Before we get into our $1M Portfolio, let’s look at our hedges.

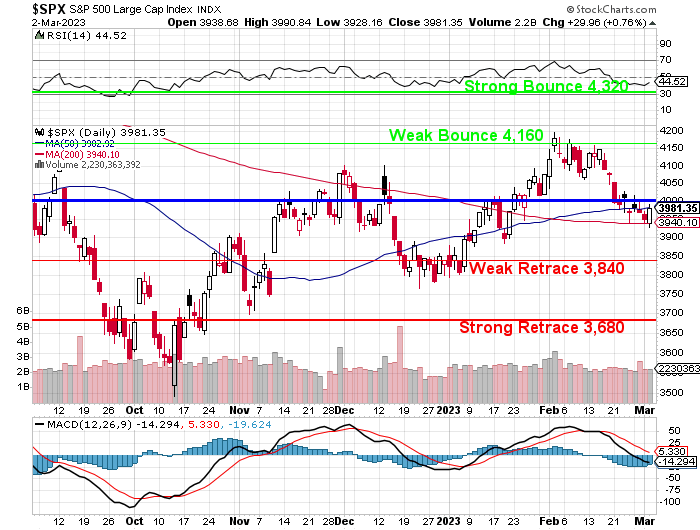

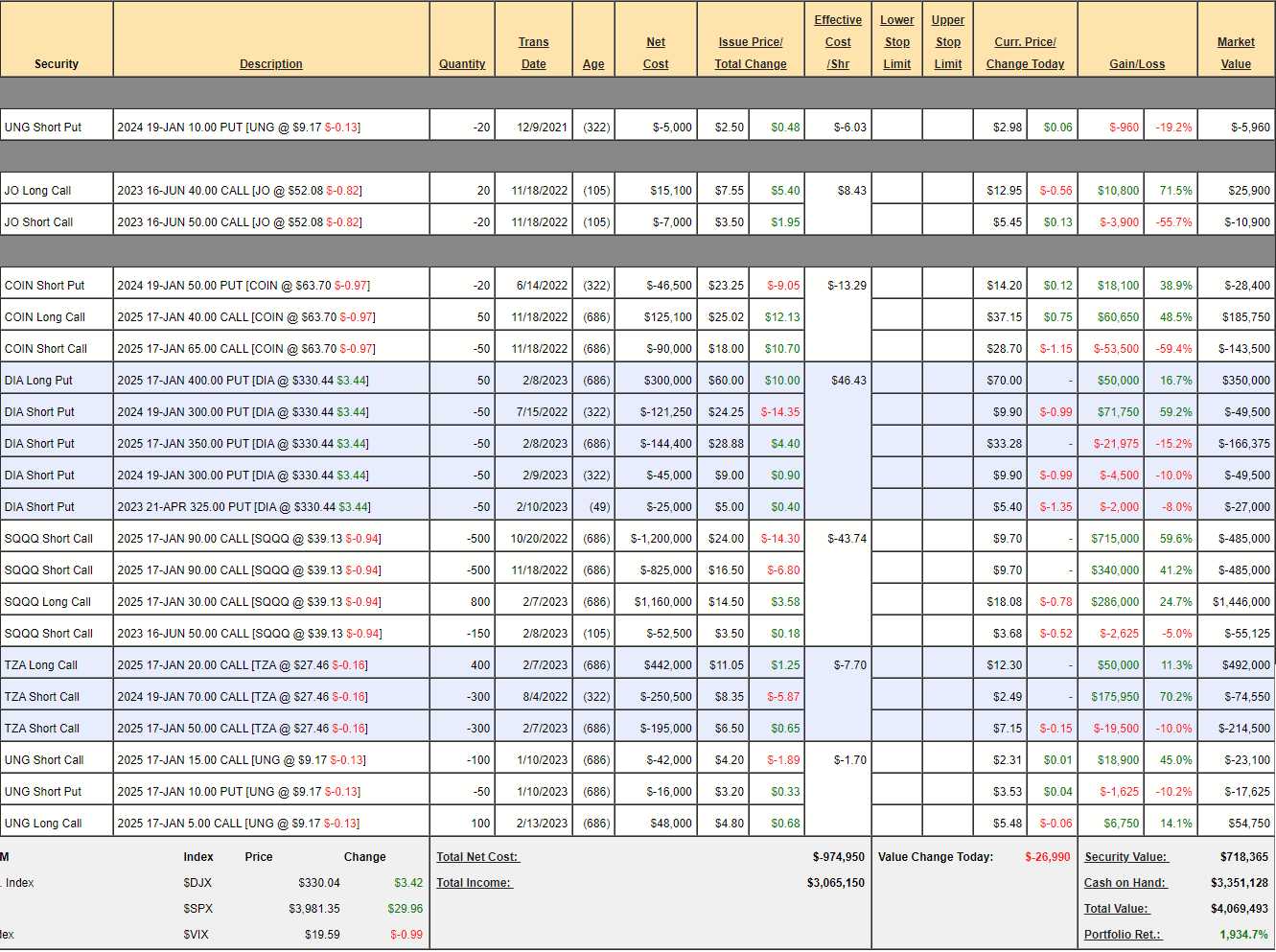

We last reviewed our Short-Term Portfolio on Valentine’s Day, when the S&P 500 opened at 4,126 but we had already made our adjustments in our Live Member Chat Room on the 7th, when the S&P hit 4,176 which did, in fact, turn out to be the high for the month. That left us with nothing to change on the 14th, and the portfolio was at $3,888,503 and, this morning, after not being touched since, it’s at $4,069,493, which is up 1,934.7% in 3 years and up $180,990 in just over two weeks – which is how you end up being up 1,934%, of course…

Keep in mind we are 85% in CASH!!! at the moment and the value of our positions on the 14th was only $537,375 so the active positions have gained 33.6% on a 3% drop in the S&P – that’s the key to good hedging. We have close to $6M in downside protection in this portfolio and that’s more than we have in long positions so we’re a bit bearish overall but, on the other hand, our longs will make far more than enough to cover the losses on our hedges should we find ourselves too bearish – it’s a great balance and we’d hate to mess it up – so we are being very cautious when adding new longs.

