40%!

40%!

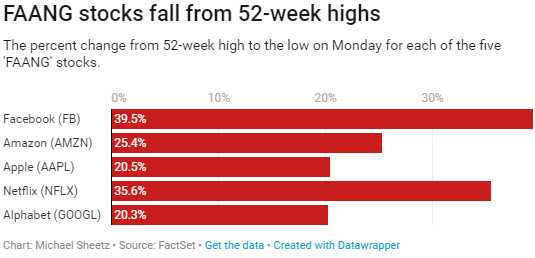

Facebook (FB) is 40% off it's 52-week high ($215) and Netflix (NFLX) is not far behind and even our beloved Apple (AAPL) is down 20% as news spreads that Apple has slashed orders from their suppliers of about 1/3 of the 70M unit production schedule for the iPhone XR, XS, and XS Max models that were unveiled at the September event. That, of course, is sending ripples throughout the tech sector as Apple's suppliers get hit hard but all tech manufactuers are now selling off in fear of some sort of sudden global slowdown because – if AAPL can't make sales – then who can?

I've been the outlier all year saying that NFLX and Amazon (AMZN) were better shorts than longs and we even made money in our Short-Term Portfolio with shorts on both of those stocks and the Nasdaq Ultra-Short (SQQQ) is the primary hedge in our portfolios but I certainly wasn't expecting Facebook (FB) to fall 40% but they have been plagued with scandal after scandal – that my Mom and her freinds know nothing about.

In other words, I don't think many of Facebook's 3.6Bn users are going to delete their accounts over privacy issues, election hacking or whatever until there's a better place to share pictures of their puppies and children. Likewise, my kids couldn't even contemplate life without Instagram and they have no idea its owned by Facebook and people in Europe aren't going to drop WhatsApp and start paying for their phone calls (much as the telcos who fund the political and media attacks would like them to).

In other words, I don't think many of Facebook's 3.6Bn users are going to delete their accounts over privacy issues, election hacking or whatever until there's a better place to share pictures of their puppies and children. Likewise, my kids couldn't even contemplate life without Instagram and they have no idea its owned by Facebook and people in Europe aren't going to drop WhatsApp and start paying for their phone calls (much as the telcos who fund the political and media attacks would like them to).

Unlike Amazon or Netflix, Facebook is a real company that makes real money – not projected future money to justify its current market cap. FB, in fact, made $16Bn last year and they've made $15.25Bn in Qs 1,2&3 so far this year so call it $20Bn in 2018 and, at $130, the market cap of FB is down to $375Bn, so they are now trading at just 18.75 times their current earnings vs. 85x for AMZN and 100x for NFLX. FB is being attacked for things that don't really have anything to do with whether or not they make money and it's going to be a great opportunity to invest – once the rest of the market stops collapsing.

When will the market stop collapsing is the question, right? Well, as I said last Thursday, "...even fixing Brexit wasn't enough to hold the weak bounce line yesterday for the S&P and Powell didn't save us last night so it's all up to President Trump to make a deal with China that will save the markets – what could possibly go wrong?"

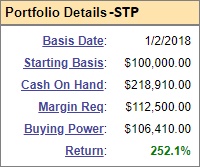

That was sarcastic, of course, we assume anything Trump is involved in will go wrong and, fortunately, we kept ourselves short into the fake rally and that gave us a nice 50% pop in the Short-Term Portfolio, which is what we use to hedge the positions in our Long-Term Portfolio. BALANCE is the key to keeping your sanity in these crazy markets – and don't think you don't need to hedge just because we already hit our primary correction goals – there's no limit to how far panicking investors can take down a market – no matter how much the companies actually earn.

That was sarcastic, of course, we assume anything Trump is involved in will go wrong and, fortunately, we kept ourselves short into the fake rally and that gave us a nice 50% pop in the Short-Term Portfolio, which is what we use to hedge the positions in our Long-Term Portfolio. BALANCE is the key to keeping your sanity in these crazy markets – and don't think you don't need to hedge just because we already hit our primary correction goals – there's no limit to how far panicking investors can take down a market – no matter how much the companies actually earn.

