Tough call today.

Tough call today.

The Dollar bounced off 79.75 this morning, nothing to crow about for Dollar bulls as the Euro remains just over the critical $1.30 mark and the Pound is solidly over $1.55 for the moment.

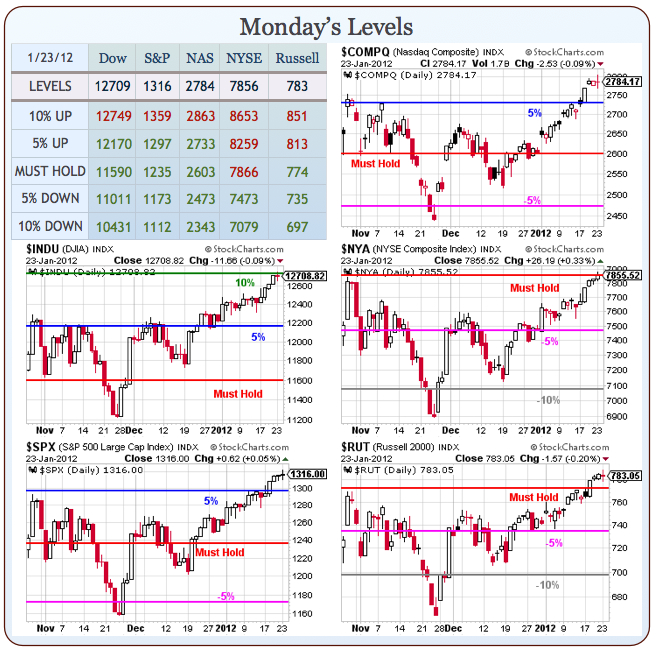

You could say it's a bearish sign that the Dow and the NYSE stopped dead at our breakout levels but that's to be expected on a first attempt at breaking out – even if they have already attempted the same move back in late October, when the Dow was 5% lower in it's test and the NYSE was testing the same line (7,866).

Our broadest market index is the one that's holding everyone back as what little volume there has been in this rally has been fairly narrowly focused on certain leaders. Now a pessimist might say that this is a reflection of the blatant manipulation of the indexes in which certain Banksters place buys on stocks that have disproportionate positive effects on the junior indexes in order to fool retail traders into believing there is a rally while the Banksters drive the VIX down to multi-year lows, dump all their stocks on the bagholders and prepare to cash in by crashing the markets on a major event like tomorrow's FOMC Rate Decision which is, in fact, very unlikely to have any language specific to the QE3 that has been promised by the MSM since Thanksgiving.

An optimist would say – well, you can read almost any MSM site for that. It's lonely at the top of the range when you are bearish, one by one the other bears capitulate and soon you are there all by yourself with your shorts – your lovely, lovely, cheap shorts! The Dow shot up yesterday to just over the 12,749 breakout line we have as the tippy top of the range on our Big Chart so of course I called for DIA puts in Member Chat. The DIA Feb $123 puts, which came in around .75 and finished the day not much higher at .78 after topping out at .95. Ranges usually hold – if you're not going to have conviction at the very top of a range to short – when will you? For one thing – you have a very good stop line to watch!

An optimist would say – well, you can read almost any MSM site for that. It's lonely at the top of the range when you are bearish, one by one the other bears capitulate and soon you are there all by yourself with your shorts – your lovely, lovely, cheap shorts! The Dow shot up yesterday to just over the 12,749 breakout line we have as the tippy top of the range on our Big Chart so of course I called for DIA puts in Member Chat. The DIA Feb $123 puts, which came in around .75 and finished the day not much higher at .78 after topping out at .95. Ranges usually hold – if you're not going to have conviction at the very top of a range to short – when will you? For one thing – you have a very good stop line to watch!

As noted by Dave Fry in his SPY chart, the bulls have engineered their golden cross and have spent a hell of a lot of money and time doing it – now they are counting on machines and retailers to respond like Pavlov's dogs to the sign of the cross and take all those expensive shares off their hands.

Or maybe CAT should be at $106. The p/e is a reasonable-looking 16 and they are projected to grow next year despite the Global outlook for a mild recession in the first half. Looking at other major Dow components: CVX at $107 is only 10% higher than it was in 2008, when oil was $140 a barrel (with projections of $200) and Natural Gas was $8 – makes sense to you, doesn't it? BA I do think is worth $75 for many reasons and IBM at $189 is more than I'd pay but I wouldn't kick them out of bed either.

