Will Powell be wearing pants?

Will Powell be wearing pants?

That is the burning question on everyone's mind as the Chairman of the Federal Reserve will be zooming in his address to the nation at 2:30 this afternoon. Powell has already said (3 week ago) that the Fed will act "forcefully" to help the US recover and that the economy can be "robust" once the virus is contained. Traders are assuming that means more of the same today but today it's Powell's job to assess whether or not the virus is contained – so that's a potential point of disappointment as well as the strong likelihood that Powell will have a "wait and see" approach as clearly they can't possibly have spent the $4Tn they have been allocated yet, so those expecting more from the Fed are likely to be disappointed.

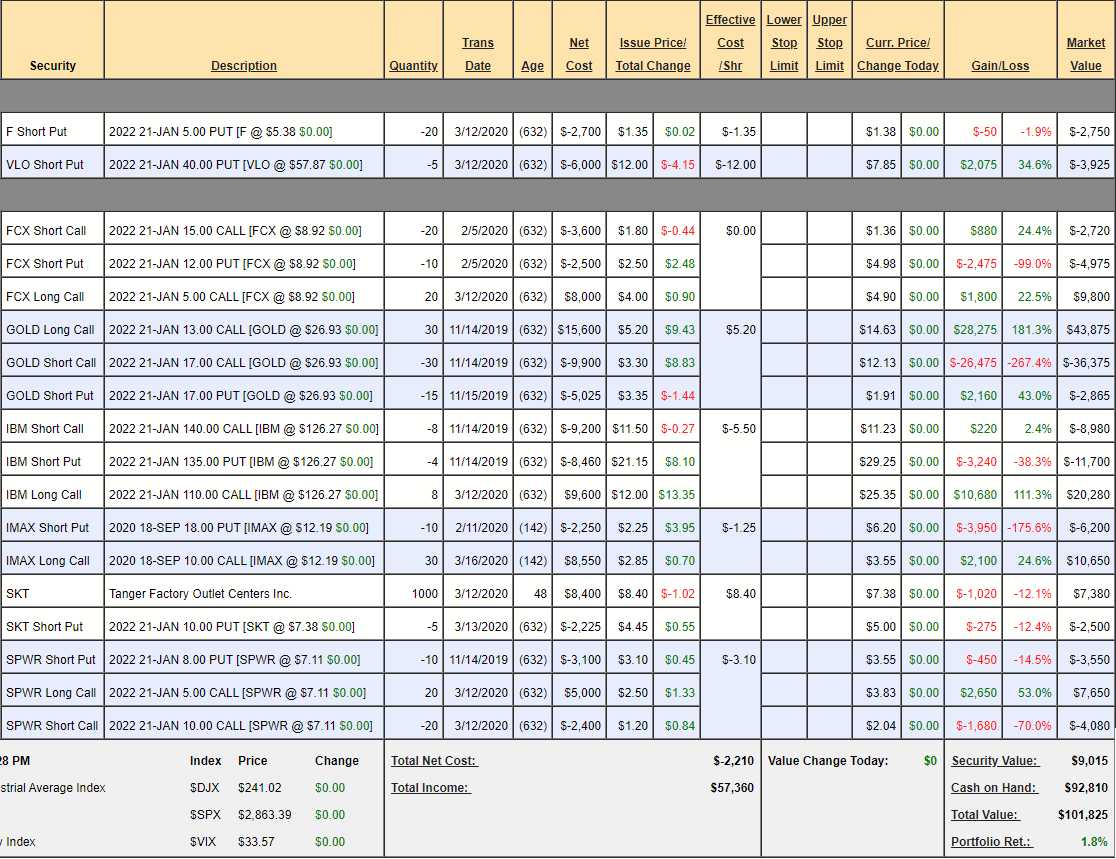

We are certainly waiting and seeing this morning and we have a list of 16 positions we are thinking about trimming from our Member Portfolios, about 20% of the total and we'll discuss two of them here in our Money Talk Portfolio Review, as I'll be on the show this evening (BNN at 7:30) and we only adjust the portfolio on show days.

