NEGATIVE 0.5%!

NEGATIVE 0.5%!

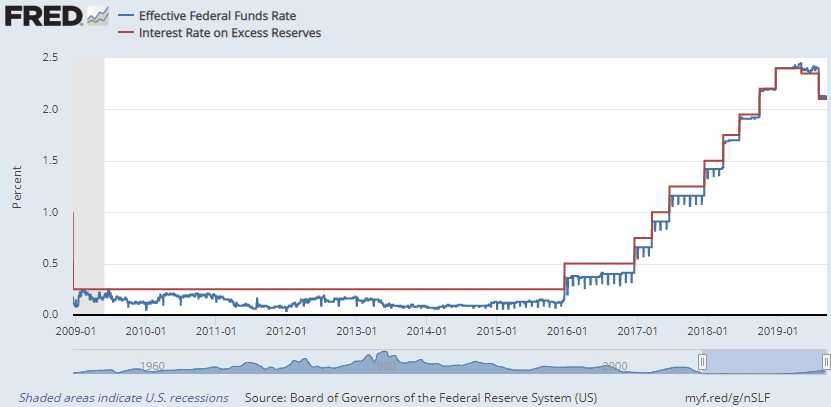

That is now the European Central Bank's Deposit Rate. That's 2.6% lower than our Fed's current 2.1% rate and 0.75% lower than our all-time low of 0.25% (and you thought we couldn't go to zero!) back in the throes of the Recession. As you can see from the bottom of the Fed's historical rate chart – this has never happened before in the history of the World so don't listen to people who tell you that they know what is going to happen in a negative-rate World – no one has any friggin' idea what is actually going to happen when we go below the zero line…

We've had Recessions, Depressions, Hyper-Inflation and even Deflation in Human Economic History but we have not had a situation in which rich people (Banksters) CHARGE YOU money for holding your money. And they are not HOLDING it, you are lending it to them and they are using it to make more money (as Jimmy Stewart explains) – they don't even HAVE your money – IT's GONE!!!

Negative rates sent the Euro plunging lower (if you have 100 Euros, and you put it them the bank for 10 years, you get back 95 Euros), which will not make Trump happy, as he wants a weak Dollar to inflate the value of his real estate assets so he will pressure the Fed to lower our rates further, so Trump can then borrow money at lower rates to buy more buildings and, of course, the US Taxpayers pay the bill for all these artificially low rates through gigantic deficits and Putin wins again – but there's no collusion – things just work out for him… all the time.

In fact Russia has been hoarding gold and dumping US assets – almost as if they knew what Trump was going to do. Russia has been the World's largest buyer of gold recently with the value of their reserves climbing 42% in the past year alone. “Russia prefers to cushion its macroeconomic stability through politically neutral tools,” said Vladimir Miklashevsky, a strategist at Danske Bank A/S in Helsinki. “There is a massive substitution of U.S. dollar assets by gold — a strategy which has earned billions of dollars for the Bank of Russia just within several months.”

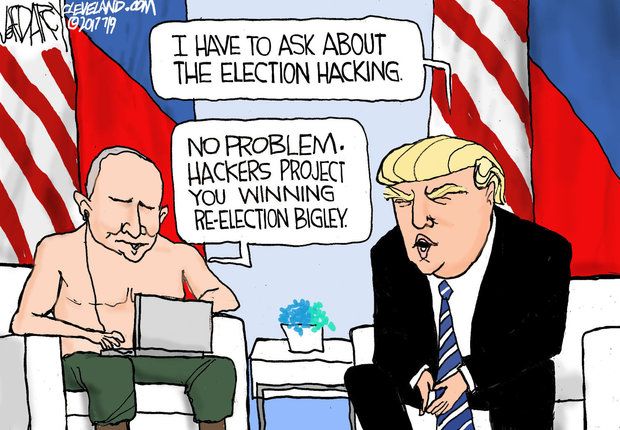

Russia needs that money to hire more hackers but, fortunately, everyone has already forgotten the part of the Mueller Report that CONCLUSIVELY showed that Russia did indeed hack the US elections to put Trump in office and even Marco Rubio said that Russia was in a position to “change voter registration files in 2016,” and the Mueller revelation that a major Florida software vendor, VR systems, which operates in most Florida counties and seven other states, was “hacked by Russia" and that they did it again in 2018 for other Republicans and they plan to do it again in 2020.

