WOW!!!

WOW!!!

What else can you say when the S&P 500 is up almost 20% in two months? That's a pace of 120% annual gains, if we make that for 10 years we can turn $100,000 in to $265,599,227.91 so go market, right? Obviously, if it becomes that easy to make money – even for just a few people, then money will very soon become meaningless so we need to have a genuine Fear Of Missing Out if this is going to be a sustained rally that takes us to 4,200 by November (another 20%) and S&P 5,000+ to close the year.

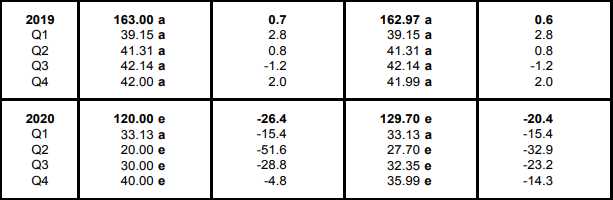

The funny thing is that the S&P 500 companies themselves – EVEN when you include the earnings powerhouses of AAPL, FB, GOOGL, AMZN and MSFT, have made 32.9% less in Q2 than they made in Q2 of 2019, which was only a 0.8% improvement from Q2 of 2018 and the S&P 500's earnings are projected to be down 23.2% in Q3 and down 14.3% in Q4, giving us a not-so-grand total of -20.4% earnings for the year.

Overall earnings per "share" of the S&P 500 are in the $120-130 range for the year, though that assumes a very nice rebound in Qs 3 &4 that are not entirely certain. Let's say the EPS is $125, though and we divide that by 3,550, the current share price of the S&P 500 and that gives us a p/e ratio of 28.4 – about double the historic average.

As we discussed in our "Stock Market Physics" notes yesterday (and see the original SMP article here), the higher you pump up the S&P, the more inflows you need to sustain it so it gets harder and harder to sustain it as it goes higher. We have money flowing into the markets via Government Stimulus and Fed Stimulus and that's great while it lasts but Steve Mnuchin (of Goldman Sachs and the Treasury) just told Congress they need more stimulus NOW or "bad things will happen."

Well, since we clearly know that Steve Mnuchin doesn't give a crap about people, he must mean bad things will happen to his money and that does make sense becuase we need almost twice as much inflows per day to keep this rally going now as we did in March. Richmond Fed's Tom Barkin is also alarmed that the Labor Market's "weakovery" is going very slowly and may not last at that:

Well, since we clearly know that Steve Mnuchin doesn't give a crap about people, he must mean bad things will happen to his money and that does make sense becuase we need almost twice as much inflows per day to keep this rally going now as we did in March. Richmond Fed's Tom Barkin is also alarmed that the Labor Market's "weakovery" is going very slowly and may not last at that:

“What we’ve learned is that if you reopen with the right kind of distance protocols, and you have compliance with it…then we have a shot at having an economy that’s not disease-free, but at least is predictable enough that people can transact in it,” said Mr. Barkin in a phone interview Tuesday. “We are learning that there’s a model of maintaining public health that keeps this virus bouncing around as opposed to escalating.”

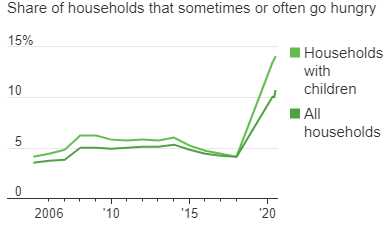

The ranks of the struggling are growing. The federal government’s $600 in additional weekly unemployment benefits expired in July. People have largely spent the stimulus checks they received in the spring. Lenders are bracing for more people to fall behind on debt payments. Grocery shoppers are cutting back on spending. Almost 11% of U.S. households didn’t have enough to eat in the previous seven days, as of July. About a third of renters reported little or no confidence they could make next month’s payment.

