Thank you Madam Chairwoman!

Thank you Madam Chairwoman!

Not that Yellen said anything of substance but that won't stop her from saying it again this morning (9:30) so let the rally continue – for another day, at least.

Yellen made an congressional appearance yesterday, where she argued the economy “needed more help”. She didn’t articulate how the Fed might help given the ongoing taper, although ZIRP would continue for a considerable time which bulls took to mean “indefinitely”.

Oddly she also suggested small cap stocks were near bubble conditions but then said she couldn’t see any bubbles. All in all, it was the kind of obfuscating testimony that would have made Alan Greenspan proud.

As Dave Fry notes on his Dow chart, that index is just window dressing for the tourists, with 7 stocks (AXP, CVX, JNJ, MCD, MMM, UTX and V) accounting for ALL of the Dow's gains yesterday in this stupidly price-weighted index.

As Dave Fry notes on his Dow chart, that index is just window dressing for the tourists, with 7 stocks (AXP, CVX, JNJ, MCD, MMM, UTX and V) accounting for ALL of the Dow's gains yesterday in this stupidly price-weighted index.

The Russell is clearly in trouble and tested that bottom bar at 1,080 again (1,088 was the low) early in the morning and we caught the turn on the nose in our Live Member Chat room, when my 10:25 comment to our Members was:

Wow, what a ride! Gotta take some profits off the table on the Futures shorts – people don't like Janet's testimony but she can still pull it out with the Q&A. /NQ at 3,500 – that shouldn't go down easy. Actually it's a good bullish bounce play, as is 1,090 on /TF (with very tight stops). /YM 16,300 is also a good line – go long on the laggard.

As you can see from the intra-day SPY chart – the timing of that call could not have been better! The Dow finished the day back at 16,500 and, at $5 per point per Futures contract, that made a $1,000 per contract on that call. We took $1,000 and ran when the Russell hit 1,100 but then got a chance to reload for a ride to 1,110 later that day (+$2,000 per contract).

The Nasdaq Futures (/NQ) went all the way back to 3,550 – also good for $1,000 per contract gains. In case you missed it, we did a whole Futures Trading Webinar on Tuesday.

Of course, it's not all Futures trading at PSW – that's just how we amuse ourselves while we wait for longer-term trade ideas to play out. RIG, for example, who I've been pounding the table on all year, just had great earnings and should be back over $45 shorts (we were buying below $40). Those are the kinds of trades we commit big money to in our Long-Term Portfolio – the short-tem stuff just gives us something to do, though it also serves as a quick hedge should the market turn on us.

Yesterday, for example, in the morning post (which you would get pre-market if you SUBSCRIBED HERE) we had a $700 credit on an earnins spread on FSLR, selling 5 July $75 calls for $3 ($1,500) and buying 4 Jan $77.50/85 bull call spreads for $800 to cover. Anything under $75 is at least a $700 per unit winner for us and, oddly enough, the stock spiked UP at the open, so you could have still gotten that trade in the morning for a huge daily profit.

Yesterday, our earnings play was on TSLA, and I sent out an Alert to our Members to add it to our Short-Term Portfolio, saying the following at 2:35 in Live Chat:

TSLA may go up on talk about Norway (where there are massive incentives for EVs) and CHINA!!! (which is CHINA!!!) but I don't see them popping $220 (up 10%) or failing $180 (down 10%) too easily as those are the 50 and 200 dmas.

I'm generally bearish on TSLA and you can sell 3 Sept $200 calls for $26.50 ($7,950) and buy 2 2016 $220/300 bull call spreads for $20 ($4,000) and sell 2 2016 $140 puts for $22 ($4,400) for a net credit of $8,350, which means you have $80 x 2 = $160 upside protection on the long spreads plus $83.50 in cash = $243.50 divided by 3 short calls = $81 of upside protection without even taking rolling into account.

