What the Hell were people expecting?

What the Hell were people expecting?

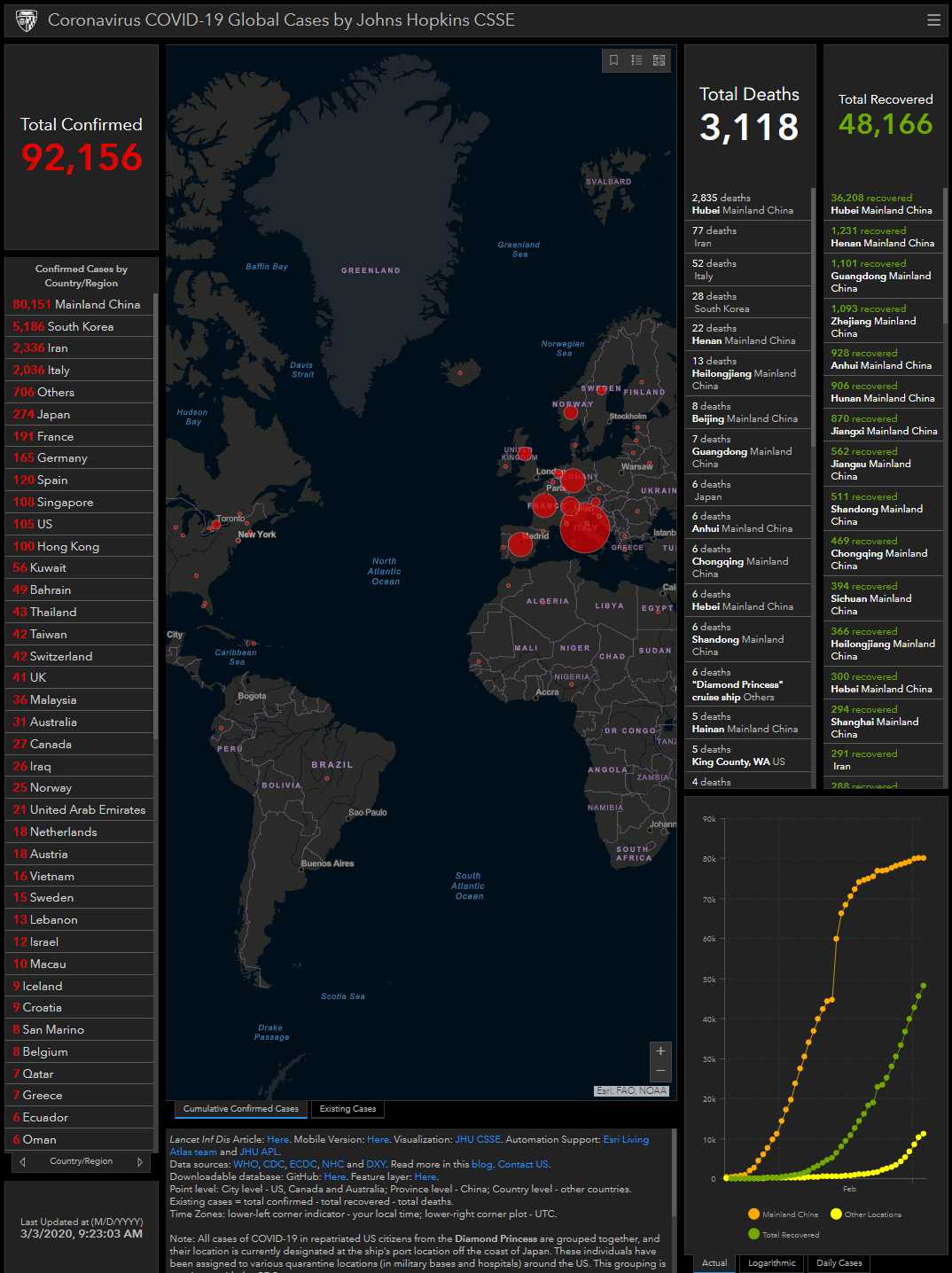

The markets rallied insanely yesterday on expectations of a 50-point rate cut along with coordinated cuts around the World and tax cuts and Santa Clause, etc., etc. – total idiocy. This morning the futures are turning down already as the G7 "Emergency Meeting" has not actually come up with any actual emergency measures – it's more like one of those "hopes and prayers" messages after a school shooting – good luck guys!

