We're got our strong bounces on Friday – now we'll see if they hold up! .

We're got our strong bounces on Friday – now we'll see if they hold up! .

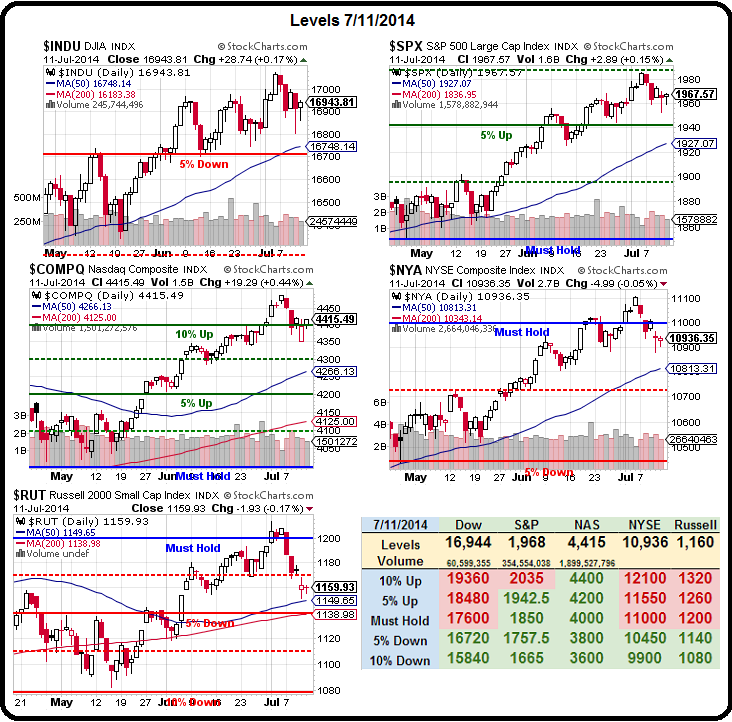

As you can see from our big chart, we still have Spitting Cobra patterns forming on all but the Russell, which has turned into a Vomiting Cobra, spilling all the way down to the 50 dma at 1,150. We're still below the Weak Bounce Line on the NYSE – so we'll watch that closely and the Russell needs to get over their Strong Bounce at 1,170 to confirm:

- Dow 17,050 to 16,800 is 250 in 3 days so you need to make a strong bounce in 1.5 days in order to have a chance at a V recovery. Bounces would be 50 points so 16,850 and 16,900 are what we'll watch.

- S&P 1,985 to 1,955 is 30 points so 6-point bounces to 1,961 and 1,967 will be our targets.

- Nasdaq 4,485 to 4,360 (now I'm rounding) is 125 so 25-point bounces to 4,385 and 4,410.

- NYSE 11,100 to 10,900 is 200 points so 40-point bounces to 10,940 and 10,980.

- Russell 1,208 to 1,140 is 68 points and we'll call that 14-point bounces for 1,155 (rounding) and 1,170.

Also key, of course, is the 3 of 5 red signals on our Must Hold line on our Big Chart™ – only the NYSE is likely to make it over today, with a 64-point move (0.5%) taking it back to 11,000 – certainly that's not asking too much before we flip to some more bullish betting, is it?

Also key, of course, is the 3 of 5 red signals on our Must Hold line on our Big Chart™ – only the NYSE is likely to make it over today, with a 64-point move (0.5%) taking it back to 11,000 – certainly that's not asking too much before we flip to some more bullish betting, is it?

We still have 29 stocks on our Buy List (Members Only) and, since they dynamically update, it's very easy to see that about 1/2 of them haven't gotten away yet and are still playable for dip buying. We also have 29 more stocks from our old Long-Term Portfolio, which we liquidated on May 29th – and that is full of great trade ideas as well.

We just did Week 4 for our our May Trade Review over the weekend and we slipped to 73% that week (ending 5/23) which brought us down to 84% for the month with 158 out of 197 trade ideas on the winning side. Still, going from 125-17 to 158-29 was an early indicator that we were losing our feel for the direction of the market – which led to us taking the money and running into the holiday weekend.

Our Long-Term Portfolio was up 19% for the year when we cashed it in and we're still up 19% after re-deploying $200,000 of our $1M in margin ($500,000 Virtual Portfolio) on new trades for the 2nd half.

