It's only been three weeks but it's time for an update!

It's only been three weeks but it's time for an update!

Back on the 3rd, I had said: "Let’s take a look at a quick dozen trade ideas for short-term gains. I like all these stocks long-term too (it’s always better to play short-term where your fallback is you own the stock long-term) but we haven’t been doing much gambling lately as it’s all been boring-old hedged positions that were smart, but not really giving us that immediate satisfaction you can get from some quick, monthly gains."

And what a month it's been, a dozen stocks, about 30 different trade ideas and we're already up to our 50% and 100% goals on most of the shorter-term ones. The longer-term positions are mostly looking good and we have hedged to cover them but let's go over each postiion to make sure it's worth keeping. I already called an out on HMY as they poked through $11.50 the other day but that was a directional trade (the October $10s) that was already up 133% and one thing we're not is greedy, right?

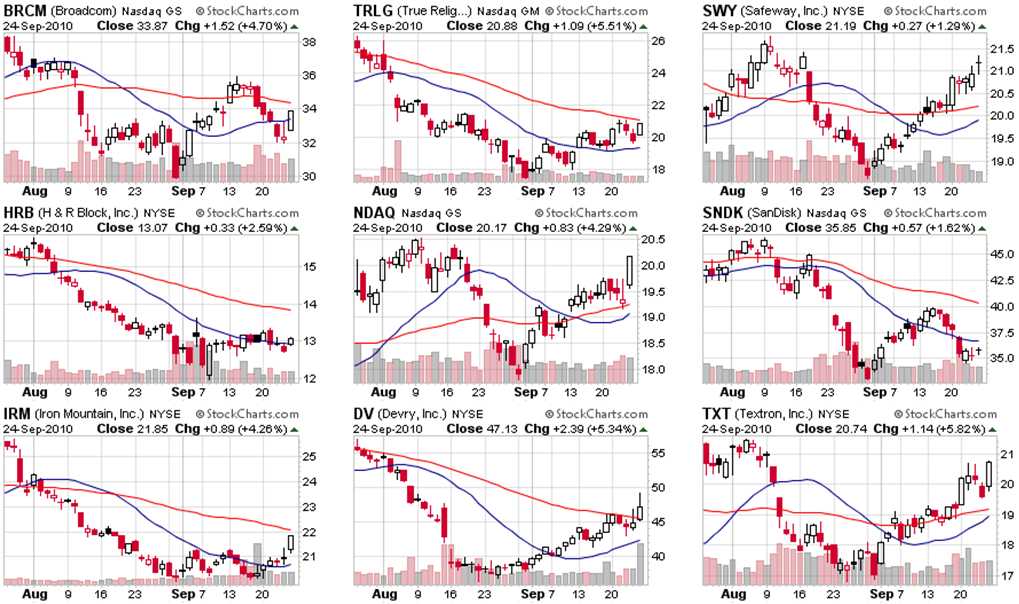

HMY was the only trade that was a pure short-term, directional trade. Virtually every othe stock had longer components and that's where our decision-making process comes in. I went over the logic of each entry in the original post and I won't rehash it here as we'll just look over the possible trade adjustments and decide what looks good to keep and what to cash. For purposes of this discussion, we'll use this multi-chart which indicates the 20 (blue) and 50 (red) dma:

So, how worried are we? We picked these stocks based on fundamentals. As you can see, they certainly didn't have any upward momentum on Sept 3rd! It should be no surprise that they outperformed as the market rose 10% for the month but the question we have to ask now is: How comfortable do we feel about holding them through a downturn?