.jpg) It's been a while since we had a Top Trade Alert.

It's been a while since we had a Top Trade Alert.

Top Trade Alerts are the trade ideas we like the most in any given week, the ones we feel as very likely to do well and usually we are running with around an 80% success rate, which is amazing. I often tell our Members that the reason we are so successful with our trade ideas and futures plays is not because we are so good at picking winners but because we are so good at NOT picking losers.

When you decide to be a trader, professionally or as a hobby, you tend to sit down at your desk looking for things to trade but, like a good baseball hitter, the thing you have to learn is PATIENCE – if you don't wait for a good pitch, you are going to swing and miss a lot. In baseball, it's just a strike but in trading, it's a loss!

Home run hitters tend to strike out a lot because they swing for the fences and, while it's spectacular when they connect, many great home run hitters are terrible batters because that's all they do well while almost any player with an 0.300 batting average is going into the Hall of Fame. An 0.300 trading average is not great, but, if you learn how to manage your money correctly, it can work but traders who can bat 0.500 (50%) and manages their losses will always get into the hall of fame.

The highest batting average in baseball history was Ty Cobb, who battet 0.367 but, because he didn't swing at pitches he didn't like, he also walked a lot and his "On Base Percentage" (times he got to first base) was an amazing 0.433 – almost half the time he got up, he got on base! Being selective in your trades will also get you to first base (profits!) much more often but that, unfortunately, means there are certain times – or UNcertain times like these – when you are better off not swinging at all.

The highest batting average in baseball history was Ty Cobb, who battet 0.367 but, because he didn't swing at pitches he didn't like, he also walked a lot and his "On Base Percentage" (times he got to first base) was an amazing 0.433 – almost half the time he got up, he got on base! Being selective in your trades will also get you to first base (profits!) much more often but that, unfortunately, means there are certain times – or UNcertain times like these – when you are better off not swinging at all.

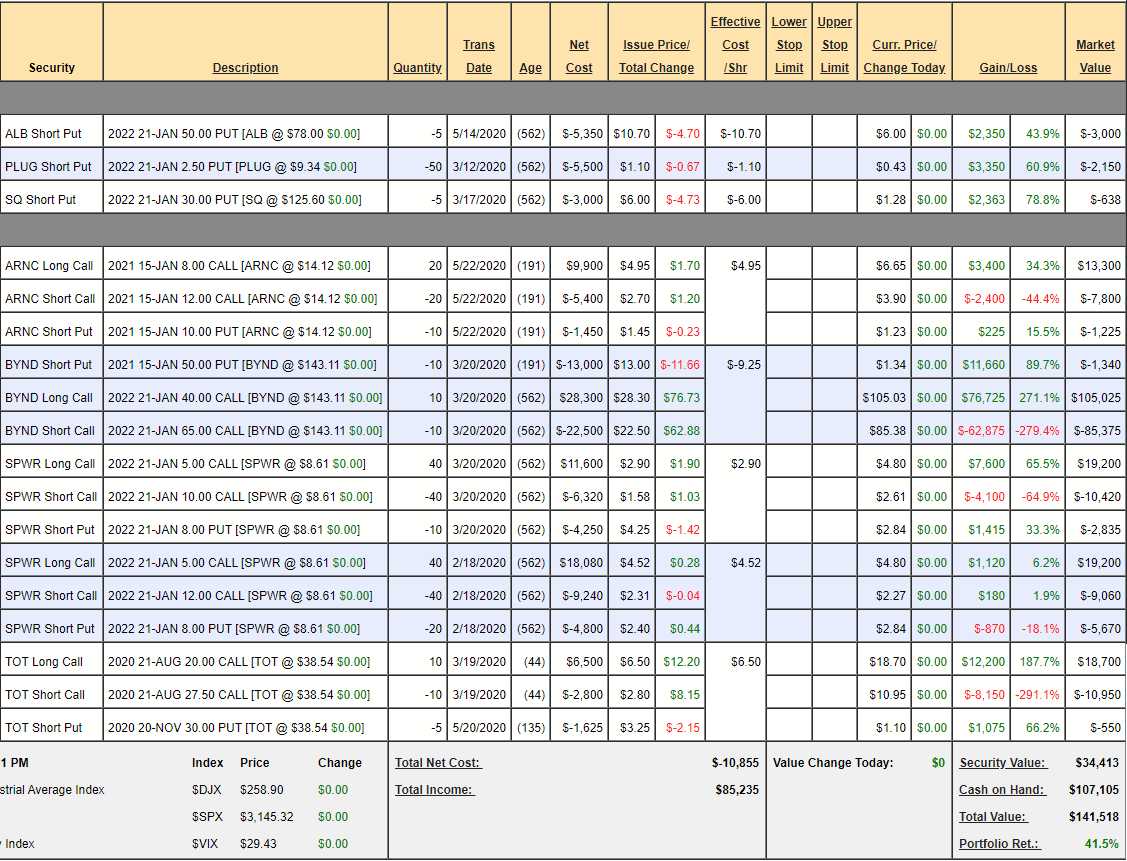

While we were happy to buy stocks when they were cheap earlier in the year, there simply aren't too many bargains left and, so, not a lot of Top Trade Picks recently. Our last one was a month ago on June 3rd and that was IMAX, because we thought they would do very well if the re-opening was successful (not really so far) but China is doing well and so are parts of Europe so I still like our IMAX trade for the long term, but we'll have to roll our short puts out to longer strikes when they become available.