We still have 80% of our buying power and 100% of our cash on the sidelines (because we sell premium to BE THE HOUSE – Not the Gambler™). On the other hand, our generally bearish Short-Term Portfolio is UP 10% since the end of May – even though the S&P is up 50 points.

We still have 80% of our buying power and 100% of our cash on the sidelines (because we sell premium to BE THE HOUSE – Not the Gambler™). On the other hand, our generally bearish Short-Term Portfolio is UP 10% since the end of May – even though the S&P is up 50 points.

That tells us that things may not be as they seem and that's made pretty clear by the dramatic pullback in companies buying their own stock. As you can see from this chart (thanks Dave) – the last time we had a pullback like this it was a very good indicator of a pending market crash but who, in the summer of 2008, would have believed that?

Two months of dramatically lower buybacks also tells us that it won't be so easy for those companies to beat on EPS down the road because they are no longer decreasing the S that the Es are divided by – that's how these things turn into self-fulfilling prophecies.

Speaking of ways to manipulate stocks – there was a fantastic article by Matt Levine that lays out how CYNK and other penny stocks are able to manipulate their prices. I don't say this often but you MUST read this article or you are missing a huge portion of your market education!

Speaking of ways to manipulate stocks – there was a fantastic article by Matt Levine that lays out how CYNK and other penny stocks are able to manipulate their prices. I don't say this often but you MUST read this article or you are missing a huge portion of your market education!

While it's very clear that closely held companies like CYNK are manipulated, why do you find it hard to see how stocks like TSLA are manipulated? According to Yahoo, 68% of TSLA's shares are held by Institutions and 35% are held by Insiders and yes, that's more than 100% because of naked shorting that goes on in even the biggest of stocks. So, if you are a retail shareholder who happens to own TSLA – it's an accident and your actions buying and selling the stock matter as little as the price of gas does to a Tesla driver.

When you buy stock in an IPO, like AliBaba – which is coming up, you are VOLUNTARILY getting into a situation where just 10% of the stock is actually floated while the rest is held by insiders and the Banksters who took them public. You are every bit as much a sucker as the people buying penny stocks. You may do well, but only if it suits the goals of the people who really control the action.

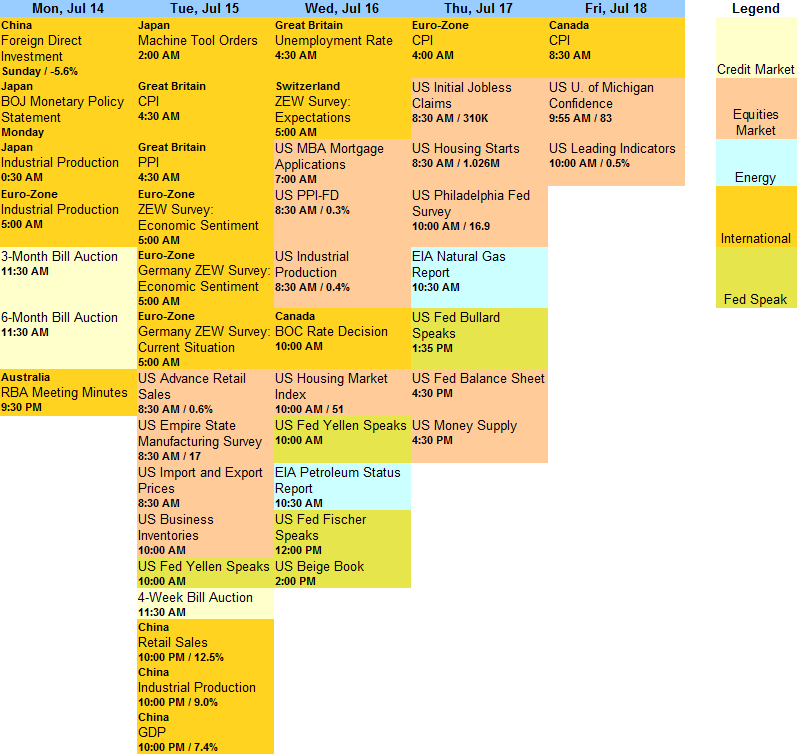

As I mentioned above, today's action will be meaningless and Friday's gains on 54M SPY shares traded (1/2 normal volume) was meaningless so we will watch and wait patiently for Ms. Yellen's Senate Testimony tomorrow morning. THAT will have some meaning. Here's StJ's chart for the week ahead:

Plenty of data to chew on, once the week gets started. Until then – be careful!