We already had our value discussion on Sept 12th, in a Morning Report titled "Will We Hold It Wednesday – Dow 26,000 Edition" where the first line of the report was "No, we won't." We did carry on until 27,000 on the Dow (/YM) but now we're back below 25,000 and likely to re-test the October lows of 24,000 before we're through. At the time (9/12), I said:

You can short the Dow Futures (/YM) below the 26,000 line with tight stops above – that's a fantastic reward/risk play or you can play the Dow Ultra-Short ETF (DXD) long at $29.85 and the Oct $28 calls are only $2, which is just 0.15 premium for a 37-day play – very reasonable if you want to lock in some gains!

DXD peaked out at $32 on Oct 12th for a nice double (up just 50% if you waited until the 10/19 expiration) and the /YM Futures, which we reiterested last Thurdsay as our shorting line – just paid us another $5,000 per contract at 25,000 and that's now our stop line as we're already down 350 pre-market at 24,675 (great for the STP!). Over $32 on DXD will mean a new downtrend for the Dow – so let's keep an eye on that today.

The S&P 500 topped out at 2,940 on Sept 21st and it's a good time to reveiw the skepicism we had in the week leading up to it (14th-21st):

Fake Money Friday – Weak Dollar Makes Markets Look Like They Are Recovering

The Dollar is testing 94. That's down over 1% since Sept 1st and 1.5% off it's highs so take the market "gains" with a Lot's wife-sized grain off salt since the indexes have gone nowhere for the month yet the Dollars they are priced in have lost 1% of their buying power – that's not good!

Monday Market Madness – Denial is Not Just a River in Egypt

Holy cow! I guess it's because I'm one of the last macro fundamentalists left in the markets that I am surprised – no, shocked, by the complete and utter denial the bulls are in regarding what is already the biggest Trade War since the 1930s and will very soon be the biggest Trade War in human history. As noted on the chart to the right though, it's a very normal psychological phenomena – especially when experienced by those unprepared for a loss and, after 10 years of stimulus – there's a whole generation of traders who don't even know what a market loss is…

The market is clearly in denial and the Financial Media is merely a tool of the Investment Banks, so don't expect them to explain things to you and, unfortunately, very few people know what a Trade War actually is or what it does – thanks to a very poor education system – especially when it comes to Finance in this country.

Tariffic Tuesday – Markets Ignore Another $200Bn Drag on Global Trade

So what? $200Bn here, $200Bn there – after a while it might add up to something but investors only react AFTER something is a problem and these tariffs don't even take effect until next week (24th). Our wise Negotiator-In-Chief has decided to hit China (ie. the suckers who voted for him and actually have to pay this tax) with a 10% tax on $200Bn worth of Chinese goods that are bought in the US and that tax will rise to 25% – taking another $30Bn out of the pockets of the poor so Trump can continue to give tax breaks to the rich.

Will We Hold It Wednesday – S&P 2,915 Again

While it's been fun watching the Dow 30 blast higher, the S&P 500 has been struggling to get back to where we were at the end of August when I warned on "Toppy Tuesday – S&P 2,900 so it’s 3,000 or Bust!" as well as "Will We Hold It Wednesday – Record Highs Edition" and we were shorting the S&P (/ES) Futures at 2,915 and we got another entry yesterday as we topped out at 2,917 just before 3pm.

At the time, we were shorting Gasoline (/RB) at $2.10 and now it's $2, which was good for gains of $4,200 per contract if you rode it out all the way (we were in and out several times since) and we shorted Oil (/CL) at $70 (and we're short again now) and went long on Coffee (/KCN9) as it tested $100, which worked at the time but now it's down to $94 so a lot of things are not improving – including the Nasdaq, which is down from 7,700 to 7,500 (2.5%) while the S&P has bounced back.

