Courtesy of Mark Perry at Carpe Diem. CARPE DIEM is Latin for "Seize the Day."

Why Today is Different From the Inflationary 1970s

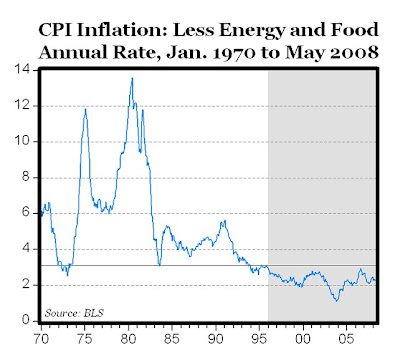

Also, compared to a recent peak close to 3% during 2006, the core inflation rate is lower today, and has been generally declining since late 2007.

Rising energy prices alone cannot cause inflationary increases in all goods and services, as the situation today suggests, with core inflation remaining low and stable despite rising energy prices. Keep in mind also that during the double-digit inflation in the U.S. during the 1970s, fueled by expansionary monetary policy, the German central bank demonstrated much greater monetary restraint, and inflation in Germany never exceeded 8% in any year during the 1970s and averaged only 5% during that decade (despite experiencing the same increase in world oil prices as the U.S.).