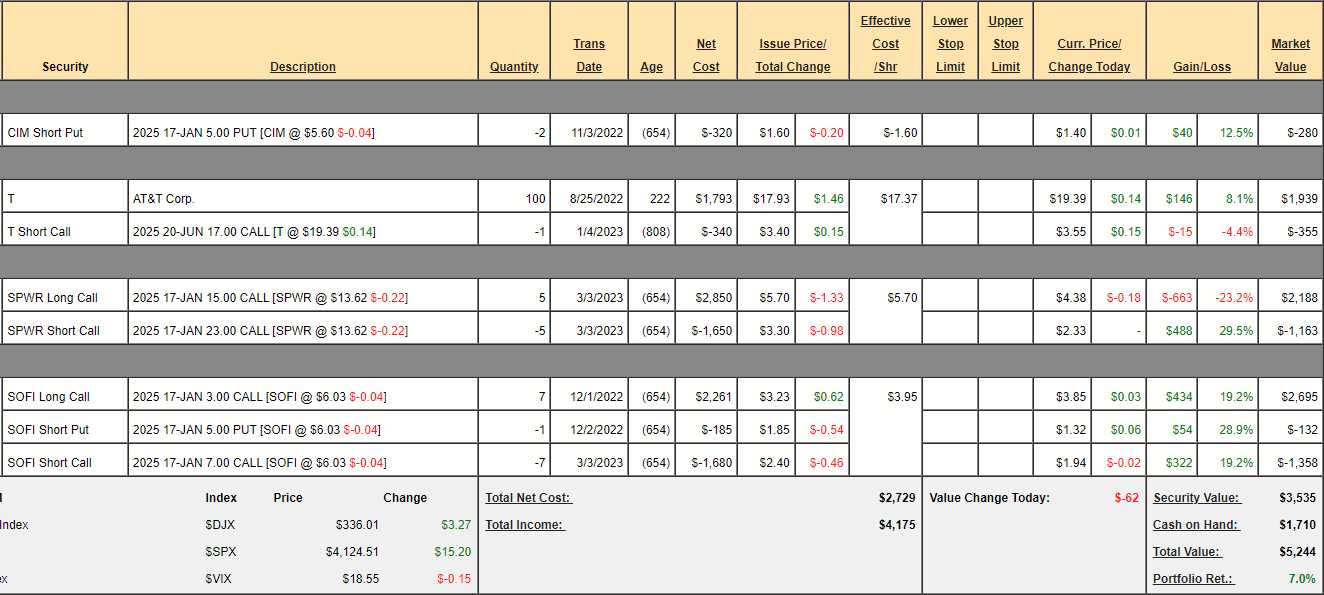

$5,244 is up 7% in 7 months.

That’s a step back from up 8.5% in our last review but it’s been a tricky month, to say the least. Months 1, 2, 3, 4, 5 and 6 are also available for review and now, in month 8, we will add another $700 and see what there is to buy.

Our goal in this portfolio is to show our Members how to use slow, steady, simple options strategies to amass over $1M over 30 years by investing just $700/month ($252,000). If you can apply this discipline in your early working years – your retirement will be a breeze.

Our goal is to make 10% a year on our investments and, though it has only been 7 months – the portfolio is up 7%. That’s a pace of 12% per year and, if we did that for 30 years, we’d have $2,291,429.84. No, I’m not kidding, you can do the math right here! That’s well ahead of goal, despite the recent set-back. We will have ups and downs along the way and this portfolio doesn’t attempt to time the market – but it’s off to a good start.

When we started the portfolio (Aug 25th), the S&P 500 was at 4,000 and now we’re at 4,165, so essentially flat. Nonetheless, we made 7%. That’s the magic of using options and our Be the House – NOT the Gambler strategy, even when you play very conservatively, you can still make nice gains in a flat market.

As with all our PSW portfolios, the returns tend to accelerate as our positions mature and we are still ahead of expectations, which is very nice in a no-margin portfolio.

