Did you see 60 Minutes last night?

This craziness is part of the "Fraudclosure" scandal that has been well documented by Barry Ritholtz over at The Big Picture so I’m not going to spend too much time on it other than to look at the overall trend. 37,000 people went to an event in Los Angeles for people who are in foreclosure and wanted to know their rights, 12,000 people came to a similar event in Miami, law firms are beginning to take cases on contingency in exchange for liens on the homes, which can become very valuable if the law firm successfully shoos the bank away from the Mortgage.

LA and Miami are big cities so let’s say that, nationwide, only 200,000 of the 4M homeowners facing foreclosure are able to challenge their loans and let’s say only 50% are successful. That’s still 100,000 mortgages that may be written off and, at $200,000 per average mortgage, that’s $20Bn worth of bank write-offs to work through the system. But, if the 4M people who don’t think this applies to them begin to see their neighbors ripping up mortgage documents – how long will it remain something only 5% of the affected people do? Just taking the banks to court over every loan can cause nightmares.

LA and Miami are big cities so let’s say that, nationwide, only 200,000 of the 4M homeowners facing foreclosure are able to challenge their loans and let’s say only 50% are successful. That’s still 100,000 mortgages that may be written off and, at $200,000 per average mortgage, that’s $20Bn worth of bank write-offs to work through the system. But, if the 4M people who don’t think this applies to them begin to see their neighbors ripping up mortgage documents – how long will it remain something only 5% of the affected people do? Just taking the banks to court over every loan can cause nightmares.

Understand that what 60-Minutes is looking at is beyond "robo-signing," where an actual bank official’s name is signed by a computer without proper review. In those case, even if flaws are in the documents, it’s hard to argue the banks don’t have legal possession of the property. This is very different, this is fraud. Not only is the bank using fictitious names but they are blatantly using multiple people who represent themselves as the same person AND the notarizations are fraudulent. It’s very easy to imagine many outraged judges voiding the entire transaction (which the banks charged the homeowners to complete) or even entertaining lawsuits by consumers that will go far beyond just walking away from mortgages.

Keep in mind this a whole new body of case-law so each lawsuit provides additional ammunition to be used against the banks as each attorney pokes at the many, many holes that have been created in the chain of title in the past decade. Last week, LaSalle Bank lost a case in which their right to foreclose was denied for simply failing to provide proof of assignment. If we use that as a benchmark, approximately 25% of the 75 Million mortgages in this country ($3.75 TRILLION) are "unforclosable."

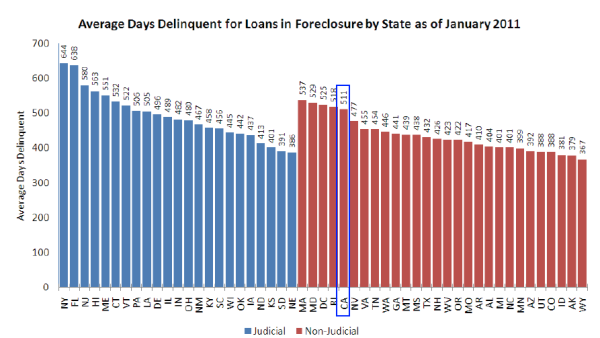

One of the dirty little secrets driving our economy in the past year is the fact that there are currently 7M people living in homes in the United States who are not paying their mortgage. There is not one single state in this country where the average number of days delinquent in a foreclosure proceeding is less than 365 days and states like NY and Florida are OVER 600 days past due on the average home in foreclosure process. The Mortgage Fraud issue has distorted these numbers very much to the downside as banks are not filing foreclosures on delinquent homes – the real numbers are incredibly worse.

One of the dirty little secrets driving our economy in the past year is the fact that there are currently 7M people living in homes in the United States who are not paying their mortgage. There is not one single state in this country where the average number of days delinquent in a foreclosure proceeding is less than 365 days and states like NY and Florida are OVER 600 days past due on the average home in foreclosure process. The Mortgage Fraud issue has distorted these numbers very much to the downside as banks are not filing foreclosures on delinquent homes – the real numbers are incredibly worse.

In California, for example, "only" 188,097 homes are in foreclosure at this time. However, an additional 499,802 homes are more than 90 days delinquent. Even if the average mortgage payment were "just" $2,000 – that’s $1,000,000,000 PER MONTH not being collected by the banks but, on the bright side, that’s $1Bn PER MONTH that Californians can use to buy IPads or subscribe to NFLX or buy gold, stocks or oil futures.