Knowing how to hedge is like knowing how to apply the brakes in your car. If you don’t know that, you can only drive very slowly for fear of crashing into something or flying off the side of the road on a curve. The ability to brake opens up a whole new world of possibilities in your driving and in your investing – it allows you to move faster towards your goals, confident in your ability to make adjustments.

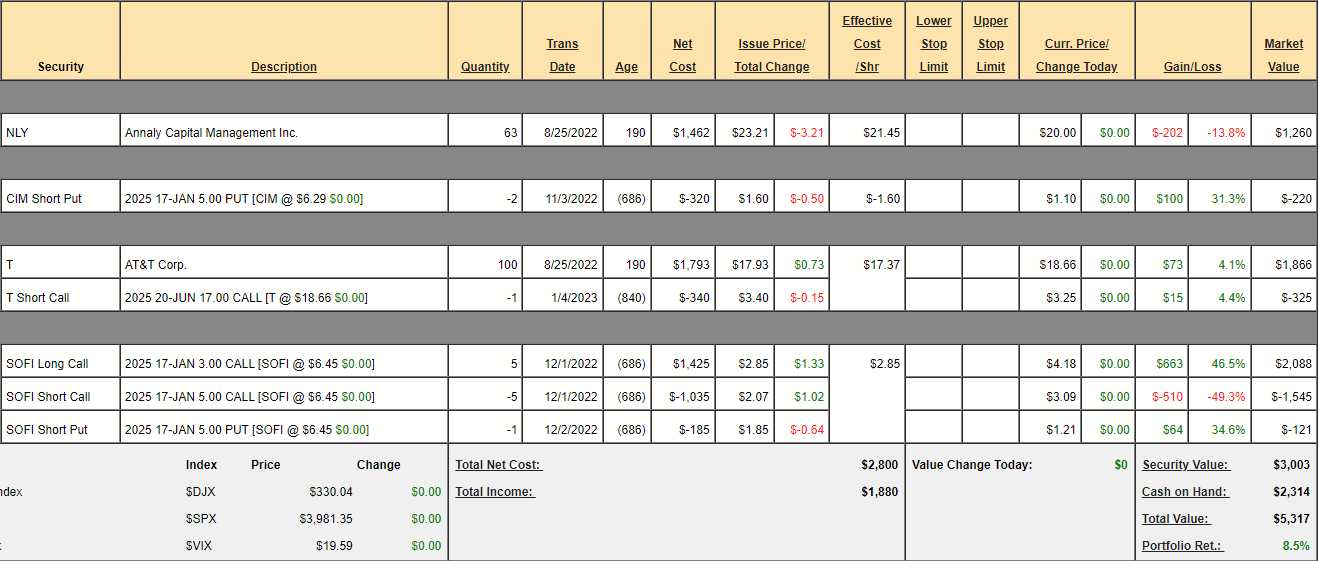

Unfortunately, we have not yet hedged our $700/Month Portfolio and we’re taking our first loss this month. Months 1, 2, 3, 4, 5 and 6 are available for review. This is an opportunity to learn our portfolio-building strategies step by step that, hopefully anyone will be able to follow.

Our goal in this portfolio is to show our Members how to use slow, steady, simple options strategies to amass over $1M over 30 years by investing just $700/month ($252,000). If you can apply this discipline in your early working years – your retirement will be a breeze.

Our goal is to make 10% a year on our investments and, though it has only been 6 months – the portfolio is up 8.5%. That’s a pace of 17% per year and, if we did that for 30 years, we’d have $6,440,776.90. No, I’m not kidding, you can do the math right here! Don’t expect to keep up that pace – we’ll have ups and downs along the way and this portfolio doesn’t attempt to time the market – it’s just off to a good start.

