Once again, we're done with our day before you get up.

In my 5am note to Members, I said: "I see nothing in the news to justify this pre-market "recovery" and I hate to sound like a broken record but I like shorting oil (/CL) if we get below that $102 line with tight stops and the Dow (/YM) is right at 12,400, which is a great spot to short. RUT (/TF) is at 762 and below 760 (same as yesterday) will confirm a downturn but 12,400 is a great line so why wait?" By 6:26, I was able to follow it up with:

And wheeeeeeeeeeeeeeeeeeeeeeeee! There go the Futures!

It's 7:07 and we're still going down, with oil at $101.24 (up $760 per contract) and the Dow at 12,340 (up $300 per contract) and, as Dennis said: "Good enough for steak and eggs for me!" Roro got up late but still caught the Dow at 6:16 and that was right on the nose for the oil drop as well as we hit it right on the nose this morning and now we're done and waiting for the next good set-up.

Of course we scale in and scale out of positions as there's no need to get greedy in the Futures, where a single remaining contract catching a $1 move down in oil (now $101.25 again) pays $1,000. This week, we have even stationed our own Craigzooka in New Zealand, where it's tomorrow – which makes it much easier to bet on today's action as he can tell us what happened already! Not that today was all that hard to predict, right? My comment to Members LAST Wednesday was:

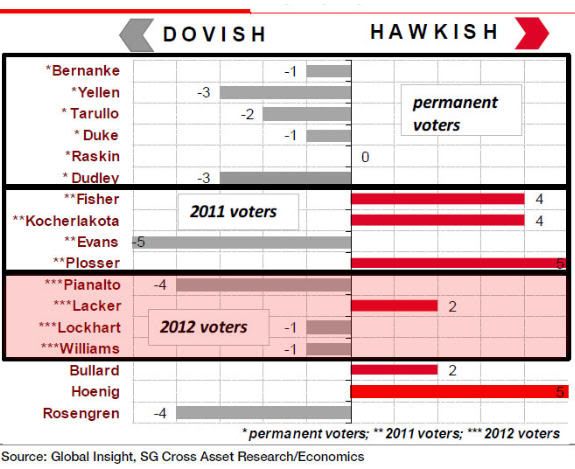

It’s been a pretty reliable bet that they tank the markets into the longer-term note auctions because it scares people into T-Bills and keeps the rates low. From this line-up, it seems to me they intend to jack us up on Friday and then zap us on Tuesday as Esther George releases something hawkish ahead of the 3-year and it’s no coincidence that Plosser, by far the biggest Hawk, is given the floor at 12:30 on Wednesday – just 30 minutes before the critical 10-year auction. Coincidence? Surely you cannot be that naive!

So that's how we've been playing the past 7 days and it culminated in pressing our bets into yesterdays expected morning pump, leaving our $25,000 portfolio so bearish that I had to warn Members that it would be ugly if our premise was wrong. We had to swim against the TA tide to hold onto our positions but, once again, Fundamentals triumph in the end. Tomorrow is the 30-year auction but "only" $13Bn and at least that one pays a semi-realistic 3% (for the optimists, that is) so we're not going to chance that and we'll be taking that bearish money and running into today's sell-off (mostly and see this morning's pre-market chat for more news that's keeping us bearish).

We weren't all bearish of course and, in fact, why don't we take the opportunity this morning to review the year's trade ideas as I won't want to do this again by next week but this should be interesting while we wait for the open. It's a good chance to see what's working and what's not in a very choppy market:

Tuesday (in order of posting):

Shorting Dow Futures (/YM) at 12,350 – now 12,350 (I'm ignoring the fact that we caught 12,250 in between)

Shorting Russell Futures (/TF) at 750 – now 760 (same for all of these, just reporting current price as we're in and out of these constantly)

- Selling FCX 2013 $35 puts for $5.85, now $4.70 – up 20%

- Buying FCX Feb $40 calls for $1.42, now $2.25 – up 58%

- Shorting Oil Futures (/CL) at $102.50, now $101.50

- Shorting S&P Futures (/ES) at 1,275, now 1,281

- Shorting Dow Futures at 12,385, now 12,357

- IMAX 2013 $17/15 buy/write at net $10.50/12.75, now $20.25 – too complicated to explain here but $6.50 upside potential (62%) very much on track – here's my comment to Members at the time (11:05 am):

As a new play, I like IMAX at $18 selling the 2013 $17 calls for $5 and the $15 puts for $2.50 for net $10.50/12.75, which is a LOVELY 29% discount if put to you and a ripping 62% profit if called away $1 LOWER than it is now.