JNJ is $5 off it's 2008 highs, KO is 5% over, MCD is 50% higher than it was in 2008, MMM is back to $90, PG is $10 shy of their $75 high, UTX is back to $80 (but down from $90 in July), XOM is a bit shy of their $95 high (also with oil 40% lower and nat gas 70% lower) and TRV wasn't in the Dow in 2008 but is over their highs by 10%. Those are the Dow components over $50 – the ones that count in this price-weighted index.

JNJ is $5 off it's 2008 highs, KO is 5% over, MCD is 50% higher than it was in 2008, MMM is back to $90, PG is $10 shy of their $75 high, UTX is back to $80 (but down from $90 in July), XOM is a bit shy of their $95 high (also with oil 40% lower and nat gas 70% lower) and TRV wasn't in the Dow in 2008 but is over their highs by 10%. Those are the Dow components over $50 – the ones that count in this price-weighted index.

MCD Just reported nice revenues of $6.8Bn in Q4 along with $1.33 in earnings and that was indeed quite a bit better than 2008, where we had 0.87 EPS on $5.6Bn in earnings so nice – but is it up 50% nice? Maybe the problem is that there are so few good stocks these days, that the really good ones are now fetching a hefty premium, which helps explain the Dow's relative outperformance since November.

Without risk (see above diagram), you can make a case for pricing MCD at $100 but are we accounting for the current risk in these prices? Are we accounting for the risk that sent MCD from $66 in Aug 2008 to $46 in October?

Without risk (see above diagram), you can make a case for pricing MCD at $100 but are we accounting for the current risk in these prices? Are we accounting for the risk that sent MCD from $66 in Aug 2008 to $46 in October?

Of course they were a screaming buy at $46 but the fact that they CAN fall that far needs to be taken into account when determining the VALUE (not PRICE) of a stock as a part of your portfolio. We could go over the components one by one (maybe on a weekend) but the bottom line is we are priced to perfection at the moment and that perfection includes ONE TRILLION additional dollars being poured into our $15Tn economy (6.66%) by the Fed pretty much TOMORROW.

Anything less than that may lead to a bit of disappointment.

Not to be nitpicky – but the Dollar was at 88 in Q4 2008 so the Dollars MCD was collecting then were 10% more valuable than they are now. While the growth of MCD is still impressive – they are a bit of a "Recession Stock" that benefits from the decaying buying power of the Global Middle Class, who have traded down to Happy Meals and the Dollar Menu to the benefit of MCD – other Dow components and other companies in general are far less impressive when viewed in the light of the earnings power provided them by the worth(10%)less Dollars they are now reporting earnings in.

Not to be nitpicky – but the Dollar was at 88 in Q4 2008 so the Dollars MCD was collecting then were 10% more valuable than they are now. While the growth of MCD is still impressive – they are a bit of a "Recession Stock" that benefits from the decaying buying power of the Global Middle Class, who have traded down to Happy Meals and the Dollar Menu to the benefit of MCD – other Dow components and other companies in general are far less impressive when viewed in the light of the earnings power provided them by the worth(10%)less Dollars they are now reporting earnings in.

Of course, if you are an American, you have to buy your MCD in Dollars too so it's right that they should charge you an additional 10% for their very valuable stock, isn't it? Priced in Euros, in fact, MCD dropped 2% this week but it's not about the day to day picture – it's about the Global Macros. In 2008, we didn't think the entire system would collapse in a single quarter, we didn't know the housing market would collapse or that over 100M people World-wide would lose their jobs in the next two years or that entire nations would face bankruptcy. So maybe, just maybe, we can be excused for ignoring the risks.

But now? REALLY??? Are we back to completely ignoring risk as if everything is all better in Europe and Japan and China and the good old USA despite the fact that pretty much NONE of those 100M people got their jobs back and another 100M people were born and they don't have jobs either!

But now? REALLY??? Are we back to completely ignoring risk as if everything is all better in Europe and Japan and China and the good old USA despite the fact that pretty much NONE of those 100M people got their jobs back and another 100M people were born and they don't have jobs either!

STAGnant Global economy, rampant inFLATION and we are pricing things BETTER than they were in 2008 – before we were made aware of how many problems lay just below that bullish surface?

I suppose it's the lack of a sense of risk that is really bothering me. As you can see from the chart – we've been this complacent before (and paid the price) but, as I said to Members yesterday – if we break our levels we'll just have to switch off our brains and stop reading the news so we can invest properly along with the crowd.

But we're not there yet. Where's my Trillion Dollars Dr. Bernanke? Where's the deal on Greece? Where are the jobs? Where are my breakout levels? It's hard to be patient but I believe the risk is real and I'd rather be relieved to find out I'm wrong and my biggest problem is how to deploy my pile of cash than to be fully invested and falling off a cliff – at least I learned that in 2008.