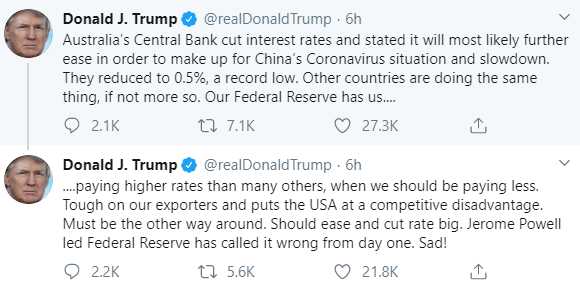

Of course the G7 doesn't have the power to do much – only to suggest and, as Trump pointed out, the Australian Central Bank lowered their rates by another 0.5% but keep in mind that Australia was on fire a few weeks ago and NOW they have the virus AND their primary trading partners are China and Japan – that's a little worse off than we are.

Keep in mind the lunacy that is going on here – we are having emergency G7 meetings led by Steve Mnuchin (a Goldman Sachs Bankster) who is telling the Global Finance Leaders that they must lower rates to prop up the markets BECAUSE THEY ARE 8% below their all-time record highs. Propping up the markets is very expensive and it adds to government debt and it only helps the Top 1%, who own 90% of the stocks – what is the real agenda here?

Keep in mind the lunacy that is going on here – we are having emergency G7 meetings led by Steve Mnuchin (a Goldman Sachs Bankster) who is telling the Global Finance Leaders that they must lower rates to prop up the markets BECAUSE THEY ARE 8% below their all-time record highs. Propping up the markets is very expensive and it adds to government debt and it only helps the Top 1%, who own 90% of the stocks – what is the real agenda here?

Remember that Steve Mnuchin's primary experience after leaving Goldman Sachs in 2002 was overseeing the complete collapse of Sears as a Board Member from 2005 until 2016 when Trump decided he was the perfect guy to supervise the collapse of the United States of America as well…

Going more into debt can't be the answer for every problem – especially when it's "Let's go more into debt by giving more money to rich people." The money doesn't trickle down – it's been 40 years of this BS and it has NEVER trickled down – it's a ridiculous strategy that used to be called "Voodoo Economics" until the Republicans realized they could win elections and, more importantly, win campaign contributions by making it the cornerstone of their economic platform.

That's why Shelly Adelson, who's worth $37Bn, is giving $25M to Trump and $100M to other GOP candidates this year – Trump's tax policies have already saved him Billions of Dollars and will save him Billions more over the next 4 years if Trump is re-elected while Bernie Sanders thinks Wynn (WYNN) Casinos should pay more than the (negative!) -$497M on $1.25 BILLION in Operating income they (un)paid in 2018 and perhaps Shelly should pay more than 12% taxes on his $4.2Bn income.

That's why Shelly Adelson, who's worth $37Bn, is giving $25M to Trump and $100M to other GOP candidates this year – Trump's tax policies have already saved him Billions of Dollars and will save him Billions more over the next 4 years if Trump is re-elected while Bernie Sanders thinks Wynn (WYNN) Casinos should pay more than the (negative!) -$497M on $1.25 BILLION in Operating income they (un)paid in 2018 and perhaps Shelly should pay more than 12% taxes on his $4.2Bn income.

It's Super Tuesday today with 14 states holding primaries including Texas and California and it's very possible that Bernie will sweep and essentially lock up the nomination – that will make things interesting for Corporate Profit forecasts as roughly 20% of corporate profits are the results of the Trump Tax Cuts, something Bernie and a Democratic House will quickly put a stop to in 2021.

And well they should as we are $1.2Tn in debt this year and, if Trump does get more stimulus pushed through to boost his re-election chances then Bernie, like Barack will come into the White House in a year that we are already running a $1.5Tn annual deficit. No wonder Shelly is fighting so hard to keep Trump in office, 3% of that deficit has been going right in Adelson's pockets!

Obviously, it would be unfair for a man earning 76,363 times more than the Average American ($55,000) to pay more taxes than the Average American ($17,000) but it would be nice if at least we didn't have to PAY HIM $497M to fund the expansion of his casino in China. What's more likely to happen under Trump is that we will be bailing out Mr. Adelson as his "vital" casino business is having a rough quarter due to the virus. After all, who else do we know who owns a casino that might want a bailout?

