Financial Markets and Economy

Sept. 30 is historically the worst day of the year for stock-market investors (Market Watch)

September has been tough for stock investors. But if history is any guide, the last day of September may deliver one more blow to already battered markets, according to the financial blog Bespoke.

Party Like It's 2008! (Paul Price, GuruFocus)

Fall is in the air and so is fear. The Middle East is at war. Our Federal Reserve Bank is clueless about what to do. Volkswagen’s diesel deceit threatens to undermine Germany’s economic strength. Commodity giant Glencore says it is solvent, just like Lehman did back in the day. China’s national coal company is planning to fire 100,000 workers. Even employee-friendly Whole Foods Market (WFM) will be laying off 1,500 people.

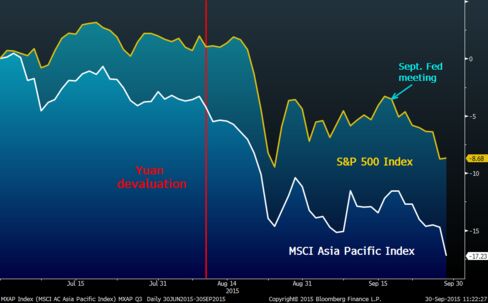

Things haven’t seemed this bad since, well, 2008. Stock market action has been bad all year but really fell off a cliff over the past couple of months.

Asian Futures Rise Amid Late U.S. Rally While Yen Holds Advance (Bloomberg)

Asian investors took heart from a late-in-the-day rally in U.S. stocks, with futures on indexes from Japan to Australia signaling gains as the worst quarter for global equities since 2011 comes to a close.

This measure of earnings hasn't really moved in 3 years (Business Insider)

Carl Icahn sees danger ahead.

In a new video, the billionaire Wall Street veteran warns that stock prices and corporate earnings have been propped up by an overly generous Federal Reserve pumping billions of dollars into the financial markets using crisis-era monetary policy.

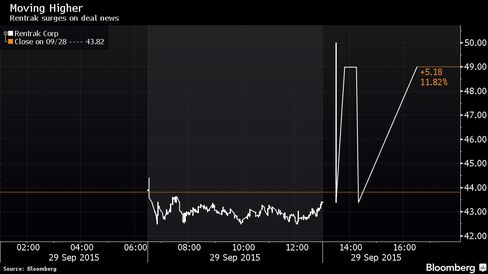

ComScore to Buy Rentrak for Over $800 Million in All-Stock Deal (Bloomberg)

ComScore Inc., the Internet researcher, agreed to buy Rentrak Corp. in an all-stock merger valued at more than $800 million, combining two media-monitoring companies to create a more formidable rival to Nielsen.

Japan just joined the global market meltdown (Quartz)

The global financial slump that kicked into high gear last month has claimed its latest victim: Japan.

Biotech bull market is dead (CNN)

The biggest bull market ever in biotech stocks has been killed by the threats from politicians to curb price hikes.

Americans are clueless when it comes to Social Security (Business Insider)

The Financial Planning Association and AARP surveyed 1,279 Certified Financial Planners and 1,215 Social Security beneficiaries between the ages of 45 and 64 about Social Security, and the results were astounding. According to the results, about half of the beneficiaries surveyed are counting on Social Security to be a major source of income during retirement with 39% of those respondents believing it will equate to 50% or more their income. However, just more than 4 in 10 CFPs believe Social Security will provide their clients a major stream of income during retirement and 94% say Social Security will make up less than 50% of retirement income…

Traders Flee Emerging Markets at Fastest Pace Since 2008 Crisis (Bloomberg)

Investors have pulled $40 billion out of developing economies in the third quarter, fleeing emerging markets at the fastest pace since the height of the global financial crisis.

Cash is king. It's better than stocks or bonds (CNN)

For the first time since 1990, cash is outperforming stocks and even most bond funds, according to Bank of American Merrill Lynch.

"Cash is king," declared Bank of America in a recent research note.

The man who delivered one of the great economic speeches in history just made a bold move to bolster India's economy (Business Insider)

While you were sleeping, the Reserve Bank of India cut interest rates.

After Oil Auction Snub, Mexico Sweetens Pot — But Is It Enough? (Bloomberg)

After Oil Auction Snub, Mexico Sweetens Pot — But Is It Enough? (Bloomberg)

Mexico is sweetening the terms of its next oil-block auction in a bid to avoid a repeat of its failed earlier attempt at opening up the industry. The big question now: Is it enough?

Investors will answer that question in a sale on Wednesday of shallow-water exploration and production blocks, only the nation’s second since it nationalized its oil industry in 1938. After global energy giants Exxon Mobil Corp., Chevron Corp. and Total SA sat out the first auction in July, Mexico rewrote the rules. This time around, the blocks are bigger, the financial terms less rigid and the government’s slice of the profits smaller.

Here's how much money Microsoft's three new businesses are making (Business Insider)

Microsoft has filed a document with the SEC giving more details on its new financial structure, which it announced yesterday.

The company is moving from five business segments to three.

Economic Takeaways of U.S. Consumer Confidence, Advanced Trade (Bloomberg)

What you need to know about Tuesday’s economic data.

