11,939.61 – That was the March low!

11,939.61 – That was the March low!

11,670.19 – That was the 2006 high! We may find out tomorrow whether or not we can hold the March low, after that it's going to be all about 11.670.19 and then 11,500 and then we'll start hearing some very nasty numbers as this entire planet starts to unwind.

The last time the Dow was below 12,000, the Hang Seng was at 18,659 – that's 6,456 points (35%) down from here! I thought we were in pretty good shape as the Hang Seng bounced off the 200 dma last night and closed back over 25,000 but Bernanke just flat out terrorized the nation with his very, very, very poor use of the microphone in our nation's hour of need. As I said to members this morning, you can't have a crisis of confidence when you have a fiat currency (not backed by…. well, anything) and Bernanke is certainly no Greenspan. In fact, he's no Volker either. Actually, he's more like the parking lot attendant who just dented your car and has no possible way to pay for it.

- Before we discuss the mess in Congress today, let's review the mood when we got there:

- Ahead the bell we got Building Permits and Housing Starts that were 10% below consensus

- We got terrible but expected numbers from MER

- We got terrible and "unexpected" numbers from ABK

- My comment at 9:38, while we were still positive, was: "No lovin’ from Apple and Goog but the other shoe is dropping on Financials and, unfortunately, I think that shoe belongs to a centipede so it is far from the last!"

- We bravely bought some calls in the morning – so far, so bad!

-

At 10:01 we got a hold of Ben's statement and I quickly said: "Ben with major mixed messages in his statement AND Philly Fed sucks!!! So much for this rally for now."

At 10:01 we got a hold of Ben's statement and I quickly said: "Ben with major mixed messages in his statement AND Philly Fed sucks!!! So much for this rally for now."

- 10:11 – "Things must be bad, Ben sounds like he’s going to cry!"

- For those of you playing the LVS home game, we rolled down to the Mar $75s and covered with Jan $75s at that point.

- 10:19 – We went for Feb QID calls to stop some bleeding.

- 10:33 – "Uh, but, uh, ummm… Holy cow I'm buying more gold as he speaks!"

- 10:36 – "Speaking note for Fed chairmen: Try not to say “Trillion” and “losses” in the same sentence!"

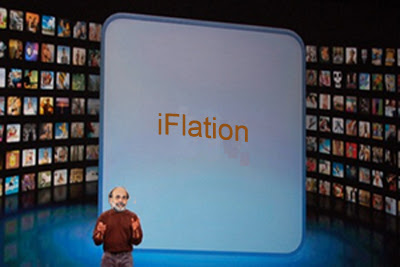

It was all downhill from there. Bernanke's speaking style leaves a lot to be desired at the best of times and these were certainly NOT the best of times. Meanwhile – How on top of things is Ron Paul? Here he is back in November telling Bernanke what's up (it was inflation). Here's a best of Ron Paul video and here's one of Ben's testimony today, talk about a mismatch! Here's Jim Rogers, who was so sure it was over that he actually LEFT the country and moved to China this summer, telling us how screwed we are. And, finally, here is our President last week, lying to us about the economy with Bernanke and Paulson at his side.

At 10:51, I said to members: "This is the kind of thing you don’t get from history books, they record the speeches but it’s so hard to recapture the tone of the moment, the panic, the news of the day, the way this guy’s voice inspires no confidence. With Bernanke it’s like an interrogation that he’s cracking under, with Greenspan it was like he was so far above the Congresspeople that they were the ones afraid of asking a dumb question and almost no one would ever go against what he said. Right or wrong, that guy made you think that at least someone in the government had a handle on things… With a fiat (non-backed) currency, it’s ALL about confidence and Bush’s choice of a weak Fed chair who would buckle to his pressure has caused a much bigger problem for our markets than it had to be."

At 10:51, I said to members: "This is the kind of thing you don’t get from history books, they record the speeches but it’s so hard to recapture the tone of the moment, the panic, the news of the day, the way this guy’s voice inspires no confidence. With Bernanke it’s like an interrogation that he’s cracking under, with Greenspan it was like he was so far above the Congresspeople that they were the ones afraid of asking a dumb question and almost no one would ever go against what he said. Right or wrong, that guy made you think that at least someone in the government had a handle on things… With a fiat (non-backed) currency, it’s ALL about confidence and Bush’s choice of a weak Fed chair who would buckle to his pressure has caused a much bigger problem for our markets than it had to be."

Sadly, just a few minutes later, at 10:55, it was already too late to save the markets as Ben put his foot right in it: "Holy cow – He’s saying massive aid is required soon or it will be too late to help! NYSE broke 9,000, Nas below 2,400, Dow near 12,350, S&P 1,359, Rus below 700… so bad!" 9 minutes later, one of the Congresspeople mentioned that it was possible that our Treasury Bonds may lose their AAA credit ratings WITHIN 10 YEARS! Now I'm all for full disclosure but that would be one of my exceptions! I also added "Housing Burst" to the list of things it would be better for a Fed Chairman NOT to say.

There was nothing left to do for the rest of the day but buy more puts and try to laugh. It was kind of like watching a slow-motion train wreck as the markets went down, and down, and down, and down for the rest of the day. Now we have to sit here like idiots waiting for the government brain trust to find some way to bail us out, but we're not going to be holding our breath, as I said at the top, we could be a long, long way from the bottom here.

Sorry to be depressing about it, but it was a depressing day. The best laugh came from CNBC who used the space where they usually title a segment to say: "Hey, at least you still have your health." That pretty much summed it up for the day! We have a lot of thinking to do tomorrow and it's going to be very hard to make any decisions ahead of what I sincerely hope will be some kind of something other than more tax cuts coming from the White House tomorrow morning.