- SCO Jan $35/38 bull call spread at $1.35, now $1 – down 25% (yes, we do have losing trades!)

- SCO Jan $34 puts sold for $1.10, now $.55 – up 50% (oops, I take it back, not yet!)

- DIA Jan $121 puts at $1.05 ($25KP play), now .40 – down 62% (there it is)

- GLL Jan $18 puts at $1.10 ($25KP play), now .50 – down 55%

- SONC June $7.50 puts sold for $1.15, now $1.24 – down 8%

- SONC June $7.50 calls at .55, now .45 – down 18%

- 3 MON April $70 calls at $5.80 ($25KP), now $11 – up 89%

- 1 MON Jan $70 call sold for $3.05 ($25KP), now $9.30 – down 204%

- 1 MON Jan $72.50 call sold for $1.68 ($25KP), now $6.80 – down 304%

Those downs sound bad but, if you kept that trade as is (we didn't), then the net $1,267 entry is now net $1,690 so up 33% in a week on an earnings ratio backspread and a very nice $577 profit in our virtual $25,000 Portfolio but we're working it to hopefully do a bit better than that.

- DMND June $37/45 bull call spread at $2.10, now $2.20 – up 5%

- DMND June $20 puts sold for $1.85, now $1.80 – up 3%

- Shorting Oil Futures (/CL) at $103, now $101.50

- AONE 2013 $2.50 puts sold for $1.20, now $1.10 – up 9%

- AONE 2013 $2.50/5 bull call spread at .25, now .40 – up 60%

Wow, what a busy day! Of course, we were coming off a very cashy close to 2011 so we were just looking for things to trade. At the end of Tuesday's Member Chat, early Wednesday morning, we had a nice discussion about Futures trading techniques (always fun in a choppy market) and I had occasion to share my favorite market quote:

"The man who begins to speculate in stocks with the intention to make a fortune, usually goes broke, whereas the man who trades with a view of getting good interest on his money sometimes get rich." – Charles Dow

Wednesday (we did not like the Fed minutes and I posited my theory for the next week, as above):

Wednesday (we did not like the Fed minutes and I posited my theory for the next week, as above):

- DIA March $122 puts at $4.10, now $3.30 – down 18%

- GLL Jan $18 calls at .80, now .50 – down 37%

- FAS 1/6 $65 pus sold for .78 ($25KP), expired worthless – up 100%

- TNA Jan $43 puts sold for $2, now .45 – up 77%

- TNA Feb $43/49 bull call spread at $3, now $3.30 – up 10%

- QQQ Jan $58 puts at $1.10 ($25KP), now .62 – down 43% (had a stop at .95)

- NAK Aug $6 buy/write at $3.80/4.90, now $6.31 – on track for 58% gain

- Dow (/YM) Futures short at 12,350 – still there.

- Oil (/CL) Futures short at $103.75 – now $101.70

Those last two Futures shorts were from the end of Wednesday's chat/Thursday morning and I did a nice play-by-play call of the trades between 2:59 am and 3:52, where we caught the Dow down to 12,300 and oil down to 102.85 – enough to pay for the old Egg McMuffins.