Last month, we gave up on NLY and we added the spread on SPWR and adjusted SOFI – let’s see what we have to work with as we add another $700 to the $210 we had left to work with.

-

- CIM – We are using $500 in margin and expect to make $280 (56%) in 20 months. The stock pays an 0.92 (16.4%) dividend so it’s very tempting to buy shares as well but that’s why we sold the puts, we promised to own it for net $2.80 x 200 shares.

-

- T – T is paying a $1.11 (5.7%) dividend while we wait to collect $1,700 from our net $1,584 position. That’s $116 plus 9 $27.8 dividend payments ($250.20) is an expected $366.20 (23.1%) over the next 2 years and that’s not good enough so we’re going to kill this, giving us $1,584 to play with.

-

- SPWR – They are way too cheap at $13.62 so let’s roll our 5 2025 $15 calls at $4.38 down to 5 of the 2025 $10 calls for $6.50 for net $2.12 ($1,060). That puts us $3.62 in the money for $2.12 and it adds $5 more upside potential, so well worth the price! Now, if we conservatively expect SPWR to get back to $20, the $10/23 spread will be worth $10,000 vs the current net of $2,085 (post roll) – so we have $7,915 (379%) of upside potential here. That is a far better use of our T money, right?

SOFI – We just added this one and all 3 legs are up, so that’s very, very good. This spread is net $1,205 on the $2,800 spread so we have $1,595 (132%) upside potential at $7. We are very much on track here!

So we have $9,490 worth of upside potential from our 3 remaining positions. That’s over 2 years so $4,745 (90%) per year against our current $5,244 if all goes well. Notice how our review system identifies relatively weak performance (both current and anticipated) from T and helps us decide how to better allocate our resources.

As noted above, we had $210 left in buying power and we are adding $700 this month and we took $1,584 off the table by killing T and then we spent $1,060 improving SPWR so now we have net $1,434 left to spend.

Rather than go to our Watch List, where BCS, BIG, BGFV, BXMT, F, FF, IVZ, JETS, JWN, LABU, LEVI, OMI, PARA, PBR, TRVG, TWO and VALE are all potential fits for this portfolio, let’s look over our recent Top Trade Alerts, where we recently picked NYCB, SPWR (twice), UNG and BBAR as potential fits for this portfolio.

BBAR is an Argentine Bank and we do really like them, though any bank is a bit of a risk with the scandal. SPWR, obviously we already picked and NYCB is another bank though we do like them as they picked up Signature’s assets very cheaply. UNG is the Natural Gas ETF and I strongly believe this ($2) is the bottom for Natural Gas.

NYCB pays 8% interest, BBAR pays 5% and nothing from UNG. We HAVE to buy UNG because the 2025 $5 ($3.70)/8 ($2.70) bull call spread is only net $1 and it’s $1 in the money with $2 (200%) upside potential at $8, which is a very reasonable target (about $2.50 on /NG).

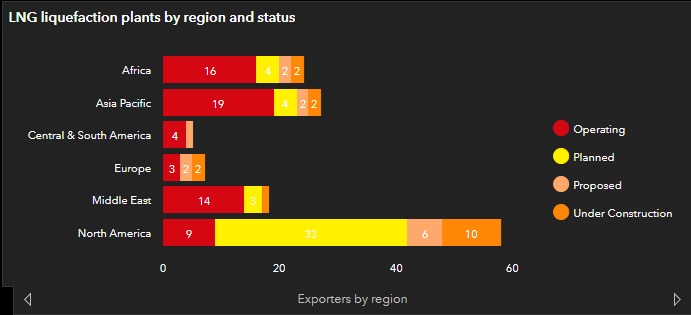

Over the longer-run, there are 264 Regasification Terminals proposed or completed in the World. 79 of the open receiving terminals and 57 of the planned receiving terminals are in Asia and 42 open and 32 planned are in Europe – that’s 210. There are only 139 Liquefaction Terminals proposed or completed and Africa has 16 in operation, Asia 19, Central/South America 4, Europe 3, Middle East 14 and US has 9 – and one of them has been down for a month.