The last time I was on the show was March 11th, a bit before we hit bottom and I made a call for jumping into blue chips and I made a call for selling puts on stocks you want to buy, using Valero (VLO) and Ford (F) as examples. We also added Tanger Factory Outlets (SKT) as a long-term dividend play. Our Money Talk Portfolio was down 8.4% at the time and we made a series of aggressive moves I detailed in that morning's PSW Report – in order to take advantage of the market decline.

The last time I was on the show was March 11th, a bit before we hit bottom and I made a call for jumping into blue chips and I made a call for selling puts on stocks you want to buy, using Valero (VLO) and Ford (F) as examples. We also added Tanger Factory Outlets (SKT) as a long-term dividend play. Our Money Talk Portfolio was down 8.4% at the time and we made a series of aggressive moves I detailed in that morning's PSW Report – in order to take advantage of the market decline.

We had the advantage of being mostly in CASH!!! In fact, we had $99,235 of cash in the portfolio while the positions themselves were worth -$7,670 for net $91,565 out of our original $100,000 we began with back on 11/13/19. We had stayed "Cashy and Cautious" – as we did with all of our Member Portfolios, as we felt fairly certain that SOMETHING was going to cause the market to sell off – we just didn't expect it to be a virus!

We used $14,540 of our sideline cash to make adjustments and another net $1,425 was spent on the three new positions (our core strategy at PSW is to sell premium, not to buy it). So far, so good as we're back to $101,825 as of yesterday's close but we're a little worried about two of our positions and we're going to add a couple as well:

- Ford (F) – They made it through the last crisis without a bailout so we think net $3.65 would be a great entry but, on the whole, we're very confident we'll collect the full $2,750 that is currently charged against us.

- Valero (VLO) – Another new addition and already nicely profitable. All VLO has to do is not be below $40 in Jan of 2022 and we make another $3,925 – aren't options fun? Our worst case would be owning VLO for net $28, less than half of the current price!

- Freeport MacMoRan (FCX) – As much as I love this company, we are dumping them as I don't see Congress getting around to doing infrastructure spending we were expecting and we've already had a nice bounce so better to use the money on more productive plays.

- Barrick Gold (GOLD) – Our Stock of the Year is actually one of the best-perfoming stocks of the year and we are very confident we'll collect the full $12,000 on this spread and it's only net $4,635 at the moment so $7,365 (158%) left to gain if GOLD stays above $17. Good for a new trade as it's so conservative for a still very nice reward now.

- IBM (IBM) – Last year's Stock of the Year is doing well, considering and I'm very confident in our target for 2022. It's a $24,000 spread and currently showing a net $400 credit so I'd call that good for a new trade with $24,400 (6,100%) of upside potential and your worst case is owning 400 shares of IBM for $135 ($54,000), which would be a bit much for this portfolio but I was supremely confident that wouldn't be an issue – though the drop was scary.

- IMax (IMAX) – Not that I don't love them but they don't have long-term options and I'm not sure when movies will be a thing again so it's just not worth the risk and we'll take the small loss and move on.

- Tanger Factory Outlet (SKT) – This is a mall REIT (Boo!!!) that I think is ridiculously undervalued but a lot of people disagreed and we went as low as $4. In our active Member Portfolios, we doubled and even tripled down as it bottomed but here we're stuck with our net $6.17 entry and I feel strongly we'll get to $10 at least for $10,000 and it's currently net $4,880 so $5,120 left to gain.

- Sunpower (SPWR) – A great solar player that has gotten stupidly cheap. This is a potential $10,000 spread that is currently at net $20 so it has $9,980 of upside potential at $10 – so it's great for a new trade.

The new trade ideas we're adding to the Money Talk Portfolio are as follows (I was interviewed on Monday so I'm adjusting the numbers to meet yesterday's closing prices):

ViacomCBS (VIAC) – One of America's premier broadcast networks is having a fire sale at $17.45, which is about an $11Bn valuation for a company that made $3.3Bn last year. Even if earnings drop to $2Bn, that would be a ridiculously low 5.5 times earnings for the p/e ratio. Sometimes, I can't even imagine what traders are thinking and this would be my Stock of the Year – if I could pick it right now.