The Top Trade Idea before IMAX was Harmony (HMY) on May 29th, which was also featured in that day's Live Member Chat Room under: "Faltering Friday – Low-Volume Rally Sputters into the Weekend". That trade idea is in our Long-Term Portfolio and is already on the way to make the full $10,000 (100%) profit by January if HMY simply stays above $3 and possibly much more if we can roll the short calls:

| HMY Long Call | 2022 21-JAN 1.00 CALL [HMY @ $5.05 $0.00] | 100 | 5/29/2020 | (562) | $24,000 | $2.40 | $1.75 | $2.40 | $4.15 | $0.00 | $17,500 | 72.9% | $41,500 | ||

| HMY Short Call | 2021 15-JAN 3.00 CALL [HMY @ $5.05 $0.00] | -100 | 6/4/2020 | (191) | $-9,000 | $0.90 | $1.40 | $2.30 | $0.00 | $-14,000 | -155.6% | $-23,000 | |||

| HMY Short Put | 2022 21-JAN 3.00 PUT [HMY @ $5.05 $0.00] | -50 | 5/29/2020 | (562) | $-5,000 | $1.00 | $-0.38 | $0.63 | $0.00 | $1,875 | 37.5% | $-3,125 |

See, it's a nice, conservative spread that we spent $10,000 on and will double if HMY just stays over $3 and it was at $3.50 at the time! You don't have to swing for the fences to hit a home run – the home runs will come sometimes if you just get a lot of hits!

The Top Trade Idea before that was May 22nd, when Arconic (ARNC) came up in our chat room and we decided that would be a very likely winner – so I posted it as a Top Trade Idea for our Future is Now Portfolio. We ended up spending net $3,050 and already the spread is at net $4,275 for a 40% gain in less than two months and, more importantly, it's welll on the way to being in the money in January and paying us the full $8,000 for a 146% gain in 8 months – very nice hitting!

| ARNC Long Call | 2021 15-JAN 8.00 CALL [ARNC @ $14.12 $0.00] | 20 | 5/22/2020 | (191) | $9,900 | $4.95 | $1.70 | $4.95 | $6.65 | $0.00 | $3,400 | 34.3% | $13,300 | ||

| ARNC Short Call | 2021 15-JAN 12.00 CALL [ARNC @ $14.12 $0.00] | -20 | 5/22/2020 | (191) | $-5,400 | $2.70 | $1.20 | $3.90 | $0.00 | $-2,400 | -44.4% | $-7,800 | |||

| ARNC Short Put | 2021 15-JAN 10.00 PUT [ARNC @ $14.12 $0.00] | -10 | 5/22/2020 | (191) | $-1,450 | $1.45 | $-0.23 | $1.23 | $0.00 | $225 | 15.5% | $-1,225 |

In fact, our entire Future is Now Portfolio is already up 41.5% for the year after starting it on 12/12 with $100,000, in honor of my Dad's (who was a futurist) birthday. We have only made 8 picks in 7 months but, because we chose carefully, NONE of them are losers.

Well, 7 picks really as we liked Sunpower (SPWR) so much we picked it twice. Gee, who'd have though solar energy would be a thing, right? Speaking of the Future, back on May 21st, in our Member Chat Room, I mentioned to our Members that we were helping to get PPE equipment, including 3M masks for those in need and I said at the time:

As a company, I'm liking 3M (MMM). They won't make much money on the masks but they are going to sell Billions of them for $2 and that will bump their revenues up considerably. $146.50/share is a market cap of $84.25Bn and they are dropping $5Bn to the bottom line so not super-cheap but not unreasonable – and they do have one of the hottest products on the planet. For the LTP:

Sell 5 MMM 2022 $130 puts for $18 ($9,000)

Buy 15 MMM 2022 $130 calls for $29 ($43,500)

Sell 15 MMM 2022 $160 calls for $14.50 ($21,750)

Sell 5 MMM July $150 calls for $5.40 ($2,700)

That's net $10,050 on the $45,000 spread and we'll sell more premium along the way but the upside is about $35,000 (350%) as it stands so a great way to get started on a Blue Chip industrial.

