There was something for everyone in yesterday’s Fed Conference – and nothing as well.

There was something for everyone in yesterday’s Fed Conference – and nothing as well.

The Fed’s hawkish stance on 2% Inflation was more than what the bulls had bargained for, resulting in a 2% sell-off that had the S&P 500 testing the 4,000 line once again – wiping out the entire week’s worth of gains. It seems like the Fed is determined to prioritize Inflation but are they willing to do so “at all costs“?

The Fed’s focus on inflation could mean that they may need to tighten monetary policy more than expected, which could lead to even slower growth. In fact the Fed’s “plan” seems to be to have us flatline at 0.1% – inches above a Recession while they try to get Inflation down to their 2% target level AND it’s going to take them until 2025 to accomplish it – at best. This may be good news for savers and bondholders, but bad news for borrowers and investors who have come to rely on cheap credit.

Moreover, the Fed’s stance on inflation seems to reinforce the status quo of capitalism, where profit-maximizing banks and corporations are at the forefront. It’s no secret that the current economic system is rigged in favor of the rich and powerful, and the Fed’s policies seem to only exacerbate this trend.

In any case, the market is likely to remain volatile in the coming days as investors digest the Fed’s statement and economic report. It’s important to stay nimble and be prepared for any eventuality in these uncertain times. As the saying goes, “Hope for the best but prepare for the worst.”

We prepared for the worst ahead of the drop, adjusting our hedges more bearish but we also hoped for the best and went bargain-hunting – using our Watch List as a guide to set up a dozen bullish plays in our Long-Term Portfolio.

Now we are waiting and seeing which way the wind blows. As I noted in yesterday’s Live Trading Webinar, the data we’re looking at shows inflation is NOT calming down as the Fed expects and the UK just had 10.4% inflation – driven by food prices. They do not calculate inflation very differently than we do so why would we assume we are magically dodging that bullet?

Tomorrow we will see how Durable Goods Orders went in Feb and we also get the IHS Markit PMI Reports and Manufacturing was contracting last month. Next week we have Consumer Confidence on Tuesday, a revision to Q4 GDP on Thursday (was 2.7%) and then Friday we will have several important data releases that could impact the markets:

The Personal Income and Spending Reports, as well as the PCE Prices, Chicago PMI and Consumer Sentiment are all high-impact releases. These reports are closely watched by the Federal Reserve as they provide insights into inflation and consumer spending, which are key drivers of economic growth.

In the bigger picture, it’s all about the 4,000 line on the S&P 500 but, frankly, that’s EXACTLY where we should be as that’s the line we’ve been using to indicate the fair value for the S&P 500 since 2021:

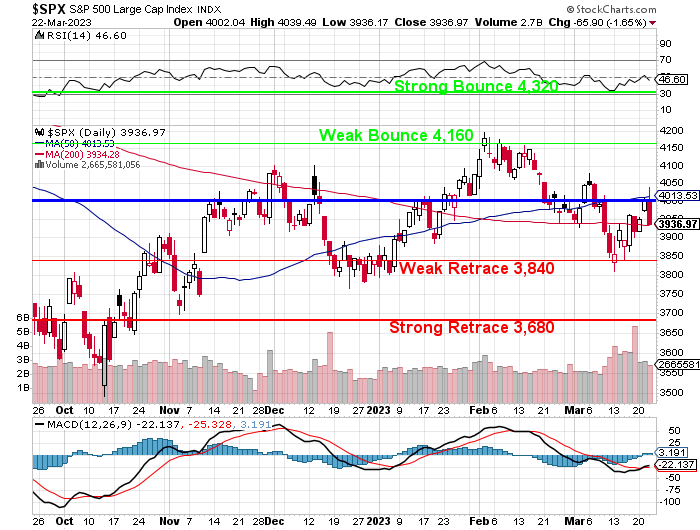

As you can see, ignoring all the Fundamentals that drive us, we’re kind of stuck between the 200-Day Moving Average and the 50-Day Moving Average and we need to be very concerned if the 200 dma is broken as we have no support until our Weak Retrace line at 3,840.

Then the question becomes, what has changed since the last time we tested that line (properly), back in December? Are things now better or worse? Here’s what we were talking about back in the Day:

Dec 5th: Mixed Signal Monday – Nothing to Get Excited About

“A full re-opening of China – if it goes smoothly, would take months to roll out – so Q1 is shot already. China is only just now starting a program to vaccinate their high-risk elders but, being China, that’s 173M people! That is only step one towards re-opening.

“Russian Crude currently trades at $50 and Putin has threatened to unilaterally cut production if the caps are enforced but first Brent Crude, now $87.50, would have to be back over $100 and that’s not very likely so it’s all a lot of hot air and is no reason for WTIC (/CL) to be at $82.50 this morning. Still, it’s a dangerous short (last week was obvious) and I’d be very careful playing it – with very tight stops above $82.50.

