Holy cow – when will it end?

Holy cow – when will it end?

As I mentioned yesterday, we were expecting a whipsaw after the morning sell-off and we played that perfectly with bullish trades on the DIA and OIH and, as we move up, we took bearish plays on GLL, TZA and QQQ. All good so far but then we did a little bottom fishing before wising up and shorting USO into the close – just in case. The futures were up 2% this morning at 5am and I had to warn our Members:

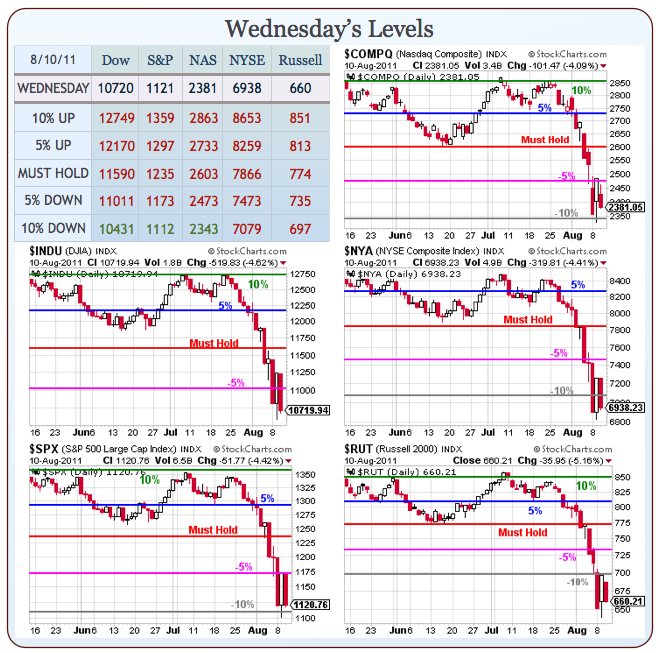

Overall, this is too weak to get us over the hump and we are going to have to lean a little more bearish unless we can follow Europe up 2.5% or more. Our charts will turn from "spiking low on volume" to "consolidating for a move below 20%" very quickly if we don’t gets something bullish going by tomorrow.

The Dollar was at 74.64 at the time and it’s only 75.04 now (7:50) but the futures have gone from up 2% to down 1% in less than 3 hours – that is insane! How are retail investors supposed to play this market? The average person does not have the stomach for watching their virtual portfolio’s value go up and down 5% a day – at some point they are all going to pull the plug and walk away. Of course, as I was saying yesterday – that’s just what the Banksters want you to do, assuming they know QE3 is right around the corner, accompanied by a 20%+ market rally into the year’s end.

Anyway, hope is NOT a strategy for the prudent investor so I published another set of Disaster Hedges this morning as it’s time to add a layer to our longer hedges (which are now deeply in the money). I hate to chase these plays but one thing we learned in 2008 is that there may never be a bottom (not in the short run) no matter how oversold you think things may be. Was the market wrong in 2008 to go below S&P 1,000? Well 3 years of subsequent trading seem to indicate that it was – but that did not stop us from dropping 33% lower, to 666 (the mark of the Blankfein!).

Anyway, hope is NOT a strategy for the prudent investor so I published another set of Disaster Hedges this morning as it’s time to add a layer to our longer hedges (which are now deeply in the money). I hate to chase these plays but one thing we learned in 2008 is that there may never be a bottom (not in the short run) no matter how oversold you think things may be. Was the market wrong in 2008 to go below S&P 1,000? Well 3 years of subsequent trading seem to indicate that it was – but that did not stop us from dropping 33% lower, to 666 (the mark of the Blankfein!).

Our entire goal in a sell-off like this is to simply preserve our cash. The lower we go the better the opportunities will be in the future but for now, it’s going to be a wild ride down to the bottom if we’re breaking below our 20% lines (-10%) along with investors’ spirits.

