Preparing For Lower Returns

Courtesy of Michael Batnick

We’ve been hearing about the prospect of lower future returns for U.S. based investors for years now*. The thesis behind this is fairly straightforward; high recent returns coupled with high valuations in the stock market, and low interest rates in the bond market is not conducive to further above average returns.

Consider the following:

- A U.S. only 60/40 portfolio has compounded at 10.5% over the last 10 years.

- The CAPE ratio is at 30.9

- The ten-year treasury is currently yielding 1.8%

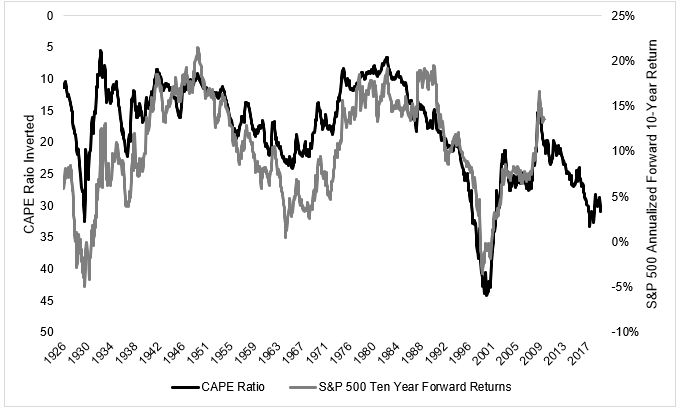

The more you pay for an asset relative to its underlying fundamentals, the less you should expect to receive going forward. You can see this relationship in the chart below, which plots the inverted CAPE ratio on the left-axis, and forward 10-year returns on the right-axis.

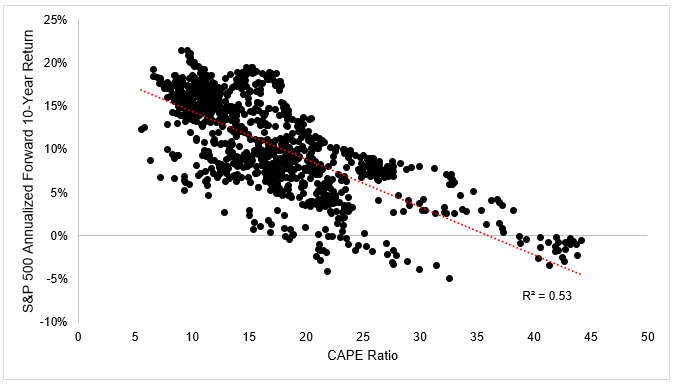

But valuations don’t matter over the short-term, sometimes matter over the medium-term, and usually matter over the long term. This is a long way of saying that valuations are a terrible timing tool, as we’ve learned over the last few years. We can see the relationship between higher valuations and lower returns in the chart below. Again, they matter, but no guarantees.

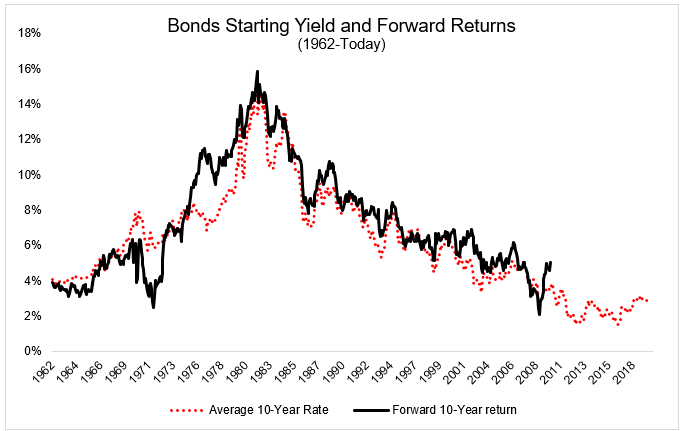

Future bond returns, unlike stocks, can be boiled down to a single variable, starting yield. The chart below shows the relationship between the starting yield of a ten-year bond and the future ten-year returns.

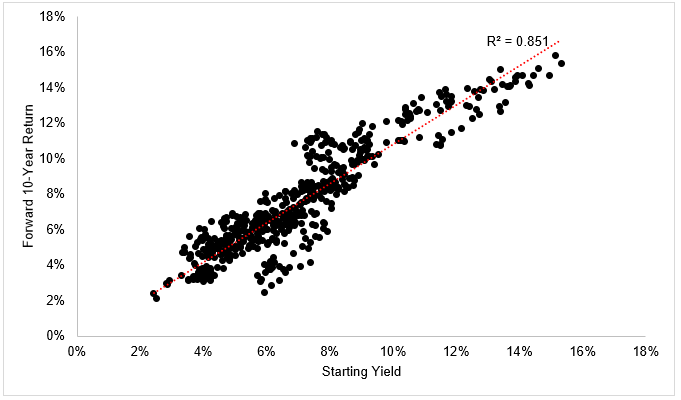

Below is a scatter plot that shows just how tight this relationship is. Starting yield tells you pretty much all you need to know about forward returns.

Okay, so we suspect that the above average returns we’ve been accustomed to won’t continue forever. The obvious question is, what do we do with this information?

Here are a few ideas (not investment advice)

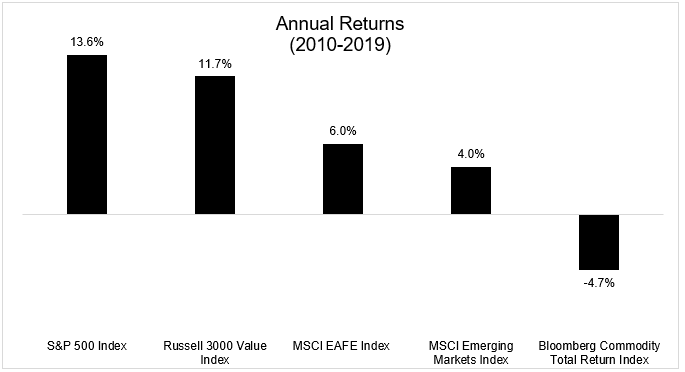

Go beyond the S&P 500. Value stocks have done well, despite lagging by nearly 2% per year, foreign stocks, both developed and emerging, have done bubkis, while commodities have done downright awful.

If you’re worried about not just lower returns, but a potential market crash, realize that crashes are outliers. Yes they happen, but they are inherently unpredictable and by the time we’re in one, it’s usually too late to react. Okay, all that said, if you’re worried about a market crash, nobody is going to convince you not to be worried about one. That’s fine, it’s your money. If you’re in this camp, there are sensible ways to allocate your portfolio. First and foremost, hold more bonds or cash or whatever you have to do to sleep at night. This is guaranteed to lower your returns, but that’s okay if you’re uncomfortable with seeing big swings in your portfolio. Another option is to add a tactical component to your portfolio whether that’s managed futures or options or trend following, to name a few. But be careful with these, understand what you’re getting into before you sign up. Think of these strategies as insurance, hopefully you’ll pay a premium and never collect. By that I mean don’t expect great returns if we don’t see a big drawdown, and in a perfect world, these will mitigate some of the decline.

As I sat down to write this post I had a feeling of deja vu. That’s because I already wrote it, with the exact same title, in November 2015*. Since then, the S&P 500 is up more than 70%. ¯\_(?)_/¯.

We should continue to plan as if our best days are behind us because it’s better to prepare for low returns and be pleasantly surprised than to prepare for high returns and be disappointed.

High returns probably won’t bail you out if you don’t have your financial affairs in order, but low returns are fine if you’re working with a margin of safety.