Thursday: In the main post, I called BAC my "One Trade" for 2012 – saying if you want to be bullish, you can just buy my BAC spread and walk away. This was a rare case of initiating a trade in the main post and not in Member Chat but we don't mind giving out samples once in a while…

- BAC 2013 $5 buy/write (see post for all details) at $3.20/4.10, now $6.58 – on track for 56% gain

- FAZ 2013 $40/60 bull call spread (small hedge to BAC) at $3.10, now $2.45 – down 20%

- FAZ 2013 $20 puts sold for $3, now $3.20 – down 7%

- BKS Feb $10 puts sold for $1.20 ($25KP), now .60 – up 50%

- BKS at $10.50, now $11.70 – up 11%

- BKS 2013 $10 puts sold for $3, now $2.50 – up 17%

- VLO June $18 puts sold for $1.75, now $1.40 – up 20%

- BBY 2014 $18/27 bull call spread at $4, now $4.60 – up 15%

- BBY 2014 $18 puts sold for $3.10, now $2.65 – up 14%

- Shorting Oil Futures at $102.40, now $101.50

- Shorting Oil Futures again at $103, now $101.50

- QQQ 1/13 $58 puts at $1.05 ($25KP), now .62 – down 41%

Notice that, in our $25KP, we are taking a beating (so far) compared to our more balanced general picks. That's because it's a short-term, VERY AGGRESSIVE virtual portfolio where we're aiming to hit $100,000 by the year's end (otherwise we underperform last year by a mile) and you don't make 300% a year by sitting on the fence! So, as I mentioned above, we went short to the point of getting nervous yesterday morning – hopefully our theory will be right and we'll be off to a good start for the year.

Friday – I strongly reiterate my CASH call for the majority of our Portfolios, markets too dangerous to call:

- Shorting Dow (/YM) Futures at 12,350, still 12,350

- QQQ 1/13 $58 puts at $1, now .60 – down 40%

- CASH!!!!

- DIA 3/31 $120 puts at $3.35, still $3.35 – even

- 2 SQQQ Jan $19 puts at $1.45 ($25KP), now $1.70 – down 18%

- 6 SQQQ Jan $17/18 bull call spreads at .55 ($25KP), now .50 – down 9%

- CASSSSSSSSSSSH!!!!!! (from the Morning Alert to Members)

- HOV at $1.65, now $2.05 – up 24%

- HOV 2014 $1 puts sold for .50, now .45 – up 10%

- HOV 2013 $1/2 bull call spread at .35, now .45 – up 29%

- GLL Jan $18 calls at .65 ($25KP), now .50 – down 23%

- VXX 1/13 $32/33 bull call spread at .30, now .13 – down 56%

- VXX 1/13 $30 put sold for .35, now .39 – down 11%

- 5 NFLX Jan $90 calls sold for $3.50 ($1.750), now $8.20 – down 134%

- 3 NFLX March $100 calls at $6.60 ($1,980), now $11.20 – up 70%

- GLW at $13.50, now $14 – up 4%

- GLW 2014 $12 puts sold for $2.35, now 2.10 – up 11%

- GLW 2013 $10/15 bull call spread at $2.85, now $3.50 – up 23%

Here's a good lesson about options. We had 3 ways to play GLW and you could just buy the stock to be bullish and made 4% or you could commit far less that $13.50 to short the $12 puts for a net $9.65 entry, worst case and you make 11% or you can hedge your bet and commit just $2.85 and you not only make 23% in less than a week but you make .65, which is more than you would have made committing 5x more to owning the stock. Silly, silly stock traders – when will you learn?

- 5 AAPL March $425/450 bull call spreads at $10 ($5,000), now $10.10 – up 1%

- 1 AAPL July $350 put sold for $12.50 ($1,250), now $11.25 – up 10%

- 2 AAPL Feb $450 calls sold for $6.25 ($1,350), now $6.10 – up 2%

That last one is another bit of options fun as we're taking advantage of high earnings premiums to commit very little cash ($2,400) towards a potential cash out at $12,500 if all goes well (AAPL under $450 in Feb but over in March) with lots of ways to win in between. That one is still close enough to play from scratch.

Well, that was last week but now I'm out of time, maybe I'll do this week over the weekend as it's a nice review for newer Members to go over what is working and what is not as we head into full-blown earnings season next week. Overall, in our first week of 2012, we had 35 winning trade ideas and 19 that we haven't turned around yet (and I'm only kind of joking as turning around those losing trades is how we make our money in the $25KP).

We'll see how things go into the 10-year auction. If it goes well, they can afford to use the Beige Book (2pm) to flip the markets back up as the 30-year note auction of $13Bn tomorrow is a rounding error to the Fed!

And wheeeeeeeeeee!