GRANDPA JOE: But this roof is made of glass. It’ll shatter into a thousand pieces. We’ll be cut to ribbons!

GRANDPA JOE: But this roof is made of glass. It’ll shatter into a thousand pieces. We’ll be cut to ribbons!

WILLY WONKA: Probably.

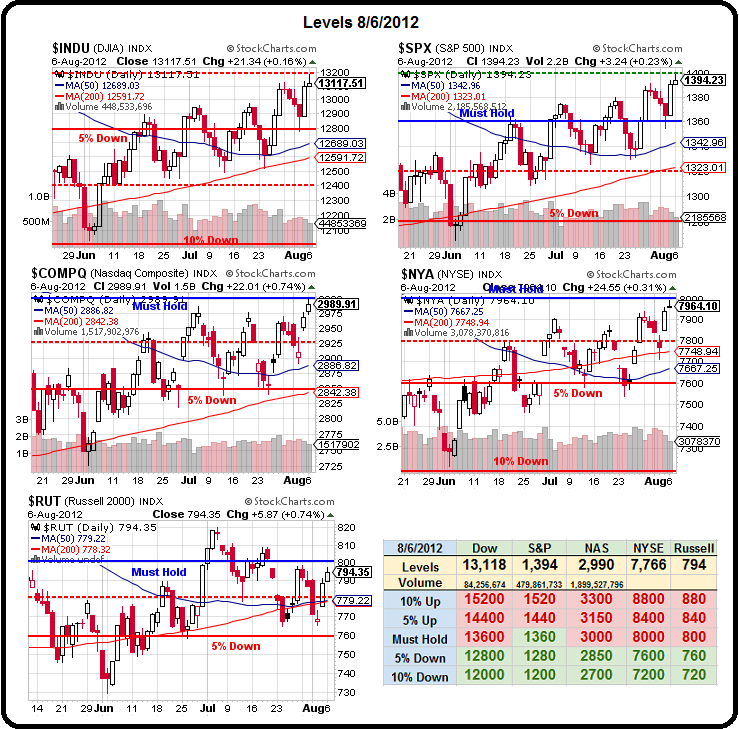

Is today going to be the day? After pressing against our breakout levels on and off since failing them in May, today do we should finally have the gas to get over the top or will our Must Hold levels keep acting like a solid barrier? Our goals on the Big Chart have been Dow 13,200, S&P 1,400, Nas 3,000, NYSE 8,000 and Russell 800 and we came right up against them yesterday but failed to punch through.

It is certainly no surprise, in this BS manipulated market, that the levels they failed to take out yesterday in regular trading are all being crossed in ultra-light pre-market trading because, as we know, investors are complete idiots who use squiggly lines on a chart to make all of their major financial decisions. Essentially, when you follow TA – you are saying to hedge fund managers – "If you can get your stock to cross this line, I will buy it." That's very much like me saying to my youngest daughter that if she can get her older sister to say "quit it," I will give her $20. Once she decides I'm serious – I'd be hearing "quit it" all day long.

We were, at the time, at the top of a very bogus-looking, low-volume rally (again) that had taken us up 7.5% from 12,100 in early June to 13,187 at yesterday's high. The S&P has been our leader but the Russell keeps flashing warning signs as it failed to hold it's -2.5% line (780) at the beginning of the month and looking very similar to the pre-disaster pattern we had in April, ahead of the May collapse – which we also tried to warn you about while it was on the way up on QE rumors (see "Federally Fueled Thursday – QE Maybe?" or "Thank GDP it's Friday – Reality Check?". Despite being dead right to call a top at the time – it took the market another week to drop but we fell off a cliff on Friday, May 4th and we were down 1,000 points by the 18th so better a week early than a week late with these calls.

Willy Wonka understood stock market physics, there had to be enough power to get through that overhead resistance or it was going to be a very painful test of the top (like the one we had in April). Since our last dip, we’ve come back for another try but the volume has been substantially lower than it was in April, leading us to believe it is only TradeBots, and not Oompa Loompas, who are buying this market. Can TradeBots alone give us enough "thrust" to break through this time? It shouldn't be THAT hard, in April we had highs of Dow 13,338, S&P 1,415, Nas 3,085, NYSE 8,211 and Russell 830 so it's not like we're asking for a lot with our little breakouts, are we?

Willy Wonka understood stock market physics, there had to be enough power to get through that overhead resistance or it was going to be a very painful test of the top (like the one we had in April). Since our last dip, we’ve come back for another try but the volume has been substantially lower than it was in April, leading us to believe it is only TradeBots, and not Oompa Loompas, who are buying this market. Can TradeBots alone give us enough "thrust" to break through this time? It shouldn't be THAT hard, in April we had highs of Dow 13,338, S&P 1,415, Nas 3,085, NYSE 8,211 and Russell 830 so it's not like we're asking for a lot with our little breakouts, are we?