That’s why /NG is so cheap at the moment – a combination of a mild winter and 10% of our exports off-line is causing a surplus in the US but notice that 33 new export terminals are planned, 6 more are proposed and 10 are already under construction – which will double our export capacity over the next two years. By the end of this year, exports are expected to be up 50% over last year.

That’s why /NG was speculated all the way up to $9 early last year but the reality of how long it takes to build and permit the terminals (/NG is kind of explosive) along with the pipeline issues began to cool off the speculators and then Freeport LNG in Texas shut down due to an explosion last June, which meant that all the gas that was set for export was flooding the US markets. Freeport just restarted and it will still take some time for the supply glut to work off.

Still, at net $1 per $3, it’s a good spread to park extra cash in…

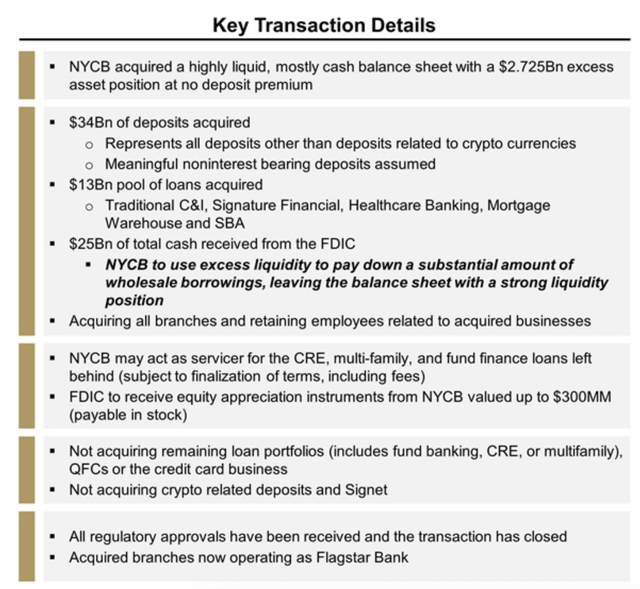

And I guess I’ll have to choose NYCB – as they hit the jackpot. They made $650M last year and expected to make $775M this year but they also have $1Bn net of debt and $86Bn under management, up from $57Bn last year – then this happened:

When everything is said and done, New York Community Bancorp will boast 435 with branches across the markets in which it operates. Of the 40 branches added, 29 are located in New York, with seven others in California. Historically speaking, New York Community Bancorp has focused its footprint largely on parts of the Rust Belt like Ohio, Michigan, Indiana, Arizona, and Wisconsin. It also has a sizable footprint in Florida and, naturally, it has operations in New York and California already. On the loan side of things, the company’s portfolio will grow from $69 billion to nearly $82 billion.

I’m certainly comfortable committing to buying 100 shares so let’s do the following:

-

- Sell 1 NYCB 2024 $10 put for $20 ($200)

- Buy 2 NYCB 2025 $7 calls for $2.35 ($470)

- Sell 2 NYCB 2025 $10 calls for 0.90 ($180)

That’s net $90 on the $600 spread and we are tying up $1,000 of buying power but the upside potential at $10 is $510, which is 46.7% of our $1,090 cash+margin outlay. We hope to sell another put in January, of course.

That leaves us with $344 in buying power so let’s also take 3 of the UNG spreads as such:

-

- Buy 3 UNG 2025 $5 calls for $3.70 ($1,110)

- Sell 3 UNG 2025 $8 calls for $2.70 ($810)

That’s net $300 on the $900 spread with $600 (200%) upside potential at $8.

So now we have added $1,110 in upside potential to our existing $9,490 which is $10,600 in upside potential in what is now a $5,600 investment. As long as we can stay reasonably on-track, we can look forward to a very good 2nd year as we head into the summer months!