Twitter has created an entirely new Wall Street ecosystem — here are the companies leading the way (Business Insider)

Twitter has created an entirely new Wall Street ecosystem — here are the companies leading the way (Business Insider)

Traders are turning to Twitter to get in front of big market-moving trends.

That in turn is creating an eco-system of companies looking to make sense of Twitter data and pull the signal from the noise.

According to a TABB Group report issued last week, the industry is growing at a rapid pace.

Cumulus Media replaces CEO after stock drop (CNN)

Cumulus Media, the nation's second-largest radio broadcaster, announced Tuesday that it will replace its chief executive next month — a change that comes after a year in which the company's share price fell by more than 80%.

BofA Said to Cut Dozens of Traders, Bankers as Revenue Drops (Bloomberg)

Bank of America Corp. is cutting dozens of jobs across the firm’s trading and banking divisions after Chief Executive Officer Brian Moynihan pledged to trim expenses amid a decline in trading revenue, according to two people with knowledge of the plans.

Crude oil falls after U.S. inventories show buildup (Business Insider)

Crude oil falls after U.S. inventories show buildup (Business Insider)

Crude oil futures fell in early Asian trade on Wednesday after U.S. inventories showed a weekly buildup that far exceeded analyst expectations.

The American Petroleum Institute (API) said late on Tuesday that U.S. crude oil stockpiles rose by 4.6 million barrels to 457.8 million barrels in the week to Sept. 25. Analysts polled by Reuters had expected an increase of only 102,000 barrels.

Yahoo investors say ‘good riddance’ to Alibaba spinoff (Market Watch)

The Internet company said it was going ahead with its plan to spinoff its stake in Alibaba despite uncertainty over the tax implications. Yahoo investors appear to be saying ‘good riddance.’

Politics

Puerto Rico Congressman: We feel like 2nd class citizens (CNN)

Puerto Rico Congressman: We feel like 2nd class citizens (CNN)

That's the message Puerto Rico's lone Congressman, Rep. Pedro Pierluisi, had for his colleagues Tuesday in a harsh rebuke of Congress' treatment of Puerto Rico.

"If you treat us like second class citizens, don't expect us to have a first class economy," Pierluisi said to the Senate Finance Committee in a hearing. "Congress treats Puerto Rico in a discriminatory fashion under numerous programs."

Donald Trump clobbers 'bankrupt' Forbes for 'embarrassing' $4.5 billion net-worth valuation (Business Insider)

Republican presidential front-runner Donald Trump trashed Forbes in an interview for a larger piece the magazine published Tuesday on the real-estate magnate's net worth.

Technology

Charge Two Gadgets at Once With the Power of the Sun (Gizmodo)

Charge Two Gadgets at Once With the Power of the Sun (Gizmodo)

Whether you spend a lot of time outdoors, or you just want to be prepared for an emergency, this 14W Anker solar panel can charge two USB gadgets at once using the power of the sun. $40 is the lowest price we’ve ever seen by $10, and its 4.4 star review average is stellar for a product in this category. [Anker 14W Dual-Port Solar Charger with PowerIQ Technology, $40.

Health and Life Sciences

Can A Blood Test Find Undetected Cancers? 'Not So Fast' Says FDA (Forbes)

Can A Blood Test Find Undetected Cancers? 'Not So Fast' Says FDA (Forbes)

Last week, the FDA made it clear that it is not happy with Pathway Genomics, a San Diego company that on September 10 launched its “liquid biopsy”—a blood test, marketed directly to consumers, that purports to find signs of undetected tumors. The product, called CancerIntercept Detect, “has not received adequate clinical validation and may harm the public health,” the FDA said in its letter. Furthermore, the FDA said, the test is being marketed as a medical device without having received approval from the agency. Pathway has until October 9 to respond to the FDA’s concerns and request for a follow-up meeting.

Rugby 'cold therapy' may not work (BBC)

Rugby 'cold therapy' may not work (BBC)

The Cochrane team found no good evidence that the therapy works.

Cryotherapy chambers – where players are exposed to air temperatures of minus 160C – were credited with being a big factor in Wales' run to the semi-finals of the World Cup in 2011.

Life on the Home Planet

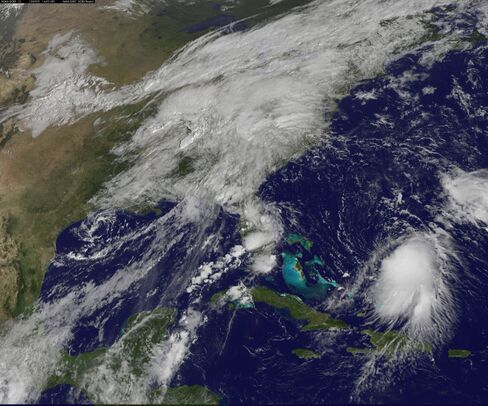

Joaquin Jumps in Strength; Hurricane Growth Possible Wednesday (Bloomberg)

Joaquin Jumps in Strength; Hurricane Growth Possible Wednesday (Bloomberg)

Tropical Storm Joaquin jumped in strength and is forecast to become a Category 1 hurricane by Wednesday, even as computer models disagree on where it will end up.