GRANDPA JOE: But this roof is made of glass. It’ll shatter into a thousand pieces. We’ll be cut to ribbons!

GRANDPA JOE: But this roof is made of glass. It’ll shatter into a thousand pieces. We’ll be cut to ribbons!

WILLY WONKA: Probably.

Is today going to be the day? After pressing against our breakout levels all week, today do we should finally have the gas to get over the top or will our 7.5% levels keep acting like a solid barrier? Oddly enough, I was asking the same question (with the same title post) on August 5th, when we were trying to break out over our 5% lines of Dow 10,710, S&P 1,123, Nas 2,310, NYSE 7,140 and Russell 666. At the time I concluded that the only way we were going to do that was if the Fed gave us more Quantitative Easing.

We were, at the time, at the top of a very bogus-looking, low-volume rally that had taken us up 10% from 9,700 in early July to 10,680 on August 4th. The Dow and the Nasdaq were our leaders but the Russell kept flashing warning signs as it failed to hold it’s satanic 666 target and, on Aug 2nd, just like on October 5th, we had a big, silly jump up to what we were pretty sure was a blow-off top. Despite being dead right to call a top at the time – it took the market another week to drop but we fell off a cliff on Wednesday, August 10th and we were back at 10,200 on the 11th so better a week early than a week late with these calls.

Willy Wonka understood stock market physics, there had to be enough power to getthrough that overhead resistance or it was going to be a very painful test of the top (like the one we had in August). Since our last dip, we’ve come back for another try but the volume has been substantially lower than it was in Aug, leading us to believe it is only TradeBots, and not Oompa Loompas, who are buying this market. Can TradeBots alone give us enough "thrust" to break through this time? It shouldn’t be THAT hard, in April we had highs of Dow 11,258 (5.6% higher than 10,680), S&P 1,219 (7.5% higher), Nas 2,535 (9.2%), NYSE 7,743 (7.2%) and Russell 745 (11.1%) so it’s not like we’re asking for a lot with our little breakouts, are we?

Willy Wonka understood stock market physics, there had to be enough power to getthrough that overhead resistance or it was going to be a very painful test of the top (like the one we had in August). Since our last dip, we’ve come back for another try but the volume has been substantially lower than it was in Aug, leading us to believe it is only TradeBots, and not Oompa Loompas, who are buying this market. Can TradeBots alone give us enough "thrust" to break through this time? It shouldn’t be THAT hard, in April we had highs of Dow 11,258 (5.6% higher than 10,680), S&P 1,219 (7.5% higher), Nas 2,535 (9.2%), NYSE 7,743 (7.2%) and Russell 745 (11.1%) so it’s not like we’re asking for a lot with our little breakouts, are we?