Once we have our additional highly leveraged, downside hedges in place, THEN we are able to do a little bottom fishing. Even yesterday, when we opened with a bullish trade idea on the Dow in my Morning Alert to Members (made 20% or more 4 times yesterday!) by 10:20 I put up the following hedge idea for TZA:

Disaster hedges – I would wait and see if my premise is right at 11:30 but the TZA Sept $61/73 bull call spread is $2 for the $12 spread and that’s 500% upside right there so you can risk stopping out at $1 to make $10 and you can offset with anything you REALLY want to own like VLO Sept $18 puts at $1.03 or DIS Sept $29 puts at $1.15, or T Sept $28 puts at $1.

These are the kind of hedges I favor at the moment, ones that set us up for a new entry on one of our favorite stocks at a better price. This is still an optimistic strategy as our goal is to offset a potential 50% loss on the spread (where we would stop out or roll) with a short $1 put that is unlikely to expire in the money if the Russell is on the rebound.

These are the kind of hedges I favor at the moment, ones that set us up for a new entry on one of our favorite stocks at a better price. This is still an optimistic strategy as our goal is to offset a potential 50% loss on the spread (where we would stop out or roll) with a short $1 put that is unlikely to expire in the money if the Russell is on the rebound.

With luck, these insurance trades will work out very cheap if it turns out we don’t need them. I still think this is all a flush ahead of QE3, with the IBanks and their Media Lackeys doing everything they can to panic competing investors out of equities so they can buy in at another Bernanke bottom.

I know investors have short memories but wasn’t it last August, after the Fed minutes on August 10th and before QE2 was officially announced on Sept 1st that the market dropped 7.5% in less than 3 weeks. It was August 25th that I put up a Hedging for Disaster post, JUST LIKE THIS MORNING’s – that turned out to be completely unnecessary just 5 days later. Fortunately, on August 29th, we also picked up a half dozen bullish Dow plays that did very, very well in "Defending Your Virtual Portfolio With Dividends."

What were the stocks we liked then?:

- MSFT at $24.23, ran up to $29.29, now $24.20

- T at $26.94, ran up to $31.51, now $27.88

- VZ at $29.84, ran up to $37.96, now $33.66

- HD at $28.74, ran up to $38.82, now $28.51

- KFT at $30, ran up to $36.30, now $32.80

- PFE at $16.09, ran up to $21.21, now $17.05

- MRK at $35, ran up to $37.25, now $29.81 (we don’t like MRK anymore!)

- INTC at $18.37, ran up to $23.73, now $19.93

So, thanks to additional action from the Fed just days later, 7 of 8 were big winners and, of course, using our options for leverage, even bigger and now a couple have made the full round trip and are attractive again. As I said, we’ve been doing some bottom fishing in Member chat but it’s on companies like these and with 20% downside hedges from here as we don’t know when this madness will end but I HOPE (not a valid strategy) it ends soon.

So, thanks to additional action from the Fed just days later, 7 of 8 were big winners and, of course, using our options for leverage, even bigger and now a couple have made the full round trip and are attractive again. As I said, we’ve been doing some bottom fishing in Member chat but it’s on companies like these and with 20% downside hedges from here as we don’t know when this madness will end but I HOPE (not a valid strategy) it ends soon.

Let’s keep in mind that those were our "safety" picks as we were hoping we had bottomed at Dow 10,000. AFTER QE3 was announced, on Sept 3rd, with the Dow already up 350 points (which seemed like a lot at the time – it’s amazing what you get used to), felling more confident I put up our much more aggressive "September’s Dozen" list and those 12 plays averaged over 160% returns vs. less than 50% on our dividend plays – EVEN THOUGH THE DIVIDEND PLAYS HAD BETTER TIMING!

PLEASE keep that in mind this week. We are simply following a prudent strategy as we test the waters bringing our cash off the sidelines and that’s hedge first, then take CONSERVATIVE long positions and then AFTER we have DEFINITIVE bullish news (like QE3) THEN we layer in some aggressive long positions.

Even as I write this, the futures markets are in another wild swing, this time back up and are now about flat to yesterday’s close. Why? Who cares? This is a very silly, irrational market and we should just be glad that we’ll get a good price on our disaster hedges and THEN we can look for some more upside plays – maybe we can go for yesterday’s DIA calls again, those were fun…