By ZeroHedge

The largest US meat company, Tyson Foods, badly missed Wall Street estimates for quarterly profit on Monday and cut its expectations for operating margins this year in the face of falling – yes falling – beef prices, easing demand for pork, and an ongoing crash in chicken prices as a result of overproduction.

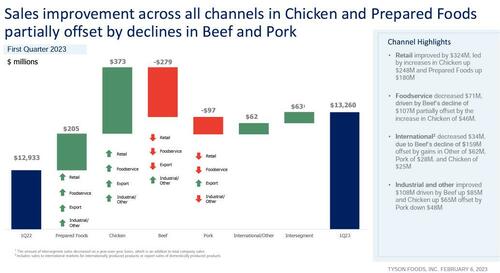

Sales rose 2.5% to $13.26 billion in the three months ended Dec. 31, missing analysts’ average estimate of $13.52 billion.

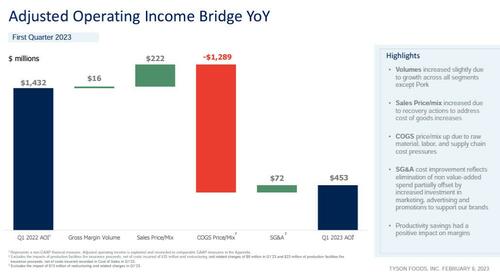

Adjusted earnings of 85 cents per share were much lower than expectations of $1.33 per share, as first-quarter earnings plunged 70% from a year ago and missed expectations. The reason: a $1.3 billion hit from COGS price/mix as cost of goods sold rose while margins/selling prices shrank.

Results were “bad all around,” Credit Suisse said in a note, and the CEO did not disagree: “We got hit in the mouth in Q1 because of all the protein on the market,”Tyson Chief Executive Officer Donnie King said in a Monday call with investors. From November to now, “the demand didn’t show up in fresh chicken,” King said, adding that its second quarter will be softer than the first.

The earnings miss comes as prices for some meats have been tumbling from record levels and stockpiles swelled more than anticipated. Faced with surging prices and lack of stimmies which kept up demand for expensive proteins in 2021 and 2022, many consumers have since reduced their spending and switched to cheaper types of meat, such as buying hamburger instead of steaks.

Chief Executive Donnie King said challenging “market dynamics and some operational inefficiencies” hurt profitability.

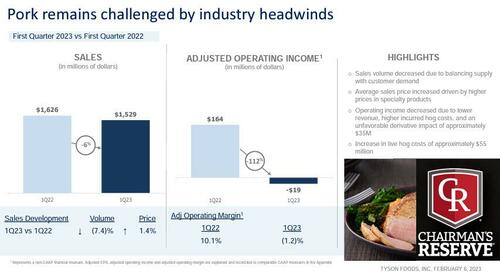

Chicken production has been rebounding, resulting in more supplies but smaller profit margins for vertically integrated companies such as Tyson, the top US producer. Meanwhile, tighter supplies of cattle and hogs were forcing meat companies to pay more for livestock. Operating margin in pork fell to a negative 1.4% for the first quarter, down from 10% in the first quarter of 2022.

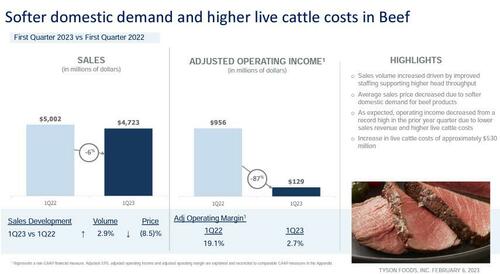

In Tyson’s beef business, its largest segment, operating margins shrank to 3.5% from 19.1% a year earlier. Average beef prices fell by 8.5%, compared to a surge of nearly 32% a year earlier, according to the company. Profit margins fell to 3.5% for the quarter, from over 19% a year ago, hurt by “softer domestic demand and higher live cattle costs,” according to a slide presentation.

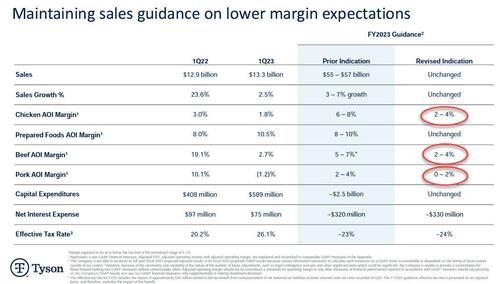

Tyson’s average pork prices rose 1.4% in the latest quarter, while sales volumes declined 7.4%. The company cut its outlook for adjusted operating margins in pork to 0% to 2% for fiscal 2023 from a previous forecast of 2% to 4%.

Tyson lowered its outlook for operating margins in its chicken business to 2% to 4% from 6% to 8%, even though prices rose 7.1% in the latest quarter, making chicken the only segment to “overcome commodity market headwinds.”

JP Morgan said it was “surprised by the magnitude of both the earnings miss and guidance reductions” which saw the company slash margins on everything from Chicken, to Beef and Pork.

Still, Tyson maintained its annual-sales outlook for record sales between $55 billion and $57 billion, with King saying the company expects to “improve our performance through the back half of fiscal 2023.”

Wall Street analysts have also said chicken prices are now trending lower, with brokerage Piper Sandler noting prices of boneless, skinless chicken breast down by about 45% in the quarter.

The results were “weaker even than what we were braced for with our lowered numbers, and management lowered guidance considerably for the year,” said Ben Bienvenu, an analyst at Stephens Inc., in an emailed note. “The implied earnings power is quite a bit lower than we expected.”

Tyson recently named several new executives to help it navigate through the inflationary environment while John R. Tyson, great-grandson of the company’s founder and the chief financial officer, last month pleaded guilty to charges of trespassing and public intoxication following an incident where he was found asleep in a home that wasn’t his own.

Slides source: Company Supplemental Information report