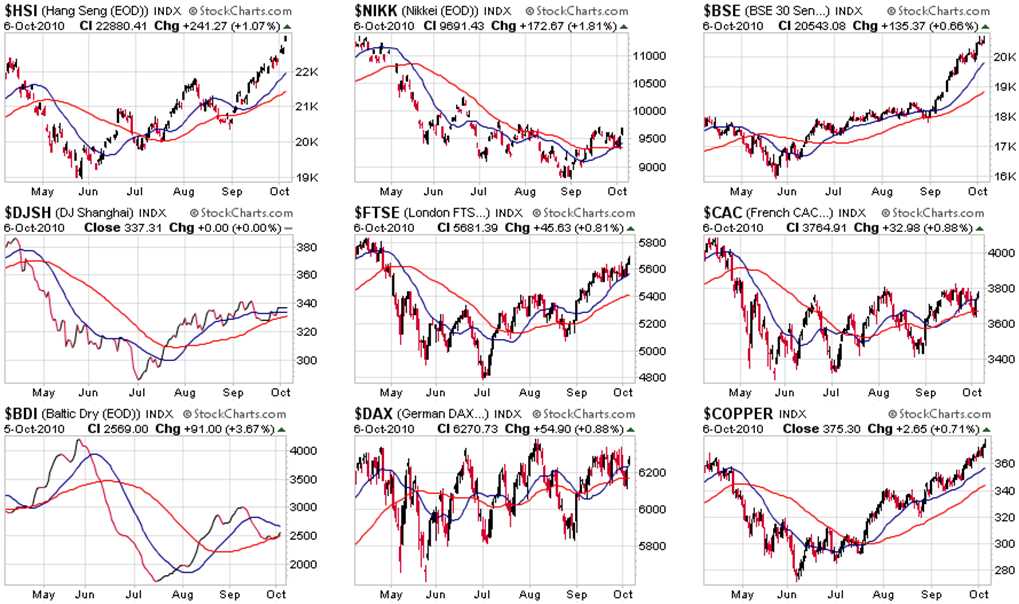

SOX were 404, now 345 (down 14.6%), Transports were 2,279, now 2,291 (up 0.5%) and have been our leader so we’re watching them closely but what an odd discrepancy with the SOX, who have generally been reporting good earnings (although Samsung’s guidance today was disturbing). Internationally, the Hang Seng is off 4.6% (from 24,000), 12.3% on the Shanghai (3,026), 15.1% on the Nikkei (11,408) but the BSE is UP 11.7% – leading all global markets (except Mexico) at 18,172! Not far behind India is Germany’s DAX, are down just 1% this morning at 6,275 vs April’s high of 6,341. The FTSE is more in line with other indices, down 2.5% from 5,833 and the CAC is also down 7.6% from 4,086. As I mentioned yesterday, the Dollar is down 13% (and still falling) since June while Copper is up 32% (and way over the early April high of $3.68 at $3.76), gold is 22.7% above April’s close (and we shorted it now) at $1,360 and oil went wild yesterday (another short – see post, Member Chat) and finished the day $1 over our $82.50 upside target, but still 4.5% below April’s ridiculous close. Mixed signals to say the least!.

Today we have Jobless claims and tomorrow we get the Non-Farm Payroll Report. Less than 450,000 jobs lost and more than 100.000 net jobs gained can give us the push we need to break up and out as QE2 now seems to be in the bag, regardless of any short-term improvements in the economy. India is through the roof and breaking the bounds of market gravity and the Nikkei, the World’s lagging index, made the biggest gain this week (up 4.5%) but STILL 47% off the Feb 2007 high of 18,215. We expected this run on Yentervention and I suggested playing the EWJ Apr $10 calls at .40 in my Sept 10th post. Those have now hit goal at .60 (up 50%) so be very careful here!

Today we have Jobless claims and tomorrow we get the Non-Farm Payroll Report. Less than 450,000 jobs lost and more than 100.000 net jobs gained can give us the push we need to break up and out as QE2 now seems to be in the bag, regardless of any short-term improvements in the economy. India is through the roof and breaking the bounds of market gravity and the Nikkei, the World’s lagging index, made the biggest gain this week (up 4.5%) but STILL 47% off the Feb 2007 high of 18,215. We expected this run on Yentervention and I suggested playing the EWJ Apr $10 calls at .40 in my Sept 10th post. Those have now hit goal at .60 (up 50%) so be very careful here!

I’ve already sent out a Morning Alert to Members with a chart that indicates a very disturbing divergence between the S&P and interest rates. The last time we had this much of a gap between the 10-year rates and the SPY was 2008 – and that was not a year that ended very well! From the "Phil’s Favorites" section of our web site, Graham Summers points out that the ONLY reason stocks have rallied this month is courtesy of BILLIONS of dollars of cash the Fed has been pumping into Wall Street – TIMED SPECIFICALLY TO COINCIDE WITH OPTIONS EXPIRATIONS WEEKS. How much? Well try $31Bn on April 15th, $10Bn on May 13th, $12Bn on June 17th and $8.6Bn on July 15th (we don’t have the Aug numbers yet). April held us up until the flash crash (as you would think $31Bn would) and we got a little pop from May and June was enough to keep us going until that Friday but, by July, it was getting expensive to maintain 10,400 and $8.6Bn was just not enough and that failed with a huge expiration day sell-off. August expirations were also weak as the Fed was winding down QE1 so it’s no wonder that they announced QE2 in September and even less wonder that that rallied the markets, right?

Mike Snyder points out why you will never hear this stuff from the MSM, as pretty much everything you see, hear or read is controlled by 6 corporations – down from 50 in 1983, before Reagan deregulated the media to "foster competition." What you will hear today is BUYBUYBUY with Jim Cramer coming on the Today Show to spread the madness and an 8:30 drop in jobless claims to "just" 445,000 jobs lost last week, which was 10,000 (2%) less than expected and that was enough to pop the Dow futures 60 points, with the S&P futures back at the 1,160 mark.

