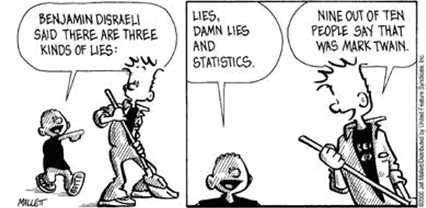

Beware the data!

Beware the data!

The first thing you will hear this morning is that COST had a 9% rise in sales, with International sales up a whopping 25%. What you are less likely to hear is that COST sells a lot of gasoline, which has doubled in price since last December and, excluding inflation in gas prices, same-store sales are up just 2%, a tremendous miss of the 7.9% expected. Out of the 25% increase in International sales, 15% is attributable to currency exchange so up 10% is the real number.

This is nothing against Costco, I like that company, but it's a caution sign to look carefully at the retail numbers we're going to be seeing today as there are several outside factors that are skewing the results drastically – to the point where the numbers, whether good or bad, are almost meaningless. It's also good to keep in mind that we are comping sales to the WORST CHRISTMAS EVER so anything less than double digit gains over last year is still pretty sad.

Mish did a good job yesterday of pointing out the statistical nonsense known as the Non-Farm Payroll Report, where "Birth/Death" model revisions that were as much as 356,000 a month last year (January) make the data beyond useless for any kind of serious analysis. Nonetheless, analyze it they will and if we manage to avoid posting our 24th CONSECUTIVE month of losses, surely they will be pouring champagne on CNBC and acting like Capitalism has once again triumphed over evil (evil being people without money who still want to live with dignity).

Speaking of dignity – if you know 100 people in Nevada then, statistically, 3 of them went bankrupt this year, up 61% from last year as our economy "recovers". In Tennessee, Georgia and Alabama, just 2 of your 100 friends filed while California, surprisingly "only" had one in 66 households file for bankruptcy so you can go almost a whole day and not run into someone who lost everything in California – too bad the same can't be said for the State overall! California needs $21Bn over the next 18 months to keep the lights on. This doesn't seem so bad, GMAC is losing $13Bn this quarter and we're bailing them out but if we bail out CA then NY, NJ and 47 other states will come knocking to the tune of $230Bn in state deficits and that we can't afford.

China says they can't afford runaway inflation and the PBOC unexpectedly raised a key interbank market interest rate Thursday for the first time in nearly five months, signaling a change in its policy focus toward pre-empting inflation risks in the new year. The tightening move, in the form of a higher yield in its weekly bill sale, came less than a day after the People's Bank of China hinted its priorities had shifted toward managing inflation expectations and away from single-mindedly supporting economic growth. Imagine that – the government says they will do something and then —– THEY DO IT! That is amazing!

China says they can't afford runaway inflation and the PBOC unexpectedly raised a key interbank market interest rate Thursday for the first time in nearly five months, signaling a change in its policy focus toward pre-empting inflation risks in the new year. The tightening move, in the form of a higher yield in its weekly bill sale, came less than a day after the People's Bank of China hinted its priorities had shifted toward managing inflation expectations and away from single-mindedly supporting economic growth. Imagine that – the government says they will do something and then —– THEY DO IT! That is amazing!

The PBOC drained a net 137 billion yuan from the money market this week, its biggest weekly fund withdrawal in nearly three months. The central bank has been draining liquidity for 13 consecutive weeks. Outlining its tasks for the new year, the PBOC said in a statement Wednesday it "must maintain policy efforts to support steady economic growth and stabilize prices and effectively manage inflation expectations." In a rare interview with the state-run Xinhua News Agency late last month, Chinese Premier Wen Jiabao discussed growing inflation expectations and expressed concerns about fast-rising property prices.

That sent the Shanghai Composite down another 2% this morning and the Hang Seng dropped 147 points (.66%) and the Nikkei also fell half a point as the dollar dropped back to 92 Yen. Japan's new finance minister, Naoto Kan, hit the ground running this morning and said he wants the Japanese currency to weaken a bit more and that he would cooperate with the Bank of Japan to guide the yen exchange rate to "appropriate" levels, specifically 95 Yen to the dollar. "It's a strong message, particularly for overseas players," said Hideaki Inoue, chief foreign exchange manager at Mitsubishi UFJ Trust and Banking Corp. "Speculation is growing that the government will be more likely to intervene in the market" if the yen rises sharply."

Here we have the Shanghai measured against other international indexes. Note the Hang Seng is fairly closely tied while the Nikkei (who we got out of yesterday) has been the best performer for the month, followed by the Nasdaq – both up around the 5% rule for the month. It's interesting that the China growth story that the Western economies are chasing isn't being bought by China at the moment but don't tell that to some sucker who just paid $83 for a barrel of oil (we shorted oil yesterday) or the guy who paid $1,140 for an ounce of gold (we shorted the gold futures yesterday). That's -2% in China for the month.