| MMM Long Call | 2022 21-JAN 130.00 CALL [MMM @ $154.82 $0.00] | 15 | 5/22/2020 | (562) | $42,300 | $28.20 | $5.93 | $28.20 | $34.13 | $0.00 | $8,888 | 21.0% | $51,188 | ||

| MMM Short Call | 2022 21-JAN 160.00 CALL [MMM @ $154.82 $0.00] | -15 | 5/22/2020 | (562) | $-20,625 | $13.75 | $3.00 | $16.75 | $0.00 | $-4,500 | -21.8% | $-25,125 | |||

| MMM Short Call | 2020 17-JUL 150.00 CALL [MMM @ $154.82 $0.00] | -5 | 5/22/2020 | (9) | $-2,700 | $5.40 | $1.03 | $6.43 | $0.00 | $-513 | -19.0% | $-3,213 | |||

| MMM Short Put | 2022 21-JAN 130.00 PUT [MMM @ $154.82 $0.00] | -5 | 5/22/2020 | (562) | $-9,250 | $18.50 | $-3.98 | $14.53 | $0.00 | $1,988 | 21.5% | $-7,263 |

As you can see, we're already at net $15,587 from our net $9,725 entry so up $5,862 (60%) in 2 months on a very conservative entry on 3M based on some very simple fundamentals we thought were leaving the company undervalued below $150 at the time. Fundamental trading is easy – PATIENCE is hard….

Other Top Trade Ideas in the very merry month of May were:

Other Top Trade Ideas in the very merry month of May were:

- Top Trades for Wed, 20 May 2020 15:49 – MU

- Top Trades for Tue, 19 May 2020 15:55 – FL

- Top Trades for Mon, 04 May 2020 13:46 – BRK.B

- Top Trades for Tue, 28 Apr 2020 13:12 – SPG

Every single one a winner (so far) so we're batting 1.000 (1,000, as they say) and, as far as I'm concerned, we are batting 1,000 in June as well as we only made one pick but then, when the re-opening did not go as planned, we decided NOT to play for the rest of the month while we stepped back and waited for more clarity.

So far, we are still waiting.

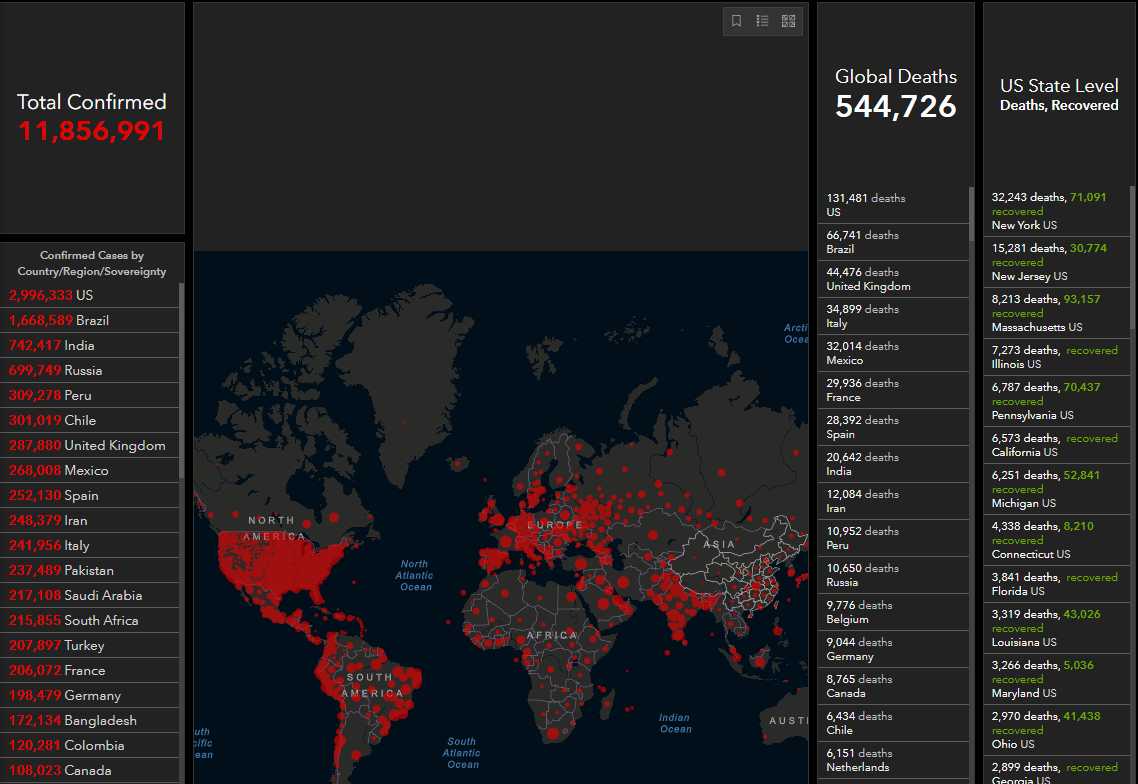

And happy 3M cases of Covid America, less than 30 days ago, we crossed the 2M mark and here we are at 3M after a fabulous re-opening. 4 more years!!!

Remember on 9/11/2001, when 4,000 Americans lost their lives and our Government made a no-holds barred effort, not to save the economy, but to save the American people from further harm?

Those were the days….