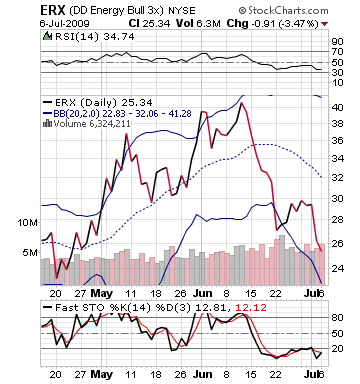

What to Buy: ERX

Courtesy of David at The Oxen Group

David at The Oxen Group recommends a purchase of Direxion’s Oil and Energy Daily Bull ETF (ERX) for Tuesday. The oil market may be ready to make some positive gains which should light a fire under this ETF.

David at The Oxen Group recommends a purchase of Direxion’s Oil and Energy Daily Bull ETF (ERX) for Tuesday. The oil market may be ready to make some positive gains which should light a fire under this ETF.

Oil is looking slightly bullish on Tuesday to begin with because of a technical correction that is needed. The market has fallen over 10% in a week, and prices have moved down too low, too fast. A lot of sellers have sold and are becoming buyers again. Gerard Rigby of Fuel First Consulting believes oil is ready to move back to $70 per barrel as the economy is in the same place and there really is no reason for it to move down any further. He believes the profit taking and correction is done. At least for tomorrow, this makes sense.

Tomorrow, there is really no significant economic news once again and no primary earnings, which should send the market into a similar seesaw that it was in today. This is a perfect opportunity for a purely technical correction. More bad news from Nigeria’s militant operations, analysts’ saying crude inventories are falling again, and speculation on the EIA data on Wednesday could all be catalysts to help drive up crude prices slightly.

The price of oil gained in Asia, which is a telling sign that a technical correction should be on the way. The futures are slightly negative, but with no positive news in the after hours, this seems logical. ERX will benefit greatly from any movement positively in oil prices. The stock has dropped over 10% in just two trading days, and it looks poised for a pop. Get in early and ride a nice 3-4% gain.

Entry: Recommend entering 10-25 minutes into session.

Exit: Recommend exiting on 2-4% increase from buy price.

Resistance: Upper at 28

David’s Results Charts

| date | stock | entry | exit | change |

| 5/29/09 | GPS | 16.99 | 17.67 | 4.0% |

| 5/30/09 | TM | 80.77 | 81.72 | 1.2% |

| 6/2/09 | SRS | 18.06 | 18.6 | 3.0% |

| 6/3/09 | DUG | 16.68 | 17.35 | 4.0% |

| 6/4/09 | TLAB – SS | 5.95 | 5.84 | 2.0% |

| 6/5/09 | XOP | 35.84 | 35.85 | 0.0% |

| 6/8/09 | BLK | 164.76 | 168.87 | 2.5% |

| 6/9/09 | USD | 20.3 | 21.12 | 4.0% |

| 6/10/09 | SINA | 30.17 | 31.07 | 3.0% |

| 6/11/09 | SRS | 18.39 | 19.3 | 5.0% |

| 6/12/09 | NSM | 13.23 | 13.56 | 2.5% |

| 6/15/09 | ERY | 18.32 | 19.05 | 4.0% |

| 6/16/09 | SKF | 41.21 | 42.85 | 4.0% |

| 6/17/09 | SRS | 20.17 | 20.97 | 4.0% |

| 6/18/09 | DIG | 28.36 | 29.21 | 3.0% |

| 6/19/09 | RGR | 11.88 | 12,35 | 4.0% |

| 6/22/09 | TYH | 86.42 | 81.85 | -5.3% |

| 6/23/09 | ADI | 23.32 | 23.34 | 0.0% |

| 6/24/09 | SONC | 9.26 | 9.63 | 4.0% |

| 6/25/09 | FAZ | 5.13 | 4.93 | -4.0% |

| 6/26/09 | RIMM | 69.15 | 71.22 | 3.0% |

| 6/29/09 | VIA-B | 22.8 | 23.37 | 2.5% |

| 6/30/09 | JTX | 6.31 | 6.15 | -2.5% |

| 7/2/09 | ERY | 23.4 | 24.33 | 4.0% |

| 7/6/09 | WFR – SS | 17.19 | 16.5 | 4.0% |