July contracts before USO is forced to buy them as well.

If one of these NYMEX traders happens to be Goldman Sachs and, 3 days before USO is forced to roll their contracts, they put out a call raising their prediction for the price of oil by 30%, they can front-run that trade against the $3Bn worth of retail suckers sitting in USO and make $2 a barrel ($1 for July and $1 for August) on 100M barrels in just a few day. The NYMEX sharks can do this every month like clockwork and it's not just USO as there is DIG and DUG and USL and DBC and ultra short ETFs (don't even get me started on how they chew up your cash!) etc, etc….

The dislocation this creates in the market is so obvious, that even the do-nothing CTFC has been forced to investigate: "CFTC enforcement staff are investigating the trading activity of multiple market participants, including United States Oil Fund LP, in crude oil markets concerning the February 6, 2009 roll," Stephen J. Obie, acting director of the CFTC Division of Enforcement, said in a statement. "Traders say the size of the United States Oil Fund has skewed the market, creating extreme price swings between the spot price of oil and contracts two or three months out."

In fact, it's very possible that if you did an proper investigation (perhaps a Congressional one) you would find that MOST of the oil traded on the NYMEX has nothing to do with real demand at all but is pure speculation that is sold to retail investors as "commodity investing" or "inflation hedging" but what kind of inflation hedging loses 33% a year PLUS TRANSACTION FEES before a profit can be made? Oh and a funny note – who handles USOs cash and places trades on the ICE and NYMEX for them? Aw, you guessed it – Goldman Sachs!

So here you are giving your money to an ETF that gives its money to the biggest shark in the ocean, who chews off your legs in transaction fees and contango spreades BEFORE they even bother to circle around for the kill by gaming the market. NOT ONLY THAT, but the idiotic rules of the fund lead them to PUBLISH THE DAYS THEY ARE ROLLING IN ADVANCE so every little shark in the sea knows exactly when and where to feast on your bloody, bobbing carcas this month – and the next and the next and the next. Don't worry though, once you are chewed up and digested, there will be a fresh round of suckers herded back into commodities and the commodity pushing stocks and ETFs every time GS, MS or Cramer need another payday.

Perhaps now you see why we favor the short trades in USO. Since USO began trading in April of 2006, when it matched a barrel of oil at $68.82, it has fallen to $37.40 with oil now at $68.40 after peaking at just $117 when oil was $147. In fact, oil's meteoric rise began in April of 2006 as billions of dollars of retail money flooded into this much-hyped ETF, running oil up from it's more natural price in the $60s, up almost 150% before the pyramid collapsed. We're already up over 100% off the recent bottom in oil (fueled by a massive upswing in USO contracts taken as investors have been herded in since the crash) and that led us to successfully trade shorts off the $70 mark. Now that we have cashed out of most of this week's oil shorts, we would welcome a run up to $85 (if Goldman and CNBC can manage it) so we can short them again as we get ready for another spectacular unwinding of this fund, the commodity itself and the energy sector it will drag down with it.

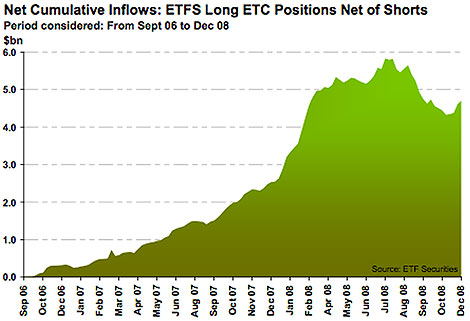

Perhaps now you see why we favor the short trades in USO. Since USO began trading in April of 2006, when it matched a barrel of oil at $68.82, it has fallen to $37.40 with oil now at $68.40 after peaking at just $117 when oil was $147. In fact, oil's meteoric rise began in April of 2006 as billions of dollars of retail money flooded into this much-hyped ETF, running oil up from it's more natural price in the $60s, up almost 150% before the pyramid collapsed. We're already up over 100% off the recent bottom in oil (fueled by a massive upswing in USO contracts taken as investors have been herded in since the crash) and that led us to successfully trade shorts off the $70 mark. Now that we have cashed out of most of this week's oil shorts, we would welcome a run up to $85 (if Goldman and CNBC can manage it) so we can short them again as we get ready for another spectacular unwinding of this fund, the commodity itself and the energy sector it will drag down with it.

Just look what happened to oil from August '08 to through October '08 when just 10,000 contracts were unwound and you can see again what happened to oil between Xmas ($45) and Jan 8th ($39), when USO unloaded another 10,000 contracts. Since then, they have added a record 60,000 contracts as all the beautiful sheeple BUYBUYBUY the ETF to the point where, as I mentioned earlier, they now hold 1/3 of all NYMEX contracts, creating a false demand for over 100M barrels of oil EVERY month as they roll over.

So we're not looking for a repeat of last summer's crash in oil. If this mother unwinds, we could have an unprecedented disaster for the energy sector and, sadly, as they have been leading our market rally, it is not likely to bode well for the markets either. As Ms. Kaminska rightly points out in another article on USO:

In the event of a perpetual contango and no new inflows this would presumably oblige the USO to self destruct eventually. Of course, such a “black-swan” scenario would have seemed distinctly unlikely in 2006 when the ETF’s methodology was first constructed — the depth and scale of the distortions being relatively unprecedented in recent WTI history.

Scenario 2 is that someone is methodically abusing the USO specifically to benefit from the profits incurred from front-running the fund in the WTI market itself. Of course, driving up the price of USO units to the extent that the fund is forced to increase its size 10-fold would be a costly operation for any one institution. It is possible there has been a systemic arbitrage opportunity unlocked by the trading community, all of whom – having identified an unsophisticated party in the oil markets — have decided to take advantage of their inexperience by doing exactly that. But there is one problem here, the situation would leave participants exposed to further downside in the USO. Perhaps it’s a risk some might be prepared to take, but it is a risk no less — even if selling-out is an option at any time due to the ETF’s liquidity.

We don't know when it will happen but it sure is going to be fun to watch and, hopefully, we'll be able to catch the next big wave as it forms. As ELP once said:

Welcome back my friends to the show that never ends

We're so glad you could attend

Come inside! Come inside!

Come inside, the show's about to start

guaranteed to blow your head apart

Rest assured you'll get your money's worth

The greatest show in Heaven, Hell or Earth.You've got to see the show, it's a dynamo.

You've got to see the show, it's rock and roll ….

And these ETFs will roll and roll and roll until all your money is gone!

Click here to sign up for a free subscription to Phil's Stock World Report. It's easy!