Obviously, it would be unfair for a man earning 76,363 times more than the Average American ($55,000) to pay more taxes than the Average American ($17,000) but it would be nice if at least we didn't have to PAY HIM $497M to fund the expansion of his casino in China. What's more likely to happen under Trump is that we will be bailing out Mr. Adelson as his "vital" casino business is having a rough quarter due to the virus. After all, who else do we know who owns a casino that might want a bailout?

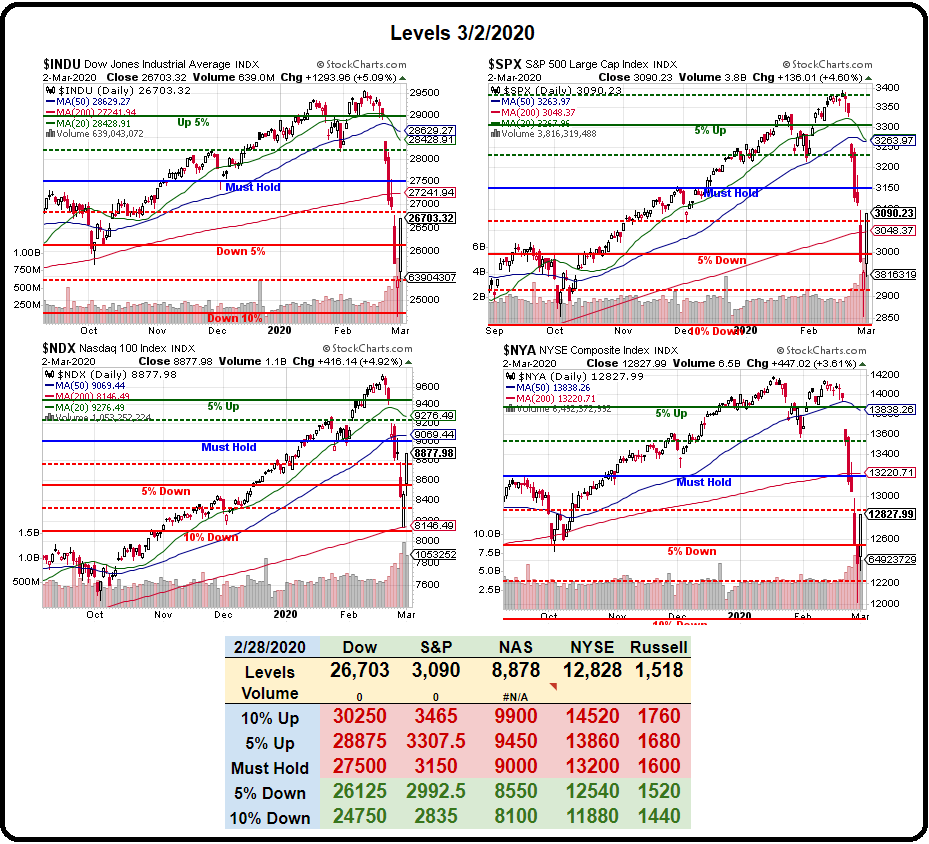

We'll be watching those bounce lines this morning and nothing less than taking back the strong bounce lines and holding them (without failing) for 2 days will convince us the sell-off is over. Until then, we will patiently watch and wait:

- The S&P, for example, fell from 3,400 to 2,900 so 500 points and a bounce is 20% of the drop so 100 points so 3,000 is a weak bounce and 3,100 is a strong bounce.

- The Dow was 29,500 to 25,000 so 4,500 would be 900 but we'll call it 1,000 as it's not an exact science and 100 points on the Dow is 10 seconds these days – and the Dow loves round numbers. So 26,000 is weak and 27,000 is strong.

- Nasdaq fell from 9,600 (because 8,000 is the base so it's the 20% line and that overrules any other spike around it) to 8,400 because we have 400-point lines working so 8,800 is weak and 9,200 is strong. 8,400 is the weak bounce line off 8,000.

- Russell 1,600 is the main line and 1,400 is strong support so that's the range but we fell from 1,700 back to 1,450 so 250 means 50-point bounces to 1,500 (weak) and 1,550 (strong)

While yesterday's recovery was very impressive – it didn't happen because the virus disappeared or the supply chains restarted or all the cancelled conferences are back on. No, it happened because people think we are getting AT LEAST a 1/2-point rate cut and we can go back to blowing our market bubble – until the virus takes the breath from our lungs, anyway...