SOX were 418, now 390, Transports were 2,452, now 2,111 (down 14%!) so there goes Dow Theory out the window, right? Internationally, the Hang Seng is off 5% (from 21,400), 12% on the Shanghai (was 306, now 269), 10% on the Nikkei (9,691) but the BSE is UP 1% – leading all global markets (except Mexico) at 17,412! Not far behind India is Germany's DAX, which made it back to flat yesterday at 6,918 vs April's high of 6,875. The FTSE is also flat at 5,808, just 10 points under the April high and the CAC is now up 3%, after putting on a 5% move in the past two days.

This is not bad considering the Dollar is up 5% since April (78 at the time) but Copper is down 15% at $3.44 – which is very weak. Gold was $1,675 in April's and oil was $106 and now back to $92.50. Mixed signals to say the least!.

Today we have Consumer Credit, which is way up and should be seen as a positive catalyst. Tomorrow we get Q2 Productivity and Labor Costs and, of course, Crude Inventories. The rest of the week is dull for data, with Wholesale Inventories and Trade Data on Thursday and Import-Export Prices on Friday along with our joke of a Treasury Budget. If we are breaking the bounds of market gravity the Nikkei is a nice lagging index and we can play them bullish with EWJ Sept $9 calls at .27 with that ETF at $9.11. Even if we only get a pop back to $9.50, where we opened July, it's a nice double!

Today we have Consumer Credit, which is way up and should be seen as a positive catalyst. Tomorrow we get Q2 Productivity and Labor Costs and, of course, Crude Inventories. The rest of the week is dull for data, with Wholesale Inventories and Trade Data on Thursday and Import-Export Prices on Friday along with our joke of a Treasury Budget. If we are breaking the bounds of market gravity the Nikkei is a nice lagging index and we can play them bullish with EWJ Sept $9 calls at .27 with that ETF at $9.11. Even if we only get a pop back to $9.50, where we opened July, it's a nice double!

We still have our very bullish Income Portfolio, which we just updated in this morning's Member Chat, taking advantage of still-low prices on SBUX and ABX to press our long-term positions. We added BBY yesterday as well as we seem to be the only ones taking the $25 buy-out offer seriously (the stock is still at $19.65!) – talk about people looking a gift-horse in the mouth! Those positions are all for 2014, though. In our shorter-term $25,000 Portfolios (see Stock World Weekly for recent update), we followed our morning plan to cash out our bullish winners into yesterday's rally and positioned ourselves for a drop. Since we are so close to breaking over our levels – they make very easy stops and we can re-position bullish if the market insists on going up.

Even if the market does jump higher on some actual stimulus news (and Boston Fed's Rsengren made a case for aggressive QE this morning, jacking up the Futures at 7:30 and again at 8:50 by coming on CNBC and saying it again), we are still liking our mid-term Long Put List (see Friday's update) because it's very doubtful they will put in enough stimulus to sustain 1,400 on the S&P. We're up 7.5% from the June lows already and that's 120 S&P points and not even $500Bn of actual G20 stimulus has been committed so we're still about $700Bn short (at $10Bn per point – which is the current price for false hopes with a 6-month duration).

That money better come fast as we're still getting plenty of negative signals (and a few positive ones – like expanding credit – which is a double-edged sword, of course) like German Factory Orders falling 1.7% in June vs. -1% expected with domestic orders down 2.1% and Eurozone orders down a whopping 4.9%. Imagine how far they'd fall if they went back to the Deutsche Mark and the rest had to exchange their worthless currency for BMWs…

Our crops are getting worse and worse with 39% of our soybeans now rated "poor to very poor" (up from 37% last week) with 50% of our corn getting the lowest rating (up from 48% last week) in the 9th consecutive weekly decline in crop quality. The Wells Fargo Small Business Index fell 25% – from 23 to 17 as of July 9th, erasing the whole year's gains with a whopping 43% of the business owners surveyed expecting declining revenues over the next 12 months. In another survey of CEO's, sentiment fell from 65.1 in Q1 to 60 in Q2, so even Big Business is getting a little nervous about the economy.

Our crops are getting worse and worse with 39% of our soybeans now rated "poor to very poor" (up from 37% last week) with 50% of our corn getting the lowest rating (up from 48% last week) in the 9th consecutive weekly decline in crop quality. The Wells Fargo Small Business Index fell 25% – from 23 to 17 as of July 9th, erasing the whole year's gains with a whopping 43% of the business owners surveyed expecting declining revenues over the next 12 months. In another survey of CEO's, sentiment fell from 65.1 in Q1 to 60 in Q2, so even Big Business is getting a little nervous about the economy.

The ICSC Retail Store Sales Index (small business) was flat this week and now up just 1.4% for the year vs up 1.8% for the year last week but Redbook Chain Store Sales (big business) ticked up 2%, albeit after taking a nasty tumble since Easter.

So we've positioned ourselves and now all we can do is watch and wait to see if we do indeed go through that roof or if, as we expect, this low volume rally shatters on impact and brings us back to reality.