Everyone is a winner in this game – by not foreclosing, the banks avoid writing off $100Bn worth of bad loans (and this is JUST California so you can multiply by 10 to get US figures) and the consumers are getting $12Bn a year in FREE MONEY and, of course, the Federal Reserve is papering over the whole thing by dumping 120Bn worth of MORE FREE MONEY on the banks.

In fact, the only people not winning are the suckers paying their mortgages as they have less free money to chase the inflationary prices that the people who live rent-free are able to stock up on. Another fun way the Government is giving out money is through "reverse mortgages," where seniors sign over the equity in their homes in exchange for no more mortgage payments or, sometimes, the bank even pays them.

There’s nothing wrong with reverse mortgages (unless you are a kid watching your parents spend your inheritance) but consider another few hundred thousand people who are benefiting from the Fed’s FREE MONEY to take the ultimate home equity loan (100%). This is why the cruise lines are doing so well – suddenly Grandma has an extra $1,500 a month to spend!

This is just another way our government is plunging further and further into debt in order to "extend and pretend" for the banks. Reverse mortgages are made possible by ultra-low interest loans from the Fed to the banks coupled with possibly tragically misguided expectations that home prices will rebound and, on that basis, the banks are effectively paying 4% interest on the home equity lines. I hesitate to mention it because it’s certainly not for everyone but NRMLA has good information and a good calculator to check out how it works.

This is just another way our government is plunging further and further into debt in order to "extend and pretend" for the banks. Reverse mortgages are made possible by ultra-low interest loans from the Fed to the banks coupled with possibly tragically misguided expectations that home prices will rebound and, on that basis, the banks are effectively paying 4% interest on the home equity lines. I hesitate to mention it because it’s certainly not for everyone but NRMLA has good information and a good calculator to check out how it works.

Unfortunately, every time we see home prices go down instead of up each month, it reminds us what a house of cards all these loans and, ultimately, bank earnings estimates (1/3 of all corporate earnings) is based on. Short-term, since mark to market is still a quaint practice that USED to happen in the bad old days, we can just keep going and ignore all this but the danger accumulates like radioactive water in a Japanese reactor and, ONE DAY, someone is going to have to take a drink…

Meanwhile, the market continues to party like it’s 1999 and the Dow futures have already jumped 50 points off the lows last night on no actual news. Why shouldn’t they be enthusiastic? As I said, we’re handing out $10Bn a month to people who don’t pay their mortgages and offsetting the discomfort felt by the banks by handing them $120Bn a month to play with and we have over 6M people who have been on unemployment for over a year as well as 45M people on food stamps and that’s about $9Bn (at $200 per month) that goes to pay the inflationary weight of food prices.

No wonder manufacturers have gone with the idea of selling less food for more money lately. We’re not expanding the markets but we are providing less product for more cash and that beefs up profits while keeping sales flat and even up. Essentially, we are living in a fraud-based economy but it doesn’t seem to be bothering anyone so I guess we shouldn’t let it bother us. Just because we know things will end very badly – it doesn’t mean we can’t enjoy the ride!

I was on a plane this weekend and a passenger walked out before the flight began and said "I’m not paying $400 to be treated like this!" We all burst into applause but then the other 199 of us passengers who were in the hot, smelly plane with one working bathroom and seats that were jammed so close together we could barely clap without poking the person next to us – all shut up and endured the flight to Florida that used to cost $250 with more legroom, working bathrooms, movies, free drinks and lunch just 2 years ago.

Oil topped out at $108.80 in overnight trading and I reminded those few Members that were up around midnight to short it at $108.50 (Members make sure you read last nigh’s comments, we covered several major issues and there were trade idea for FXE and DUG). We’re finally heading into our favorite week to short, when the NYMEX rollovers begin to loom large (still over 2 weeks away) and there is finally some real pressure on the price. Don’t worry though – Goldman Sachs is on top of this oil issue and has doubled Lloyd Blanfein’s pay to make sure he can tank up the limo on the way to the office! This is despite the fact that GS earnings were down 38% and the stock flat-lined.

Actual performance "just doesn’t matter" in this modern economy – just perception…

[Fraudclosure Chart by William Banzai7]