Qualcomm Tries to Woo Investors with Massive Buyback and Dividend Hike

Courtesy of Ockham Research

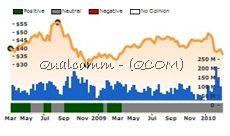

San Diego-based technology giant Qualcomm (QCOM) has been in a steady downtrend since the beginning of 2010 falling nearly 30% from the high point in January. Much of the decline was in response to a weaker than expected revenue outlook and expected margin pressure for the year ahead, even though the company reiterated their earnings guidance shares fell more than 14% on that day. Today, the stock continued its now 7 day consecutive slide, with the technology sector leading the market higher, QCOM fell by another 3%. This is not the sort of performance one would expect from a company that is deeply tied to one of the market’s hot sectors, with a market leading position in producing computer chips for mobile devices.

Desperate for some good news, management has taken action to combat the declines; they announced a 12% increase to quarterly dividends as well as authorization of a $3 billion share repurchase. The new quarterly dividend of $.19 will be effective on payments after March 28th, and the $.76 annual payout implies a 2.1% yield. Also in the press release, the company’s trumpeted that it has returned $12.6 billion to shareholders dating back to 2003, which is certainly commendable. However, the share repurchase comes with no expiration, so they get the benefit of the good press with no implied time-table to spend the cash should better uses for capital arise.

These shareholder-friendly moves have sent shares higher in after hours trading, but will this be the silver bullet that will turn QCOM stock around? Analysts and investors have been scared off by falling average unit selling prices on some of their products, but we think those concerns at this point have been nearly priced in. While there still may be some further downside, we think the value has become attractive following the pressure the shares have been under.

These shareholder-friendly moves have sent shares higher in after hours trading, but will this be the silver bullet that will turn QCOM stock around? Analysts and investors have been scared off by falling average unit selling prices on some of their products, but we think those concerns at this point have been nearly priced in. While there still may be some further downside, we think the value has become attractive following the pressure the shares have been under.

As of the beginning of this week, we rated QCOM as Fairly Valued, but was very close to the threshold to upgrade it. Any further decline in price or improvement in fundamentals may be enough to push it to Undervalued, and the dividend increase will clearly be a positive fundamental factor. In addition, QCOM’s historical price-to-sales has ranged from 6.8x to 11.6x, but the current metric is only 5.8x. This company has lowered prices on their chips, but earnings growth remains impressive. For long term investors, we think QCOM may be a stock to keep on your radar because it has fallen out of favor despite strong underlying fundamentals.