Time to get real.

We've had 3 Workshops so far on fixing our portfolios this week:

- Portfolio Repair Part 1 – Damage Assessment

- Portfolio Repair Part 2 – Resetting Your Positions

- Portfolio Repair Part 3 – Adjusting our Hedges

Now we move onto a very important topic that combines what we have learned and that is Adjusting our Goals. I talked about this on Tuesday (Part 2) in the Boeing example for someone who bought Boeing at $350 and now it's $150 (today it's $123!) and we do not sit there and HOPE (not a valid investing strategy) that BA will go back to $350 because it's no longer realistic!

As much as you may love a stock – you have to be realistic when there is damage done to it's financial position or outlook and you have to adjust your expectations accordingly – perhaps even considering abandoning the stock altoghether – especially in times like these when there are other fantastic stocks on sale and, even as I say this, I'm thinking that BA is not really a fantastic stock anymore – they simply have too many troubles to be excited about them – even at $123.

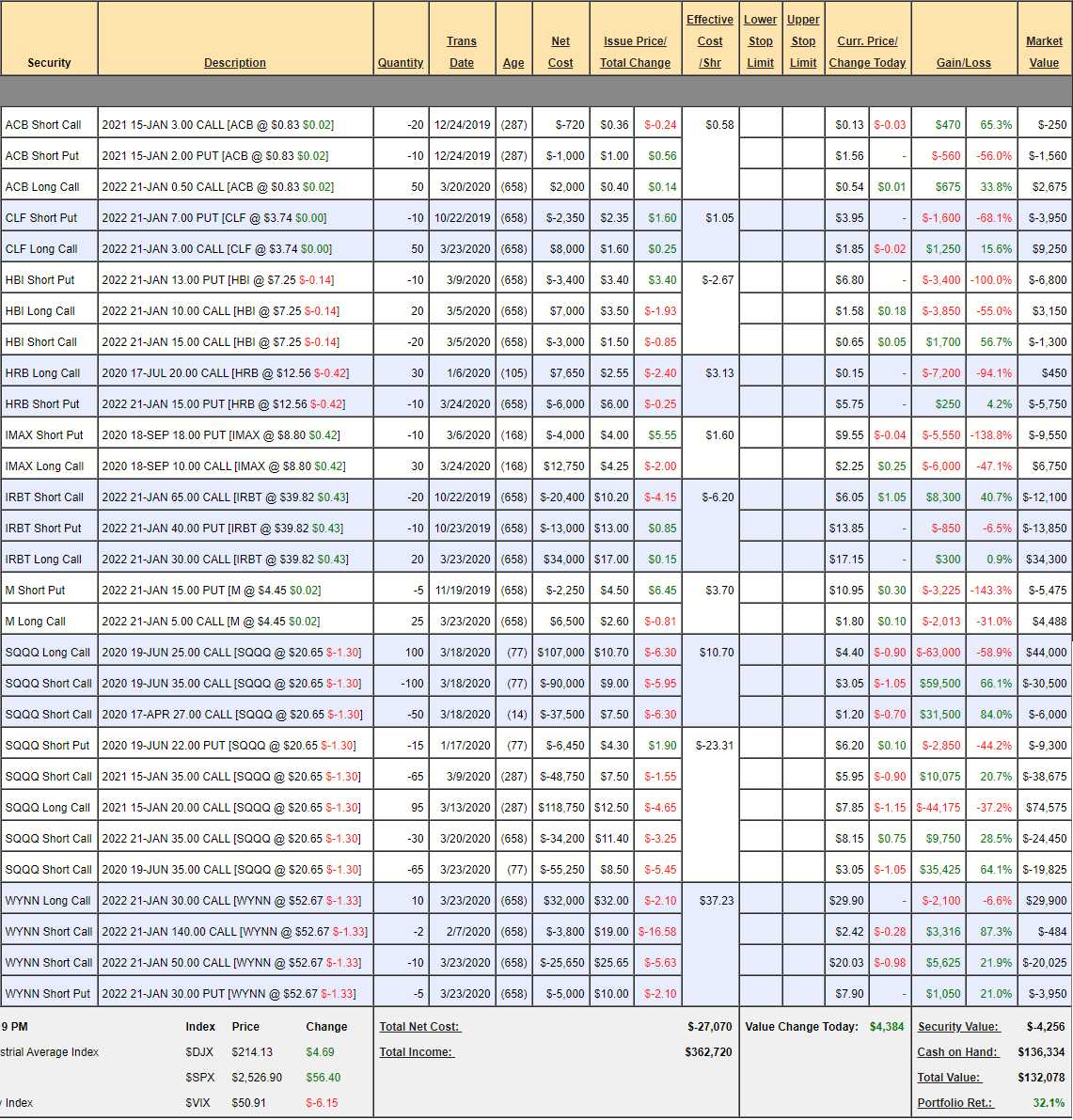

So today we'll take a look at our Earnings Portfolio, which started out with $100,000 on October 21st and was originally supposed to be just quick earnings plays but, the way things went, we ended up getting "stuck" in some good bargains (or we thought as the time) and we rolled them into longer-term bets. So now it's a bit of a hybrid but that makes it interesting. At the moment, we're at $132,078 so up 32% for the year but, as you'll see – NOT because our picks were any good – but because our HEDGES saved us!

Notice we have more cash than the portfolio has value – that's because we follow our core Philosphy, which is: "Be the House – NOT the Gambler", which means we always try to be sellers of premium, not buyers and that gives us a huge advantage in our trades while also dropping a lot of cash into our pockets – which is very useful when the market sells off and CASH!!! becomes king again.

When we go through our portfolio, we have to keep in mind that CASH!!! is valuable and we have to have a good reason for using it in our positions – otherwise we should get rid of them and get more CASH!!! Have I mentioned how much I love CASH!!! lately?