Last January and February, our markets fell DESPITE China staging a huge recovery. How will we fare this year if China leads the way lower? Over in Europe, we discussed yesterday that Sarkozy also want the dollar stronger – I would think all these global leaders wanting a stronger dollar should put somewhat of a floor under our currency, don't you? The FTSE is struggling to hold 5,500 this morning and the DAX is at the 6,000 mark with the CAC testing 3,000 so it's a hat trick in the EU if they can all hold their levels but that's going to depend on our Unemployment Report, which we get – Now…

Only 439,000 people lost their jobs last week, up 1,000 from Christmas week but well below the 500,000+ we've gotten used to. The number of people receiving unemployment insurance dropped in the prior week to 4.8 million, and those receiving extended benefits increased. Of course, in another statistical anomoly from our government, continuing claims no longer include people receiving extended benefits under Federal Programs and today’s report showed the number of people who’ve used up their traditional benefits and are now collecting extended payments INCREASED by about 165,000 to 5.44 million in the week ended Dec. 19.

We are reaching a milestone that America hasn't seen since the glory of the Carter years – 1/3 of our Noninstitutional Population (those of us who are not in jail) does not have a job. That's up from 26% in 1999. Another milestone we reached last year is that, for the first time ever, the number of Government jobs (now 23M) has surpassed the number of Goods Producing jobs (now 18M) as 6M goods producing jobs disappeared since 2006 just as the government went on a hiring spree (Homeland Security mostly). Government now employs one in 10 working aged Americans and is about 15% of the total labor force so when your political party decided to campaign against big government – just make sure they are in very tight with the other 85% who's jobs they aren't threatening!

![[10-01-03_goods_government.png]](http://2.bp.blogspot.com/_8rpY5fQK-UQ/S0TslW4yC3I/AAAAAAAAIqo/swc6nFAWN0w/s1600/10-01-03_goods_government.png)

Of course, SOMEONE needs to do some hiring. In Member Chat yesterday we were discussing how the Fed Minutes (see my highlights HERE and HERE) indicated that smaller businesses (the ones not being bailed out) are being crushed by the Corporate Wellfare clients as public companies still have access to credit are rolling over small caps and, especially, non-public companies, who have more luck getting blood from a stone than a loan from a bank. That's led to a 38% increase in Business Bankruptcies this past year with 89,402 businesses going under in 2009.

89,402 businesses bankrupt and 1,357,565 personal bankruptcies in 2009. Party on markets as it really is, as I said in my outlook, A Tale of Two Economies and God help you if you are on the wrong side of that top 10% line… Apartment vacancies are also up 8% this year, hitting a 30-year high as people can't even afford those (and the average rent has been cut 3%) yet CRE is flying – go figure. Even New York City building owners had to cut rents by 5.6% last year with an average apartment now renting for "just" $2,646 a month. Saving on rents must have put people in a shopping mood though because December Same-Store Sales were SUPER with hardly a miss in site. The early results are:

BKE +6.6% vs. +2.2%.

COST +9% vs. +8.2%.

HOTT -10.9% vs. -8.4%.

LTD -2% vs. -1.3%.

PLCE +4% vs. -5%.

SSI -2.2% vs. -4.9%.

WTSLA -4.6% vs. -5.9%.

ZUMZ +0.3% vs. -6.2%.

AEO +7% vs. +2.1%.

APP -5% vs. -5%.

ARO +10% vs. +3.3%.

BJ +4.8% vs. +4.7%.

BONT -2.6% vs. -3%.

CATO +7% vs. 0%.

DDS -7% vs. -7.5%.

JCP -3.8% vs. -4.1%.

SKS +9.9% vs. +2.6%.

TJX +14% vs. +5.5%.

ANF -19% vs. -12.3%.

FRED +1.3% vs. +0.1%.

GPS +2% vs. +2.5%.

KSS +4.7% vs. +3.5%.

M +1%, in-line.

JWN +7.4% vs. +2.4%.

ROST +12% vs. +7%.

SMRT -2% vs. -4.5%.

TGT +1.8% vs. -0.2%.

That's not too terrible! Of course we know COST is misleading but SHLD is up 15% pre-market (raised guidance), SONS is up 10%, BBBY up 8%, PLCE up 7%, SKS up 6%, TJX up 6% while GME is getting spanked for cutting estimates with an 8.6% drop in sales – down 15% in pre-market trading.

In Monday's 2010 Technical Outlook we predicted that we'd have a pop followed by two days of churn and today is the day we expected a 150-point drop. We may escape that with the strong retail numbers but the macro picture is still questionable and anything less than a nice up day today will keep us bearish.

As we have all month, we're looking for Dow 10,457, S&P 1,127, Nasdaq 2,242, NYSE 7,380 and Russell 630 to hold and we're looking for a full set of Dow 10,549, S&P 1,135, Nasdaq 2,314, NYSE 7,389 and Russell 638 to confirm a breakout, where we can get serious about making new highs.