We'd like to add VIAC to the MTP as follows:

Sell 10 VIAC 2022 $15 puts for $5 ($5,000)

Buy 20 VIAC 2022 $13 calls for $9 ($18,000)

Sell 20 VIAC 2022 $20 calls for $5.50 ($10,000)That's net $3,000 on the $14,000 spread so the upside potential at just $20 $11,000 (366%) if VIAC is over $20 in Jan of 2022. If Viacom is under $15 you risk being assigned 1,000 shares at $15 ($15,000) and if you lose the entire spread, then that cost you $3,000, putting you in 1,000 shares at an average of $16.50 so your worst case is still owning VIAC at a 10% discount to the current price. Originally we had sold the $13 puts but VIAC is up 10% this week and now I'm confident in the $15 puts.

Our 2nd addition is going to Macy's (M), which has been trashed with the other retailers and yes, retail is horrible and was horrible before the virus but now many retailers will go out of business and Macy's is likely to survive as they own about half their stores – including an entire city block in the middle of Manhattan that's worth as much as $5Bn and $6/share values M at just $2Bn. Of course they have debts and such but, when you have assets – you have a good chance of surviving and the competitors who do not survive should help M grow in the future.

We'd like to add M to the MTP as follows:

- Sell 10 M 2022 $5 puts for $1.80 ($1,800)

- Buy 30 M 2022 $5 calls for $3 ($9,000)

- Sell 30 M 2022 $10 calls for $1.35 ($4,050)

That's net $3,150 on the $15,000 spread so the upside potential is $11,850 (376%) at $10 and your worst case is owning 1,000 shares of M for $5 ($5,000) plus $3,150 if the spread is wiped out so $8.15 per share is quite a bit more than it is now, so we're being aggressive.

The upside potential from the existing trades is $53,540 and our new trades will hopefully add another $22,850 so that's $76,390 we hope to gain in our $100,000 portfolio over the next two years. That's if all goes well, of course and, so far, it has not but now we have positions set at real bargain prices and all we have to do is move past this virus and we should be in ecellent shape.

8:30 Update: Q1 GDP is down 4.8%, a bit worse than expected and it only contains a few weeks of March, when we began to take the virus seriously in the US. That does not bode well for Q2 but FORGET THAT as Gilead (GILD) is halted on news that a study of their anti-viral drug has shown positive results against the coronavirus. THAT is boosting the futures. GILD was our second virus play way back in our February 3rd PSW Report (subscribe here): "Just Another Manic Monday" – our first virus hedge was actually on January 23rd: "How We Are Hedging China's Coronavirus Crisis" – if only Trump had listened to me then!

Our trade idea for Gilead was as follows:

Gilead (GILD) is up 5% pre-market because they have been working on an anti-viral drug for Ebola and SARS called Remdesivir and it's being rushed into human trails in China to see if it will be effective against the Coronavirus.

I like GILD down here at $65.50 (where it should open) as it's "just" an $80Bn valuation and GILD is good for about $8Bn in profits, though not last Q when they lost $1.2Bn on write-offs and such. Overall, they are a great company with a respectable pipeline and I think this is a great entry so we're going to add them to our Long-Term Portfolio as follws:

- Sell 5 GILD 2022 $62.50 puts for $8 ($4,000)

- Buy 15 GILD 2022 $55 calls for $13 ($19,500)

- Sell 15 GILD 2022 $65 calls for $8.50 ($12,750)

That's net $2,750 on the $22,500 spread so $19,750 of upside potential if GILD can simply hold $55 through Jan, 2022. Ordinary margin on the short puts is $2,400 so it's a very efficient way to make $19,750 over 2 years.

While we can look for potential brights spots, like GILD, the bottom-line is that the entire first Quarter for China is now shot to Hell and that's a $13Tn economy so $3Tn+ potentially hit and I'd say that's at least a $1Tn hit to the Global GDP (1%), which has a good chance of pushing many countries into recession – and that's WITHOUT the virus spreading.

Only 11 cases in the US at the time (Feb 3rd), now over 1 Million! So sad…

Not so sad for our GILD trade though, as the stock has already blasted up to $80 and much higher today, I'm sure so we can expect to make the full $19,750 on that one but the best thing is that WE JUST DOUBLED DOWN ON IT in our recent Long-Term Portfolio Review.

As I said, EXCELLENT SHAPE!