We are not going to fight the tape, or the Fed, here. We went to cash so we could play either way. We already have our bearish bets and there are lots of nice, upside trades we can take (we looked at several in yesterday’s Member Chat). Retail Sales have been coming in generally well but TGT missed by a lot (up 1.3% vs 2.2% expected) and GPS was down 2% vs up 0.2% expected. M was strong at +4.8% and we already knew COST was going to beat (up 5% vs. 4.5% expected) and ZUMZ is the most impressive specialty retailer, up 17% this Q with LTD getting honorable mention, up 12%. PEP earnings came in on target at $1.22 for Q3 and it’s the same old success story with International Sales driving growth and US sales forcing a cut to guidance. They fell to $66 pre-market and I like them there for a long-term play.

We are not going to fight the tape, or the Fed, here. We went to cash so we could play either way. We already have our bearish bets and there are lots of nice, upside trades we can take (we looked at several in yesterday’s Member Chat). Retail Sales have been coming in generally well but TGT missed by a lot (up 1.3% vs 2.2% expected) and GPS was down 2% vs up 0.2% expected. M was strong at +4.8% and we already knew COST was going to beat (up 5% vs. 4.5% expected) and ZUMZ is the most impressive specialty retailer, up 17% this Q with LTD getting honorable mention, up 12%. PEP earnings came in on target at $1.22 for Q3 and it’s the same old success story with International Sales driving growth and US sales forcing a cut to guidance. They fell to $66 pre-market and I like them there for a long-term play.

Normally, strong retail sales would give us a stronger dollar (more demand for dollars makes them more valuable) but this market is not normal and expectations are being ratcheted up daily for how much Global Quantitative Easing we will get. That is driving the dollar to new lows and we have to guard against the possibility of this causing an inflation shock. It does look like we went short too early but we’re not going to whine about it – we just need to find some upside covers to take advantage of the move up.

We expect at least a pop back to Nas 2,400 this morning – anything less than that and we stay bearish. A very simple way to play for additional upside is something like the XLF Nov $14/15 bull call spread at .60, selling the $15 puts for .65 so that’s a nickel credit on the $1 spread that’s currently .80 in the money. That’s why we don’t fear a break up, we can make a 2,000% profit in a month if this rally is real – all they have to do is sustain this BS through earnings!

Let’s take a look at the big picture on our multi-charts. As I mentioned, the BSE is off to the races and the Nikkei is clearly lagging. Why? Well, India’s economy is tiny and Asia is booming so they are getting a lot of benefit from that, as well as the continued outsourcing of US jobs (how do you think all these corporations are growing without hiring?). Interestingly, no one is actually shipping anything and the Baltic Dry Index is floundering at the breakdown line of 2,500. The Shangai finishes their vacation today and if we have a green day, then FXI ($44.23) should get a nice pop tomorrow as China’s junior index plays catch-up.

We can’t be comfortable if SOME of our global indexes look good. We need to see France get over the 3,800 mark on the CAC and the FTSE and DAX need to break their April highs as well. We’re close – but let’s not break out the cigars just yet! Turning to our US set, it’s obvious we have a lot of work to do. The SOX are especially weak and Samsung didn’t help today so we’ll have to see what earnings season brings us. The transports are leading the Dow higher, which is strange with the BDI still struggling but I guess everyone is using PCLN to book their next trip so expectations are high, high, high:

It’s going to be a lot of work for the markets to catch up to gold. A nice 4,000% upside play on the markets doing well for another month is similar to the XLF play, using SSO (ultra-long S&P) with a Nov $39/43 bull call spread at $2.10, selling the $40 puts for $2 so it’s net .10 to make up to $4 if SSO rises to $43 by November expirations. SSO is currently at $40.68 so this trade starts out over 1,500% in the money – again, we do not fear the upside – we just don’t trust it yet!

So we continue to walk the difficult, bearish path for the moment and we’ll likely find some nice downside plays on the weeklies today but there’s no way to be sure until after the bell so stay tuned in Member Chat!

And – be careful out there!