- Aurora Cannabis (ACB) – We (PSW Investments) own a cannabis company in California and I can tell you buisness is very good right now under quarantine. There's that reason to keep ACB as well as the fact that it's a net $280 entry which is now net $865 and has the potential to be $12,500 at $3, though that's very doubtful by the year's end but we have a 2-year call so we can sell the 2022 3 calls for another $720 when these expire and, since that's almost as much as we could collect if we cash out now (we could cover all 50 for $1,500 too) – there's simply no point to not leaving them on.

- Cleavland Cliffs (CLF) – One of the few US Iron Ore producers should do well when the economy turns back on. They beat last quarter and made 0.25/share after making 0.33 the quarter before, which was a huge 32% beat so expectations were going up and up. We believe they have the reserves to ride out the virus and they are clearly a vital industry that will get loans or bailouts if they need it so no reason to panic out. In fact, we got aggressive and bought back our short calls with a nice profit when they tested $3 and, so far, we've been right about the bounce and they are hopefully consolidating for a move above $4. I certainly expect them to get back to $6 by 2022 and that would put us $15,000 in the money vs the current net $5,300 for a potential gain of $9,700 (183%) so that's a keeper! Plus, we can sell some short calls once they hit $6 for a little income.

- Hanesbrands (HBI) – Those "brands" are Hanes Underwear, Champion Sports, Maindenform, Polo Ralph Loren, DKNY, Wonderbra and dozens of other wearables you find in every store on the planet. At $7.25, you can buy the whole company for $2.6Bn which is very, very silly as they made $600M last year and $553M the year before so it takes them just over 4 years to make all your money back (p/e 4). Again, obviously they will have a tough year with the virus but that's no reason not to own them this cheaply. Levis had a tough decade with the Great Depression but the people who owned them for $2M in 1935 are probably please that they are $4Bn now (LEVI) – and that's down 50% too!