Let's do a set of these in the STP and see how it plays out. THIS IS A HIGH MARGIN, HIGH-RISK TRADE – NOT FOR EVERYONE!

As expected, TSLA disappointed and dropped to about $180 after hours, which is perfect for us though we'll have to wait a while to realize our full potential on this one. We didn't want too short a time-frame, just in case we were wrong and, after all, isn't $8,350 in profits worth waiting for?

Overall, we're still short at the same index lines we were shorting yesterday and this morning I reiterated my conviction short on oil at $100.50 and we are still expecting a nice drop to $98.50, which would be $2,000 per contract in profits so, when you read a post later and we talk about making $2,000 trading oil contracts and you say "why don't I ever see trade ideas like that" – this would be one of those times…

Overall, we're still short at the same index lines we were shorting yesterday and this morning I reiterated my conviction short on oil at $100.50 and we are still expecting a nice drop to $98.50, which would be $2,000 per contract in profits so, when you read a post later and we talk about making $2,000 trading oil contracts and you say "why don't I ever see trade ideas like that" – this would be one of those times… ![]()

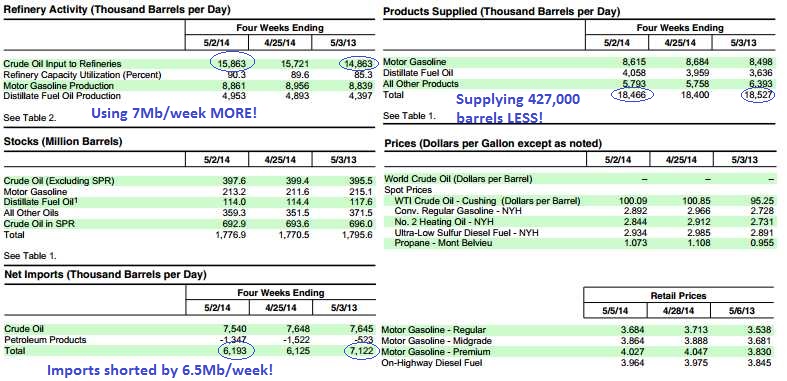

Peace is in danger of breaking out in the Ukraine and sloppy NYMEX traders have loaded themselves up with 300M barrels scheduled for June delivery when there is NO INDICATION WHATSOEVER that demand is picking up. More to the point, yesterday's oil inventory report shows what a scam it all is, with imports dropping by 6.5Mb per week from last year (which was already down 7Mb/week from the year before). Also, note that refineries are running at 90% capacity yet no additional product is making it to the supply chain. That indicates it's piling up in private storage – that's oil that will flood the market if prices start dropping.

Of course we know it's a scam – but it's a scam we understand well enough to trade against, like a roulette wheel you know comes up red 75% of the time. What do you do? Bet red, of course! Even as I'm wrting this, oil is dropping off to $100 again and – PRESTO! – another $500 per contract on those puts and the Egg McMuffins are paid for this morning.

This is why we're doing our monthy futures trading workships. Of course we can also play options on USO and SCO (and we do regularly in our Member Chat), but you can't make $500 before breakfast trading options, can you? Don't fear futures trading, we teach it to hundreds of people every year – it's just another tool you can put in your box once you learn how to manage your trading.

This is why we're doing our monthy futures trading workships. Of course we can also play options on USO and SCO (and we do regularly in our Member Chat), but you can't make $500 before breakfast trading options, can you? Don't fear futures trading, we teach it to hundreds of people every year – it's just another tool you can put in your box once you learn how to manage your trading.

Dow 16,500 (/YM), S&P 1,870 (/ES), Nasdaq 3,550 (/NQ) and Russell 1,110 (/TF) are our shorting lines in this morning's futures. We'll trade very cautiously (waiting for 3 to cross and shorting the 4th with tight stops) ahead of Yellen's 9:30 testimony but I think she's out of ammo at this point and we're likely to see new lows into the weekend. That's another good reason for us to favor downwardly biased earnings plays.