Russia needs that money to hire more hackers but, fortunately, everyone has already forgotten the part of the Mueller Report that CONCLUSIVELY showed that Russia did indeed hack the US elections to put Trump in office and even Marco Rubio said that Russia was in a position to “change voter registration files in 2016,” and the Mueller revelation that a major Florida software vendor, VR systems, which operates in most Florida counties and seven other states, was “hacked by Russia" and that they did it again in 2018 for other Republicans and they plan to do it again in 2020.

Neither President Trump or "Moscow" Mitch McConnel have allowed any bills to pass Congress to address the election interference problem and why would they – Trump is the least popular sitting President since Nixon and McConnel is the least popular sitting Senator with just 36% of the people in his own state approving of him so he needs all the Russian help he can get if he wants to be re-elected to continue to keep our Government from functioning.

25 Russians have been indicted by Mueller for interfering in US elections but, unfortunately, Trump has done nothing to extridite them and they all remain at large in Russia, almost certainly still doing the same job they did in 2016 and 2018 including hacking Demorcratic computers (like Hillary's Emails at Trump's request), "aggravated identity theft", money laundering, "conspiratcy to defraud the US to interfere with elections", wire fraud, bank fraud and voter fraud. As you can see, the Senate Report, which found extensive interference, was so redacted by Republicans that it became useless as a tool to protect ourselves from additional inteference.

25 Russians have been indicted by Mueller for interfering in US elections but, unfortunately, Trump has done nothing to extridite them and they all remain at large in Russia, almost certainly still doing the same job they did in 2016 and 2018 including hacking Demorcratic computers (like Hillary's Emails at Trump's request), "aggravated identity theft", money laundering, "conspiratcy to defraud the US to interfere with elections", wire fraud, bank fraud and voter fraud. As you can see, the Senate Report, which found extensive interference, was so redacted by Republicans that it became useless as a tool to protect ourselves from additional inteference.

The deletions were so substantial that even the committee’s recommendations for the future were not spared: The section heading on the final recommendation read “Build a Credible,” but the remainder of the heading, and two paragraphs that follow, were blacked out. I wish this were a joke but it's actually happening to us right now and the fact that you are surprised to read this shows how dangerously unprepared McConnel and the other Senate Republicans have left us going into the 2020 election.

The deletions were so substantial that even the committee’s recommendations for the future were not spared: The section heading on the final recommendation read “Build a Credible,” but the remainder of the heading, and two paragraphs that follow, were blacked out. I wish this were a joke but it's actually happening to us right now and the fact that you are surprised to read this shows how dangerously unprepared McConnel and the other Senate Republicans have left us going into the 2020 election.

“This is not a Democratic issue, a Republican issue,” said Senator Chuck Schumer of New York, the Democratic leader. “This is not a liberal issue, a moderate issue, a conservative issue. This is an issue of patriotism, of national security, of protecting the very integrity of American democracy, something so many of our forbears died for. And what do we hear from the Republican side?” he said. “Nothing.”

The simplest solution to election fraud (not voter manipulation, just direct fraud) is to go back to paper ballots of have paper back-ups to electronic systems but no money has been approved to do ANYTHING to address the issue other than $380M that was approved in the 2017 budget that Trump had to sign under duress – that's $1 per citizen to ensure your vote is counted.

The simplest solution to election fraud (not voter manipulation, just direct fraud) is to go back to paper ballots of have paper back-ups to electronic systems but no money has been approved to do ANYTHING to address the issue other than $380M that was approved in the 2017 budget that Trump had to sign under duress – that's $1 per citizen to ensure your vote is counted.

Now, you can go do nothing and go through the charade of voting and pretend it all matters next year or you and WRITE TO YOUR CONGRESSMEN and DEMAND that they DO SOMETHING about this. Just say, what are you doing to ensure the 2020 elections will not be interferred with? If they begin to get the impression the voters actually care, we might get enough of them on our side to override Mitch McConnel's next attempt to block the United States from stopping Russia's interference – maybe…