- Anyway, so we like HBI and eventually they should get back to at least 8x earnings and figure earnings will be $500M next year (a bit slow) so that's $4Bn which is up $1.4Bn or 50% so our target for HBI should be about $14 and we have the $10/15 spread for 2022 so right on target and the $10,000 spread is currently a net CREDIT of $4,950 so the profit potential at $15 is $14,950 (302%) so we're certainly happy to hold onto this one.

- H&R Block (HRB) – Well, our premise was that you can't avoid death or taxes but then the Government gave everyone a 3-month extension. I'm confident in our 2022 $15 put target but the July $20 calls are never going to happen and we'rd down $7,000 on the spread so let's take 30 of the 2022 $8 ($5.25)/$15 ($2.50) bull call spreads at $2.75 ($8,250) and we can sell 10 of the July $14 calls for $1.50 ($1,500) to get some of that money back so we're spending net $6,750 of our cash to put ourselves into a $21,000 spread that's mostly in the money to start. Our initial cost of the spread was $1,650 so our total in (not counting short call profits we already cashed out) is $8,400 and we still stand to make $6,600 at $15 not a bad fix for a stock that dropped 50% on us!

- IMax (IMAX) – Are we never going to go to the movies again? Well it seems like it at the moment and IMAX has fallen to $8.80, which is $540M and they made $50M last year, so 10x earnings. But, they have been investing in massive expansion the past few year, mostly in China and, while that is bad luck this year – it sets them up for $100M years ahead. Last quarter, in fact, they made $18M. Unfortunately, IMAX does not have long-term options and only go out to December, which may not be enough time to recover.

- So we are down $11,550 on IMAX and we love them long-term but we're not sure when they can recover? Let's roll our 10 short Sept $18 puts at $9.55 ($9,550) to 20 of the Dec $10 puts at $4.50 ($9,000) and let's roll our 30 Sept $10 calls at $2.25 ($6,750) to 50 of the Dec $5 ($5.50)/$10 ($2.70) bull call spreads at $1.80 ($8,000) so we are spending net $1,800 on top of our initial $8,750 (less profits from short calls already in the portfolio's cash position) for $10,550 but now we're in a $25,000 spread that's $3.80 ($19,000) in the money and we have a $14,450 upside potential (136%) between now and December if IMAX can get back to just $10. FIXED!

Again, I want to stress that you should NOT try to fix every position – it's just that these all happen to be excellent positions… 😉 While we are not using much cash, we are using some margin on the short puts, which obligate us to buy the stock at the strike price if assigned so it's very important we REALLY want to own 2,000 shares of IMAX for $10 ($20,000) or we should not be selling the puts! Over $10, they simply expire worthless and we keep the cash but, under $10 and we might end up having to deal with the shares – though we can buy back the puts at any time and take the loss if we change our mind.

- IRobot (IRBT) – These guys used to be our Stock of the Century but they sold their Military Robotics Division, which was our favorite stock so now Lockheed (LMT) is our Stock of the Century as we are betting on them to commercialize fusion in the next 20 years and change the World – but that's another article entirely… The consumer division of IRBT is still fun to play and they missed earnings in October so we grabbed them and it was good for a while but now down on the virus but that doesn't alter our long-term forecast. We're still miles ahead on this position at net $8,350 but it's a $70,000 spread so there's still $61,650 of upside potential to it and it's $20,000 in the money as it stands so FANTASTIC as a new trade too.

Macy's (M) – You can boo all you want but I love them. Last summer, it was estimated that Macy's had $21Bn in real estate and, while that was interesting, it wasn't what excited me. What did excite me is that they have a 7-story building in New York that's an entire city block and they plan to put 5 more floors on top of it and rent that out. Herald Square is one of the top 3 places in Manhattan for rental fees and you simply can't build anything of size there as everything is taken – except the air above Macy's! At "just' $80/foot (yes, insane but true), 1.5M feet will rent for $120M a year and even if it costs them $1.5Bn to build it – it should drop some nice cash-flow to the bottom line.