Thursday Failure – Shanghai Stocks Down 20% for the Year and Social Security Closer to Failure

Harmless trade war?

That's how the Conservatives are spinning it and many are drinking the Kool Aid and ignoring the stress and strain we are putting on the rest of the World – especially China, where the Shanghai Composite is officially a bear market, down 20% for the year and almost 50% off it's 2015 highs. 2015 was another crisis we ignored in China – until we had a "flash crash" in August and a proper 10% correction in the beginning of 2016 – even as China was "recovering" a bit.

When people tell you that what happens to the second largest economy in the World doesn't effect the largest economy in the World, those people are idiots and you should never listen to anything they say to you – ever again. Jamie Dimon of JP Morgan, for his part, is doing his best to minimize the concerns of retail investors so he can keep dumping stocks on them:

TGIF – Quad Witching Today, Window Dressing Next Week

China turned around this morning.

It's funny because everyone thinks they are "winning" the trade war. The Chinese Government is planning to cut tariffs on imports to their favored trading partners, which we assume will no longer include the US. This will disadvantage US exporters to China and encourage Chinese firms and consumers to buy goods and services from other trading partners but it's also a nice tax break so it's boosting the Shanghai this morning, up 2.5% for the day at the close.

Other than that, the news has been very quiet and we're expecting to drift along into the close today as it's a Quad Witching Day in which quarterly options and futures contracts expire (there are 4 kinds), which is often punchuated by high-volume (what is that?) moves and yesterday was already a busy day on SPY as we punched in a new high at 2,945 and we would have liked to short 2,950 but we'll take a cross below 2,940 on /ES to short that with tight stops:

Monday Market Movement – OPEC Blasts Oil Higher, China Walks from Trade Talks

Move along folks, nothing to see here.

Despite a run of bad news over the weekend, so far, the market indexes seem unphased by negative news reports. Of course it is the last week of the quarter and windows need to be dressed so we'll see what happens when October rolls in, along with Q3 earnings, when we may begin to see some companies begin to choke on higher wages and trade concerns. As noted in the Wall Street Journal, Industrial and Material stocks are in their own private bear market yet no one is taking it seriously at all.

I know it all sounds like bragging (because I was right AND for exactly the reasons I laid out!) but, hopefully the review reminds you that I might have a clue when I tell you that this is probably it for the sell-off (another 10% in panic, at most) and that we're now heading into another great round of buying opportunities – even if Trump does continue to be our President.

I know it all sounds like bragging (because I was right AND for exactly the reasons I laid out!) but, hopefully the review reminds you that I might have a clue when I tell you that this is probably it for the sell-off (another 10% in panic, at most) and that we're now heading into another great round of buying opportunities – even if Trump does continue to be our President.

There's a lot of real growth in the markets and a lot of good things in the economy like more jobs and rising wages but these are painful adjustments for Corporate America – who have to learn to share their profits with the employees again. That doesn't mean the companies are bad but it does mean that paying 100x earnings for a company is stupid. Back in the old days (2004), we used to think paying 20 times earnings for a stock was quite high because that's an annualized return of just 5% and things could go wrong while a bank note paid a risk-free 3.5%.

While historic stock market returns have been about 8% a year, there's the danger of getting caught in the wrong 10-year period and then needed 10 years to catch up (which is what happened to people who started investing in the early 2000s) and, as I noted above, we have now been plagued with an entire generation of traders who don't even know what a down market looks like.

There's also the danger of thinking that, just because AMZN or NFLX can't justify 100x earnings is NOT a reason to sell AAPL or FB, where you are paying less than 20x earnings. Not all tech stocks are the same – that's true in any sector – there are great values out there – if you know how to look for them and if you are PATIENT!

So we will watch and we will wait and we will look for more bargains to place in our Long-Term Portfolio, paid for with the profits we're making in the short-term portfolio – BALANCE is the key to happiness and success….