When we started the portfolio (Aug 25th), the S&P 500 was at 4,000 and now we’re at 3,996, so essentially flat. Nonetheless, we made 8.5%. That’s the magic of using options and our Be the House – NOT the Gambler strategy, even when you play very conservatively, you can still make nice gains in a flat market.

As with all our PSW portfolios, the returns tend to accelerate as our positions mature and we are still comfortably ahead of expectations, which is very nice in a no-margin portfolio.

Last month, we added 32 more shares of NLY and that was unfortunate timing because NLY has since fallen from $24 to $20 and we went from up $49 to down $202 on that position. Apparently they are cutting their dividend and we have no choice but to take the loss and sell the position.

We have $1,000 of margin requirement on the CIM puts and $500 on the SOFI puts and the cash on hand is $2,314 plus the $1,260 we will get from selling the NLY position – leaving us $3,574 less $1,500 is $2,074 to spend!

Before adding new positions, we should check to see if the old positions need any love:

CIM – I would jump all over these but they have the same management team as NLY so maybe cuts there too. I’m not worried about being assigned 200 shares at $5 (net $3.40) so not going to change it but it’s a bit premature to jump in with more.

T – We could add a put here, that’s tempting. The 2025 $20 put is $3.05 so we’d get $305 in cash and be obligated to buy net $1,695 more T. The return on margin in the non-margin account is only 18% over 2 years – we can do better.

SOFI – I do love them and they haven’t gotten away yet so worth considering.

As to potential new stocks:

- B2 Gold Corp (BTG) is a gold producer with a 5% dividend at $3.58, which is $3.8Bn and they make $350M so p/e about 11. They also have $600M in the bank and we like gold as a hedge.

- Nokia (NOK) is still alive and more of an equipment service provider these days. $4.68 is $26Bn and they make about $2.5Bn so 10x but just a 1.79% dividend. They do have $4Bn in cash though – I like that!

- Global Ship Lease (GSL) is a container ship leasing company who are paying a 7.3% dividend against their $20.70 stock ($751M cap) but they made $274M last year and expect to grow about 20% this year – so a nice little company.

- Barclays (BCS) is from our Watch List at $8.32, which is $32.5Bn but they make $5Bn so 6x is stupidly low. They pay 4.1% and actually have $16Bn laying around on top of that – half of their market cap!

- Ford (F) is back in consideration at $12.56, which is $50Bn and they made $6Bn last year and should bump 10% this year. I’m pretty sure, 30 years from now, you’d be kicking yourself for not buying this one. Dividend is a nice 5% too. $95Bn in debt is the dark cloud but autos, inventory, etc. – it’s kind of normal.

- Future Fuel (FF) is one of my favorite small caps. $8.67 is $380M and they made $23M so 16.5x with a 2.5% dividend but then they paid a special 0.30 (3.4%) dividend in December – a nice bonus. They also have $185M in cash – half the valuation.

- Petrobas (PBR) – Would be great but the Government forces them to essentially give oil away to Brazilians. Even now, they are trying to sell assets and the Government is interfering. In a riskier portfolio, I don’t mind but not here.

- Sunpower (SPWR) – Hard to not add our stock of the decade at $15.09, which is only $681M and they made $45M last year and should make close to $60M this year. No dividends but huge growth potential as the solar industry expands.

- Tronox (TROX) – Specialty materials are always fun and sales are up to $3.2Bn from $1.8Bn in 2018 and profits are $220M but $16.42 is $2.5Bn so call it 12x. 3% dividend as well.

- Trivago (TRVG) – Travel is picking back up and $1.76 is $600M and they expect to make $60M this year so 10X is underpriced. No dividends but fun options.

As we have the extra money and as SPWR is our Stock of the Decade and it’s only 2023 and our target is $50, not $15 (we started at $5 and already cashed out our original plays at $50) and, as the options are CRAZY – let’s add SPWR to our portfolio as follows:

-

- Buy 5 SPWR 2025 $15 calls for $5.70 ($2,850)

- Sell 5 SPWR 2025 $23 calls for $3.20 ($1,600)

This spread is costing us net $1,250 of our $2,074 buying power. It’s a $4,000 spread so the upside potential is $2,750 (220%) in two years – you’ve got to love that!

This will leave us with $824 to spend and I think that’s enough to adjust SOFI a bit more aggressively and what we will do is:

-

- Buy (to close) 5 SOFI 2025 $5 calls at $3.09 ($1,545)

- Sell 7 SOFI 2025 $7 calls for $2.40 ($1,920)

- Buy 2 (7 total) SOFI 2025 $3 calls for $4.18 ($836)

That’s net $461 spent and we’ve gone from a $1,000 spread at net $422 to a $2,800 spread at net $883 so our upside potential has increased from $578 (136%) to $1,917 (217%) by modestly adjusting our target in an already successful spread.

That still leaves us with $363 to carry over to next month!