Not that they need it. Despite dropping to $4.45 from $22 (we liked them at $15!) Macy's JUST announced a $340M profit for Q2, which ended on Jan 31st and Q3 last year, which ends of 4/30, was just $136M and Q4, which ended June 30th, they made just $86M so Q4 is everything and, if they survive into this Christmas – Macy's can still get back on track. There should be some juicy bailouts and loans in their future but it will be a long, slow recovery so we need to kiss $15 goodbye and shoot for $10:

- Roll 5 2022 $15 puts at $11 ($5,500) to 15 2022 $8 puts at $4.50 ($6,750)

- Double down on 25 2022 $5 calls at $1.80 ($4,500) to average $2.20 on 50 ($11,000)

We were already in for net $4,250 (less short calls we already took profit on) and our obligation was to own 500 shares of M at $15 ($7,500) and now it's to own 1,500 shares at $8 ($12,000), so not too bad – unless they do go BK. Meanwhile, we have 50 long 2022 $5 calls that are out of the money and we HATE having naked calls (that's being the Gambler, NOT the House) but I'm pretty confident that M will pop back over $6 and we can sell the $10 calls, now 0.67, for $1.25 ($6,250) and then we'd be in for our original $4,250 + $5,750 we just spent less $6,250 we hope to collect is net $3,750 and, if we make it to $10, that will be $50,000 for a gain of $46,250 (1,233%) – see why I can't let this one go?

- Nasdaq Ultra-Short (SQQQ) #1 – This is our newer hedge and keep in mind a hedge is like life insurance, you don't want to "win". In this case, we spent net $0 if the short April calls expire worthless so hopefully it will be free protection down the road that should cover us for 2 more month against a sharp downturn. The spread has the potential to pay $100,000 but we certainly hope we end up with nothing!

- SQQQ #2 – This was our active spread and we've torn it apart and put it back together – taking advantage of the gyrations to profit in both directions. We are left with some hefty profits on the table and job #1 is TAKE THE CASH!!! so we buy back the 65 short June $35 calls and that will leave us a lot more bearish into the weekend – just in case. We still have 30 short Jan $35 calls and, if SQQQ drops a lot next week, we can sell 30 short Jan $30 calls (now $6, $18,000) and use that money to roll our 95 Jan $20 calls at $7.85 ($74,575) down to 95 Jan $15 calls at $9.50 ($90,250). It's very important to KNOW what you are going to do if things don't go your way and, if you are comfortable with that – then it's an easy choice to take proftis like these ($34,425) when they present themselves and then you have MORE CASH!!!

Remember, the hedges provide a money-pump when the market does go down. We have so much cash in the portfolio because we cashed in some earlier hedges and now we're using that profit to improve our long positions. If we recover, we'll lose a bit of money on our current hedges but, BECAUSE WE KNOW EXACTLY WHAT WE EXPECT TO MAKE ON OUR LONGS – we know what we can afford to lose on our hegegs to keep things under control. It's all bout finding the right balance so your portfolio can weather any sort of storm.

- Wynn Resorts (WYNN) – This is a tough one because, even though Macau is open in China, the province requires travelers to quarantine at the airport for 14 days before entering the city and that is NOT the start of an ideal gambling weekend and it's April so 4 months shut in China and probably the same in the US – at least is devastating for WYNN. We have a small profit and our target is low enough but I don't think it's worth the risk so let's kill this one and look for something better.

See, we found something to cut! That's because we got new information on Macau the other day that shook our premise and, since there are so many better stories to play out there – why gamble on this one? As it stands, the positions we have have an upside potential of $153,600 and we have very little downside risk from our hedges while they are very adequately protecting our longs.

All in all, we're very well-balanced – and that was the goal of this week's workshops!

Have a great weekend,

– Phil