“Hello Group (MOMO) reports on Thursday and that’s a fun Chinese stock to play. Sales were over $2Bn pre-pandemic and profits were $285M and now they are down to 1.5Bn and $200M but you can buy the whole company for $1.1Bn at $5.75 and they have about $1Bn in the bank – so free company!”

Dec 12th: Monday Market Madness – Fed Week

“According to Bloomberg, our Leading Economorons generally predict that the Fed is about done hiking rates and they have done such a FANTASTIC job that they will, in fact, REVERSE and stat cutting rates dramatically towards the end of next year because, presumably, Inflation will have been completely defeated by Summer, much the way Covid was in the Summer of 2020, I suppose…

“I’m not even going to get into it again but WAGES!!! Wages drive inflation and 3 states will be moving to $15 minimum wages this year and next while 13 more will increase wages to $15 by 2026 while we have 22 states still paying $8 or less per hour and 13 other states still paying less than $10 per hour.

“So, last week, I chose MOMO on Monday as a great stock to play and it gained 100% in the first week (you’re welcome!) so let’s talk about Mama Mancini’s (MMMB), which is a little Italian food distributor that makes excellent but expensive meatballs and sauces. In this company, there are only 6 employees as they outsource the cooking, packing and shipping. Like a Fabless Semi-Conductor Plant – they just have a recipe….

“They do not make or lose money and they have $11M in debt but you can buy the entire company for $40M at $1.12 and sales are up from $47M last year trending towards $90M next year ($28M in 2019) and likely profits in 2024 around $5M. The company has no options but is a fun lay at $1.12/share for the long haul.”

Dec 15th: Faltering Thursday – Fed F’s Us Again!

“As I said yesterday – it’s just math.

“Despite “only” hiking rates 0.5%, once again Powell’s comments and the Fed Data we reviewed in our Live Trading Webinar got investors thinking the Fed was not done tightening and, also exactly as we predicted, overnight we got news that China is experiencing a rapidly advancing spread of Covid that looks like it will overwhelm Health Services.

“We had already determined our hedges would be more than sufficient to protect our portfolios so this is more of a buying opportunity for us but, on the whole, we are to remain “Cashy and Cautious” into January. 4,000 was our target for the S&P 500 at the end of 2022 and here we are – at 4,000 – everything is proceeding as I have foreseen!

“Retail Sales were worse than expected, down 0.6% vs down 0.2% anticipated by leading Economorons and that, unfortunately, includes our early Thanksgiving, Black Friday and Cyber Monday (28th) numbers so holiday shopping is off to a disastrous start.”

Dec 19th: Merry Monday Markets – Drifting into Christmas

“Well, we stopped going down.

“That’s a victory right there and we should be happy to accept it as the charts were getting a little ugly last week. The S&P is just over the 50-day moving average (3,863) at 3,883 this morning and holding that line is important as it’s a panic line for many TA traders. I know we have support at 3,840 but that’s 5% Rule™ support and we’re the only ones that have these lines – so they’re not going to be that effective if everyone else is panicking.

“The good news is that the trailing p/e for the S&P 500 is now 19 and 23.5 on the Nasdaq, 23.42 on the Dow and 72.61 on the Russell – which is still high but it was (seriously) 642.17 last year – THAT was insane! The Russell is at 1,774 so down 426 (19.4%) points so it wasn’t so much the change in price as the actual earnings that improved as we’ve come past Covid though certainly we’re nowhere near “normal” at 72 times earnings, are we?

“And the S&P doesn’t usually trade at 19x either (16x maybe) so why would we expect to go back to where we were with 0% interest rates and Trillions (10%+ of the GDP) in annual stimulus spending if that’s not the case going forward? We have to accept that conditions have changed and we have to accept that we’re not bouncing back – this (4,000 in the mid-range) is very likely to be our new reality going forward…”

So you see, we’ve already been there and done that so the only question is, has anything happened that would change our fair value and no, the Fed raising rates doesn’t count because I have been saying for a year that they need to get to 6% (now 5%) before they’ll start impacting inflation – that’s already baked into our model.

There’s been no essential change in inflation so the Fed is still in tightening mode, the bank crisis lasted all of a week and is kind of fixed by $2Tn in coverage by the Government but it’s not really stimulus as it is being used to cover up losses incurred on $2Tn worth of bonds – so about $300Bn in undeclared losses (see my earlier notes) is what the stimulus really is and the rest if Fed Balance Sheet nonsense.

But the bailout doesn’t change anything because the banks had never declared the losses so it’s just business as usual with another $300Bn eventually added to the deficit because, as every good Capitalist knows – banks are much more important than people!

Our range is very likely to hold into Q1 Earnings (April).