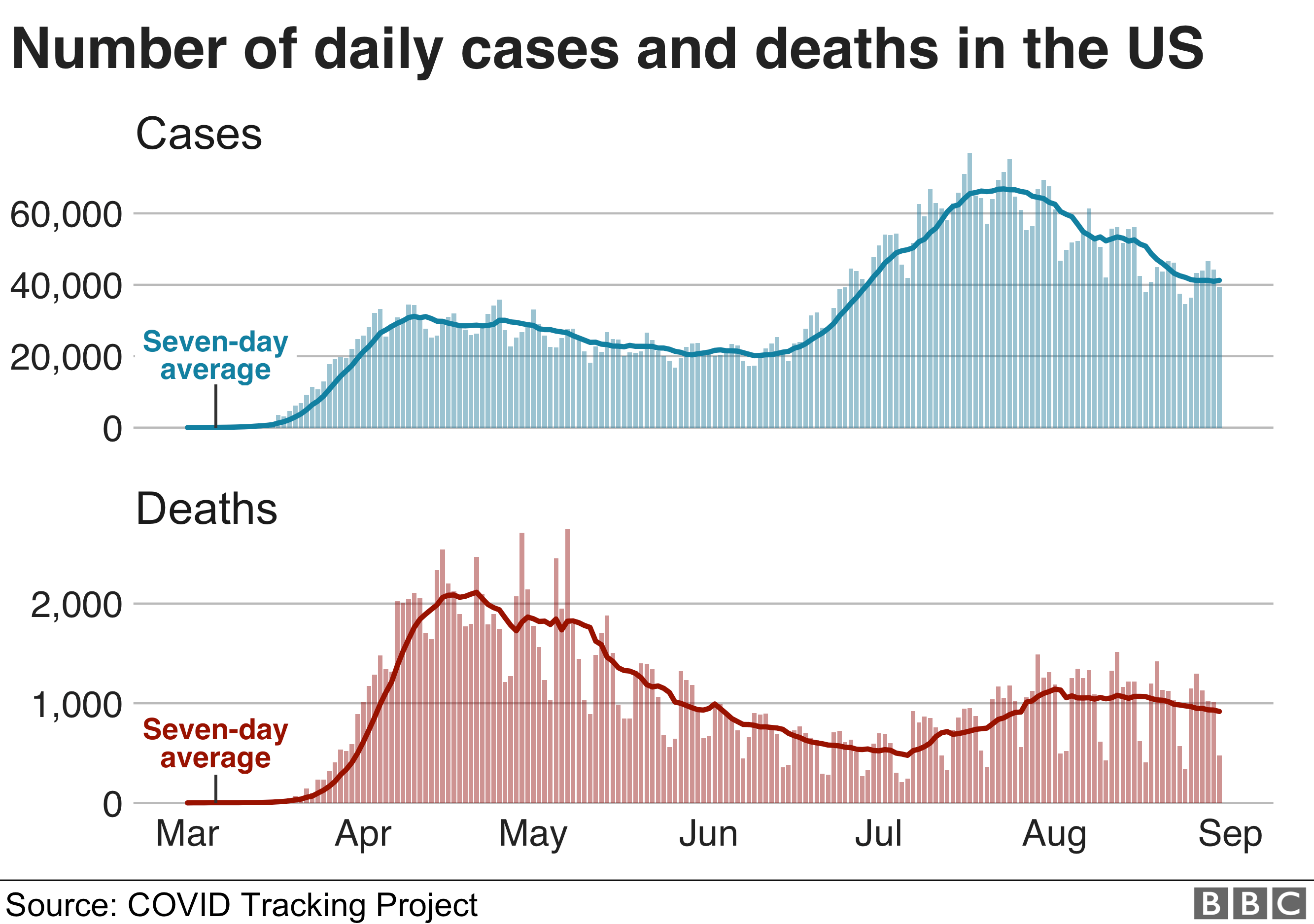

Meanwhile, the US just topped 6M confirmed cases of Covid-19 and we slowed down a little in August but now it's Back to School time next week and we're going to be marching 50M little soldiers off into crowded classrooms with poor air circulation, where they can breathe on each other all day long and then come home to breathe on the rest of the family – what a good time is in store for all of us – what could possibly go wrong?

Meanwhile, the US just topped 6M confirmed cases of Covid-19 and we slowed down a little in August but now it's Back to School time next week and we're going to be marching 50M little soldiers off into crowded classrooms with poor air circulation, where they can breathe on each other all day long and then come home to breathe on the rest of the family – what a good time is in store for all of us – what could possibly go wrong?

Well, already more than 200 employees have been barred from work in Georgia’s largest school district. A high school in Indiana had to shift to online learning after just two days. And students in Mississippi were forced to quarantine after classmates tested positive for the coronavirus during the first week of classes. Already in the South and the Midwest, students and teachers have brought the virus to school with them, triggering quarantines, delayed openings and temporary shutdowns as positive tests roll in.

President Trump, who has pressured schools to reopen and threatened to withhold federal funding from those that do not teach in person, renewed his call on Monday, tweeting first “Open the Schools!” and later “OPEN THE SCHOOLS!!!” The school Trump's son goes to is private and will not be opening due to the exessive risk it poses to the children.

“As soon as you open classrooms, within two weeks, teachers and students will get sick, bus drivers will get sick, and staff will get sick,” Dr. Peter Hotez, Dean of Tropical Medicine at Baylor College said. “And all it’s going to take is one teacher admitted to the hospital in the school district and that’s it, it’s going to be lights out and no one will show up to work.”

So we have that to look forward to!

Hey you, Whitehouse

Ha, ha, charade you areYou well heeled big wheel

Ha, ha, charade you are

And when your hand is on your heart

You're nearly a good laugh

Almost a joker

With your head down in the pig binYou're nearly a laugh

But you're really a cry – Pink Floyd